New Jersey Closing Statement

Description Settlement Statement Form Fillable

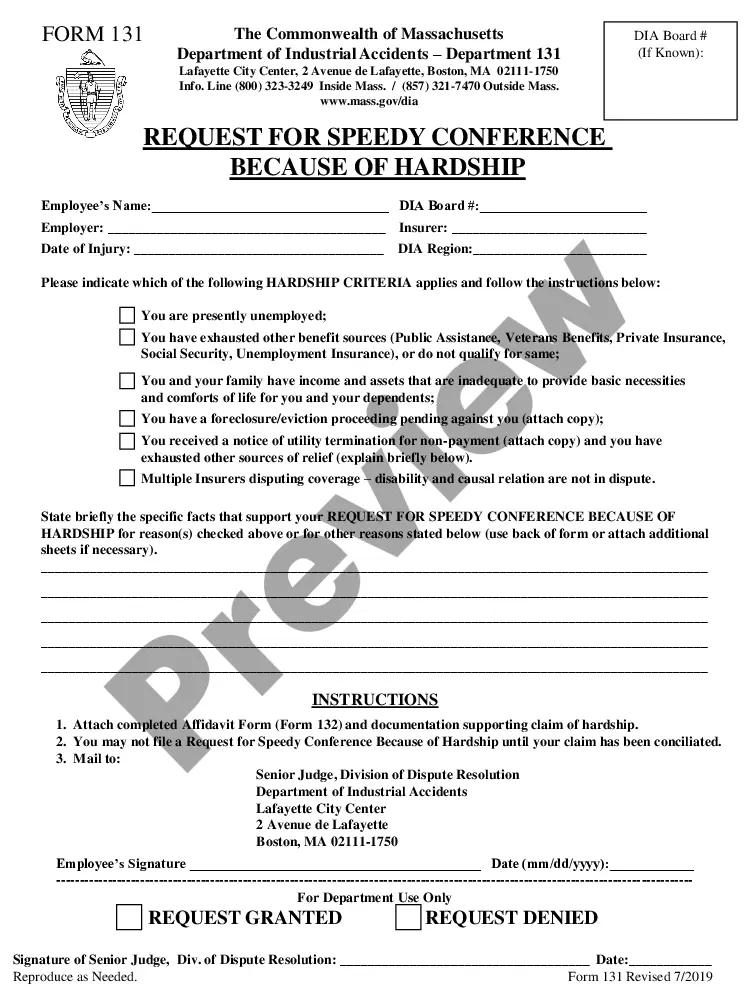

How to fill out 17b 27a Adjustments?

US Legal Forms is actually a special system to find any legal or tax document for submitting, including New Jersey Closing Statement. If you’re sick and tired of wasting time seeking suitable examples and spending money on record preparation/attorney fees, then US Legal Forms is precisely what you’re looking for.

To experience all the service’s benefits, you don't need to download any application but just select a subscription plan and sign up your account. If you have one, just log in and find the right template, download it, and fill it out. Downloaded documents are all stored in the My Forms folder.

