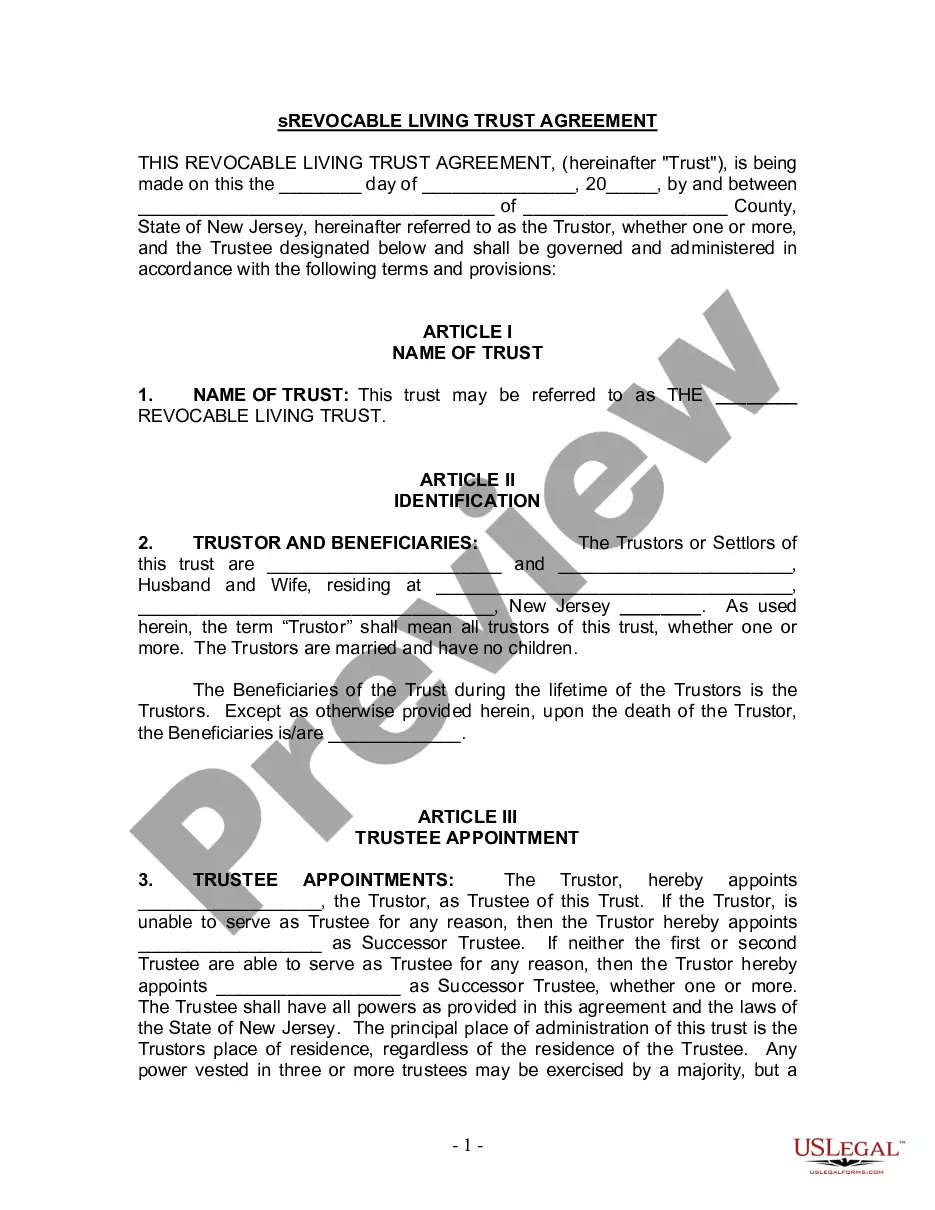

New Jersey Living Trust for Husband and Wife with No Children

Description

How to fill out New Jersey Living Trust For Husband And Wife With No Children?

US Legal Forms is a unique platform where you can find any legal or tax template for filling out, including New Jersey Living Trust for Husband and Wife with No Children. If you’re tired with wasting time looking for suitable samples and paying money on file preparation/lawyer service fees, then US Legal Forms is exactly what you’re trying to find.

To reap all the service’s benefits, you don't need to install any software but just select a subscription plan and sign up an account. If you have one, just log in and find a suitable template, save it, and fill it out. Saved documents are all stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Living Trust for Husband and Wife with No Children, have a look at the guidelines below:

- check out the form you’re taking a look at applies in the state you need it in.

- Preview the example and look at its description.

- Click on Buy Now button to get to the sign up webpage.

- Select a pricing plan and continue registering by entering some info.

- Decide on a payment method to complete the registration.

- Save the file by choosing the preferred file format (.docx or .pdf)

Now, submit the file online or print it. If you are unsure regarding your New Jersey Living Trust for Husband and Wife with No Children sample, speak to a legal professional to review it before you decide to send or file it. Get started hassle-free!

Form popularity

FAQ

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

The trust in no way protects your assets, so that reasoning is simply false. You should put your vehicles into your trust in order to avoid probate. Only those assets held by the trust will avoid probate.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

Sure you can write your own revocable living trust. In fact, you can do it better than a lot of the attorneys. First you have to ascertain that you really want a trust.

When you create a DIY living trust, there are no attorneys involved in the process.It is also possible to choose a company, such as a bank or a trust company, to be your trustee. You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Decide on the type of trust you want to form. Take stock of your property. Pick a trustee. Create the trust document, either using an online program or with the help of a lawyer. Go to a notary public and sign the document. Fund the trust.