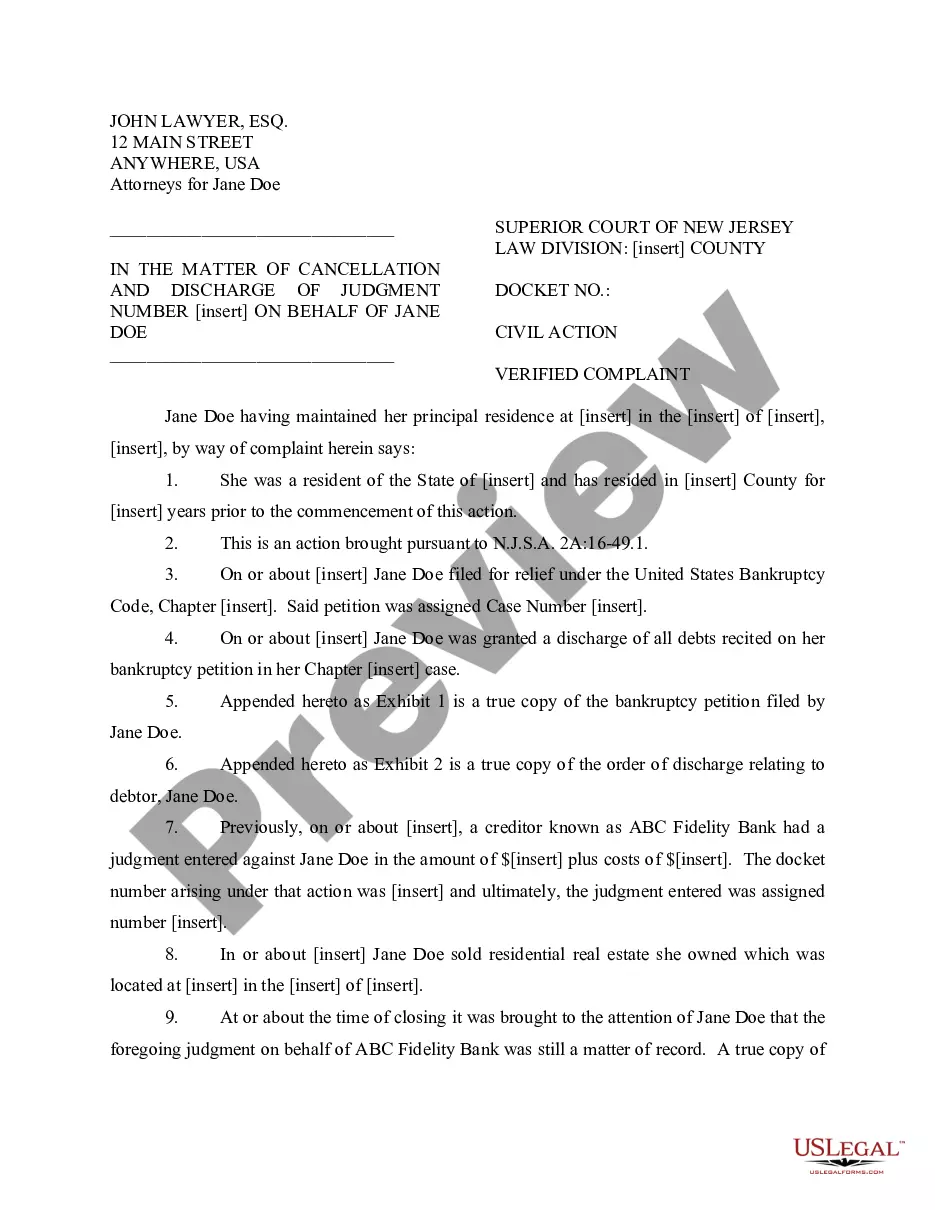

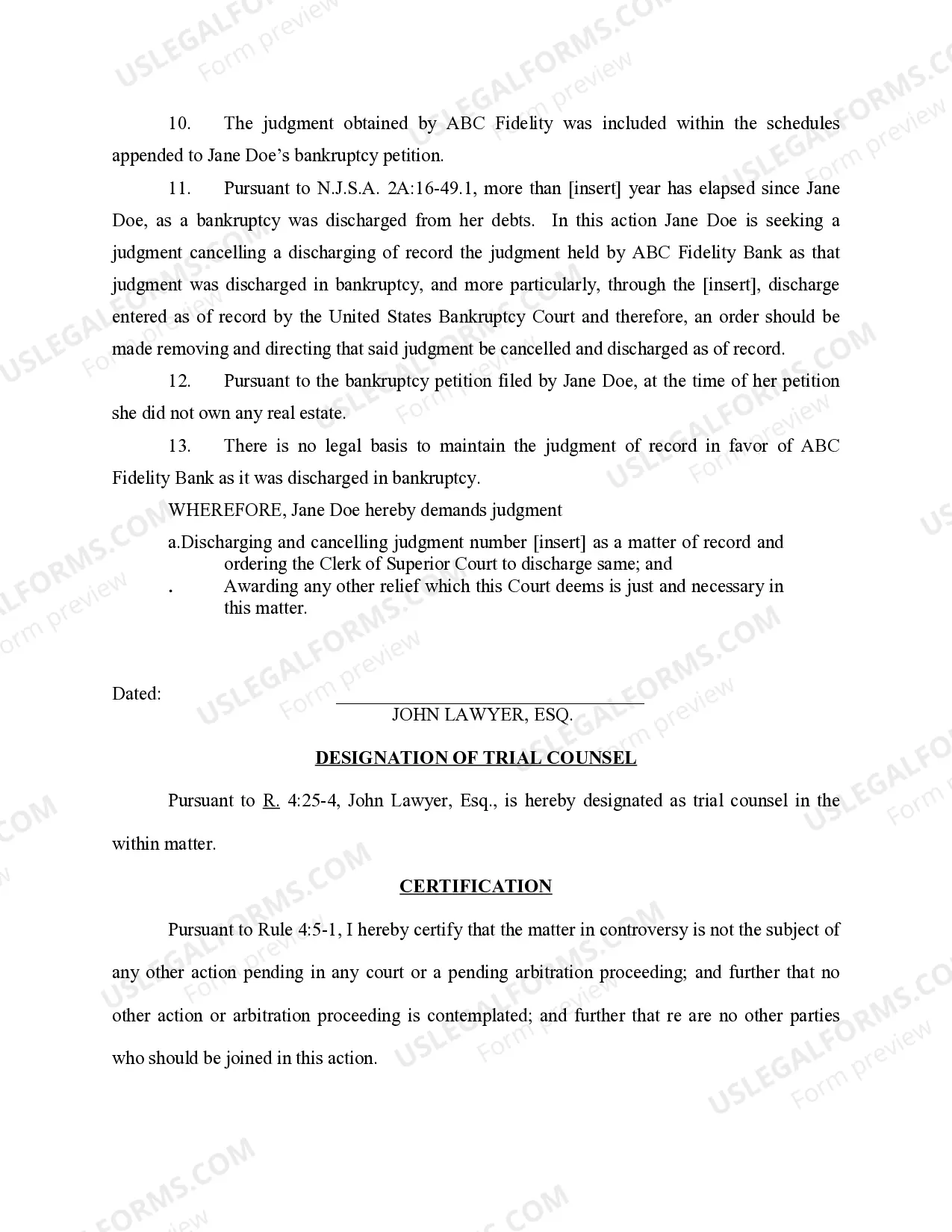

This form is a Complaint to Discharge an Existing Mortgage for use in civil proceedings within the state of New Jersey.

New Jersey Complaint to Discharge Existing Mortgage

Description Complaint Closure Letter

How to fill out New Jersey Complaint To Discharge Existing Mortgage?

US Legal Forms is actually a unique system to find any legal or tax form for completing, such as New Jersey Complaint to Discharge Existing Mortgage. If you’re fed up with wasting time looking for appropriate examples and spending money on file preparation/lawyer fees, then US Legal Forms is exactly what you’re searching for.

To enjoy all of the service’s advantages, you don't have to download any software but simply pick a subscription plan and create your account. If you already have one, just log in and look for the right sample, download it, and fill it out. Saved documents are all saved in the My Forms folder.

If you don't have a subscription but need New Jersey Complaint to Discharge Existing Mortgage, have a look at the instructions below:

- Double-check that the form you’re checking out applies in the state you want it in.

- Preview the form its description.

- Click Buy Now to get to the register webpage.

- Choose a pricing plan and carry on registering by providing some info.

- Choose a payment method to complete the sign up.

- Download the file by choosing your preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you feel unsure about your New Jersey Complaint to Discharge Existing Mortgage template, speak to a legal professional to review it before you decide to send out or file it. Begin without hassles!

Mortgage Discharge Form Form popularity

FAQ