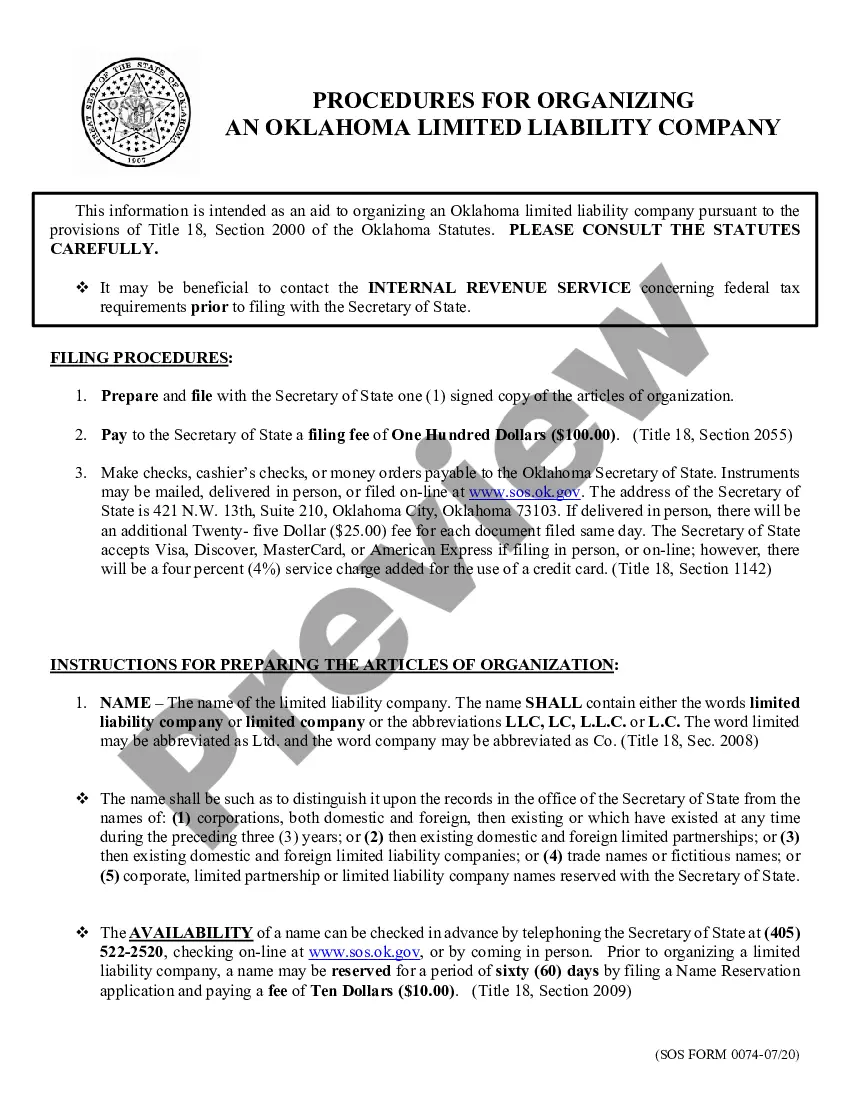

If you don't have a subscription but need to have New Jersey Closing Statement, take a look at the instructions listed below:

- check out the form you’re considering applies in the state you want it in.

- Preview the example its description.

- Click on Buy Now button to access the register page.

- Choose a pricing plan and continue signing up by entering some info.

- Choose a payment method to complete the sign up.

- Save the document by choosing the preferred file format (.docx or .pdf)

Now, submit the file online or print it. If you are uncertain concerning your New Jersey Closing Statement template, speak to a legal professional to analyze it before you send or file it. Begin hassle-free!

Hud Closing Statement Form popularity

New Jersey Closing Buy Other Form Names

31a 32a 27a FAQ

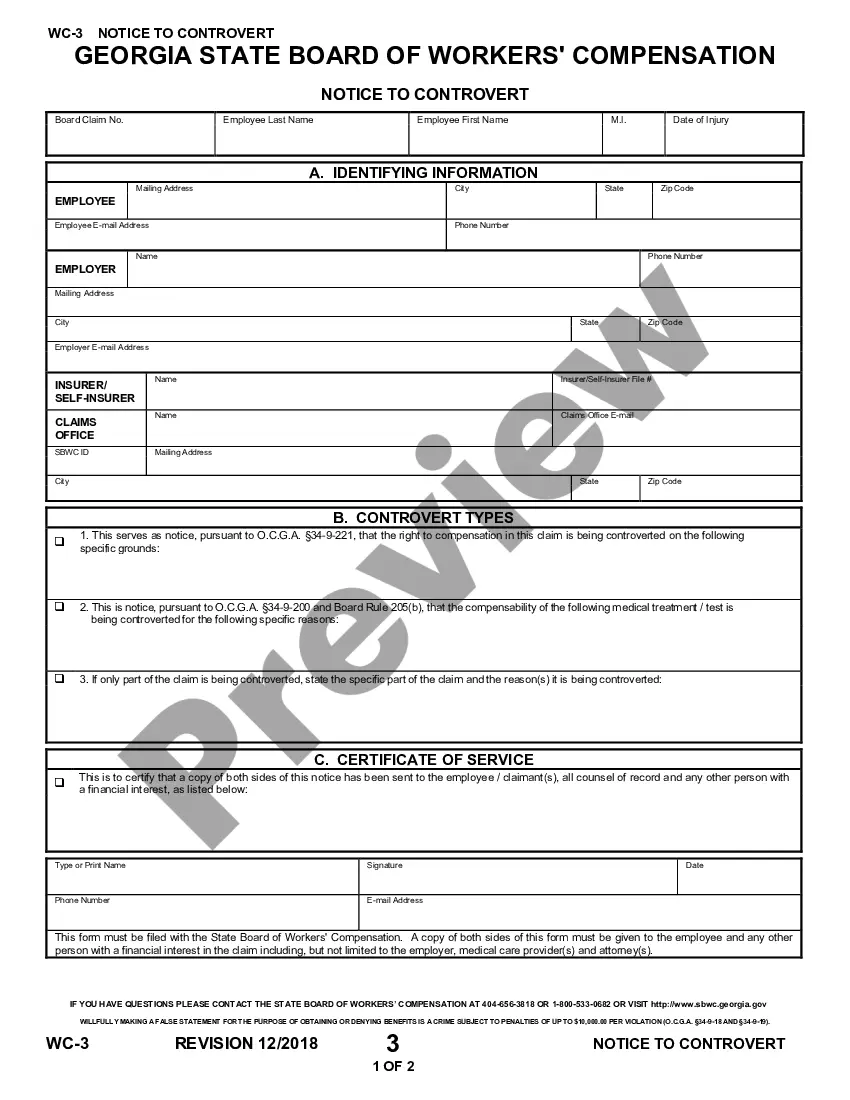

A settlement statement is also known as a HUD-1 form or a closing statement. Until 2015, when the rules changed, this form was provided twice. First, within three business days of applying for a mortgage loan, the borrower receives one in the mail with the person's estimated closing costs.

