Small Estate Affidavit for estates under 20,000

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. If the deceased had conveyed most property to a trust but there remains some property, small estate laws may also be available. Small Estate procedures may generally be used regardless of whether there was a Will. In general, the two forms of small estate procedures are recognized:

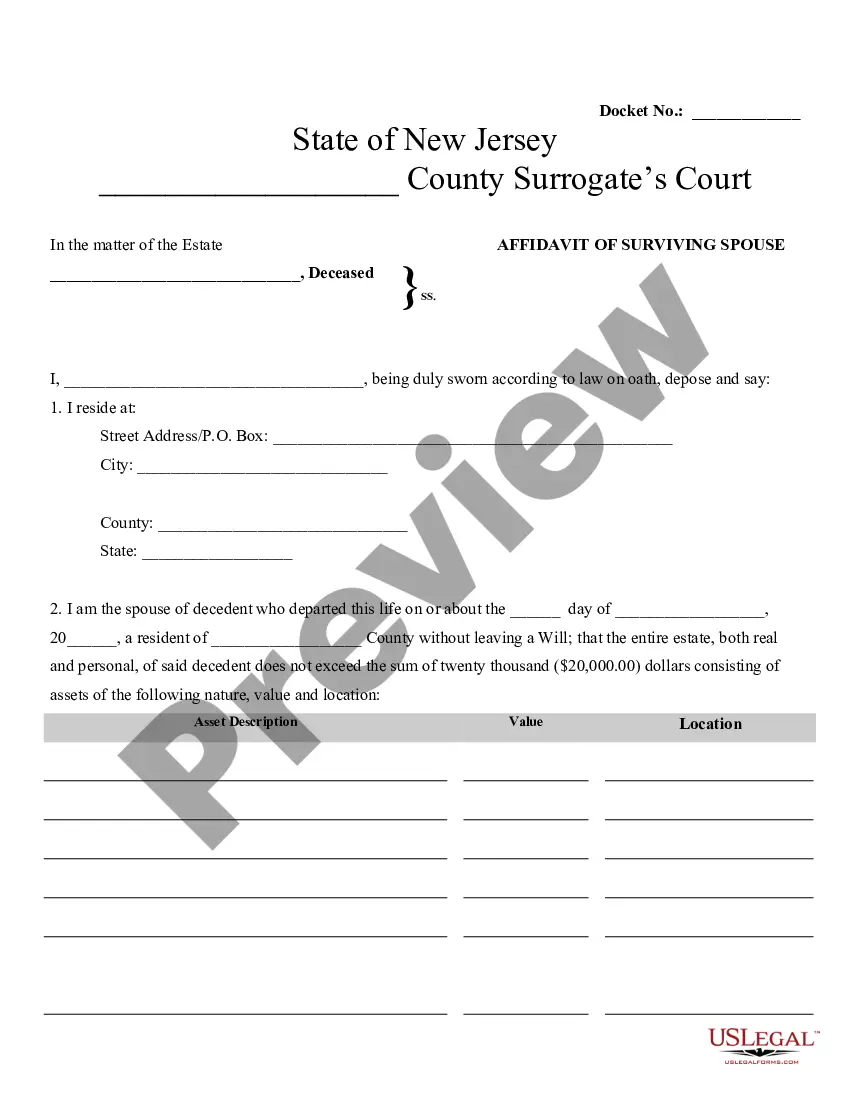

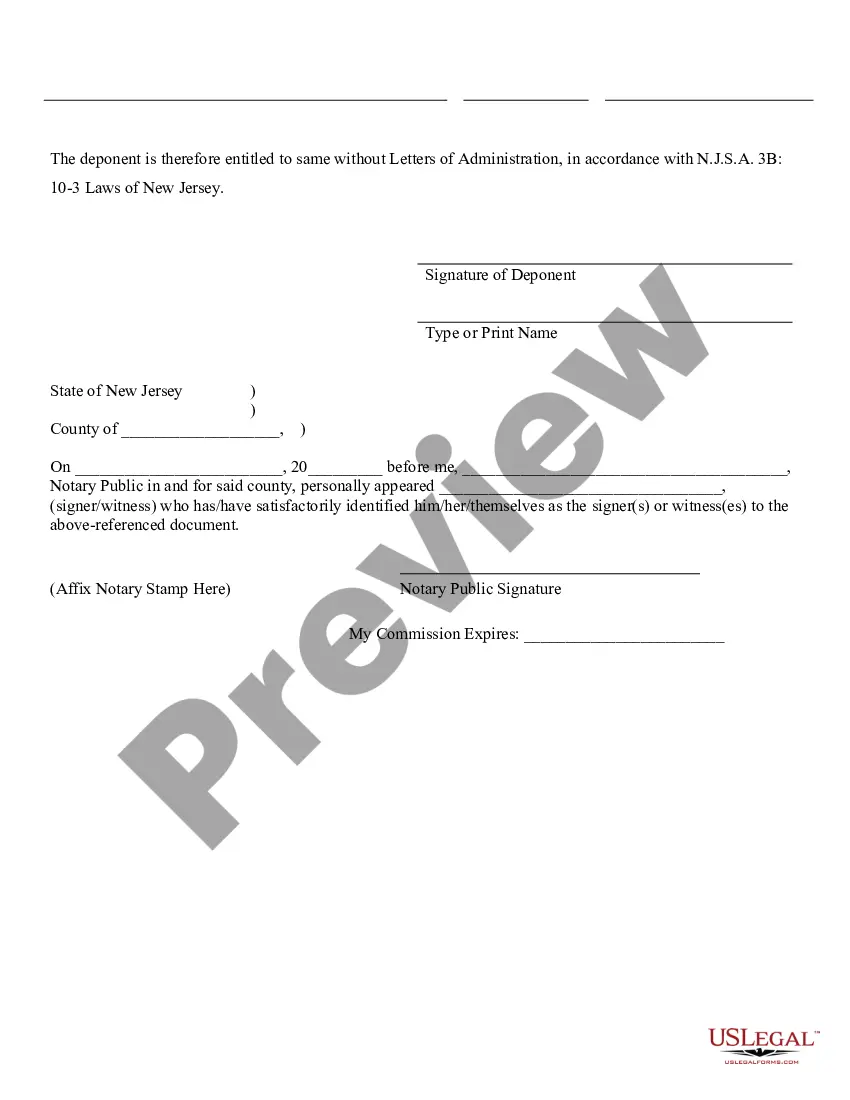

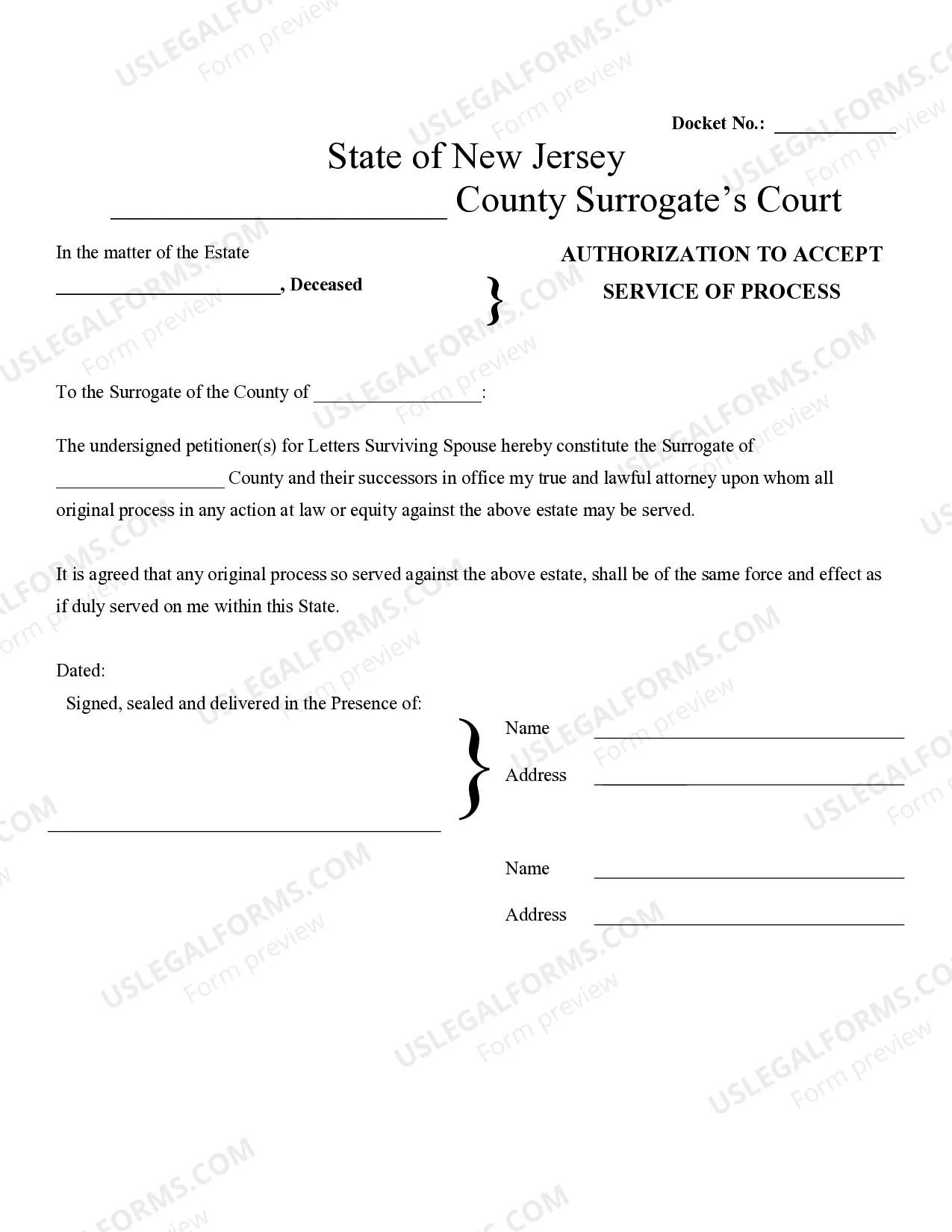

1. Small Estate Affidavit -Some States allow an affidavit to be executed by the spouse and/or heirs of the deceased and present the affidavit to the holder of property such as a bank to obtain property of the deceased. Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.

2. Summary Administration -Some states allow a Summary administration. Some States recognize both the Small Estate affidavit and Summary Administration, basing the requirement of which one to use on the value of the estate. Example: If the estate value is 10,000 or less an affidavit is allowed but if the value is between 10,000 to 20,000 a summary administration is allowed.

New Jersey Summary:

