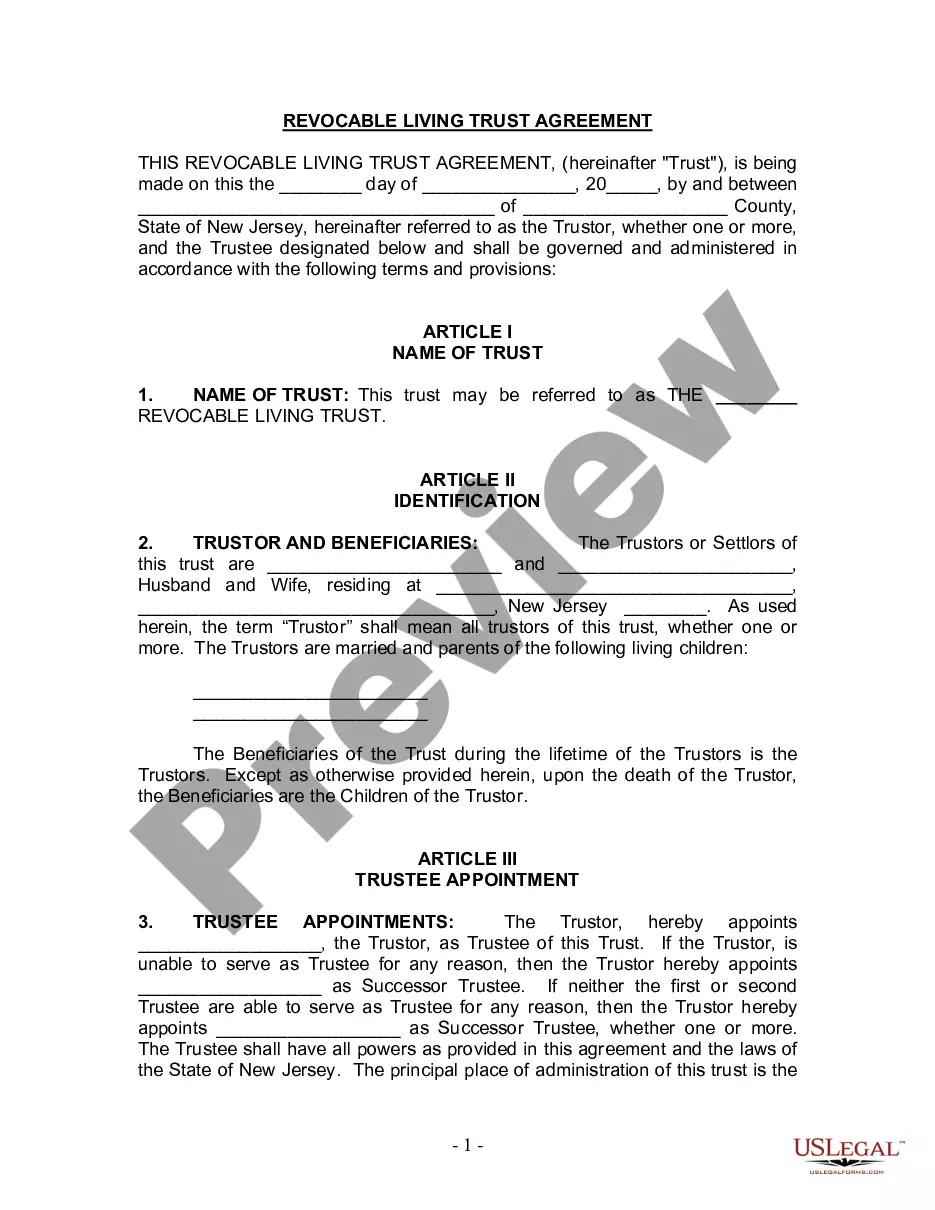

New Jersey Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out New Jersey Living Trust For Husband And Wife With Minor And Or Adult Children?

US Legal Forms is a unique platform where you can find any legal or tax document for filling out, such as New Jersey Living Trust for Husband and Wife with Minor and or Adult Children. If you’re fed up with wasting time looking for ideal examples and paying money on record preparation/lawyer service fees, then US Legal Forms is precisely what you’re looking for.

To experience all of the service’s benefits, you don't have to install any software but simply select a subscription plan and register an account. If you already have one, just log in and look for the right sample, save it, and fill it out. Saved documents are all kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Living Trust for Husband and Wife with Minor and or Adult Children, check out the instructions listed below:

- Double-check that the form you’re taking a look at applies in the state you need it in.

- Preview the sample and read its description.

- Click Buy Now to get to the register webpage.

- Pick a pricing plan and carry on registering by providing some information.

- Pick a payment method to finish the sign up.

- Download the file by choosing your preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you are uncertain regarding your New Jersey Living Trust for Husband and Wife with Minor and or Adult Children form, contact a legal professional to check it before you decide to send or file it. Get started hassle-free!

Form popularity

FAQ

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.

At the time of your death, the assets in your family trust are protected by the exemption, and the assets in your marital trust are protected by the marital deduction. No estate taxes are due.

Yes, and no. Yes, a spouse can be disinherited.The laws vary from state to state, but in a community property state like California, your spouse will have a legal right to one-half of the estate assets acquired during the marriage, otherwise known as community property.

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.

A will must become public record when it is probated. A trust is also more secure than a will because it is more difficult to contest. While a living trust does not technically shield your assets from creditors, in practice, it can help avoid them.

When one spouse dies, the joint trust will continue to operate for the benefit of the surviving spouse as a Survivor's Trust. Any specific gifts of tangible property from the first spouse to beneficiaries (other than the surviving spouse) will be given to those people.

Joint trusts are easier to fund and maintain.In a joint trust, after the death of the first spouse, the surviving spouse has complete control of the assets. When separate trusts are used, the deceased spouses' trust becomes irrevocable and the surviving spouse has limited control over assets.

Generally, trusts are considered the separate property of the beneficiary spouse and the assets in a trust are not subject to equitable distribution unless they contain marital property.Any funds remaining in the trust or in a separate account will continue to be the separate property of the beneficiary spouse.