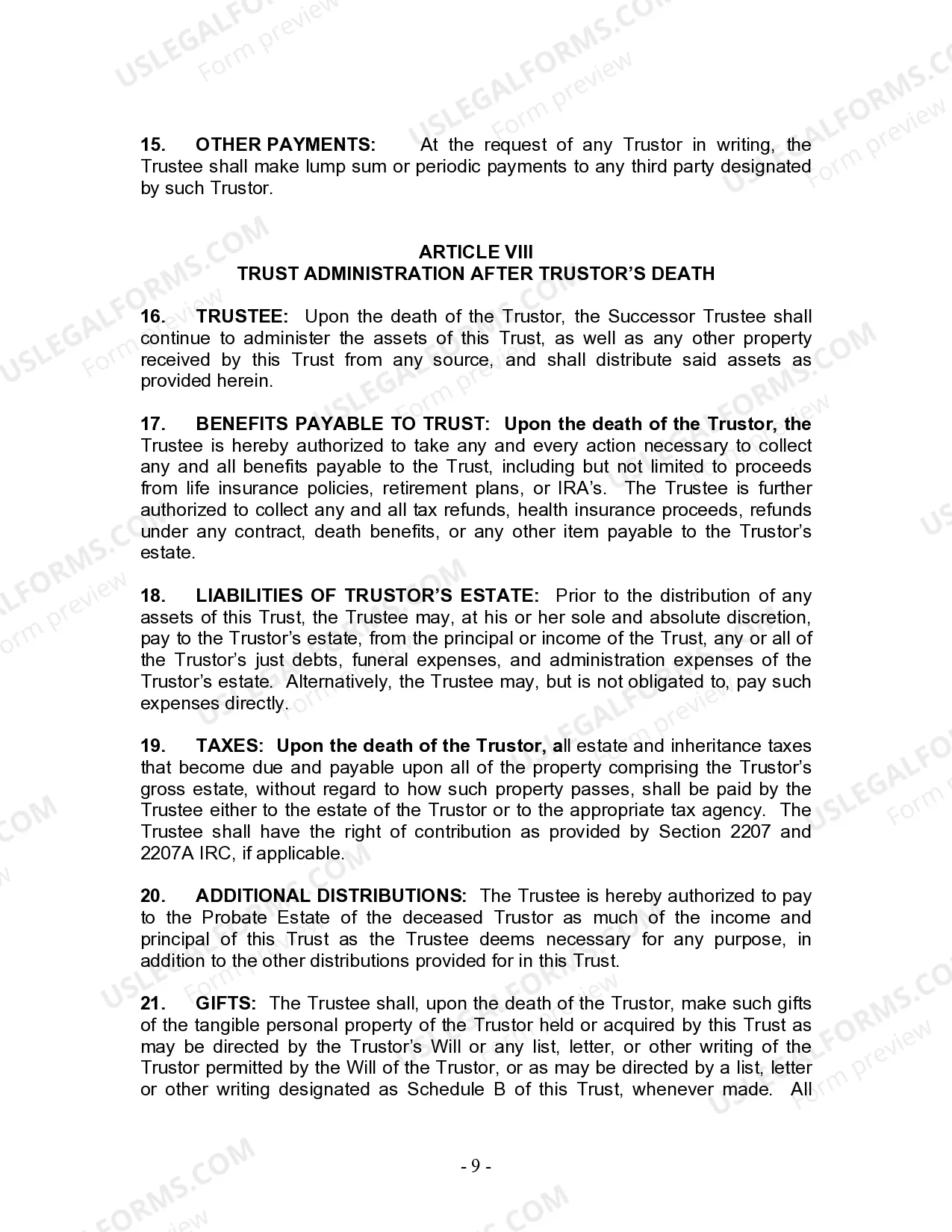

New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description New Jersey Trust

How to fill out Nj Trust Widow?

US Legal Forms is really a special platform where you can find any legal or tax document for filling out, such as New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children. If you’re sick and tired of wasting time searching for perfect examples and paying money on record preparation/attorney fees, then US Legal Forms is precisely what you’re looking for.

To experience all the service’s advantages, you don't have to download any software but just select a subscription plan and sign up your account. If you have one, just log in and get an appropriate template, download it, and fill it out. Saved documents are saved in the My Forms folder.

If you don't have a subscription but need to have New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children, check out the guidelines listed below:

- Double-check that the form you’re taking a look at is valid in the state you need it in.

