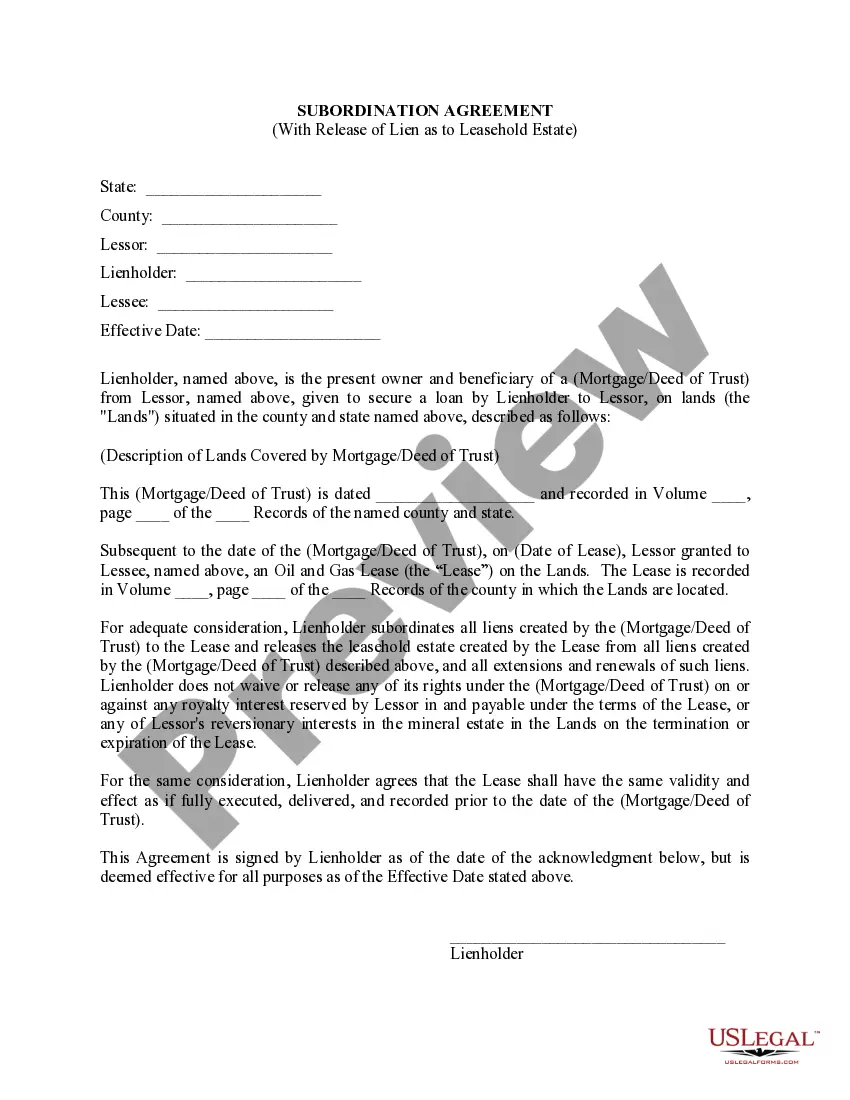

Subordination means an agreement to put a debt or claim which has priority in a lower position behind another debt, particularly a new loan. A property owner with a loan secured by the property who applies for a second mortgage to make additions or repairs usually must get a subordination of the original loan so the new loan has first priority. A declaration of homestead must always be subordinated to a loan.

New Jersey Lease Subordination Agreement

Description

How to fill out New Jersey Lease Subordination Agreement?

US Legal Forms is really a special platform to find any legal or tax form for submitting, including New Jersey Lease Subordination Agreement. If you’re tired of wasting time looking for perfect examples and paying money on file preparation/legal professional fees, then US Legal Forms is precisely what you’re trying to find.

To reap all of the service’s benefits, you don't need to install any software but just pick a subscription plan and sign up your account. If you have one, just log in and find a suitable sample, download it, and fill it out. Downloaded documents are all kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Lease Subordination Agreement, have a look at the guidelines below:

- make sure that the form you’re looking at applies in the state you need it in.

- Preview the form and read its description.

- Simply click Buy Now to access the sign up webpage.

- Pick a pricing plan and proceed signing up by entering some information.

- Decide on a payment method to complete the sign up.

- Save the document by selecting the preferred format (.docx or .pdf)

Now, complete the document online or print out it. If you are unsure regarding your New Jersey Lease Subordination Agreement template, speak to a attorney to review it before you send out or file it. Begin hassle-free!

Form popularity

FAQ

Unless there is a subordination agreement, it is virtually impossible to refinance your first mortgage. The document agreeing to the subordination must be signed by the lender and the borrower and requires notarization.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

A written contract in which a lender who has secured a loan by a mortgage or deed of trust agrees with the property owner to subordinate its loan (accept a lower priority for the collection of its debt), thus giving the new loan priority in any foreclosure or payoff.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.The primary lien on a house is usually a mortgage. However, it's also possible to have other liens.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

The signed agreement must be acknowledged by a notary and recorded in the official records of the county to be enforceable.

When a Borrower wishes to refinance the property, they must request a subordination request to the Lender. The Lender will subordinate their loan only when there is no cash out as part of the refinance.