New Jersey Special Durable Power of Attorney for Bank Account Matters

Description

Key Concepts & Definitions

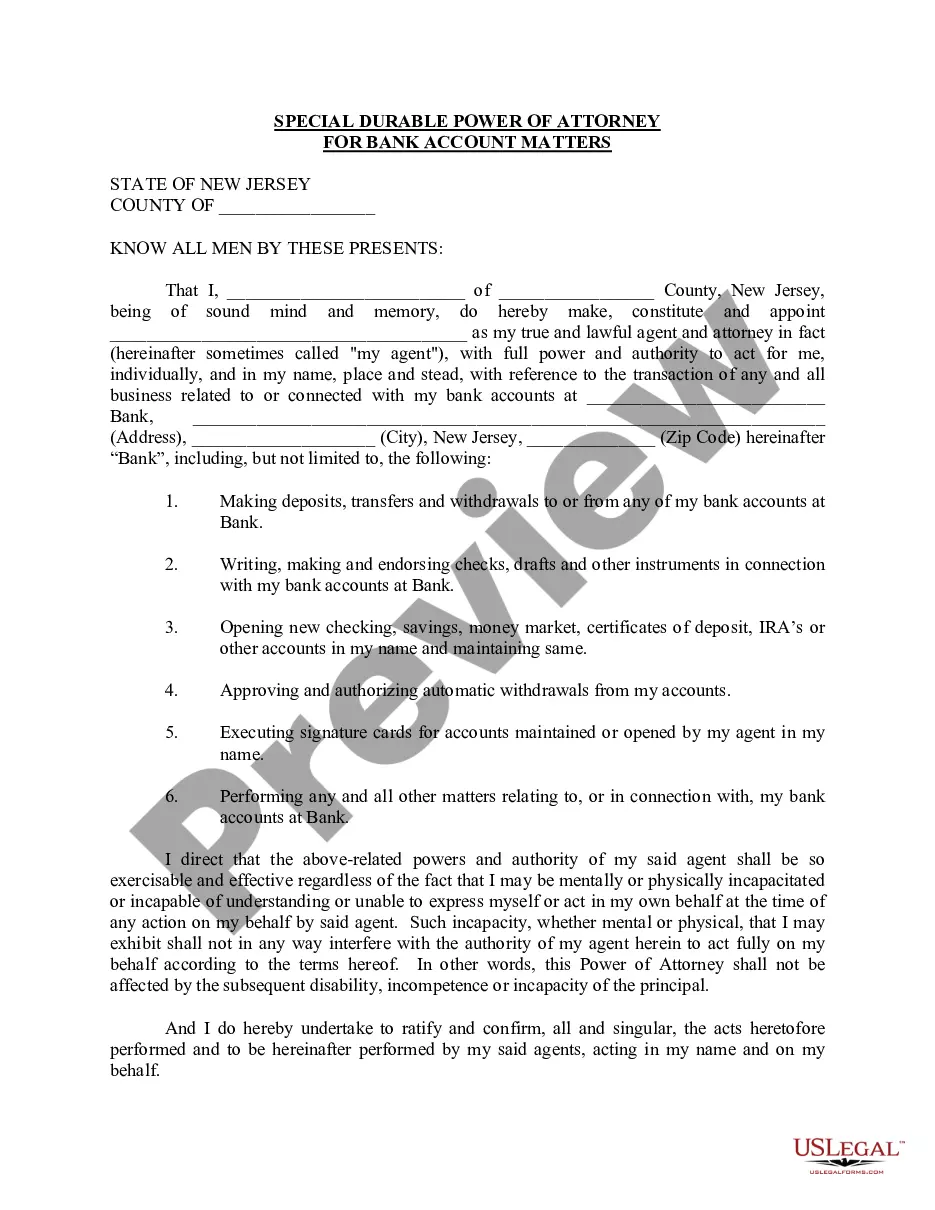

Special Durable Power of Attorney for Bank Account refers to a legal document that grants a designated agent (also known as an attorney-in-fact) the authority to manage the financial transactions related to a specific bank account on behalf of the principal. The 'durable' aspect implies that the power remains in effect even if the principal becomes incapacitated.

