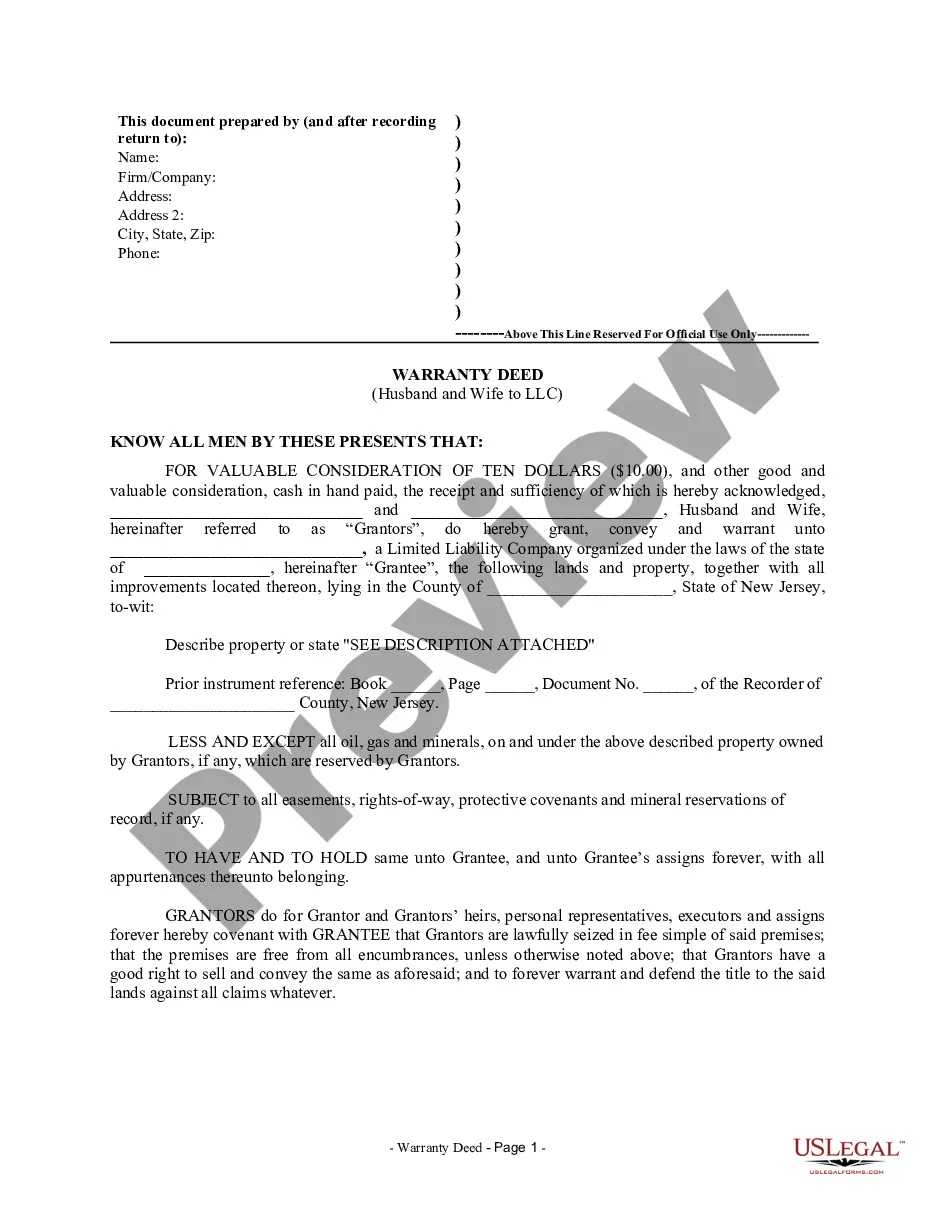

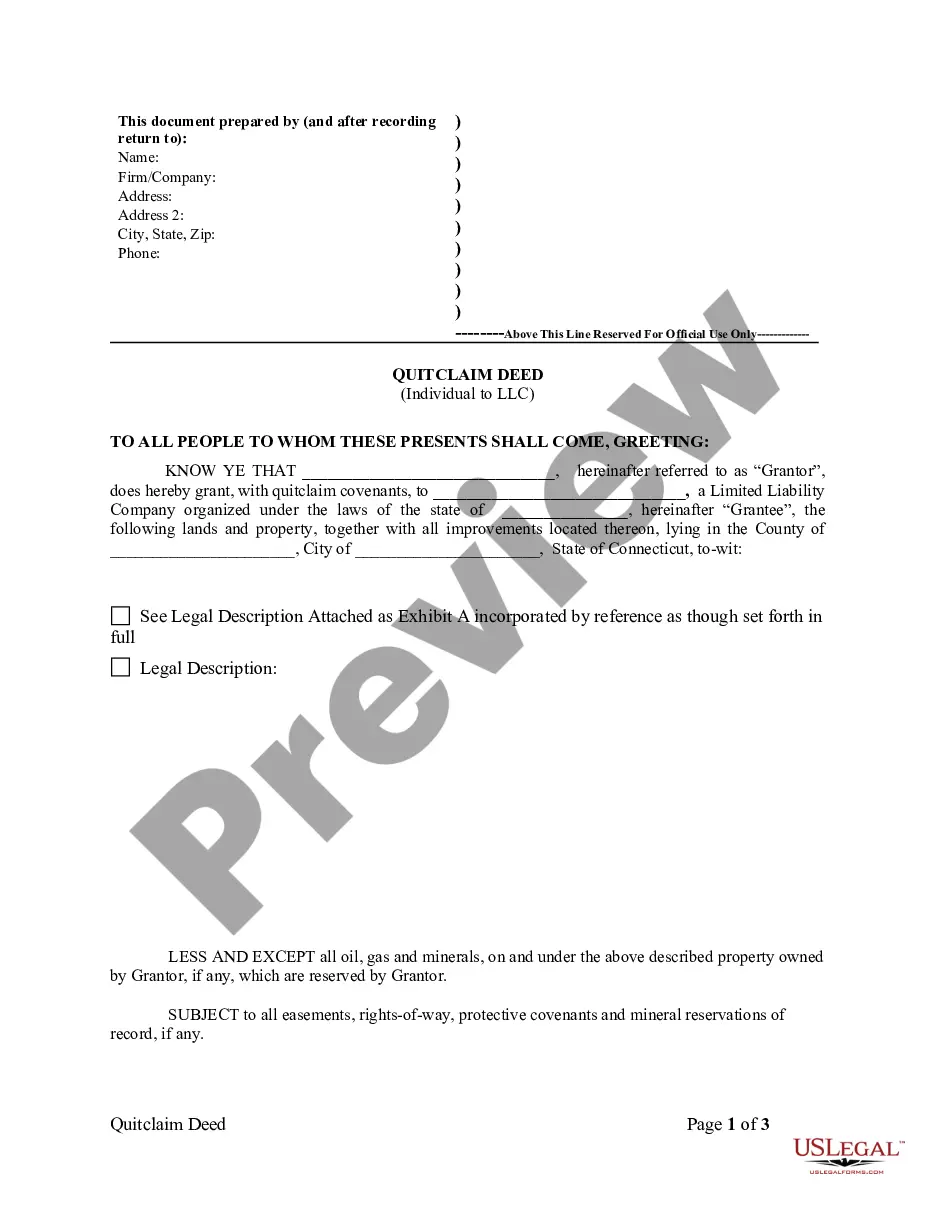

New Jersey Warranty Deed from Husband and Wife to LLC

Description

How to fill out New Jersey Warranty Deed From Husband And Wife To LLC?

US Legal Forms is really a unique platform where you can find any legal or tax form for completing, such as New Jersey Warranty Deed from Husband and Wife to LLC. If you’re fed up with wasting time seeking ideal samples and paying money on file preparation/attorney service fees, then US Legal Forms is exactly what you’re seeking.

To experience all of the service’s benefits, you don't need to install any application but simply choose a subscription plan and sign up an account. If you already have one, just log in and get an appropriate sample, save it, and fill it out. Saved documents are all kept in the My Forms folder.

If you don't have a subscription but need New Jersey Warranty Deed from Husband and Wife to LLC, have a look at the instructions below:

- Double-check that the form you’re considering applies in the state you want it in.

- Preview the sample and read its description.

- Click on Buy Now button to reach the sign up page.

- Select a pricing plan and keep on signing up by entering some information.

- Pick a payment method to finish the registration.

- Download the file by selecting the preferred format (.docx or .pdf)

Now, fill out the file online or print it. If you are uncertain about your New Jersey Warranty Deed from Husband and Wife to LLC sample, speak to a attorney to analyze it before you decide to send or file it. Start without hassles!

Form popularity

FAQ

If both spouses take part in the business and are the only members of an LLC, and a joint tax return is personally filed, a qualified joint venture can be elected instead of a partnership. This election treats each spouse as a sole proprietor instead of a partnership.

