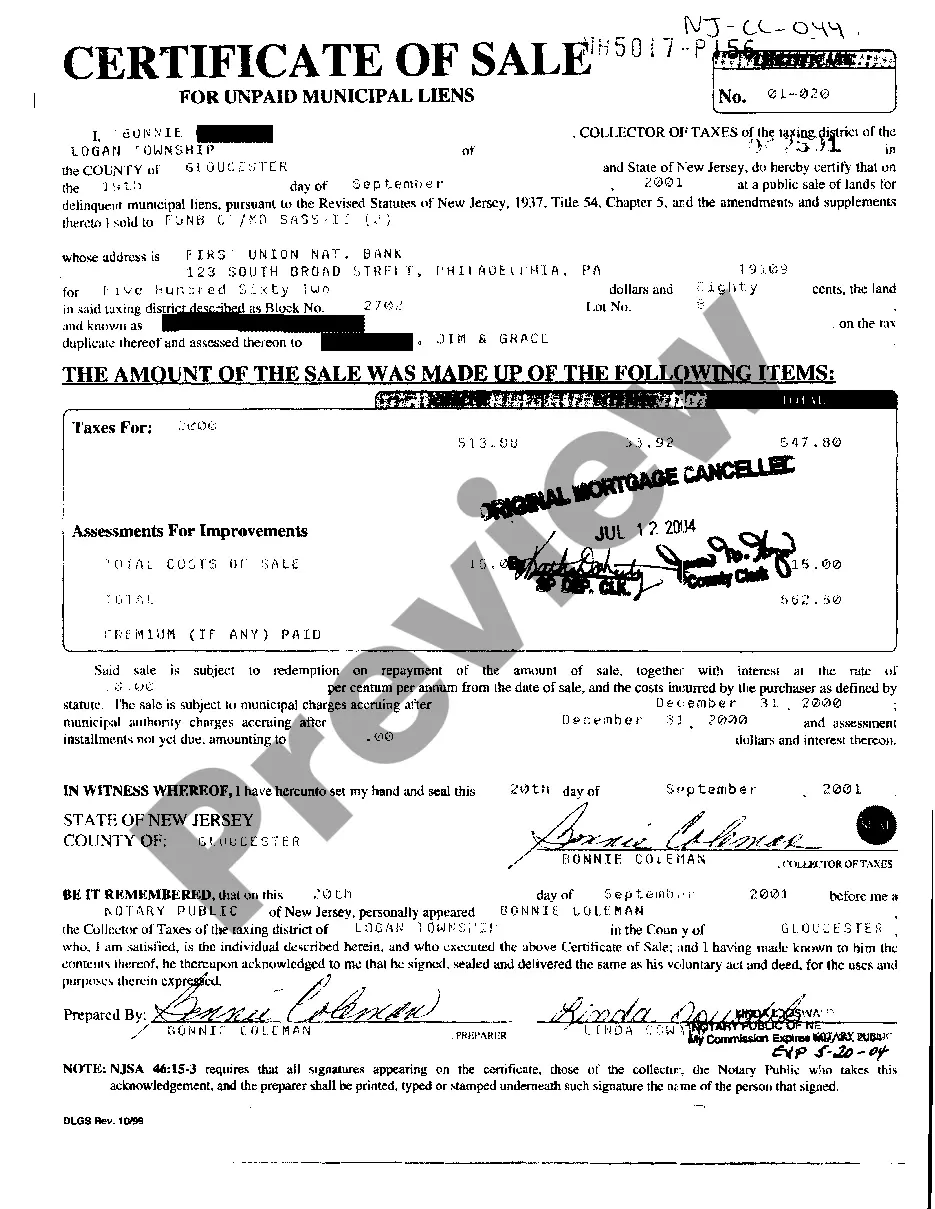

New Jersey Certificate of Sale for Unpaid Municipal Liens

Description

How to fill out New Jersey Certificate Of Sale For Unpaid Municipal Liens?

US Legal Forms is really a unique platform where you can find any legal or tax form for submitting, such as New Jersey Certificate of Sale for Unpaid Municipal Liens. If you’re sick and tired of wasting time seeking appropriate samples and spending money on papers preparation/legal professional service fees, then US Legal Forms is precisely what you’re looking for.

To experience all of the service’s benefits, you don't have to download any application but just select a subscription plan and create your account. If you already have one, just log in and look for the right sample, download it, and fill it out. Saved documents are stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Certificate of Sale for Unpaid Municipal Liens, take a look at the recommendations below:

- check out the form you’re looking at applies in the state you need it in.

- Preview the sample and read its description.

- Simply click Buy Now to get to the sign up page.

- Pick a pricing plan and proceed signing up by providing some info.

- Select a payment method to complete the registration.

- Download the file by choosing the preferred format (.docx or .pdf)

Now, complete the document online or print out it. If you feel unsure concerning your New Jersey Certificate of Sale for Unpaid Municipal Liens template, contact a attorney to analyze it before you send out or file it. Start hassle-free!

Form popularity

FAQ

Normally it takes at least two years for a tax lien to be redeemed, but with vacant properties, they can have tax sale certificates foreclosed in as little as 6 months under the New Jersey Tax Sale law and if a municipality owns the lien it can also be foreclosed on in 6 months.

Louisiana. This is one of the best states to shop for a tax lien. Mississippi. Mississippi tax liens may not have the most favorable auction policies, but its 18% interest rate and 2-year waiting period are attractive to investors. Iowa. Iowa is another state with a unique way of selling tax liens. Florida.

