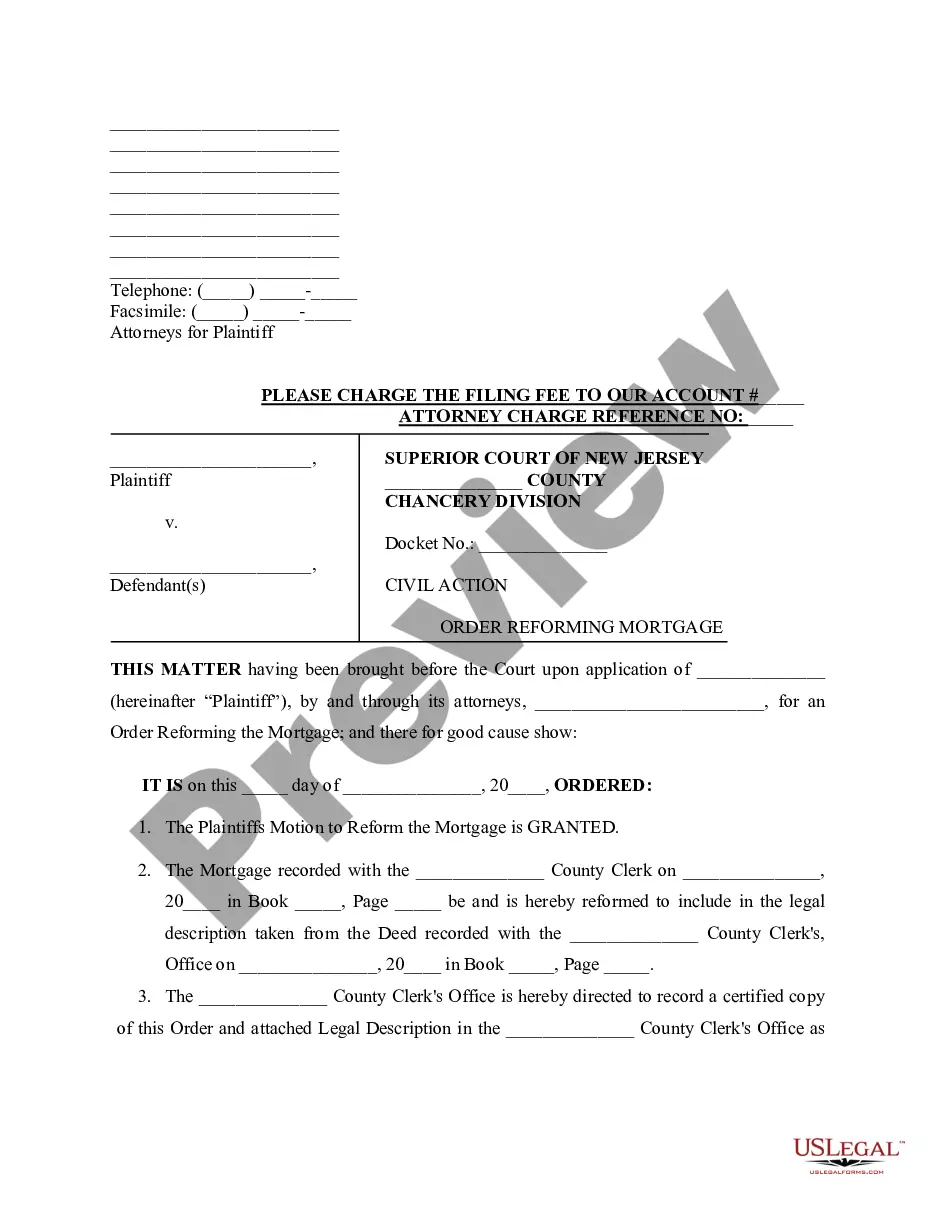

New Jersey Order Reforming Mortgage

Description

How to fill out New Jersey Order Reforming Mortgage?

US Legal Forms is really a unique platform where you can find any legal or tax template for filling out, such as New Jersey Order Reforming Mortgage. If you’re tired of wasting time searching for suitable samples and paying money on record preparation/attorney charges, then US Legal Forms is exactly what you’re looking for.

To enjoy all the service’s advantages, you don't have to install any software but just pick a subscription plan and create your account. If you have one, just log in and look for the right sample, save it, and fill it out. Downloaded files are kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Order Reforming Mortgage, take a look at the instructions listed below:

- make sure that the form you’re looking at is valid in the state you want it in.

- Preview the form and look at its description.

- Click Buy Now to reach the register webpage.

- Select a pricing plan and carry on signing up by entering some info.

- Choose a payment method to finish the sign up.

- Download the file by choosing your preferred file format (.docx or .pdf)

Now, fill out the file online or print it. If you are uncertain about your New Jersey Order Reforming Mortgage form, speak to a lawyer to review it before you send out or file it. Begin without hassles!

Form popularity

FAQ

It is a lengthy process with strict rules for mortgage lenders and multiple opportunities for you to save your home (or arrange the most favorable alternative). According to Nolo.com, New Jersey has the third-longest foreclosure timeline. The average is 1,161 days (38 months) from that first foreclosure notice.

Mortgage lenders are now prohibited by federal law from conducting a foreclosure while a mortgage modification application is under consideration. Before a foreclosure is begun, the lender or their servicer must take steps to let the borrower know what options exist to keep the house.

Although lenders in New Jersey will usually initiate foreclosure proceeding after three missed payments, legally, a lender may consider a mortgage delinquent as soon as one payment is missed.

It is still entirely possible for a foreclosure suit from the lender to be moving forward on a parallel track with your loan modification. One department for the lender may be trying to negotiate better terms with you while another is aggressively working to take your home.

Some states have complete consumer protections against deficiency suits, (known as non-recourse states). New Jersey doesn't. The lender must file their deficiency suit within 3 months of the Sheriff's sale in New Jersey. Invoking the fair market value of the property is a common defense against deficiency.