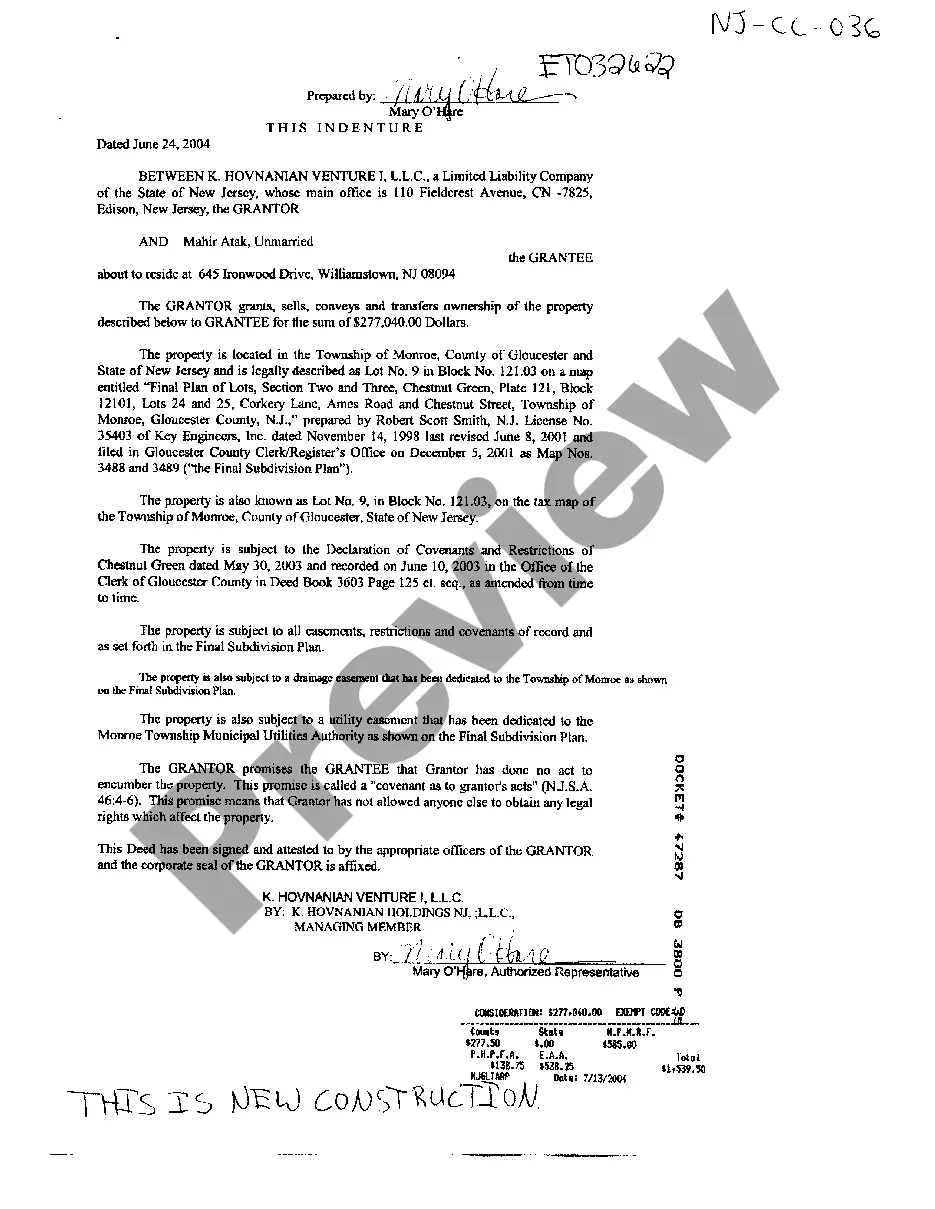

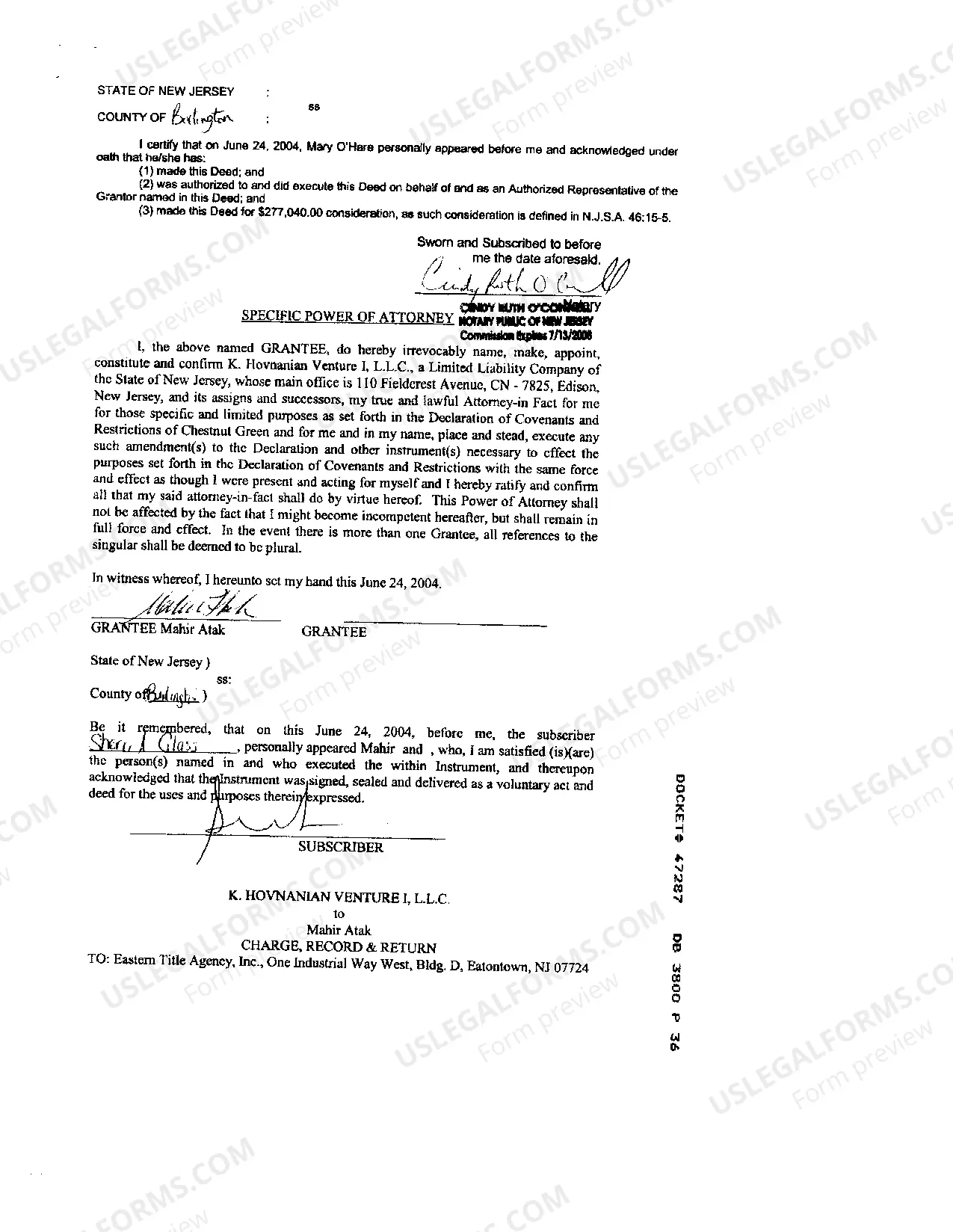

New Jersey Deed Between LLC and Individual

Description

How to fill out New Jersey Deed Between LLC And Individual?

US Legal Forms is actually a special system to find any legal or tax form for completing, such as New Jersey Deed Between LLC and Individual. If you’re fed up with wasting time searching for appropriate samples and spending money on document preparation/legal professional service fees, then US Legal Forms is precisely what you’re seeking.

To reap all the service’s advantages, you don't need to install any application but simply choose a subscription plan and create your account. If you already have one, just log in and look for a suitable template, download it, and fill it out. Downloaded documents are all kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Deed Between LLC and Individual, take a look at the recommendations below:

- check out the form you’re checking out is valid in the state you need it in.

- Preview the sample its description.

- Simply click Buy Now to get to the register page.

- Select a pricing plan and carry on signing up by entering some information.

- Decide on a payment method to complete the registration.

- Download the document by selecting the preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you are unsure concerning your New Jersey Deed Between LLC and Individual form, contact a lawyer to examine it before you send or file it. Begin hassle-free!

Form popularity

FAQ

The owners of an LLC are called its members.Sole Proprietor: The IRS considers the owner of a one-member LLC as a sole proprietor. Despite protection of their personal assets against the debts of the company, a single-member LLC owner must be responsible for all functions of the LLC.

Review your Operating Agreement and Articles of Organization. Establish What Your Buyer Wants to Buy. Draw Up a Buy-Sell Agreement with the New Buyer. Record the Sale with the State Business Registration Agency.

For an S corp or single-member LLC, the deal can be structured as either a sell of the company as a whole, or the assets of the company. A buyer who wants the whole company takes the name, stock ownership or LLC membership in its entirety, and is responsible for future tax returns.

Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more.

In New Jersey, the deed must be in English, identify the seller/buyer (grantor/grantee), name the person that prepared the deed, state the consideration (amount paid) for the transfer, contain a legal description of the property (a survey), include the signature of the grantor and be signed before a notary.

Whatever the reason, you can easily change your LLC's name by filing paperwork with your state agency that handles business filings. The most difficult and time-consuming part of an LLC name change is altering your LLC's name on all your business accounts, contracts and marketing materials.

In general, you should be able to use an LLC in any state as a vehicle to own real estate in any other states. However, some states might require your out-of-state LLC to register as a foreign LLC in that state, which can mean additional paperwork is required.

LLC ownership can be expressed in two ways: (1) by percentage; and (2) by membership units, which are similar to shares of stock in a corporation. In either case, ownership confers the right to vote and the right to share in profits.