The New Jersey foreclosure redemption time-frame is 10 days. Therefore, you have 10 days after your home has been sold at Sheriff's Sale to redeem the property and take back ownership. It should be noted that there are no exceptions made during the NJ foreclosure redemption period.

According to Ted Thomas, an authority on tax lien certificates and tax deeds, 21 states and the District of Columbia are tax lien states: Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Maryland, Mississippi, Missouri, Montana, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, South Carolina,

An annual $250 deduction from real property taxes is provided for the dwelling of a qualified senior citizen, disabled person or their surviving spouse. To qualify, you must be age 65 or older, or a permanently and totally disabled individual or the unmarried surviving spouse, age 55 or more, of such person.

What is sold is a tax sale certificate, a lien on the property. Tax sale certificates can earn interest of up to 18 per cent, depending on the winning percentage bid at the auction. At the auction, bidders bid down the interest rate that will be paid by the owner for continuing interest on the certificate amount.

If you fall behind in making the property tax payments for your home, you might end up losing the place. The taxing authority could sell your home, perhaps through a foreclosure process, to satisfy the debt. Or the taxing authority might sell the tax lien that it holds, and the purchaser might be able to foreclose.

A tax lien certificate is a certificate of claim against a property that has a lien placed upon it as a result of unpaid property taxes. 1feff Tax lien certificates are generally sold to investors through an auction process.

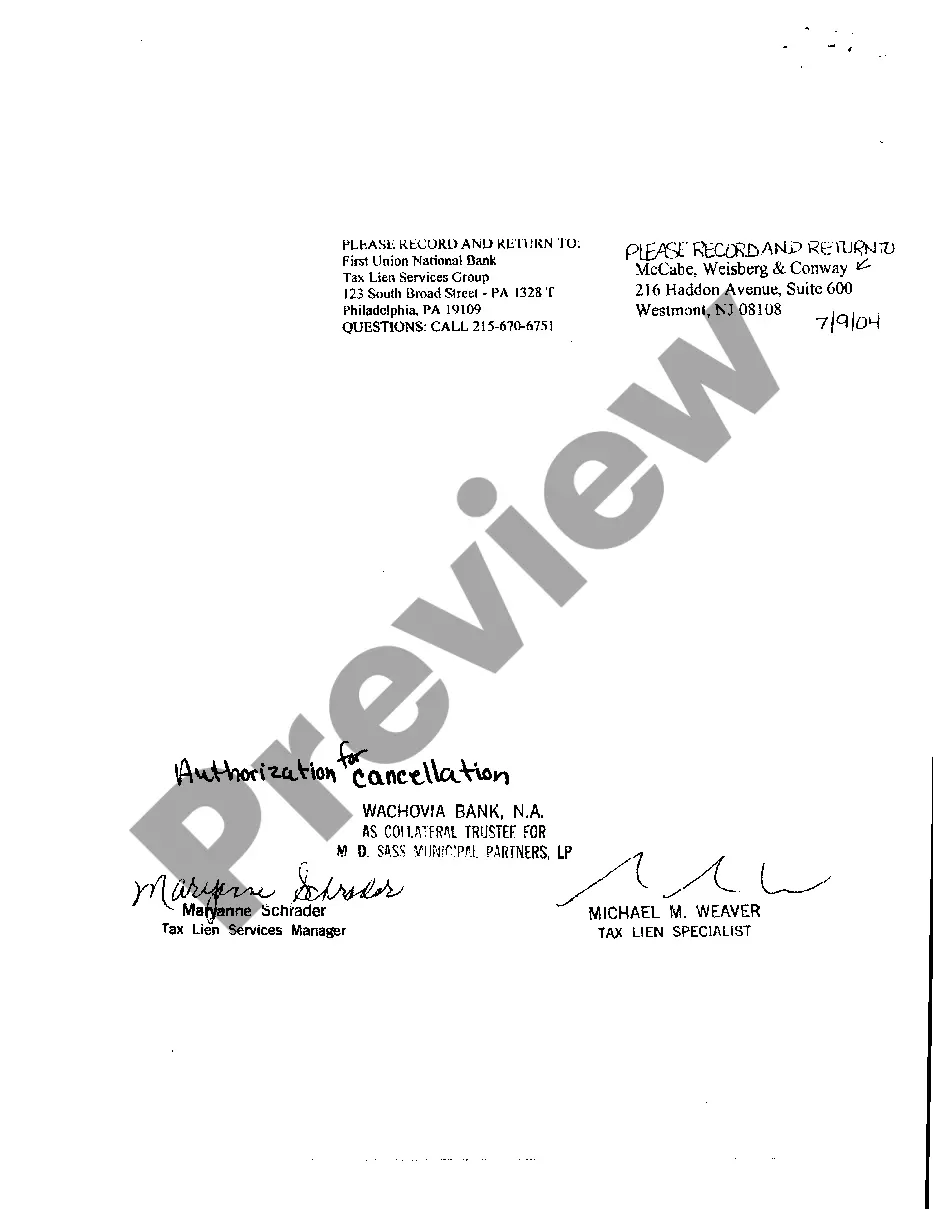

How Long You Get to Redeem Your Home. In New Jersey, unless the property is abandoned, the redemption period is usually at least: two years after the sale, if someone bought the lien, or. six months after the sale, if the municipality got the certificate of sale.