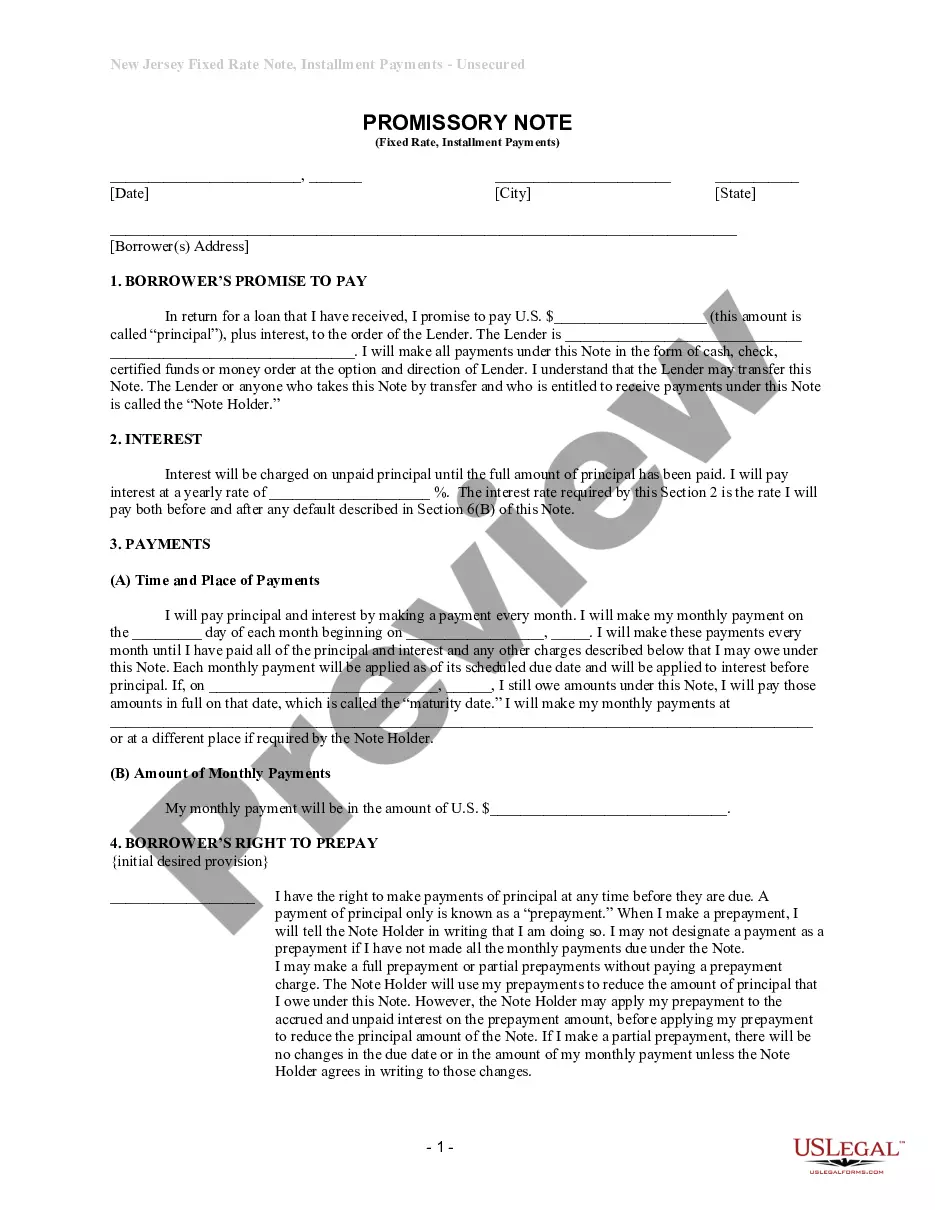

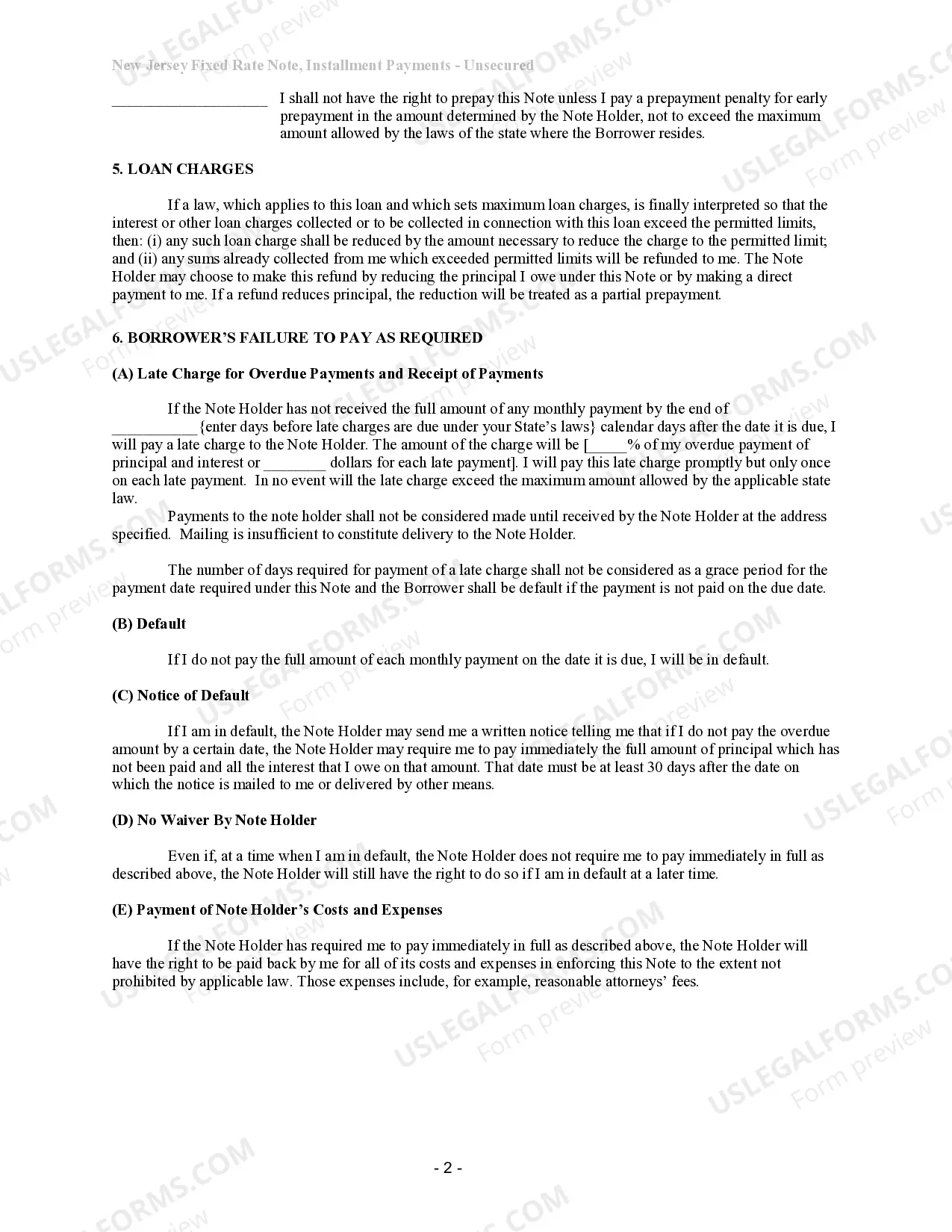

New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate

Description Installment Payment Note

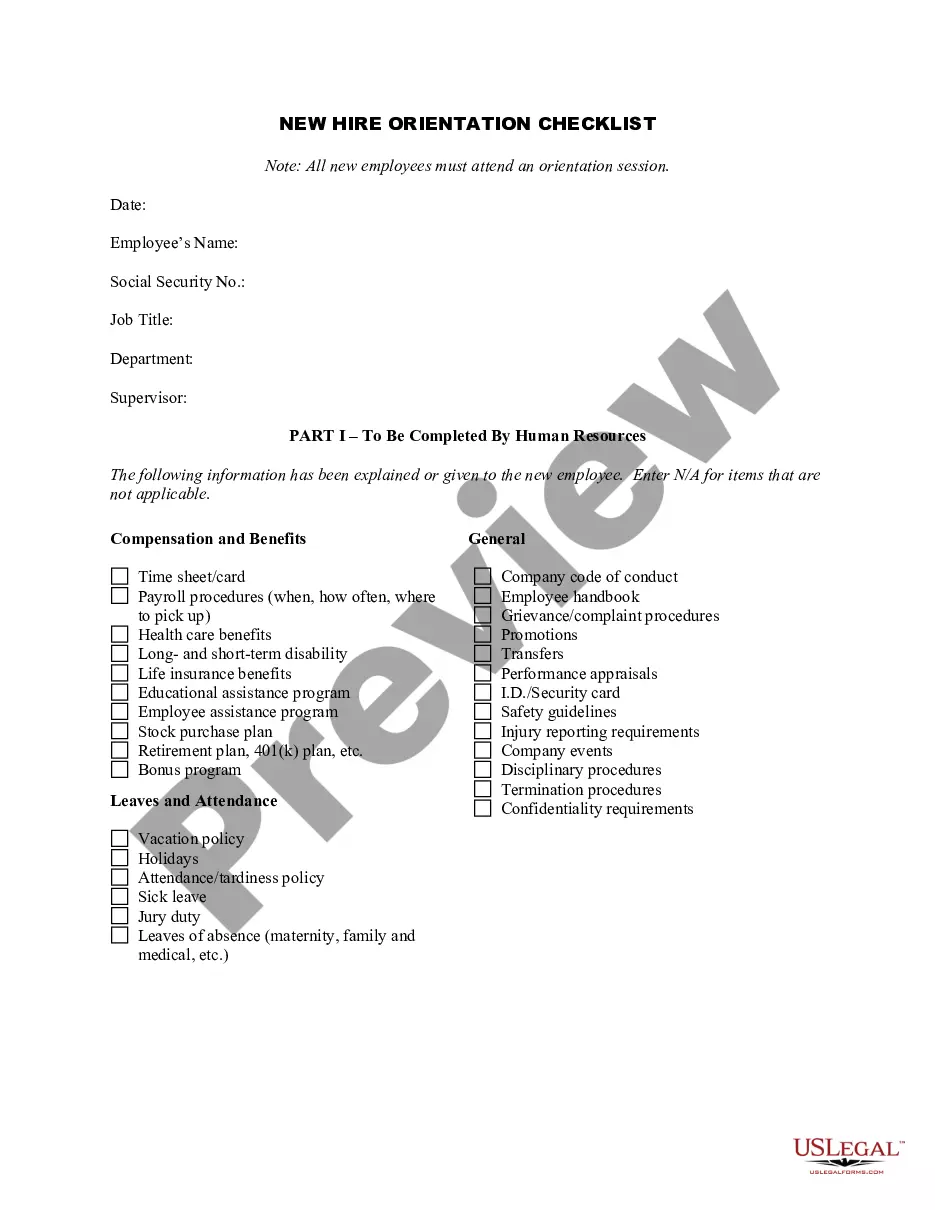

How to fill out Unsecured Payment Promissory?

US Legal Forms is really a unique platform where you can find any legal or tax template for filling out, including New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate. If you’re tired with wasting time seeking appropriate examples and spending money on file preparation/attorney charges, then US Legal Forms is precisely what you’re looking for.

To enjoy all of the service’s advantages, you don't have to install any software but just pick a subscription plan and register your account. If you already have one, just log in and find an appropriate template, save it, and fill it out. Saved files are all stored in the My Forms folder.

