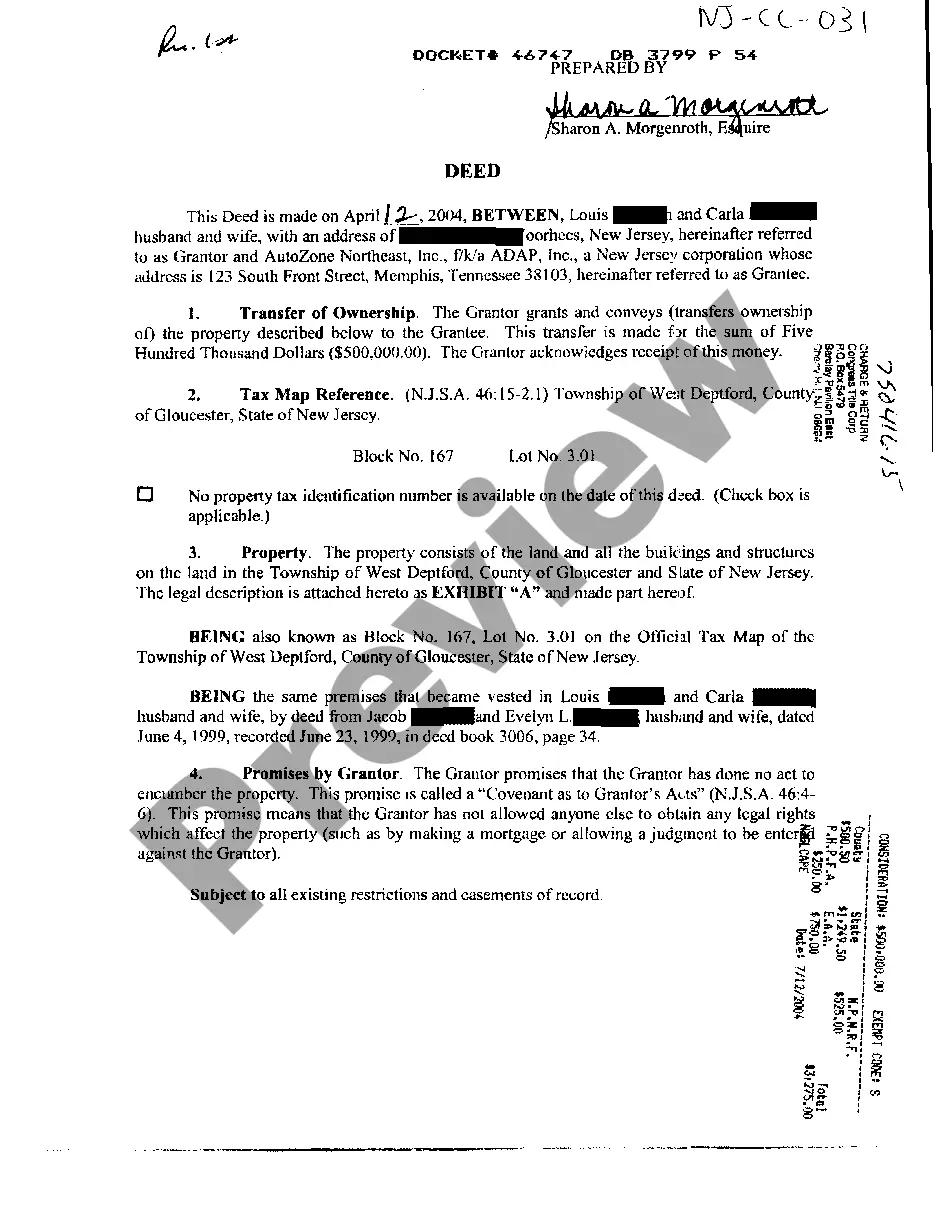

New Jersey Deed Between Married Couple and Corporation

Description

How to fill out New Jersey Deed Between Married Couple And Corporation?

US Legal Forms is actually a special platform to find any legal or tax template for filling out, such as New Jersey Deed Between Married Couple and Corporation. If you’re fed up with wasting time searching for appropriate samples and spending money on record preparation/legal professional service fees, then US Legal Forms is precisely what you’re trying to find.

To reap all of the service’s advantages, you don't need to install any software but simply pick a subscription plan and create your account. If you already have one, just log in and look for an appropriate sample, download it, and fill it out. Downloaded documents are all stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Deed Between Married Couple and Corporation, check out the recommendations listed below:

- check out the form you’re taking a look at is valid in the state you want it in.

- Preview the example its description.

- Simply click Buy Now to reach the register page.

- Select a pricing plan and proceed registering by entering some information.

- Choose a payment method to complete the sign up.

