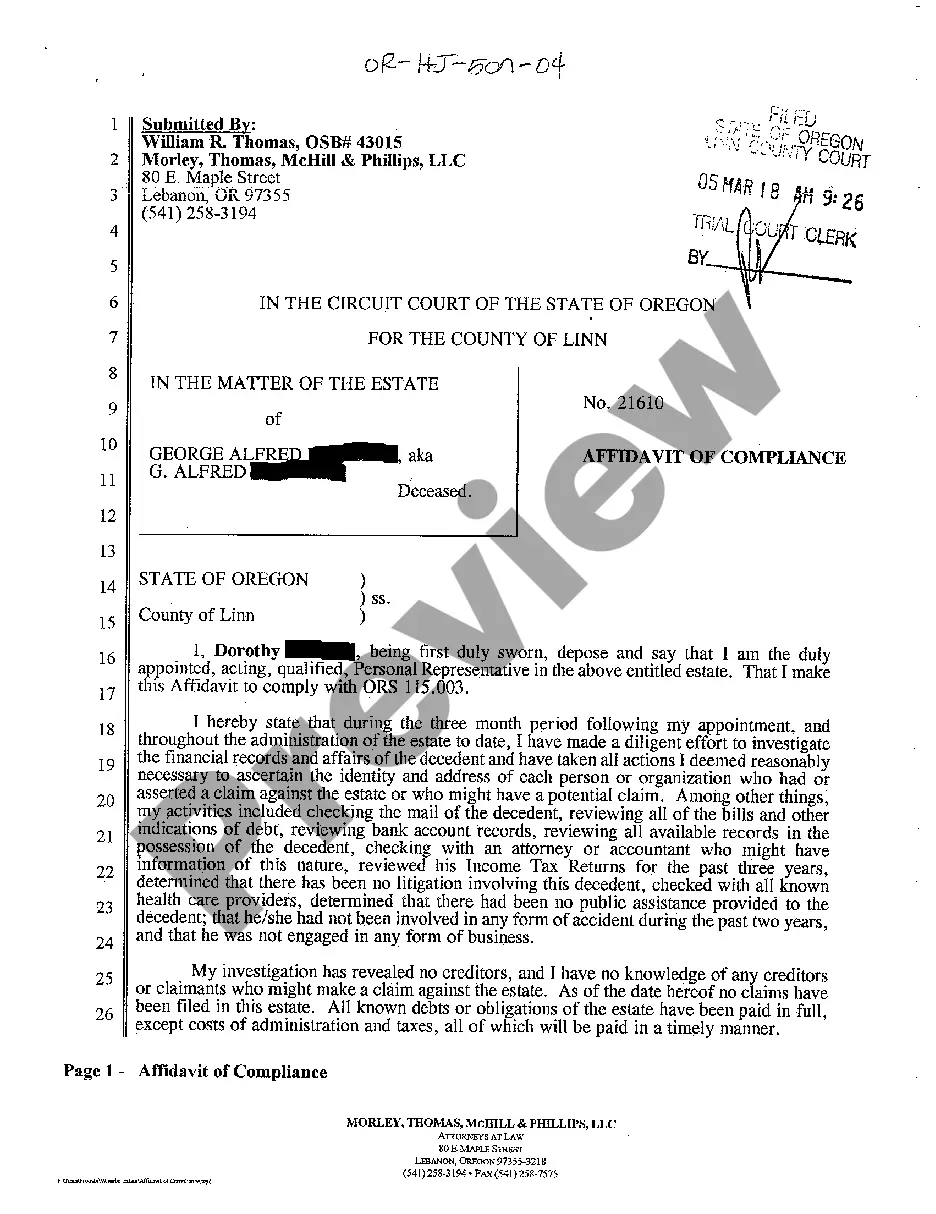

This form is a Complaint to Foreclose on a Residential Mortgage for use in foreclosure proceedings within the state of New Jersey.