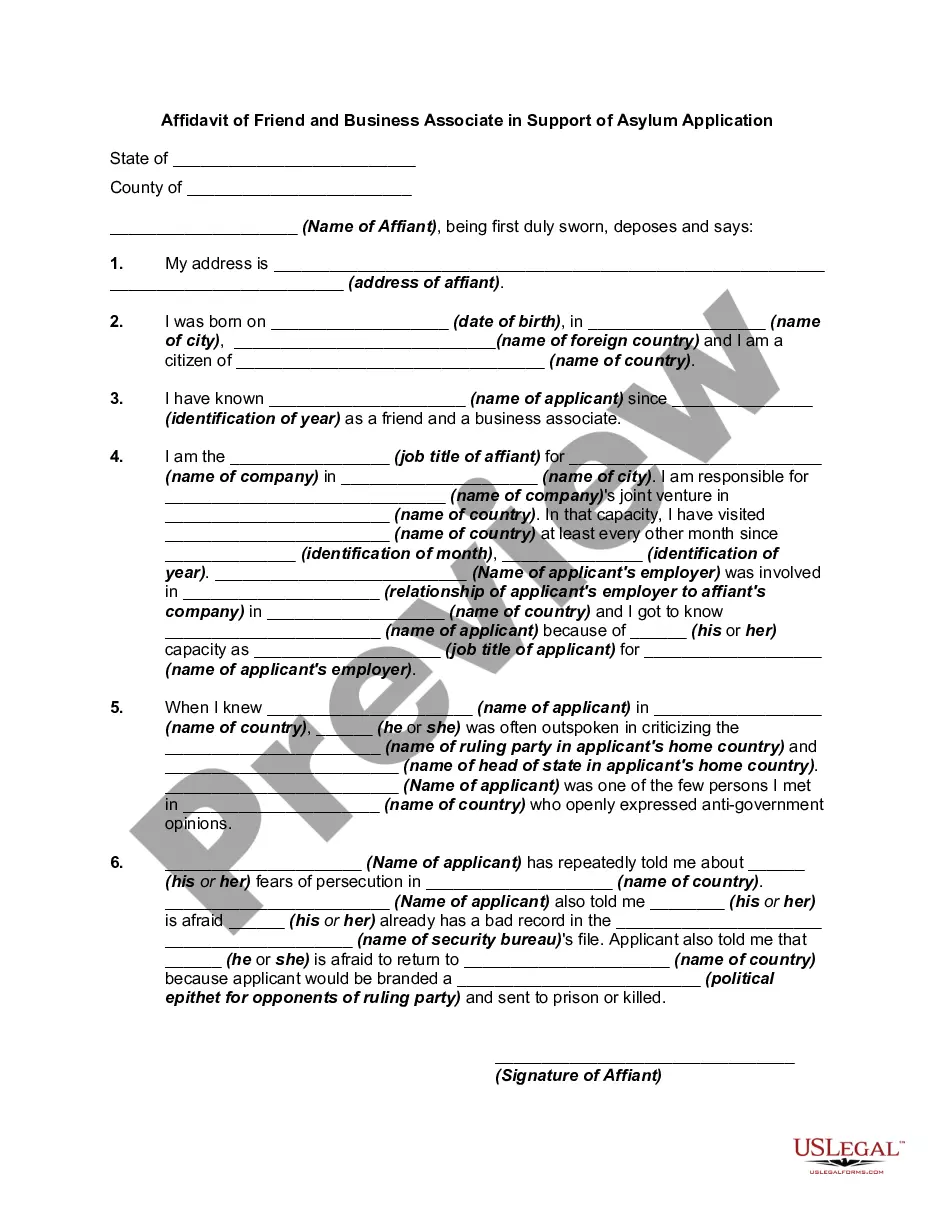

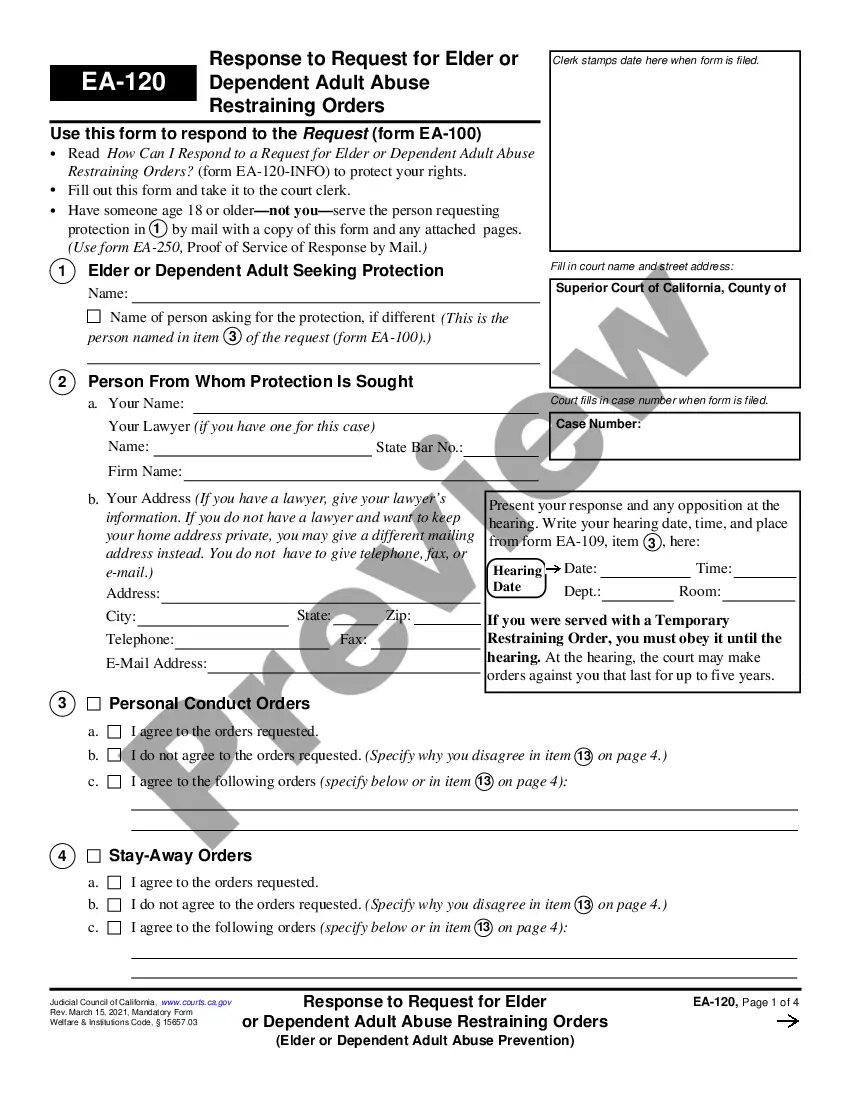

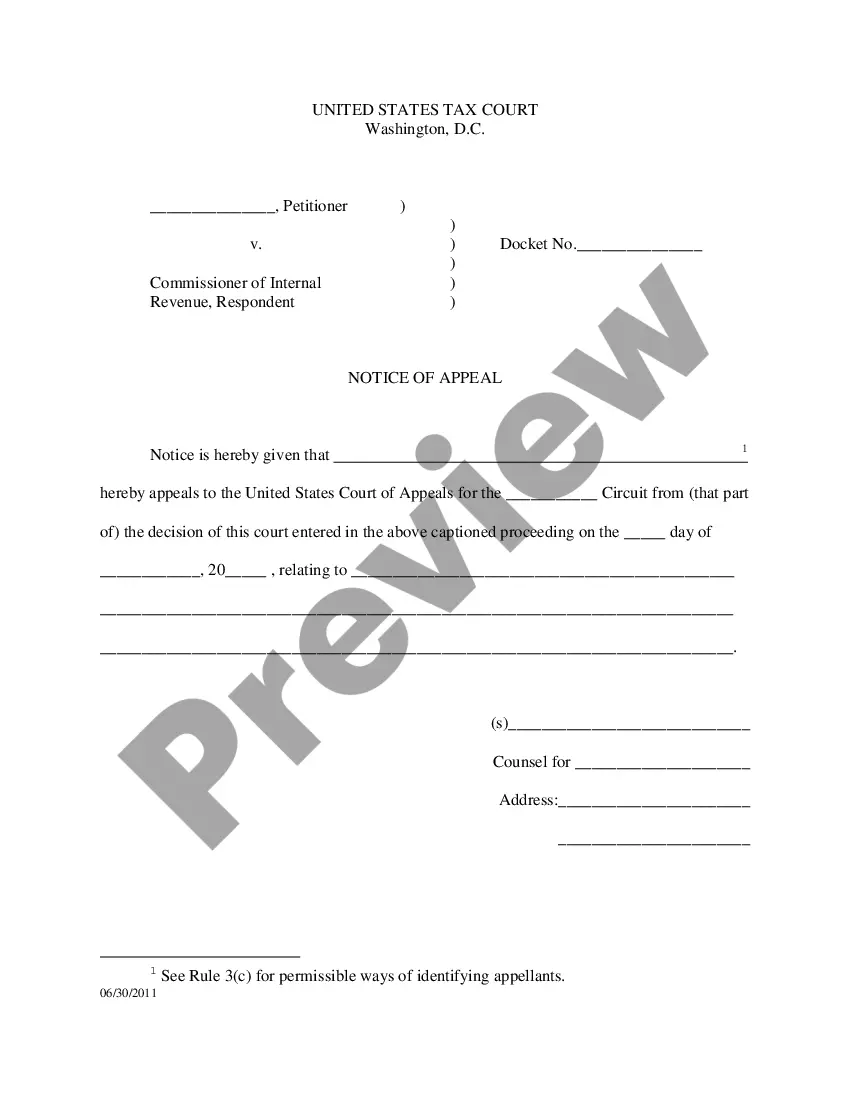

