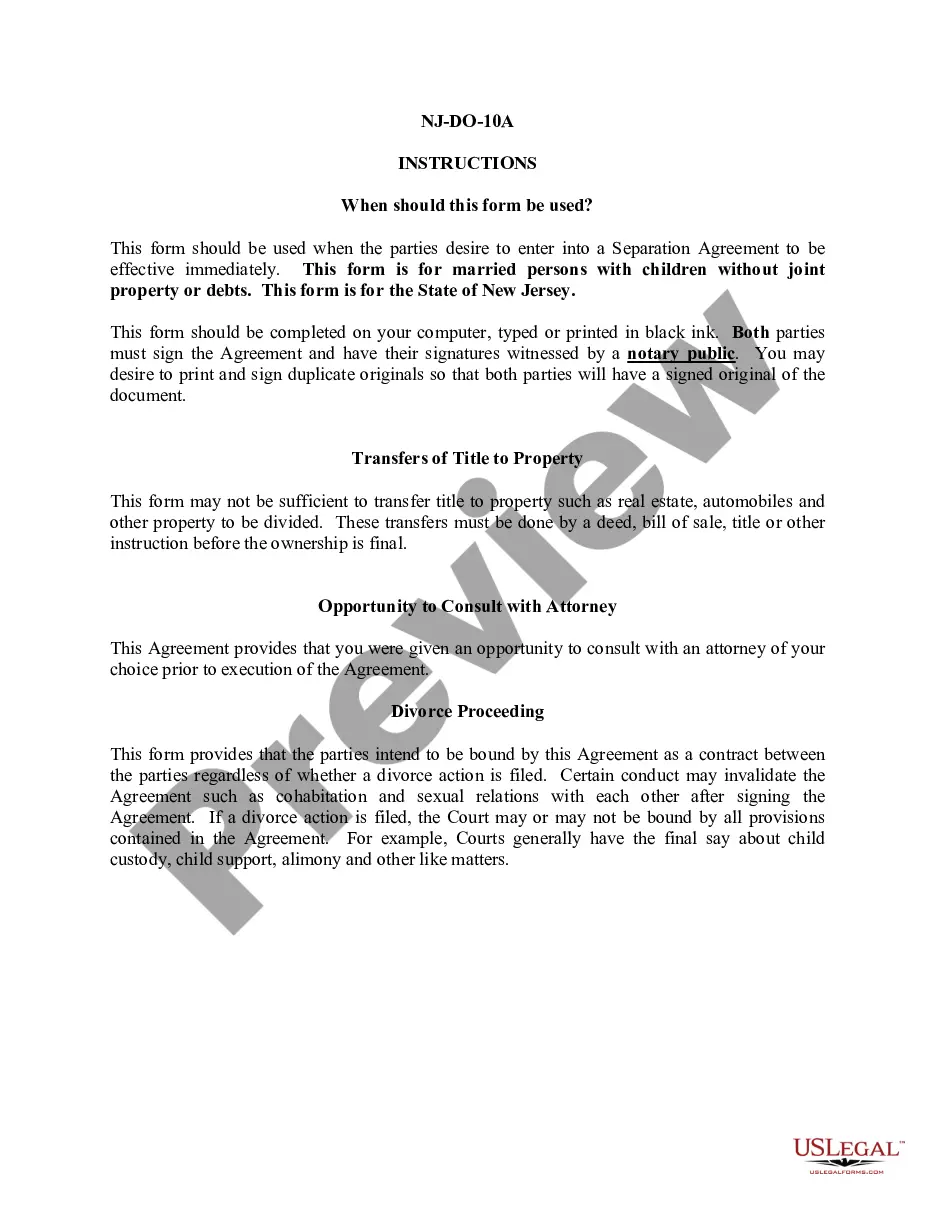

"Uniform Commercial Arbitration Memorandum" is a form to be used in the state of New Jersey to be completed before arbitration.

New Jersey Uniform Commercial Arbitration Memorandum

Description

How to fill out New Jersey Uniform Commercial Arbitration Memorandum?

US Legal Forms is really a special system to find any legal or tax document for submitting, such as New Jersey Uniform Commercial Arbitration Memorandum. If you’re tired with wasting time searching for ideal samples and paying money on record preparation/lawyer service fees, then US Legal Forms is exactly what you’re seeking.

To enjoy all the service’s benefits, you don't have to download any application but simply select a subscription plan and register an account. If you already have one, just log in and look for the right sample, download it, and fill it out. Saved documents are all stored in the My Forms folder.

If you don't have a subscription but need New Jersey Uniform Commercial Arbitration Memorandum, have a look at the instructions below:

- check out the form you’re taking a look at applies in the state you want it in.

- Preview the example and read its description.

- Simply click Buy Now to reach the sign up page.

- Pick a pricing plan and proceed registering by providing some info.

- Select a payment method to finish the registration.

- Download the document by selecting your preferred format (.docx or .pdf)

Now, complete the document online or print out it. If you feel unsure regarding your New Jersey Uniform Commercial Arbitration Memorandum form, contact a attorney to review it before you decide to send out or file it. Get started without hassles!

Form popularity

FAQ

The UCC-1 Financing Statement is filed to protect a lender's or creditor's security interest by giving public notice that there is a right to take possession of and sell certain assets for repayment of a specific debt with a certain debtor.

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

It is a set of laws that standardize U.S. business law so that it is uniform in every state. The UCC was enacted in 1952 and has had many revisions over the years. While it was not mandatory for every state, all 50 states have adopted it.

Every U.S. state and the District of Columbia have adopted at least part of the UCC (though it has not been adopted as federal law). Each jurisdiction, however, may make its own modifications (Louisiana has never adopted Article 2), and may organize its version of the UCC differently.

UCC-1 filings, which are also referred to as UCC-1 financial statements, are legal forms that lenders file to give notice of their rights to a debtor's collateral on a secured loan. This filing may allow lenders to acquire a lien on the equipment of a small business in exchange for a loan.

Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

What does UCC stand for? UCC stands for Uniform Commercial Code. The UCC is a set of laws concerning commercial transactions, such as the sale of goods. It also covers secured transactions, where a lender gains the right to foreclose on a borrower's collateral should the borrower default on the loan.

Every U.S. state and the District of Columbia have adopted at least part of the UCC (though it has not been adopted as federal law). Each jurisdiction, however, may make its own modifications (Louisiana has never adopted Article 2), and may organize its version of the UCC differently.

A UCC filing is a legal notice a lender files with the secretary of state when they have a security interest against one of your assets. It gives notice that the lender has an interest, or lien, against the asset being used by you to secure the financing. The term UCC filing comes from the uniform commercial code.