Under New Jersey statute, where as estate is valued at less than $50,000, a surviving spouse, partner in a civil union, or domestic partner, may present an affidavit of a small estate before the Superior Court. Upon the execution and filing of the affidavit, the surviving spouse shall have all of the rights, powers and duties of an administrator duly appointed for the estate.

New Jersey:

New Jersey requirements are set forth in the statutes below.

TITLE 3B ADMINISTRATION OF ESTATES--DECEDENTS AND OTHERS

3B:10-3. When spouse, partner in a civil union, or domestic partner entitled to assets without administration.

Where the total value of the real and personal assets of the estate of an intestate will not exceed $50,000, the surviving spouse, partner in a civil union, or domestic partner upon the execution of an affidavit before the Surrogate of the county where the intestate resided at his death, or, if then nonresident in this State, where any of the assets are located, or before the Superior Court, shall be entitled absolutely to all the real and personal assets without administration, and the assets of the estate up to $10,000 shall be free from all debts of the intestate. Upon the execution and filing of the affidavit as provided in this section, the surviving spouse, partner in a civil union, or domestic partner shall have all of the rights, powers and duties of an administrator duly appointed for the estate. The surviving spouse, partner in a civil union, or domestic partner may be sued and required to account as if he had been appointed administrator by the Surrogate or the Superior Court. The affidavit shall state that the affiant is the surviving spouse, partner in a civil union, or domestic partner of the intestate and that the value of the intestate's real and personal assets will not exceed $50,000, and shall set forth the residence of the intestate at his death, and specifically the nature, location and value of the intestate's real and personal assets. The affidavit shall be filed and recorded in the office of such Surrogate or, if the proceeding is before the Superior Court, then in the office of the clerk of that court. Where the affiant is domiciled outside this State, the Surrogate may authorize in writing that the affidavit be executed in the affiant's domicile before any of the officers authorized by R.S.46:14-6.1 to take acknowledgments or proofs.

amended 1983, c.246, s.1; 2004, c.132, s.77; 2005, c.331, s.24; 2015, c.232, s.1.