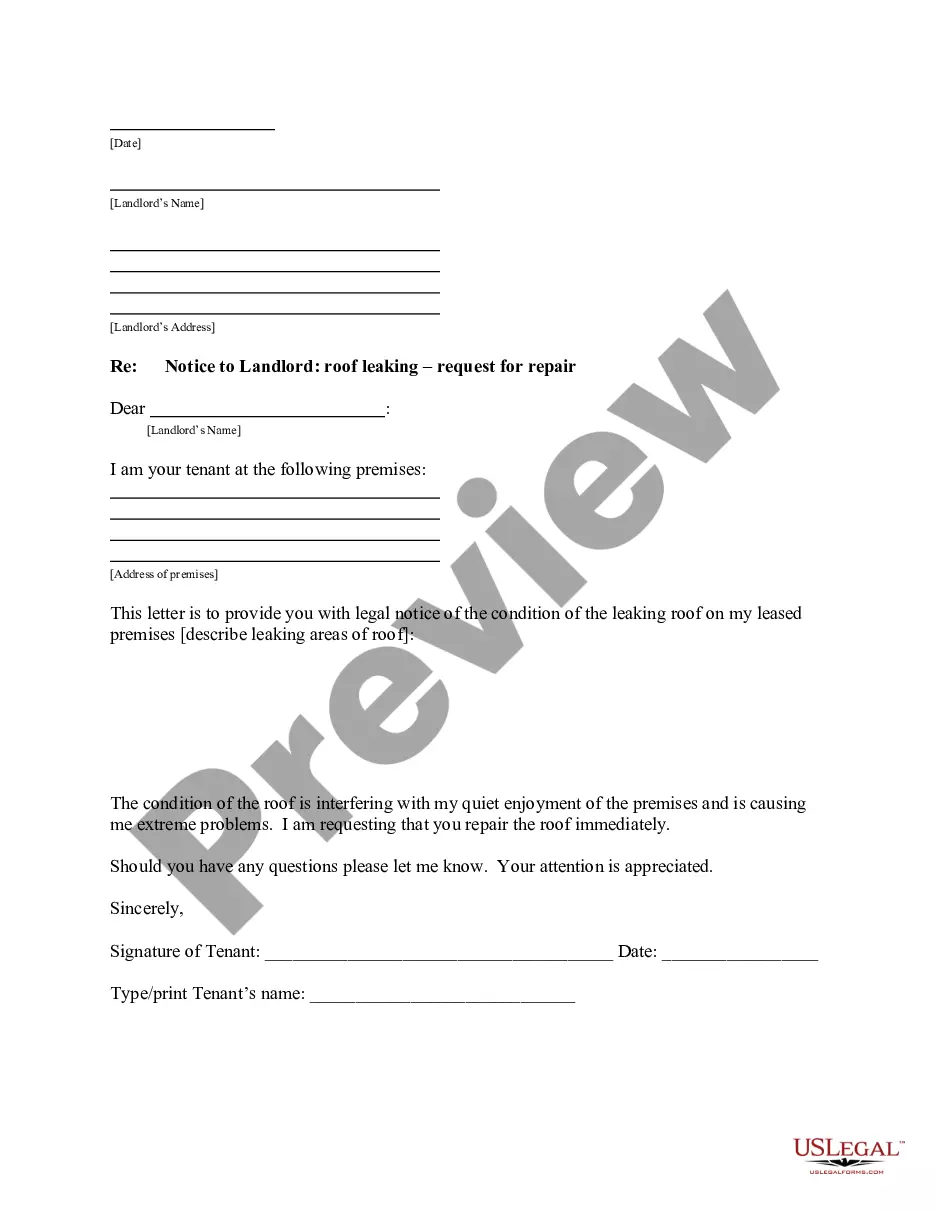

- Preview the example and read its description.

- Simply click Buy Now to get to the register webpage.

- Pick a pricing plan and carry on registering by providing some information.

- Select a payment method to finish the sign up.

- Save the file by selecting your preferred format (.docx or .pdf)

Now, fill out the file online or print out it. If you are uncertain regarding your New Jersey Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children sample, contact a attorney to analyze it before you decide to send or file it. Get started without hassles!