A two-member LLC is a multi-member limited liability company that protects its members' personal assets.A multi-member LLC can be formed in all 50 states and can have as many owners as needed unless it chooses to form as an S corporation, which would limit the number of owners to 100.

If an LLC is owned by a husband and wife in a non-community property state the LLC should file as a partnership. However, in community property states you can have your multi-member (husband and wife owners) and that LLC can get treated as a SMLLC for tax purposes.

In most places, a spouse can be added as an owner to an LLC without classifying them as an employee or partner, which would then maintain your business' sole proprietorship status.

If both spouses take part in the business and are the only members of an LLC, and a joint tax return is personally filed, a qualified joint venture can be elected instead of a partnership. This election treats each spouse as a sole proprietor instead of a partnership.

If you choose to set up your LLC with just one spouse as a member, you can classify it as a sole proprietorship.Because you are married, the IRS allows you to divide each stream of income, expenses, and tax credits proportionate to your percentage of ownership in the LLC.

When a spouse frequently works in an LLC, one of the best ways to avoid personal liability is to make the spouse a member.After the addition of a member, a limited liability company must amend the operating agreement to reflect the changes to the members' interests in voting, profits, and losses.

The business entity is wholly owned by a husband and wife as community property under the laws of a state, a foreign country, or possession of the United States; No person other than one or both spouses would be considered an owner for federal tax purposes; and.

Forming an LLC or corporation can help protect your business assets in case of divorce, especially if you incorporate before you get married.But it's important to ensure that you don't use marital assets to pay for company expenses. If you do, the court could determine that the company is actually marital property.