New Jersey Summary of Chapter 13 Plan

Description

How to fill out New Jersey Summary Of Chapter 13 Plan?

US Legal Forms is really a special platform to find any legal or tax document for completing, including New Jersey Summary of Chapter 13 Plan. If you’re sick and tired of wasting time seeking perfect examples and spending money on papers preparation/legal professional fees, then US Legal Forms is exactly what you’re searching for.

To experience all of the service’s benefits, you don't need to download any software but simply pick a subscription plan and create an account. If you have one, just log in and look for the right template, download it, and fill it out. Saved documents are stored in the My Forms folder.

If you don't have a subscription but need New Jersey Summary of Chapter 13 Plan, have a look at the guidelines below:

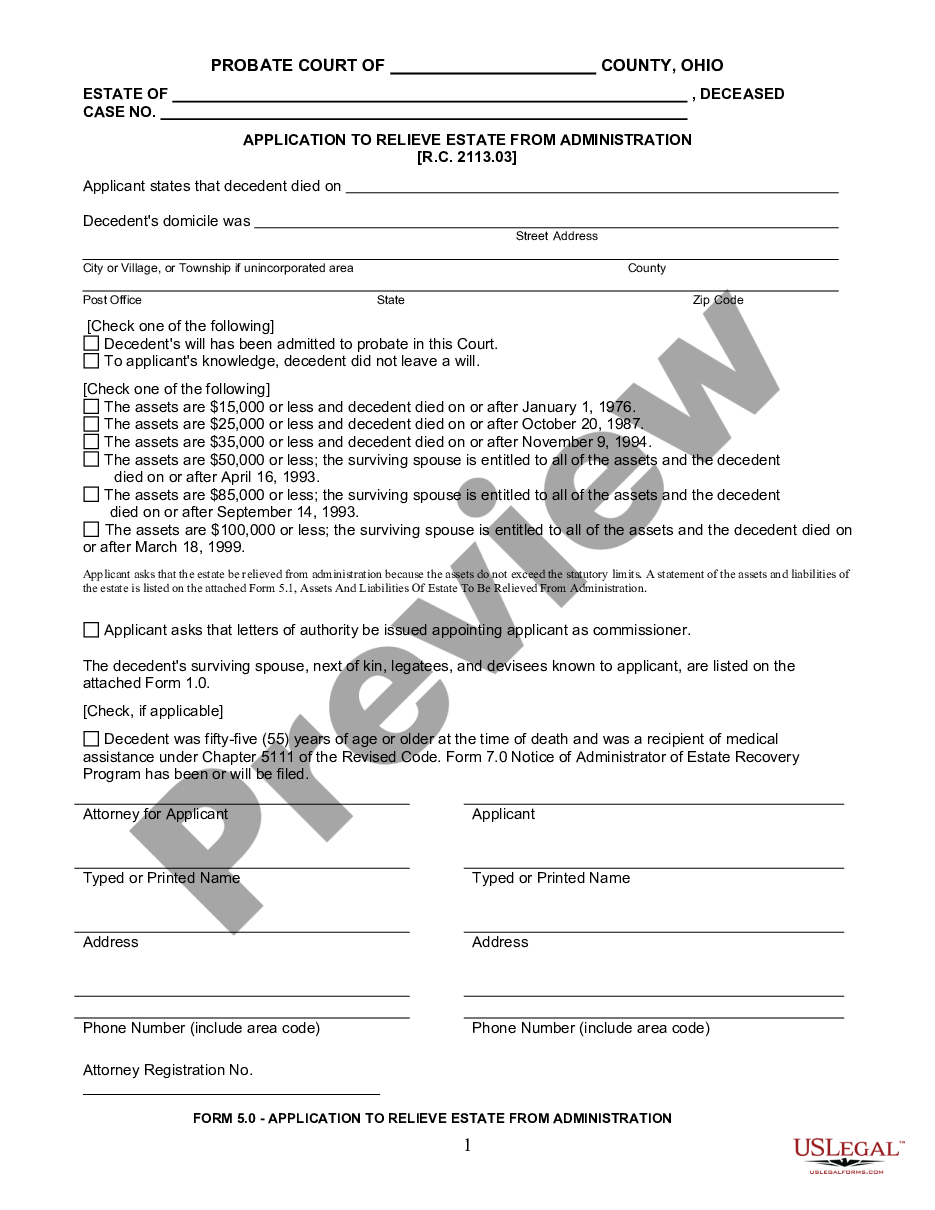

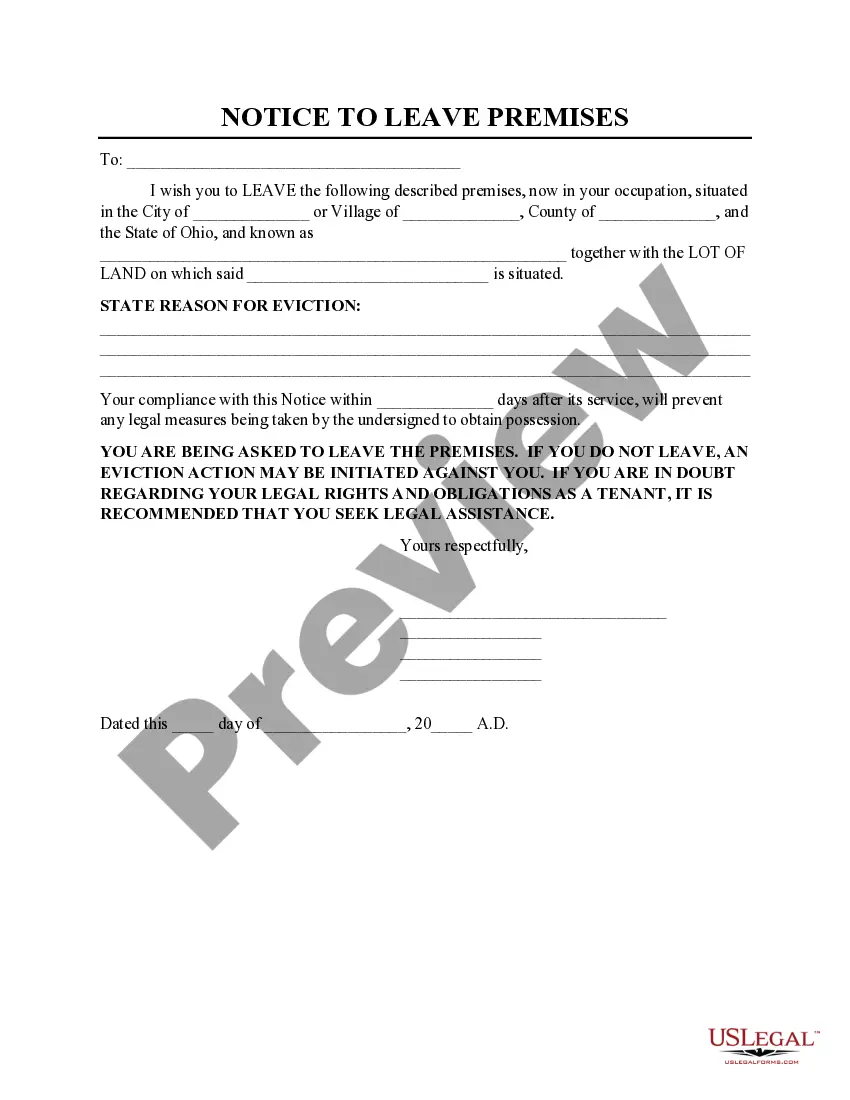

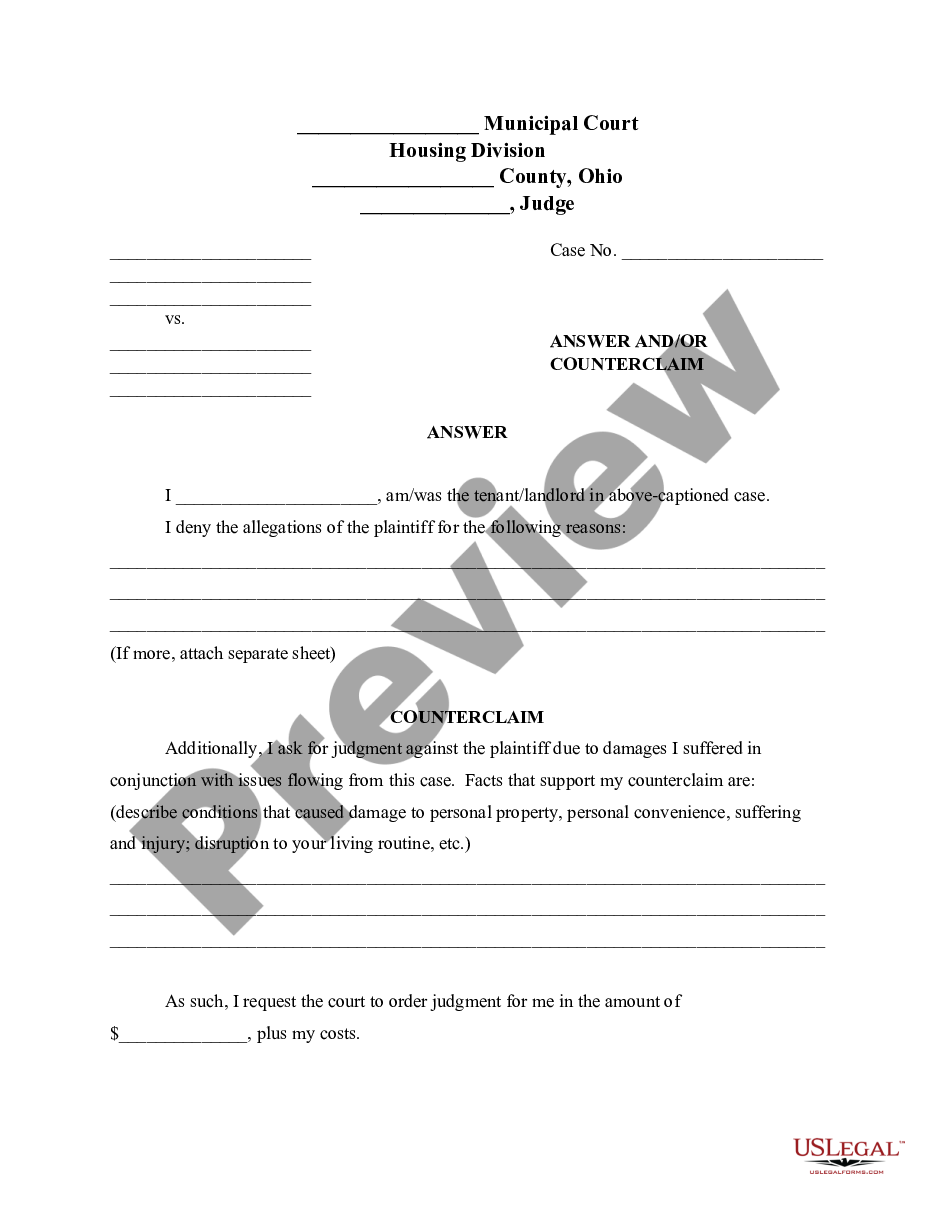

- check out the form you’re taking a look at is valid in the state you need it in.

- Preview the sample and read its description.

- Click on Buy Now button to access the register page.

- Select a pricing plan and proceed signing up by entering some info.