New Jersey Complaint to Foreclose Residential Mortgage

Description

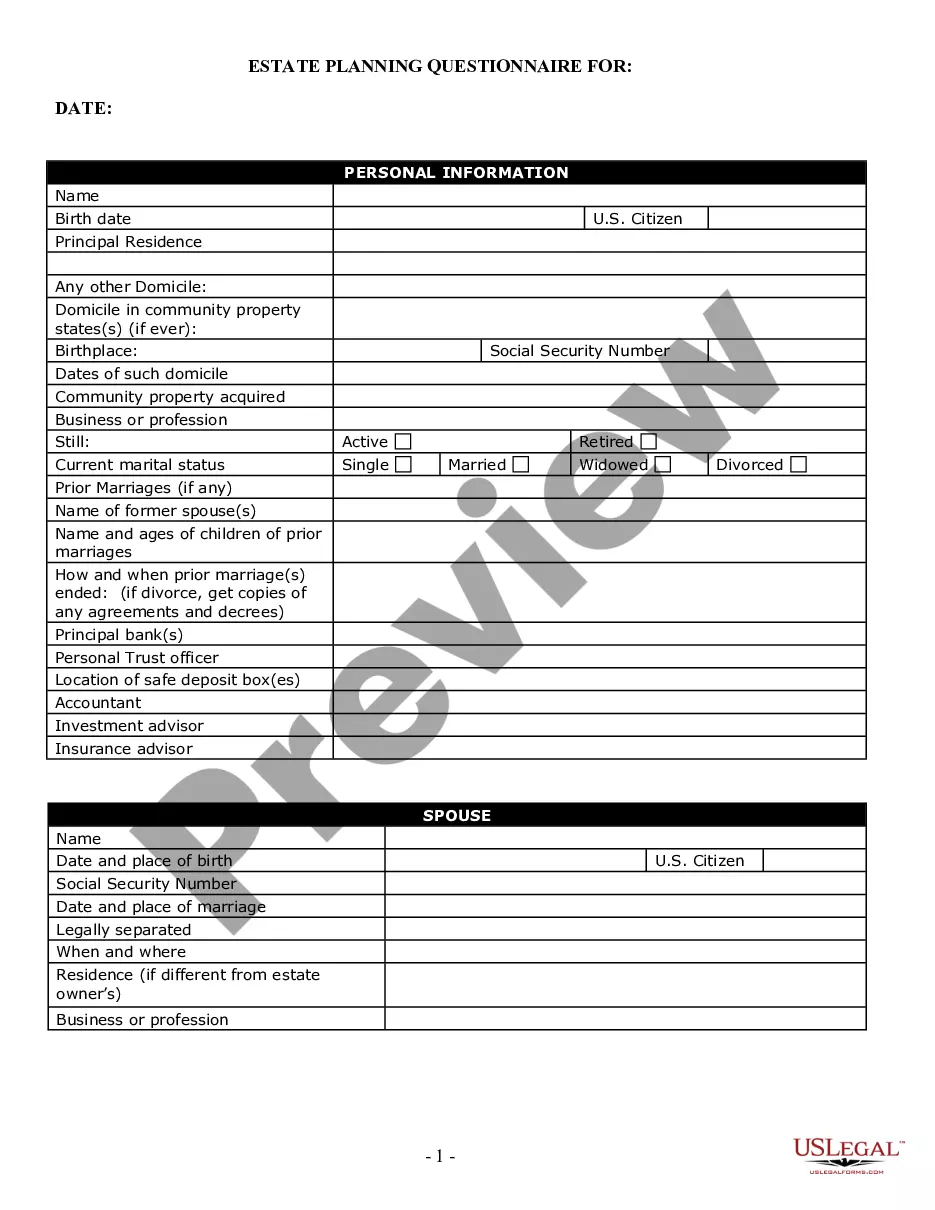

How to fill out New Jersey Complaint To Foreclose Residential Mortgage?

US Legal Forms is actually a special system to find any legal or tax document for completing, including New Jersey Complaint to Foreclose Residential Mortgage. If you’re fed up with wasting time seeking appropriate samples and paying money on record preparation/lawyer service fees, then US Legal Forms is precisely what you’re searching for.

To enjoy all the service’s benefits, you don't need to download any application but just select a subscription plan and sign up an account. If you have one, just log in and look for the right sample, download it, and fill it out. Downloaded documents are all stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Complaint to Foreclose Residential Mortgage, have a look at the recommendations listed below:

- make sure that the form you’re taking a look at applies in the state you need it in.

- Preview the sample and look at its description.

- Click on Buy Now button to access the register webpage.

- Select a pricing plan and keep on signing up by entering some information.

- Select a payment method to complete the sign up.

- Download the document by choosing your preferred format (.docx or .pdf)

Now, submit the file online or print out it. If you are uncertain concerning your New Jersey Complaint to Foreclose Residential Mortgage template, speak to a lawyer to examine it before you decide to send out or file it. Begin without hassles!

Form popularity

FAQ

If the lender is successful at the end of foreclosure proceedings, it will obtain a final judgment approving the foreclosure and a Writ of Execution.Once the Writ has been received, the Sheriff must schedule an auction for the property within 120 days.

It is a lengthy process with strict rules for mortgage lenders and multiple opportunities for you to save your home (or arrange the most favorable alternative). According to Nolo.com, New Jersey has the third-longest foreclosure timeline. The average is 1,161 days (38 months) from that first foreclosure notice.

If you choose to file an answer, you must do so within 35 days from the date that you receive the summons and complaint; and you must include a completed Foreclosure Case Information Statement, a Certification Pursuant to Court Rule 4:5-1 and the $175.00 filing fee ($250 for Answers with Counter-Claim, Cross-Claim and/

Although lenders in New Jersey will usually initiate foreclosure proceeding after three missed payments, legally, a lender may consider a mortgage delinquent as soon as one payment is missed.

Notice of Intention to Foreclose The lender must send the notice at least 30 daysbut not more than 180 daysbefore filing a complaint. The notice notifies you that you are behind in your mortgage payments and gives you 30 days to cure the default.

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.

You can file an answer to respond to the plaintiff's Complaint. An answer is a formal statement, in writing, of your defense to the lawsuit. You can say that what the plaintiff claims is not true. Or you can say it is true but give more information and reasons to defend your actions or explain the situation.

As of around mid-2019, New Jersey law requires the sheriff to conduct the foreclosure sale within 150 days, instead of within 120 days, of the sheriff's receipt of a writ of execution.