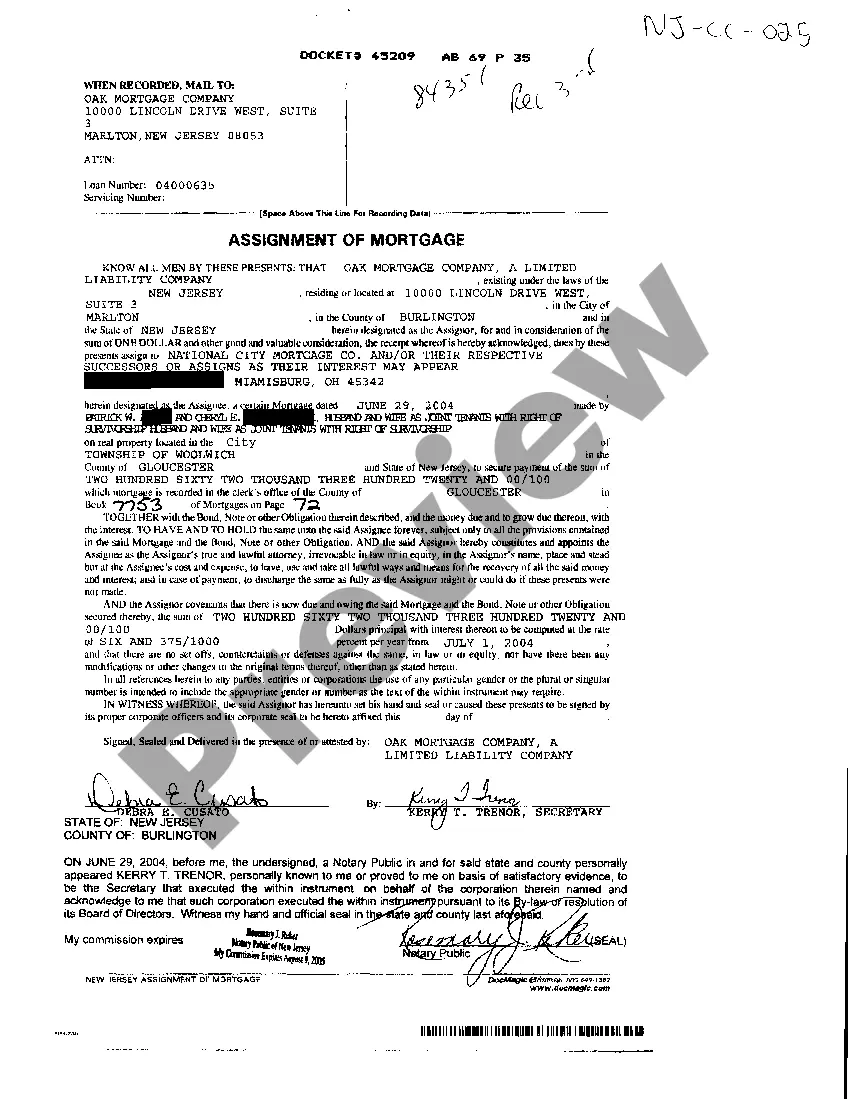

New Jersey Sample Assignment Of Mortgage

Description

How to fill out New Jersey Sample Assignment Of Mortgage?

US Legal Forms is a unique platform where you can find any legal or tax form for submitting, including New Jersey Sample Assignment Of Mortgage. If you’re tired with wasting time searching for perfect samples and spending money on papers preparation/attorney charges, then US Legal Forms is precisely what you’re seeking.

To enjoy all the service’s advantages, you don't have to download any software but just pick a subscription plan and sign up an account. If you have one, just log in and look for a suitable template, download it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Sample Assignment Of Mortgage, take a look at the instructions listed below:

- check out the form you’re considering is valid in the state you need it in.

- Preview the form and look at its description.

- Click on Buy Now button to reach the sign up page.

- Choose a pricing plan and carry on signing up by providing some info.

- Pick a payment method to finish the registration.

- Save the file by choosing your preferred format (.docx or .pdf)

Now, submit the file online or print it. If you feel uncertain about your New Jersey Sample Assignment Of Mortgage form, contact a lawyer to examine it before you send or file it. Start without hassles!

Form popularity

FAQ

What does Assignment of Mortgage mean: The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid.If a borrower transfers the mortgage to another borrower, this is called an assumed mortgage.

Purpose A gap mortgages allows funding for a property to continue while it is going through the process of selling.Documents required for a mortgage assignment are: Instead of having you pay off your old loan with money from your new lender, your original lender assigns your loan balance to the new one.

To assign the note and mortgage is to transfer ownership of the note and mortgage. Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

Gap Financing is a term mostly associated with mortgage loans or property loans such as a bridge loan. It is an interim loan given to finance the difference between the floor loan and the maximum permanent loan as committed.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note. Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

1If a loan is "assumable," you're in luck: That means you can transfer the mortgage to somebody else.2In most cases, the new borrower needs to qualify for the loan.3To complete a transfer of an assumable loan, request the change with your lender.How to Transfer a Mortgage to Another Borrower - The Balance\nwww.thebalance.com > can-you-transfer-a-mortgage-315698