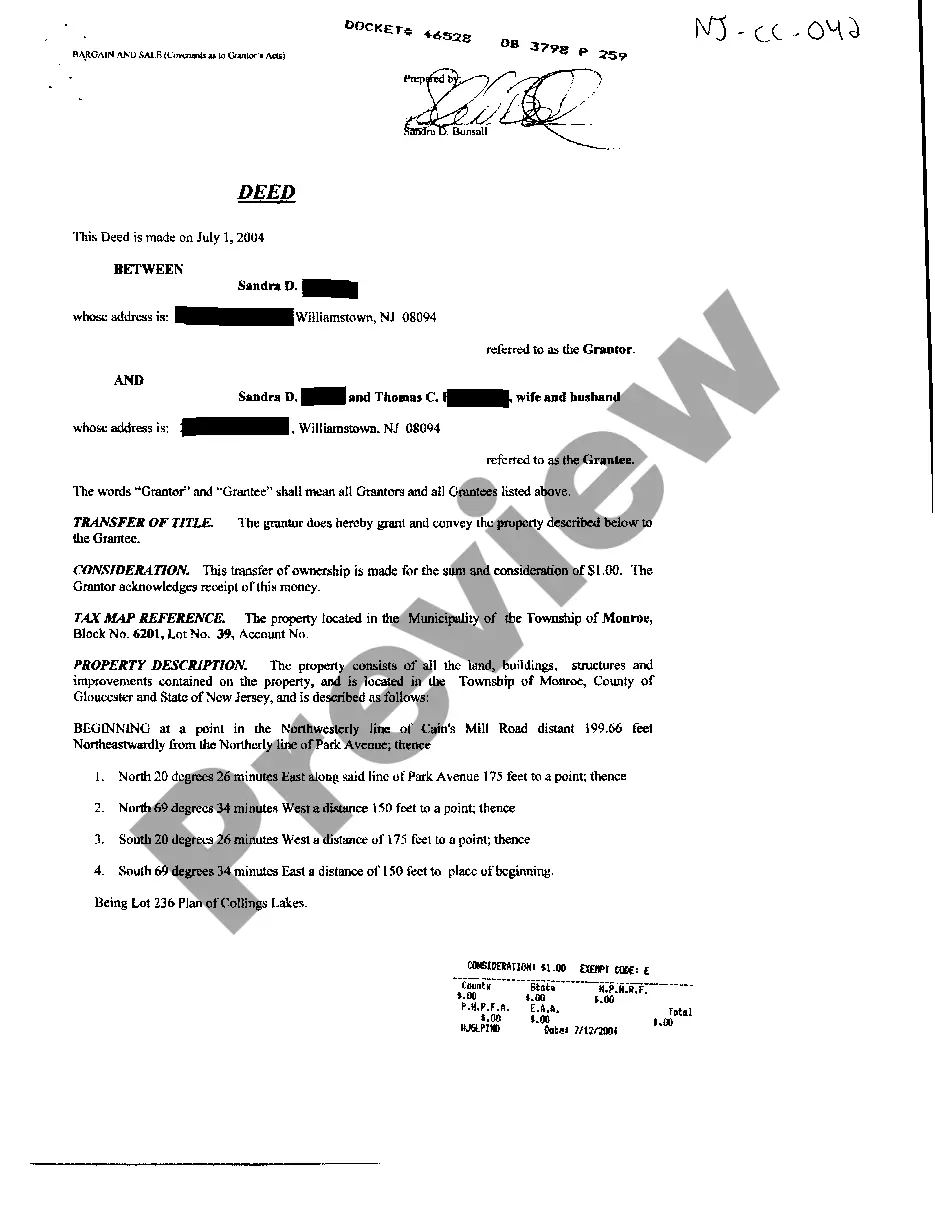

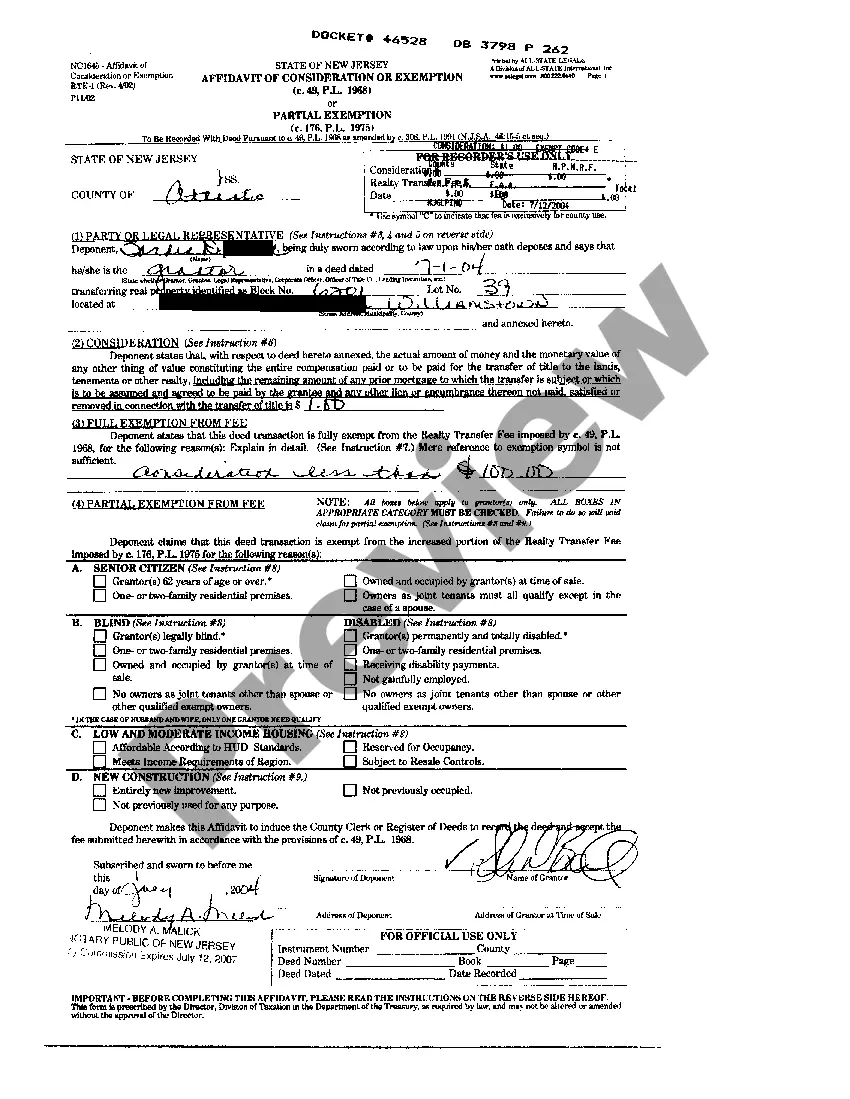

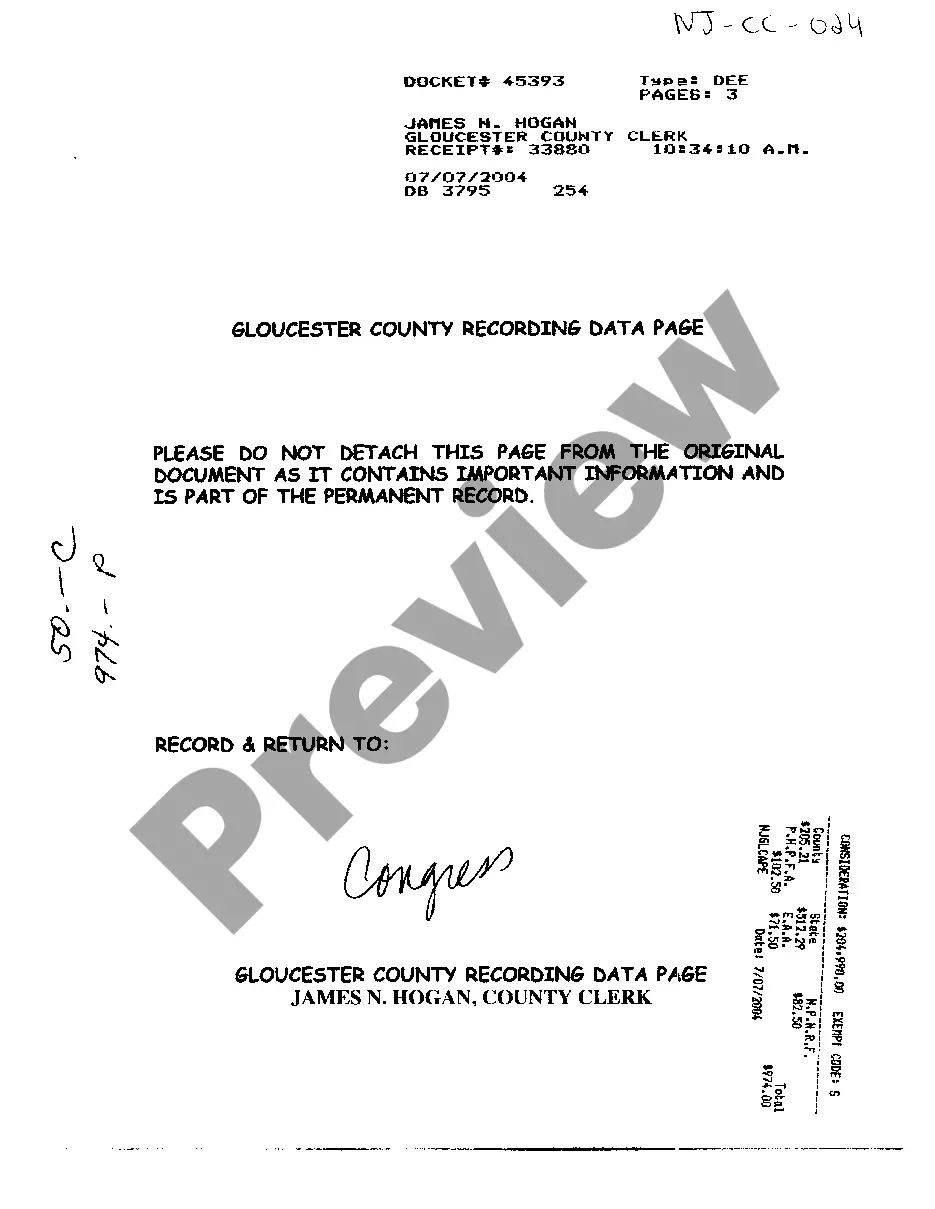

New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption

Description

How to fill out New Jersey Deed Between Individual And Married Couple With Affidavit Of Consideration Or Exemption?

US Legal Forms is actually a unique platform to find any legal or tax template for filling out, including New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption. If you’re tired with wasting time searching for ideal samples and spending money on document preparation/lawyer service fees, then US Legal Forms is exactly what you’re seeking.

To enjoy all of the service’s benefits, you don't need to download any software but just pick a subscription plan and register your account. If you have one, just log in and look for a suitable template, download it, and fill it out. Saved files are saved in the My Forms folder.

