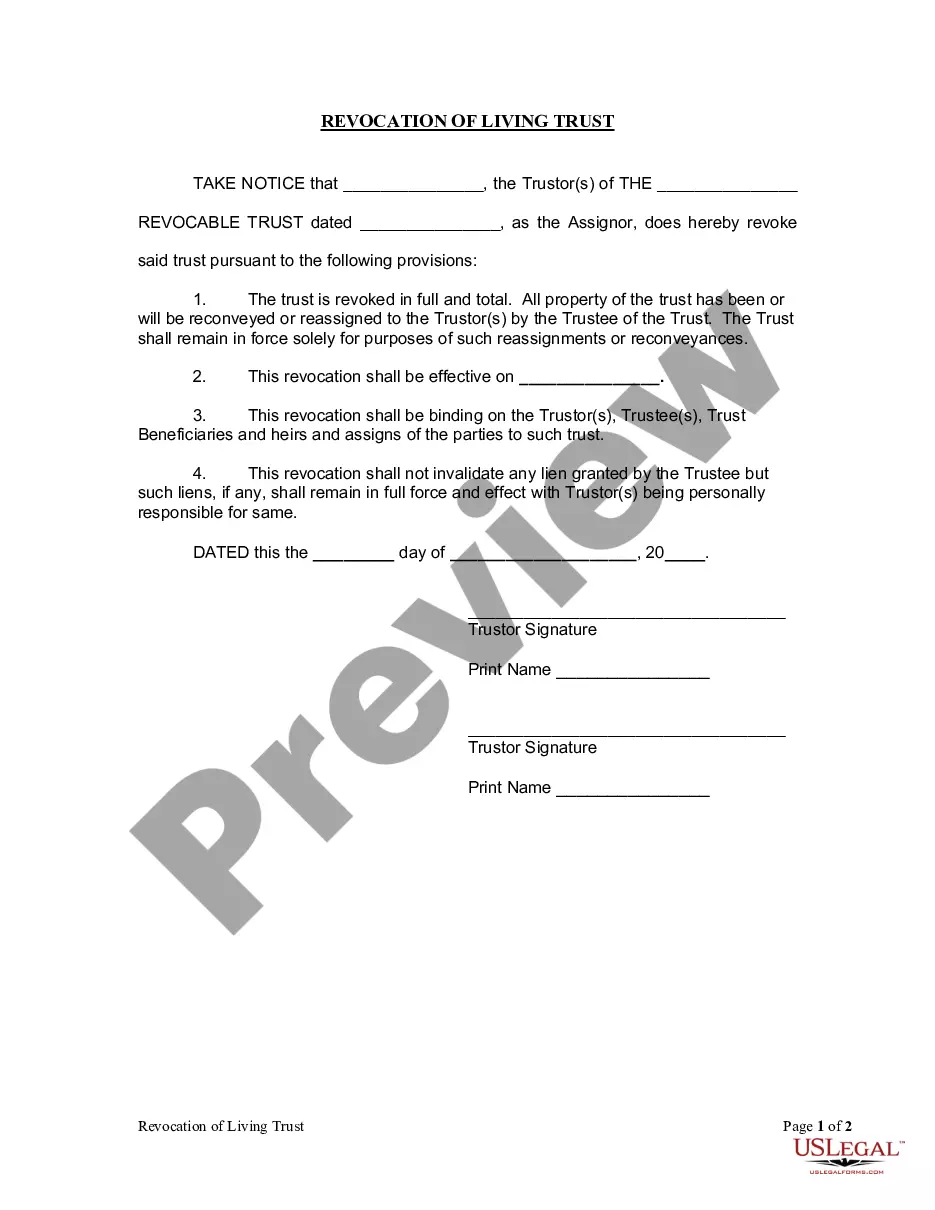

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. It declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

New Jersey Revocation of Living Trust

Description Nj Revocation Trust

How to fill out New Jersey Revocation Of Living Trust?

US Legal Forms is actually a special platform where you can find any legal or tax document for completing, including New Jersey Revocation of Living Trust. If you’re tired of wasting time looking for suitable samples and spending money on record preparation/legal professional charges, then US Legal Forms is exactly what you’re looking for.

To reap all the service’s advantages, you don't have to install any software but simply choose a subscription plan and register an account. If you have one, just log in and find an appropriate sample, download it, and fill it out. Downloaded documents are kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Revocation of Living Trust, check out the recommendations listed below:

- check out the form you’re considering applies in the state you want it in.

- Preview the example its description.

- Simply click Buy Now to get to the sign up page.

- Pick a pricing plan and continue signing up by providing some info.

- Choose a payment method to finish the registration.

- Save the file by choosing the preferred format (.docx or .pdf)

Now, fill out the file online or print it. If you feel uncertain about your New Jersey Revocation of Living Trust sample, contact a lawyer to review it before you decide to send or file it. Begin without hassles!

New Jersey Living Trust Form popularity

Living Will New Jersey Other Form Names

FAQ

A revocable trust may be revoked, certainly. If you have transferred property into that trust, then you'll need to transfer it back to yourself and then into the new trust.You would then keep the old trust name and date of original execution, but the entire document will have changed.

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

Whether your trust closes immediately after your death or lives on for a while to serve your intentions, it must eventually close. This typically involves payment of any outstanding debts or taxes before the trustee distributes the trust's assets and income to your named beneficiaries.

Dissolving irrevocable trusts if you're a beneficiary or trustee. State trust law may also permit a trust beneficiary or trustee to petition the court if they want to dissolve (or amend) the trust. The court may grant approval based on reasons cited above.

This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer. How long it takes to settle a revocable living trust can depend on numerous factors.

The grantor may be able to terminate an irrevocable trust, by following the state laws on dissolution. The laws of each state vary in this area. For example, New Jersey has adopted the Uniform Trust Code, which stipulates that an irrevocable trust can be terminated by consent of the trustee and the beneficiaries.

A revocation of a will generally means that the beneficiaries will no longer receive the specified property or financial assets. A beneficiary may have been depending on the trust property for various reasons. If the revocation occurs at a certain time, it can cause legal conflicts in many cases.

A will and a trust are separate legal documents that typically share a common goal of facilitating a unified estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, when there are discrepancies between the two.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.