- Download the document by selecting your preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you feel uncertain about your New Jersey Deed Between Married Couple and Corporation sample, contact a attorney to analyze it before you send out or file it. Begin without hassles!

Form popularity

FAQ

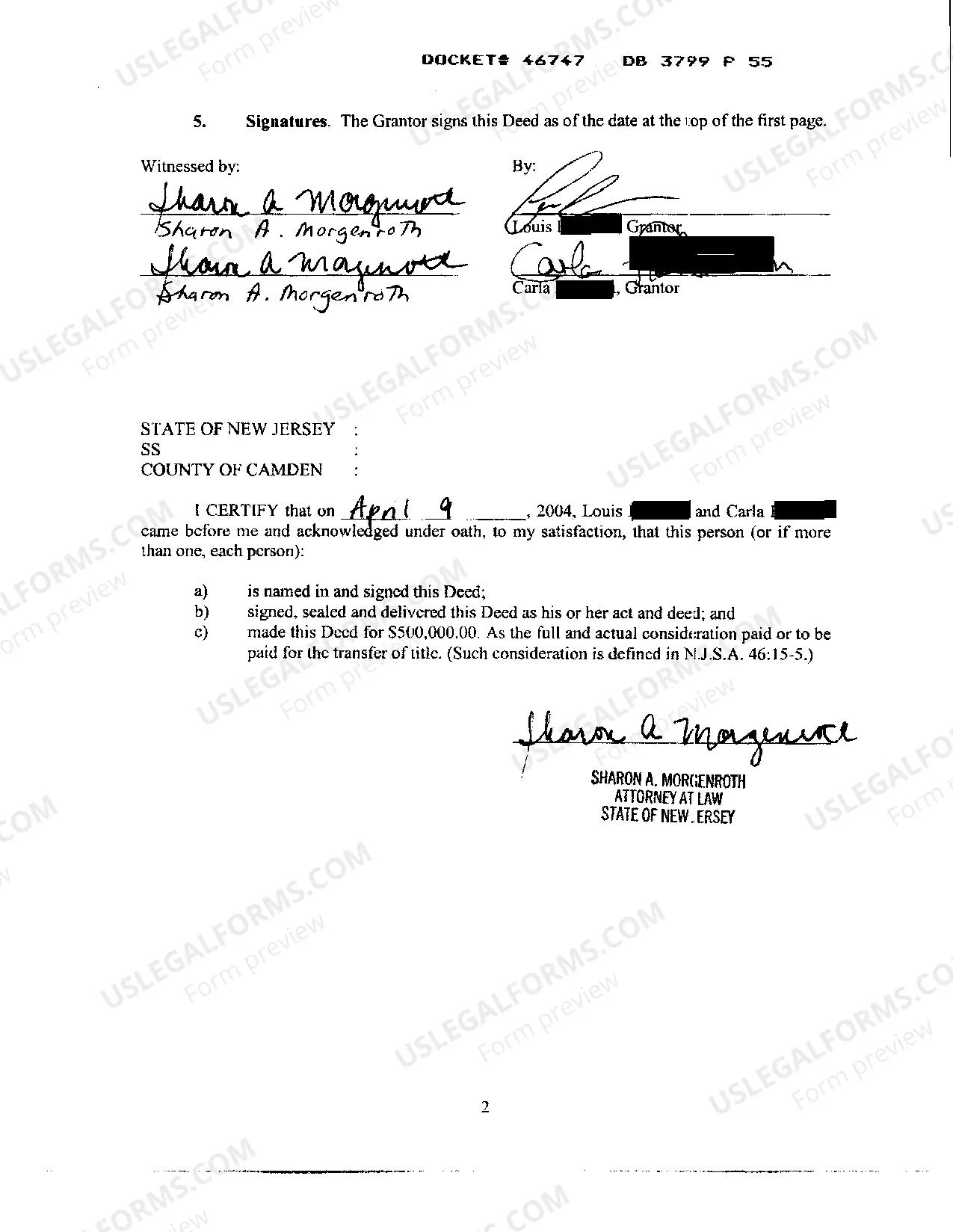

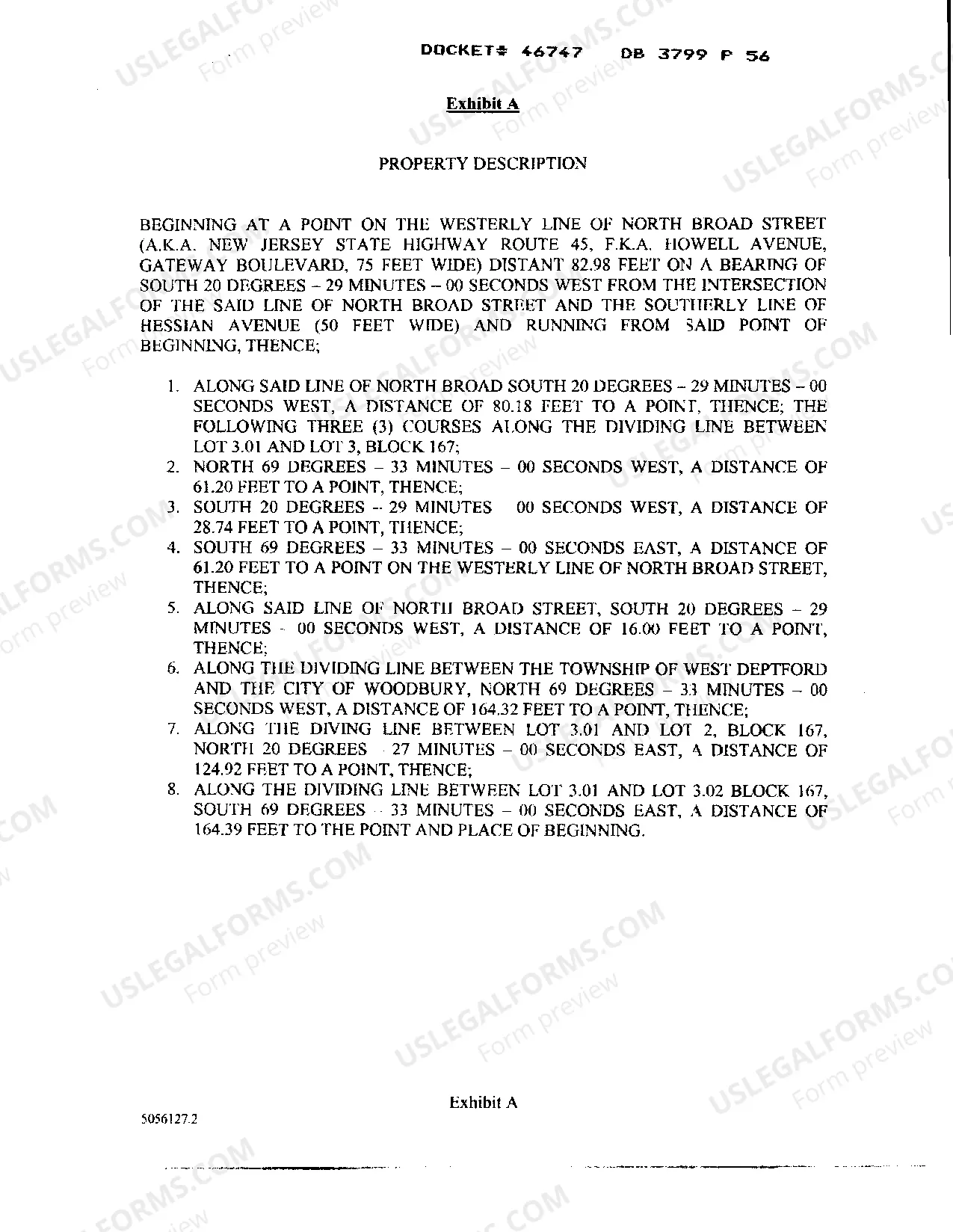

In New Jersey, the deed must be in English, identify the seller/buyer (grantor/grantee), name the person that prepared the deed, state the consideration (amount paid) for the transfer, contain a legal description of the property (a survey), include the signature of the grantor and be signed before a notary.

In estate law, joint tenancy is a special form of ownership by two or more persons of the same property. The individuals, who are called joint tenants, share equal ownership of the property and have the equal, undivided right to keep or dispose of the property. Joint tenancy creates a Right of Survivorship.

' Spouses typically acquire title as tenants by the entireties, which only applies to spouses. Sometimes you will see a couple who acquired the property before marriage. In some states, a pre-marital joint tenancy automatically becomes tenants by the entireties upon marriage.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

California is a community property state, which is a policy that only applies to spouses and domestic partners.The only property that doesn't become community property automatically are gifts and inheritances that one spouse receives.

The most recognized form for a married couple is to own their home as Tenants by the Entirety. A tenancy by the entirety is ownership in real estate under the fictional assumption that a husband and wife are considered one person for legal purposes. This method of ownership conveys the property to them as one person.

The most common of these methods of title holding are: Joint tenancy. Tenancy in common. Tenants by entirety.

California married couples generally have three options to take title to their community (vs separate) property real estate: community property, joint tenancy or Community Property with Right of Survivorship. The latter coming into play in California July of 2001.

In New Jersey, the preparation of legal documents such as a deed is considered the practice of law which may only be undertaken by an Attorney at Law of the State of New Jersey. The only exception to that rule is that an individual representing him/herself may prepare his/her own documents.