Once you've paid off your outstanding mortgage debt, the lender must prepare and issue a release of mortgage. This document officially discharges you from the debt obligation and removes the lien against the property.

4. What do i need to know? The buyer's representative ensures that the seller's representative has allowed for the Discharge of Mortgage Fee in the adjustments. The Lodgement Fee for the Discharge of Mortgage is paid from the pool of source funds (e.g. loan proceeds or purchaser's equity).

A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

Register the discharge of mortgage Once you return the Discharge Authority form, your bank would prepare a Discharge of Mortgage document. This document must be registered at the Land Titles office.

When discharging your mortgage, you are paying your current loan in full. The mortgage we have registered on the title of your property is removed, and we will no longer hold it as security.

How long does it take to discharge a mortgage? Generally it takes between 14-21 business days to complete the discharge process. At one stage it took less time, around 10-14 business days, but these days more people are refinancing their home loan so there are more discharges taking place.

Often, it is filed directly by the bank or a settlement attorney. However, in some cases, the discharge may be transmitted directly to the person who is paying off the mortgage upon making a final mortgage payment, and that person needs to record the discharge so that clear title can be conveyed to someone else.

An affidavit of title is a legal document provided by the seller of a piece of property that explicitly states the status of potential legal issues involving the property or the seller. The affidavit is a sworn statement of fact that specifies the seller of a property holds the title to it.