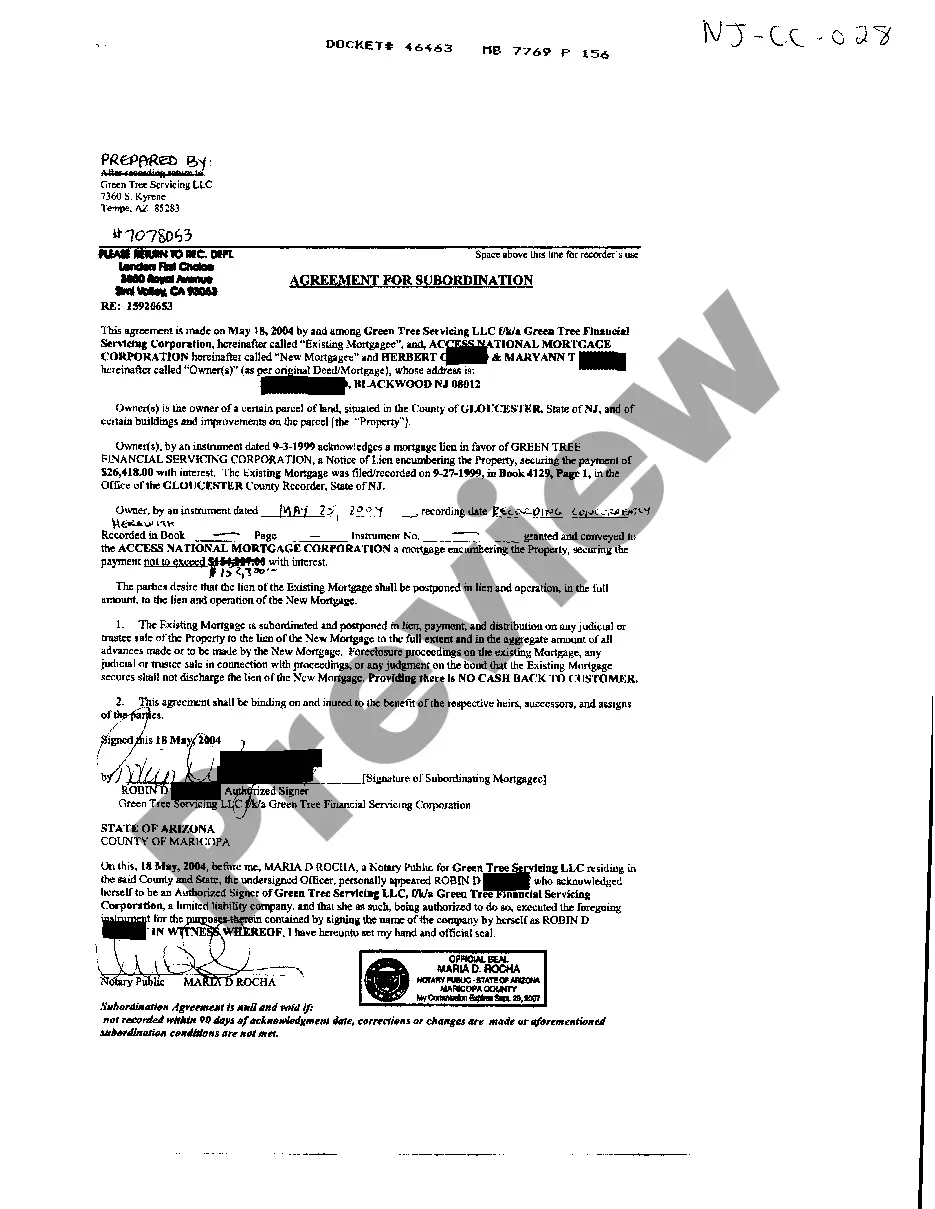

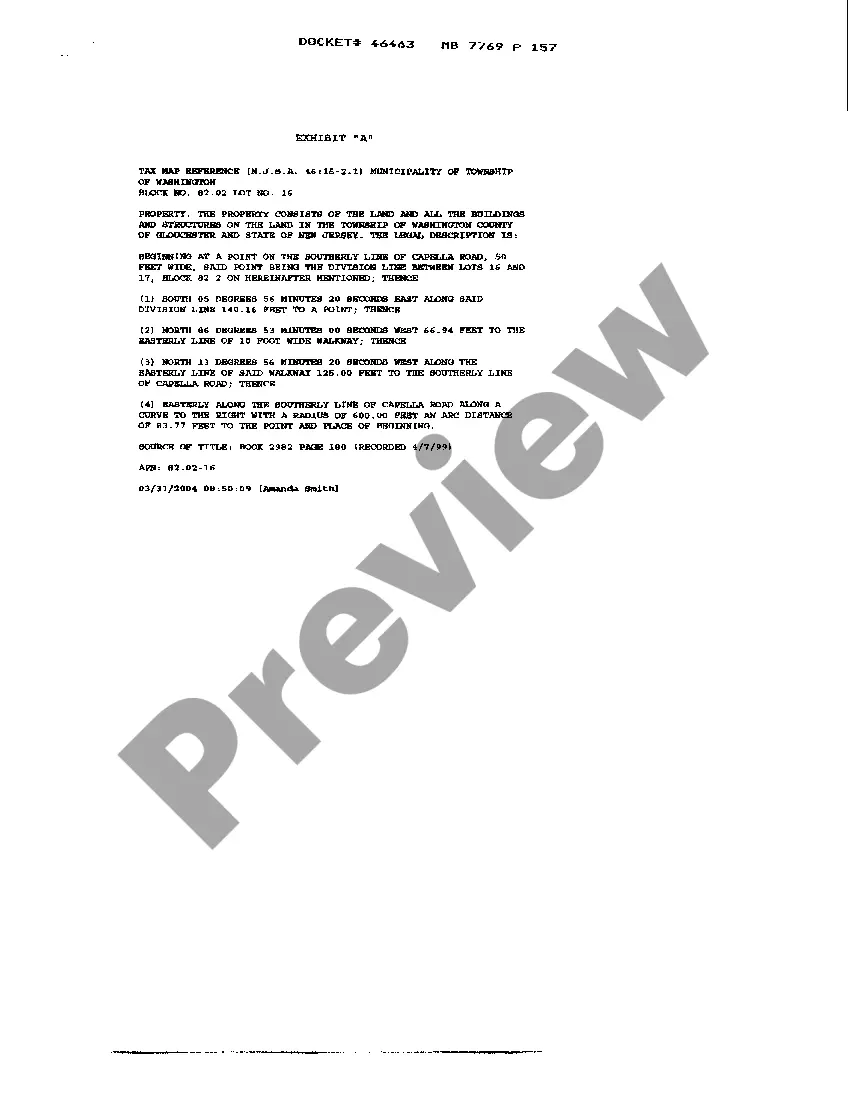

New Jersey Agreement For Subordination of Mortgage

Description Subordination Agreement Template

How to fill out New Jersey Agreement For Subordination Of Mortgage?

US Legal Forms is really a unique system where you can find any legal or tax document for completing, including New Jersey Agreement For Subordination of Mortgage. If you’re fed up with wasting time looking for ideal samples and spending money on document preparation/attorney fees, then US Legal Forms is precisely what you’re searching for.

To reap all of the service’s benefits, you don't need to download any application but just pick a subscription plan and create an account. If you have one, just log in and find the right sample, download it, and fill it out. Saved files are all saved in the My Forms folder.

If you don't have a subscription but need to have New Jersey Agreement For Subordination of Mortgage, check out the instructions below:

- check out the form you’re checking out applies in the state you need it in.

- Preview the example its description.

- Click on Buy Now button to reach the register page.

- Select a pricing plan and carry on signing up by providing some information.

- Choose a payment method to complete the sign up.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you feel uncertain regarding your New Jersey Agreement For Subordination of Mortgage template, speak to a legal professional to examine it before you send out or file it. Begin without hassles!

Form popularity

FAQ

Subordination of lease refers to the tenant's consent to subordinate his or her rights over a property to the rights of the bank holding the mortgage on the property. A subordination of lease agreement is created for this purpose.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

Subordinate Mortgages and Refinancing When you refinance, your new lender will want their mortgage to hold primary status, and for the HELOC to remain subordinate. In order for this to happen, the HELOC lender will need to agree and the HELOC will need to be re-subordinated.

When a Borrower wishes to refinance the property, they must request a subordination request to the Lender. The Lender will subordinate their loan only when there is no cash out as part of the refinance.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

Unless there is a subordination agreement, it is virtually impossible to refinance your first mortgage. The document agreeing to the subordination must be signed by the lender and the borrower and requires notarization.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.The primary lien on a house is usually a mortgage. However, it's also possible to have other liens.

The signed agreement must be acknowledged by a notary and recorded in the official records of the county to be enforceable.