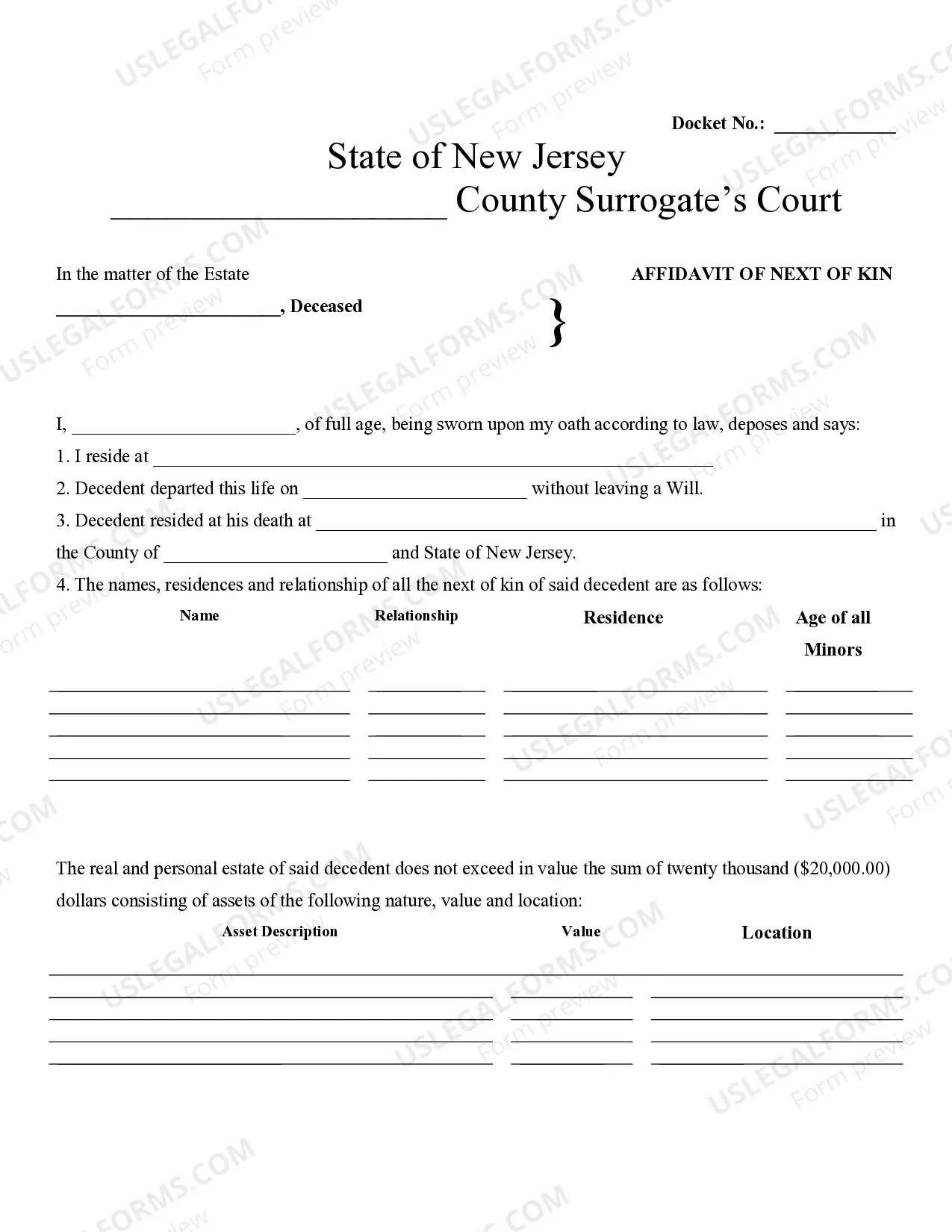

3B:10-4. When heirs entitled to assets without administration

Where the total value of the real and personal assets of the estate of an intestate will not exceed $20,000 and the intestate leaves no surviving spouse, partner in a civil union, or domestic partner, and one of his heirs shall have obtained the consent in writing of the remaining heirs, if any, and shall have executed before the Surrogate of the county where the intestate resided at his death, or, if then nonresident in this State, where any of the intestate's assets are located, or before the Superior Court, the affidavit herein provided for, shall be entitled to receive the assets of the intestate of the benefit of all the heirs and creditors without administration or entering into a bond. Upon executing the affidavit, and upon filing it and the consent, he shall have all the rights, powers and duties of an administrator duly appointed for the estate and may be sued and required to account as if he had been appointed administrator by the Surrogate or the Superior Court.

The affidavit shall set forth the residence of the intestate at his death, the names, residences and relationships of all of the heirs and specifically the nature, location and value of the real and personal assets and also a statement that the value of the intestate's real and personal assets will not exceed $20,000.

The consent and the affidavit shall be filed and recorded, in the office of the Surrogate or, if the proceeding is before the Superior Court, then in the office of the clerk of that court. Where the affiant is domiciled outside this State, the Surrogate may authorize in writing that the affidavit be executed in the affiant's domicile before any of the officers authorized by R.S.46:14-6.1 to take acknowledgments or proofs.

amended 1983, c.246, s.2; 2004, c.132, s.78; 2005, c.331, s.25; 2015, c.232, s.2.

The consent and the affidavit shall be filed and recorded, in the office of the surrogate or, if the proceeding is before the Superior Court, then in the office of the clerk of that court. Where the affiant is domiciled outside this State, the surrogate may authorize in writing that the affidavit be executed in the affiant's domicile before any of the officers authorized by R.S. 46:14-7 and R.S. 46:14-8 to take acknowledgments or proofs.