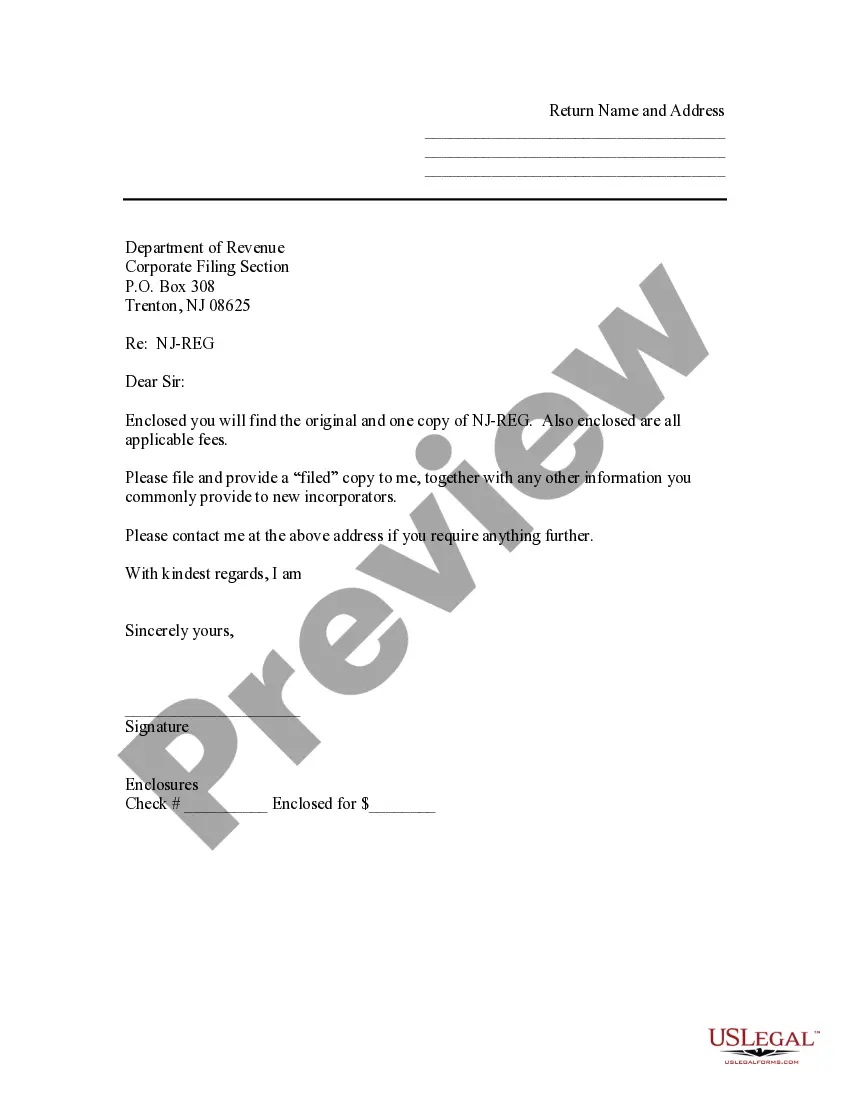

Use this sample letter as a cover sheet to accompany the Articles of Incorporation for filing with the Secretary of State's Office.

New Jersey Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation

Description

How to fill out New Jersey Sample Transmittal Letter To Secretary Of State's Office To File Articles Of Incorporation?

US Legal Forms is actually a unique system to find any legal or tax form for completing, such as Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - New Jersey. If you’re fed up with wasting time searching for perfect samples and spending money on file preparation/attorney charges, then US Legal Forms is exactly what you’re looking for.

To reap all of the service’s advantages, you don't need to download any software but just select a subscription plan and register your account. If you already have one, just log in and look for an appropriate template, download it, and fill it out. Saved documents are stored in the My Forms folder.

If you don't have a subscription but need to have Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - New Jersey, have a look at the recommendations listed below:

- make sure that the form you’re looking at applies in the state you want it in.

- Preview the sample its description.

- Simply click Buy Now to get to the sign up webpage.

- Pick a pricing plan and carry on registering by entering some info.

- Pick a payment method to finish the sign up.

- Download the file by choosing your preferred file format (.docx or .pdf)

Now, complete the file online or print out it. If you are uncertain about your Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - New Jersey template, speak to a lawyer to check it before you decide to send or file it. Start without hassles!

Form popularity

FAQ

If you want to structure your business as a corporation, one of the first formal steps you'll need to take is to file a special document with a particular state office. In most states, the document is known as the articles of incorporation, and in most states it needs to be filed with the Secretary of State.

Sole proprietors and single member LLCs do not file a business Income Tax return. They are treated as individuals for Income Tax purposes, and must file an NJ-1040 or NJ-1040NR return to report and remit any net profit earned from the business.

What Is a Certificate of Formation in NJ? A certificate of formation NJ must be filed in the public record for certain businesses to be authorized to transact business in the state. Legal entities required to file this certificate of formation include: Corporations. Limited Partnerships.

2611 Domestic corporations (New Jersey corporations) must submit a certified copy of the Certificate of Formation or incorporation, issued by the Division of Revenue in the New Jersey Department of the Treasury. To obtain the certificate, call (609) 292-9292 or (609) 292-1730 or log onto www.nj.gov/njbgs.

Send your paperwork to NJ Division of Revenue, Corporate Filing Unit, PO Box 308, Trenton, NJ 08646. You can also submit the paperwork overnight. However, send it to the following address: NJ Division of Revenue, Corporate Filing Unit, 33 West State St., 5th Floor, Trenton, NJ 08608.

The state filing fee for New Jersey incorporation is $125.00. incorporate.com will handle all filing requirements and provide you with the total cost to get your business up and running in New Jersey.

Corp. Ltd. Inc. Co.

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.

Choose a corporate name. File Certificate of Formation. Appoint a registered agent. Prepare corporate bylaws. Appoint directors and hold first board meeting. Issue stock. File annual report requirements. Comply with other tax and regulatory requirements.