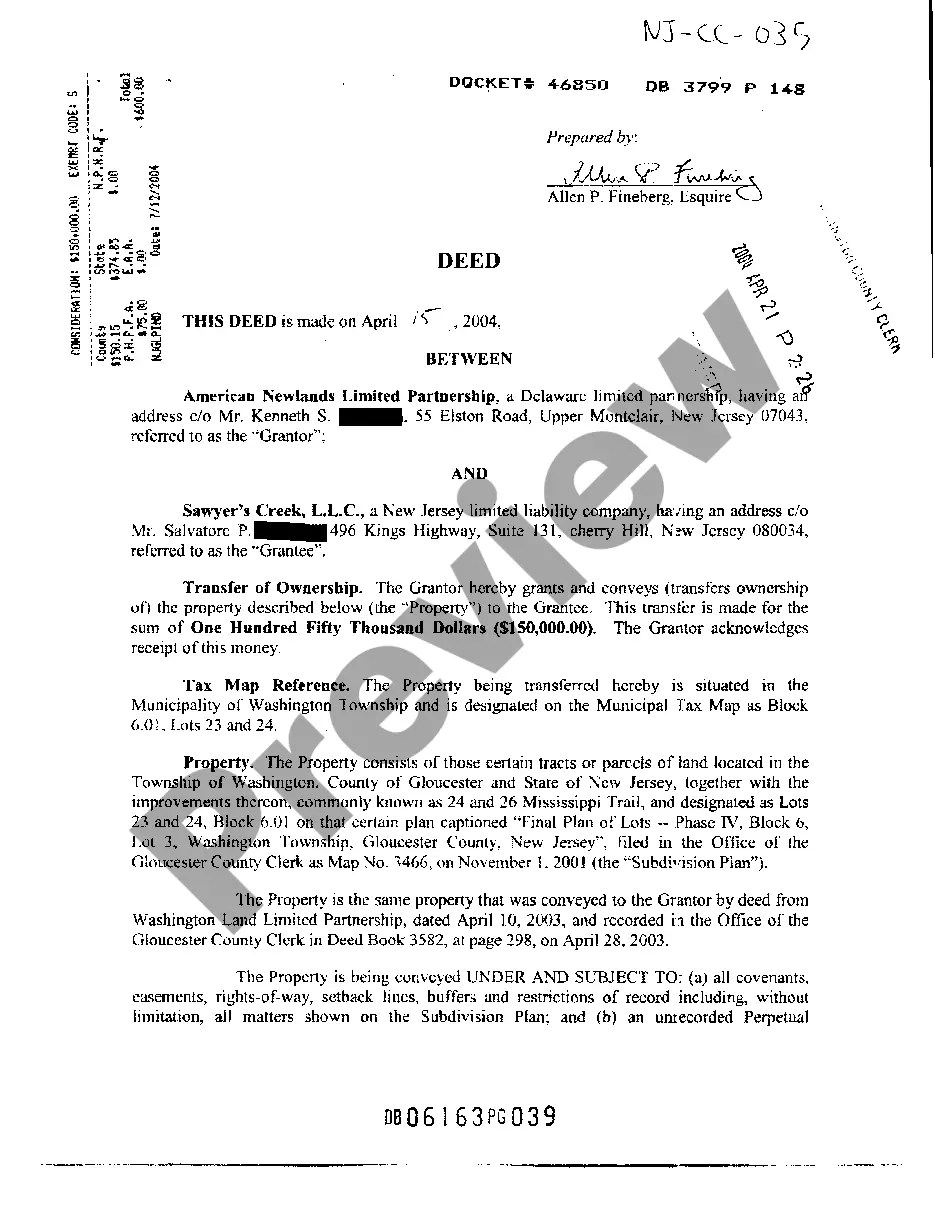

New Jersey Deed Between Limited Partnership and LLC

Description

How to fill out New Jersey Deed Between Limited Partnership And LLC?

US Legal Forms is really a special platform where you can find any legal or tax template for completing, such as New Jersey Deed Between Limited Partnership and LLC. If you’re tired of wasting time seeking ideal examples and paying money on papers preparation/lawyer charges, then US Legal Forms is exactly what you’re seeking.

To enjoy all of the service’s advantages, you don't need to install any software but just choose a subscription plan and register an account. If you already have one, just log in and find a suitable sample, save it, and fill it out. Downloaded files are all kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Deed Between Limited Partnership and LLC, take a look at the instructions below:

- check out the form you’re checking out applies in the state you want it in.

- Preview the sample and read its description.

- Simply click Buy Now to get to the register page.

- Pick a pricing plan and proceed registering by providing some info.

- Select a payment method to finish the registration.

- Save the file by choosing your preferred file format (.docx or .pdf)

Now, submit the file online or print it. If you are uncertain about your New Jersey Deed Between Limited Partnership and LLC template, contact a lawyer to examine it before you decide to send or file it. Get started hassle-free!

Form popularity

FAQ

The difference between a general partner vs. limited partner is a general partner is an owner of the partnership, and a limited partner is a silent partner in the business. A general partner is an owner of a partnership.

Without an operating agreement, most states require that all current LLC members must agree to add a new member, and the new member becomes an automatic equal partner.

Because partnerships require at least two members or individuals, a partnership becomes a single member LLC if there is only one person left in the business. As such, the IRS allows single-member LLCs to file a Form 8832 to elect treatment as a "disregarded entity" or sole proprietorship, according to UpCounsel.

Regarding liability, an LLC is always better than a general partnership. You and your partners can form an LLC and limit your personal liability. However, there will be additional costs in setting up and registering an LLC.

Obtain Digital Signature for all the partners. Partners in LLP require a DPIN/DIN. Make an application in RUN-LLP Form for name reservation on MCA website. File Form FiLLiP for Application and Statement for the Conversion of Partnership Firm into LLP.

Methods of Conversion The first is to form a new LLC, dissolve the partnership, and transfer all the partnerships assets and liabilities to the new LLC. The second method, available in many states, is to file a form with the state agency in charge of business entities that converts the partnership into an LLC.

To add (change, remove, etc) members to a NJ LLC one would need to file Amendment of Articles of Organization with the New Jersey Division of Revenue. And yes, corporations can be members of LLC as long as the LLC is not elected to be taxed as S-Corp.

LLCs protect owners against personal liability for business debts and lawsuits. This safeguards the personal assets for all owners. In a general partnership, owners have unlimited, personal liability for the businesses' debts, including, but not limited to, the acts of employees.

Limited partners (limited in both their ability to manage the partnership and liability for the partnership's debts) can exclude their distributive share for self-employment tax purposes.An LLC member can enjoy limited liability and yet still participate actively in the LLC's management.