- Decide on a payment method to complete the registration.

- Save the document by selecting the preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you are unsure about your New Jersey Summary of Chapter 13 Plan sample, speak to a attorney to analyze it before you send or file it. Start without hassles!

Form popularity

FAQ

Before the court confirms (approves) your Chapter 13 repayment plan, you must show that it represents your "best efforts" to pay back creditors. It's also called the disposable income test because you must pay all of your disposable income at a minimum.

Congress has decided that certain obligations, called priority debts, are too important to be discharged in bankruptcy. Common examples of priority debts include back child support, alimony, and certain taxes. If you file for Chapter 13 bankruptcy, you must pay off these debts in full through your repayment plan.

After you file for Chapter 13 bankruptcy, the court will schedule a confirmation hearing to determine whether or not your plan should be approved. If the trustee or your creditors don't object to your proposed plan, the court will confirm your plan at the hearing.

Through the repayment plan, which lasts either three or five years, you pay a set amount to the bankruptcy trustee each month. The trustee then uses that money to pay your creditors. Some creditors get paid in full through the plan, others (mostly unsecured creditors) get paid a portion of what you owe them.

The Overall Chapter 13 Average Payment. The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation.

A 100% plan is a Chapter 13 bankruptcy in which you develop a plan with your attorney and creditors to pay back your debt. It is required to pay back all secured debt and 100% of all unsecured debt.

Credit card debt. medical bills. personal loans. older nonpriority income tax obligations. utility bills, and. most lawsuit judgments.

A Chapter 13 debt discharge is a court order releasing the debtor of all debts that are dischargeable. You don't have to pay back debts that have been discharged. Creditors are also prohibited from trying to collect debts after the case is finalized.

Chapter 13 allows you to create a 3-5-year repayment plan without liquidating any of your assets. Even if your mortgage lender has initiated foreclosure , Chapter 13 may allow you to keep your home. You may also be able to extend loan maturity and lower either the principal or the interest rate.