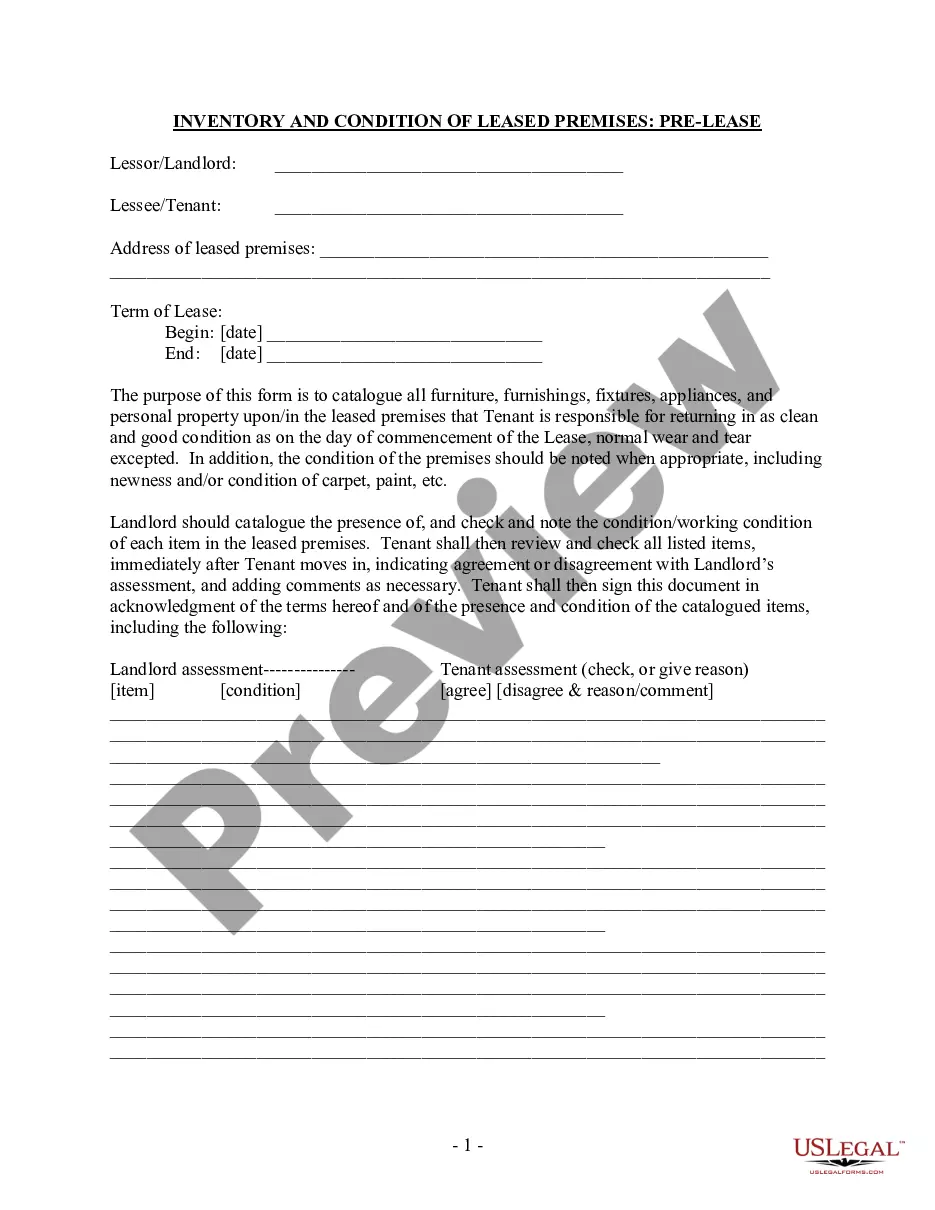

If you don't have a subscription but need New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, have a look at the guidelines below:

- check out the form you’re checking out is valid in the state you want it in.

