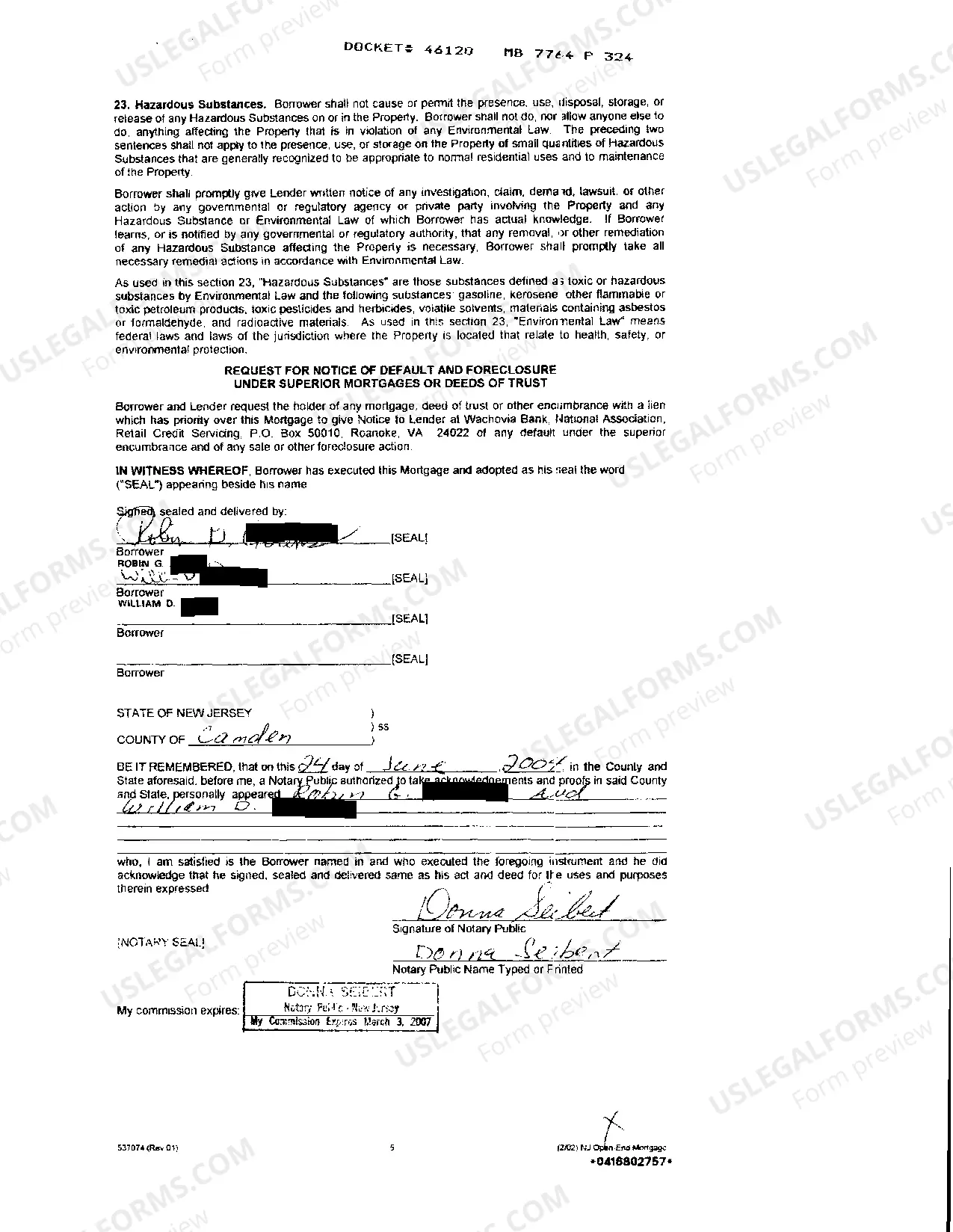

New Jersey Open End Mortgage

Description What Is An Open End Mortgage

How to fill out New Jersey Open End Mortgage?

US Legal Forms is really a special platform where you can find any legal or tax template for completing, such as New Jersey Open End Mortgage. If you’re tired of wasting time seeking appropriate samples and spending money on document preparation/legal professional service fees, then US Legal Forms is exactly what you’re seeking.

To reap all of the service’s advantages, you don't have to download any application but just select a subscription plan and register your account. If you have one, just log in and find the right sample, save it, and fill it out. Saved files are all stored in the My Forms folder.

If you don't have a subscription but need New Jersey Open End Mortgage, take a look at the recommendations below:

- make sure that the form you’re looking at is valid in the state you want it in.

- Preview the form its description.

- Simply click Buy Now to reach the sign up webpage.

- Pick a pricing plan and keep on registering by entering some info.

- Select a payment method to complete the registration.

- Download the document by choosing your preferred file format (.docx or .pdf)

Now, submit the file online or print it. If you are unsure concerning your New Jersey Open End Mortgage form, contact a legal professional to examine it before you send or file it. Get started without hassles!

Examples Of Open End Credit Form popularity

Can You Do An Open End Mortgage In New Jersey Other Form Names

FAQ

An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. Open-end mortgages permit the borrower to go back to the lender and borrow more money. There is usually a set dollar limit on the additional amount that can be borrowed.

A temporary loan, also called interim financing, bridge loan, swing loan, or gap loan, is used when funds are needed for short periods of time to complete a real estate transaction.

Open-end credit is a pre-approved loan, granted by a financial institution to a borrower, that can be used repeatedly. With open-end loans, like credit cards, once the borrower has started to pay back the balance, they can choose to take out the funds againmeaning it is a revolving loan.

A closed-end loan is often an installment loan in which the loan is issued for a specific amount that is repaid in installment payments on a set schedule.An open-end loan is a revolving line of credit issued by a lender or financial institution.

Conventional / Fixed Rate Mortgage. Conventional fixed rate loans are a safe bet because of their consistency the monthly payments won't change over the life of your loan. Interest-Only Mortgage. Adjustable Rate Mortgage (ARM) FHA Loans. VA Loans. Combo / Piggyback. Balloon. Jumbo.

Obtaining closed end credit mainly requires a good credit rating. It is also one of the best ways to build a good score.With closed end credit, the interest rate and monthly payments will be fixed; these rates may vary from one lender to another. Generally, the interest rates are favorable over open end credit.

A traditional mortgage provides you with a single lump sum. Ordinarily, all of this money is used to purchase the home. An open-end mortgage provides you with a lump sum that is used to purchase the home. But the open-end mortgage is for more than the purchase amount.

End loans help construction loan borrowers pay off their entire original balance, upon the completion of a project.By using an end loan to pay off the construction loan, the borrower saves money, based upon the difference in interest rates.

Open-end credit refers to any type of loan where you can make repeated withdrawals and repayments. Examples include credit cards, home equity loans, personal lines of credit and overdraft protection on checking accounts.