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exceptionreverse mortgages.

The HUD-1 form is used in purchase transactions, and it includes lines for both borrower charges/fees and seller charges/fees.The HUD-1A is an option, instead of using the HUD-1, for loan transactions that do not include a seller (refinance). The HUD-1 is three pages, while the HUD-1A is only two pages.

As of October 3, 2015, the Closing Disclosure form replaced the HUD-1 form for most real estate transactions. However, if you applied for a mortgage on or before October 3, 2015, you received a HUD-1.

Completing Part B of HUD-1Fill in the property location and the name and address for the borrower, seller and lender. The settlement agent, date and location also are needed. Fill in the appropriate lines in sections J and K, which are summaries of the borrower's and seller's transactions, respectively.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

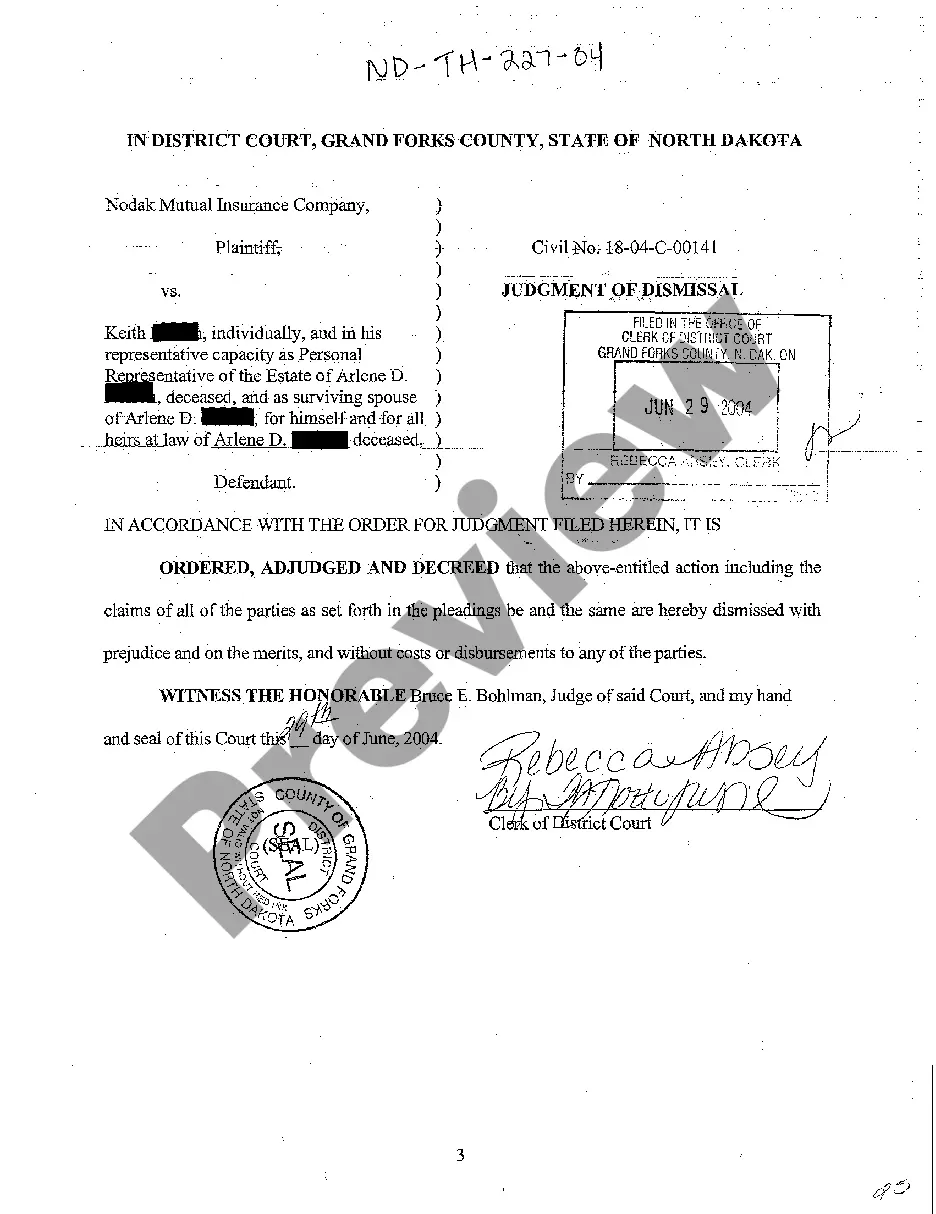

6. Attendance Required Power of Attorney Generally, all of the parties must show up at the closing. This is especially true of the buyers, who must sign all of the mortgage documents.

Sellers do not usually need to be present at a New Jersey closing so long as all costs are paid and documents are signed. Typically, the buyers will sign the final documents at the office of their title company or escrow agent and pick up the keys.