- Preview the form and look at its description.

- Click Buy Now to access the sign up page.

- Pick a pricing plan and continue signing up by entering some info.

- Decide on a payment method to complete the sign up.

- Save the file by selecting the preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you are uncertain concerning your New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate form, contact a legal professional to examine it before you send or file it. Begin hassle-free!

Unsecured Installment Promissory Form popularity

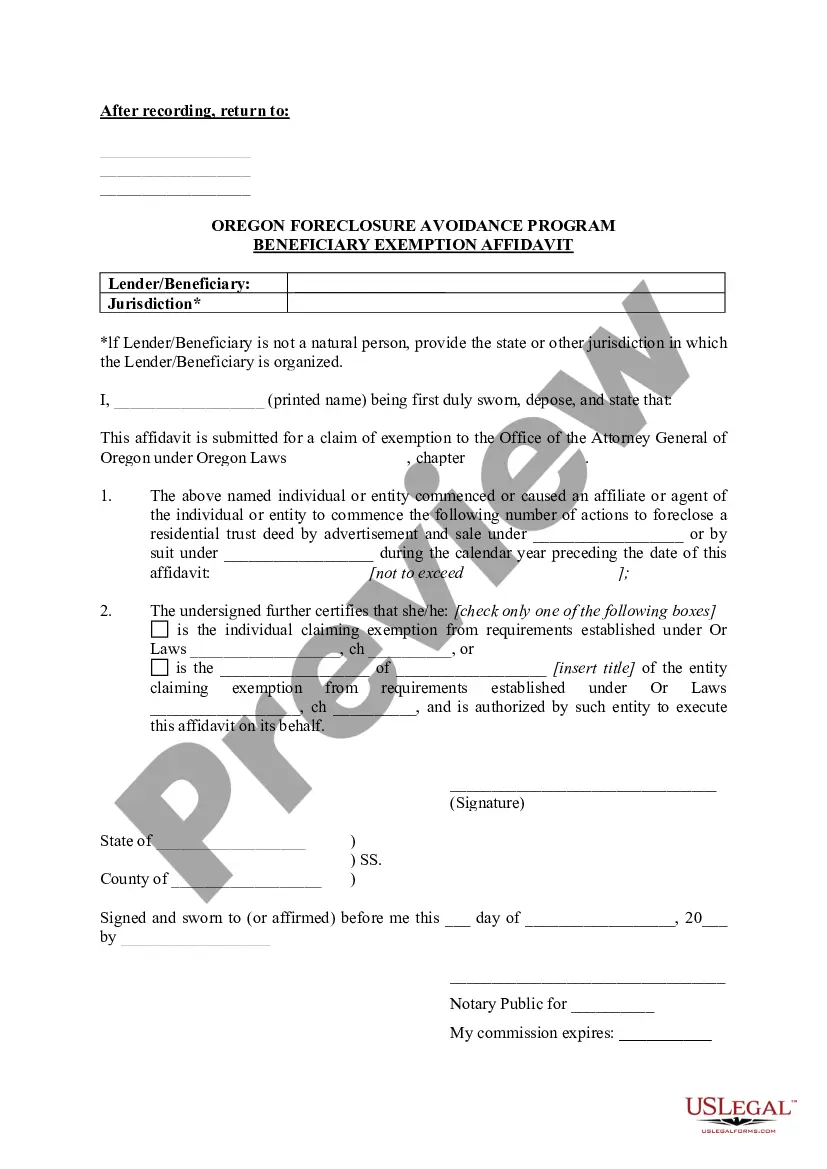

Promissory Note Receipt Other Form Names

Promissory Note Fixed FAQ

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Unsecured Promissory Notes An unsecured promissory note is an obligation for payment without any property securing the payment.A short-term unsecured promissory note is the type most often used when a relatively small amount of money is borrowed from a friend or relative.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.