If you don't have a subscription but need New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption, check out the recommendations below:

- make sure that the form you’re considering is valid in the state you need it in.

- Preview the form and look at its description.

- Click on Buy Now button to reach the sign up page.

- Choose a pricing plan and keep on signing up by providing some information.

- Select a payment method to complete the registration.

- Save the file by choosing your preferred file format (.docx or .pdf)

Now, complete the document online or print out it. If you are uncertain concerning your New Jersey Deed Between Individual and Married Couple with Affidavit of Consideration or Exemption template, speak to a lawyer to analyze it before you send or file it. Begin without hassles!

Form popularity

FAQ

Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more.

NJ Taxation An Affidavit of Consideration (RTF-1 ) must be filed with any deed in which a full or partial exemption is claimed from the Realty Transfer Fee.

The death certificate and the original deed are the only documents needed to have the deceased's name removed from the deed. File papers in New Jersey probate court to have a deed transferred, in case of a tenancy in common.

To add a co-owner, the bank would have to create a new home loan agreement, which must be registered after paying the due stamp duty and registration charges. The bank would also insist on making the co-owner a co-borrower in the home loan applicable.

Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more.

The simplest way to add a spouse to a deed is through a quitclaim deed. This type of deed transfers whatever ownership rights you have so that you and your spouse now become joint owners. No title search or complex transaction is necessary. The deed will list you as the grantor and you and your spouse as grantees.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances.If a mortgage exists, it's best to work with the lender to make sure everyone on the title is protected.