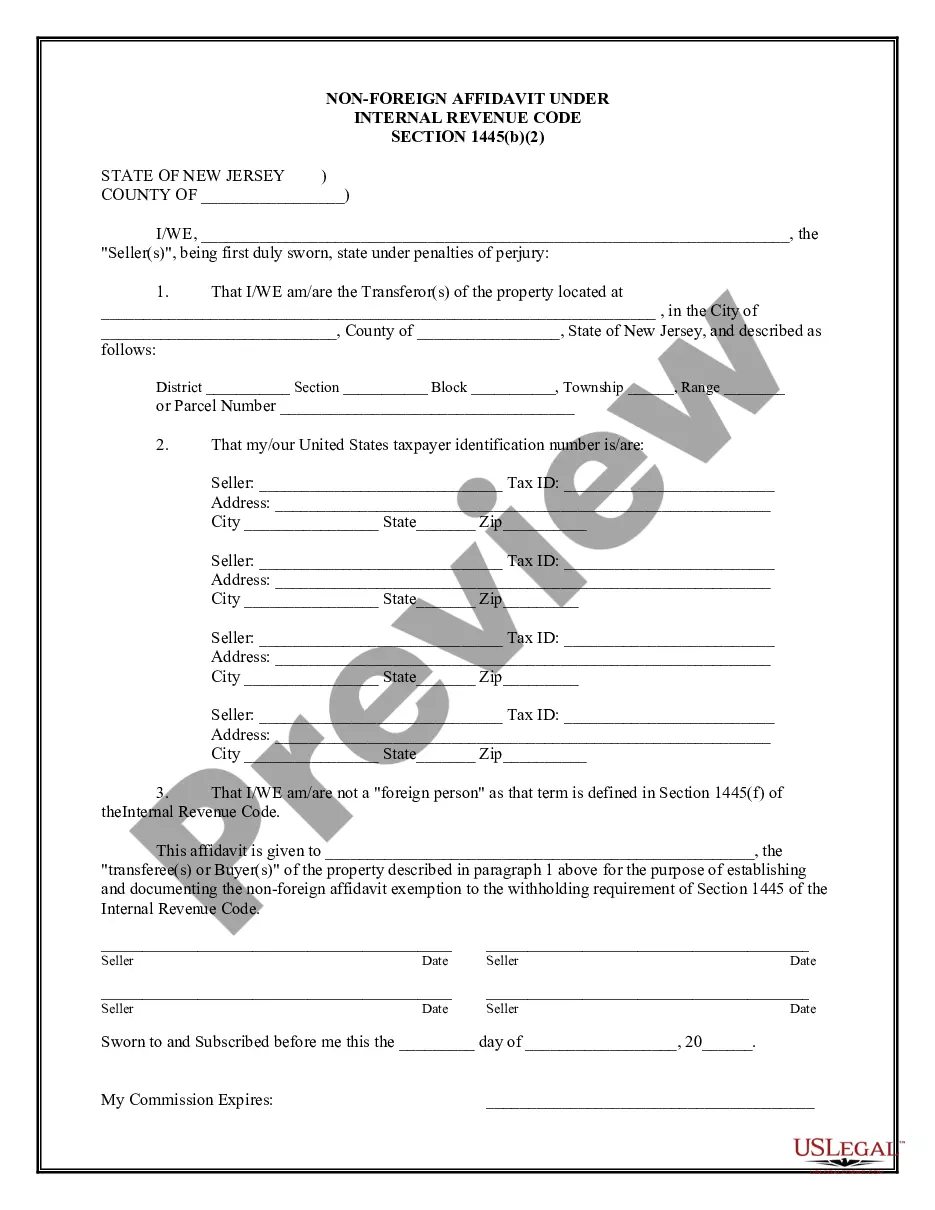

New Jersey Non-Foreign Affidavit Under IRC 1445

Description What Is Firpta Affidavit

How to fill out New Jersey Non-Foreign Affidavit Under IRC 1445?

US Legal Forms is a unique system where you can find any legal or tax form for filling out, including New Jersey Non-Foreign Affidavit Under IRC 1445. If you’re fed up with wasting time searching for perfect samples and paying money on file preparation/attorney service fees, then US Legal Forms is exactly what you’re seeking.

To enjoy all the service’s advantages, you don't need to install any software but just choose a subscription plan and create your account. If you have one, just log in and get an appropriate sample, save it, and fill it out. Downloaded documents are all saved in the My Forms folder.

If you don't have a subscription but need New Jersey Non-Foreign Affidavit Under IRC 1445, check out the recommendations below:

- check out the form you’re taking a look at applies in the state you want it in.

- Preview the form and read its description.

- Simply click Buy Now to get to the sign up webpage.

- Select a pricing plan and proceed registering by providing some information.

- Choose a payment method to finish the registration.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you are uncertain regarding your New Jersey Non-Foreign Affidavit Under IRC 1445 template, speak to a lawyer to analyze it before you send or file it. Get started without hassles!

Irc 1445 Form popularity

New Jersey Affidavit Other Form Names

FAQ

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

A foreign person includes a nonresident alien individual, foreign corporation, foreign partnership, foreign trust, foreign estate, and any other person that is not a U.S. person. It also includes a foreign branch of a U.S. financial institution if the foreign branch is a qualified intermediary.

Persons purchasing U.S. real property interests (transferees) from foreign persons, certain purchasers' agents, and settlement officers are required to withhold 15% (10% for dispositions before February 17, 2016) of the amount realized on the disposition (special rules for foreign corporations).

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445). The transferee is the withholding agent.If the transferor is a foreign person and you fail to withhold, you may be held liable for the tax.

You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.