New Jersey Trust Template Form popularity

Nj Trust Individual Other Form Names

Any Beneficiary Person FAQ

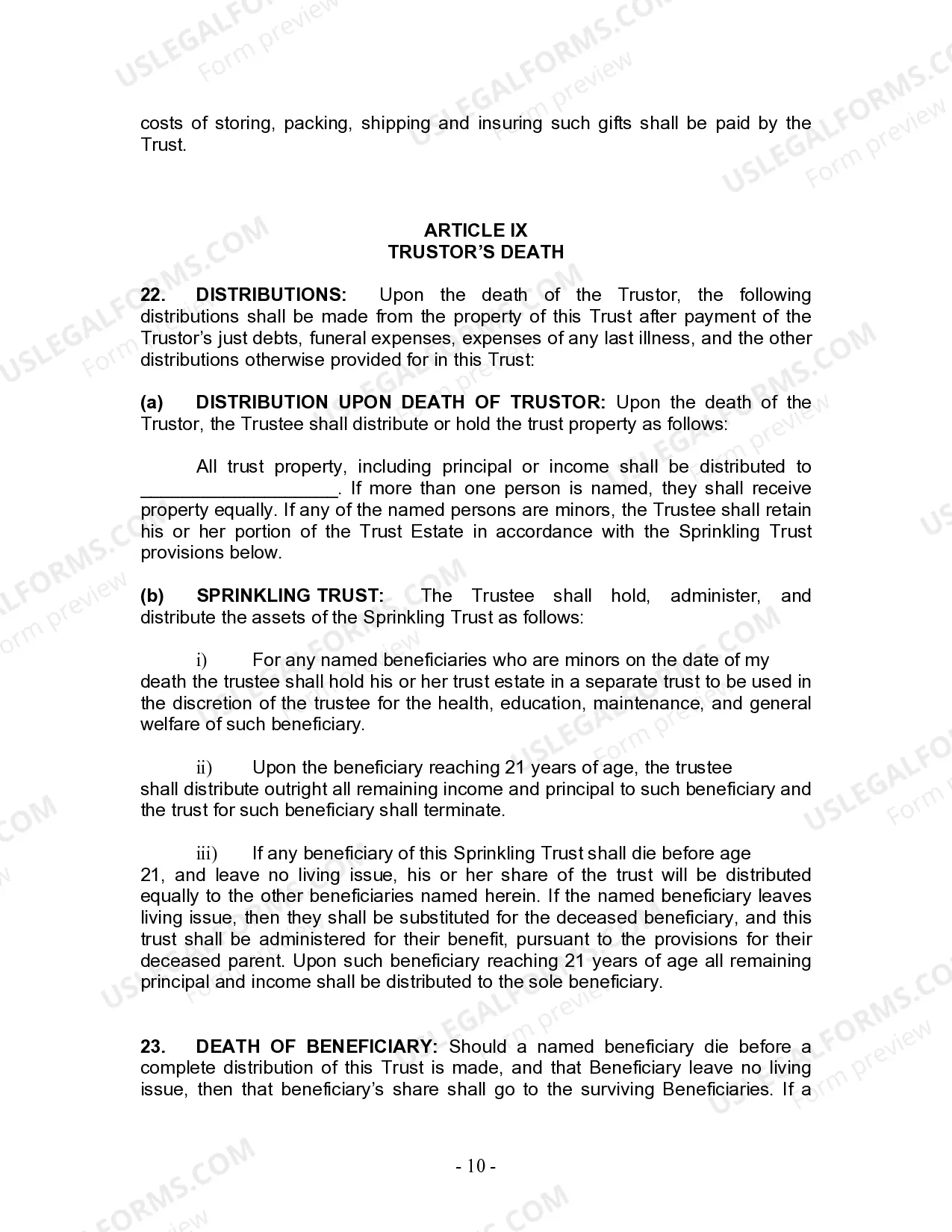

Like a will, a living trust can be altered whenever you wish.After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

If you die in New Jersey without having a will, then you have died intestate. This is a legal term that means that you have no will to probate once you are dead. Therefore, since you don't have a will, your estate is distributed according to New Jersey's law of intestacy.

Joint trusts are easier to fund and maintain.In a joint trust, after the death of the first spouse, the surviving spouse has complete control of the assets. When separate trusts are used, the deceased spouses' trust becomes irrevocable and the surviving spouse has limited control over assets.

When one spouse dies, the joint trust will continue to operate for the benefit of the surviving spouse as a Survivor's Trust. Any specific gifts of tangible property from the first spouse to beneficiaries (other than the surviving spouse) will be given to those people.

Like a will, a living trust can be altered whenever you wish.After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

For the latest information on novel coronavirus, please visit www.nj.gov/health or call 1-800-222-1222 or 1-800-962-1253 (if using out-of-state phone line).

Face coverings are required in indoor public spaces and in outdoor public spaces when social distancing is difficult to maintain.

COVID-19 testing and treatment is available to everyone in New Jersey regardless of their insurance or immigration status.

Food or beverage establishments may open, including restaurants, bars, cafeterias, and food courts, as well as all holders of a liquor license with retail consumption privileges.