Step-by-Step Guide

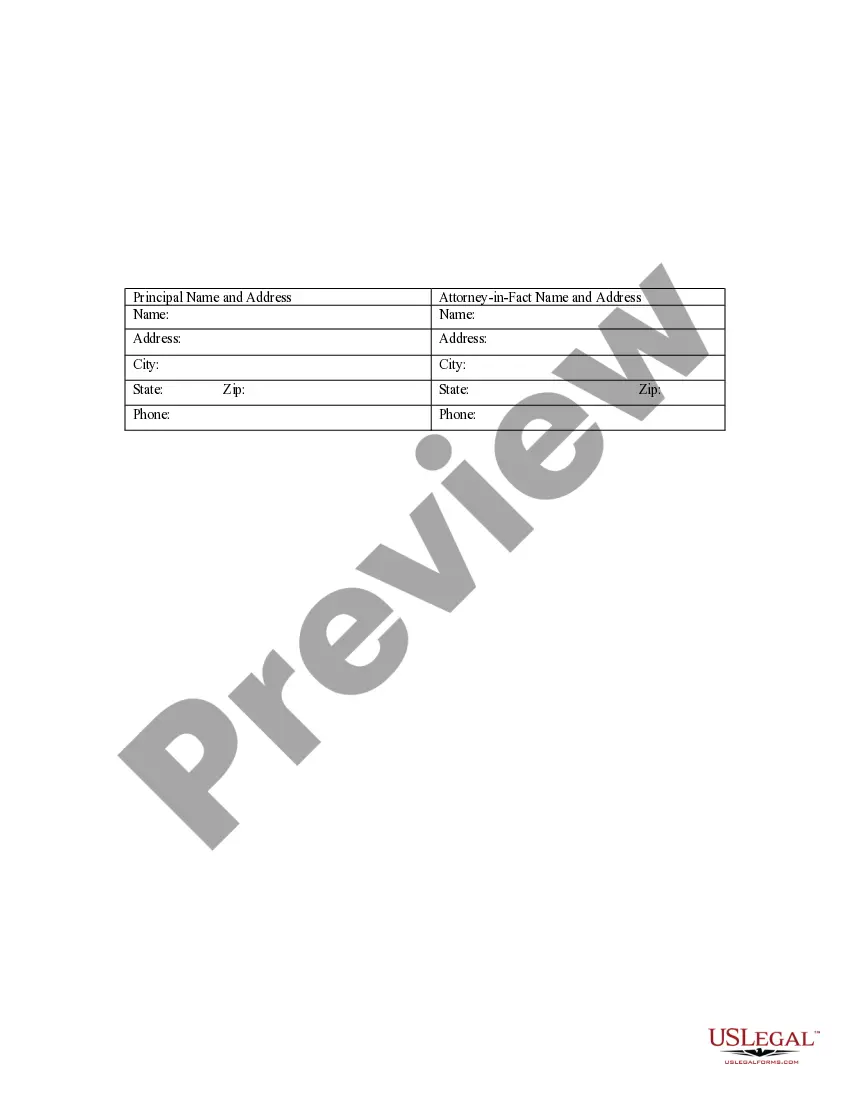

- Choose an Agent: Select a trustworthy individual who understands financial matters to act as your attorney-in-fact.

- Determine the Scope: Clearly define the transactions your agent is authorized to handle. This can include deposits, withdrawals, and managing bill payments.

- Consult a Lawyer: Engage a lawyer to ensure the form meets local legal requirements and accurately represents your intentions.

- Execute the Document: Sign the power of attorney in the presence of a notary to make it legally binding.

- Notify the Bank: Provide the bank with a copy of the power of attorney and ensure their records reflect the change in authorization.

Risk Analysis

- Unauthorized Transactions: If not properly monitored, an agent can potentially make unauthorized transactions, leading to financial loss.

- Misuse of Authority: There's a risk of the power being used beyond the intended scope if not explicitly detailed in the document.

- Legal Disputes: Ambiguities in the document can lead to legal disputes between family members or with financial institutions.

Key Takeaways

Implementing a special durable power of attorney for a bank account helps ensure that your financial affairs are managed according to your wishes, even in cases of unexpected incapacitation. It is crucial to choose a reliable agent and craft the document with clear, legal help to mitigate risks associated with misuse.

Common Mistakes & How to Avoid Them

- Vague Terms: Avoid ambiguities by clearly specifying the powers granted. Use precise language to describe permitted actions.

- Ignoring Regular Reviews: Periodically review and update the power of attorney to reflect current intents and life changes.

- Not Informing the Agent: Clearly communicate with your agent about their responsibilities and expectations to prevent misunderstandings.

FAQ

What is a special durable power of attorney for a bank account? It is a legal document where a principal appoints an agent to manage their bank account, and it remains valid even if the principal becomes incapacitated.

Can I revoke a special durable power of attorney? Yes, as long as you are mentally competent, you can revoke it at any time by notifying your agent and the involved bank in writing.

How to fill out New Jersey Special Durable Power Of Attorney For Bank Account Matters?

US Legal Forms is actually a special system where you can find any legal or tax document for submitting, such as New Jersey Special Durable Power of Attorney for Bank Account Matters. If you’re tired of wasting time searching for ideal samples and spending money on file preparation/legal professional service fees, then US Legal Forms is precisely what you’re searching for.

To reap all of the service’s benefits, you don't need to install any application but just select a subscription plan and sign up an account. If you already have one, just log in and get an appropriate template, download it, and fill it out. Saved files are all kept in the My Forms folder.

If you don't have a subscription but need New Jersey Special Durable Power of Attorney for Bank Account Matters, have a look at the instructions below:

- make sure that the form you’re looking at applies in the state you need it in.

- Preview the sample and read its description.

- Simply click Buy Now to reach the sign up webpage.

- Select a pricing plan and keep on signing up by providing some information.

- Choose a payment method to complete the sign up.

- Save the file by choosing the preferred format (.docx or .pdf)

Now, complete the document online or print it. If you are unsure regarding your New Jersey Special Durable Power of Attorney for Bank Account Matters form, contact a lawyer to review it before you send out or file it. Start hassle-free!

Form popularity

FAQ

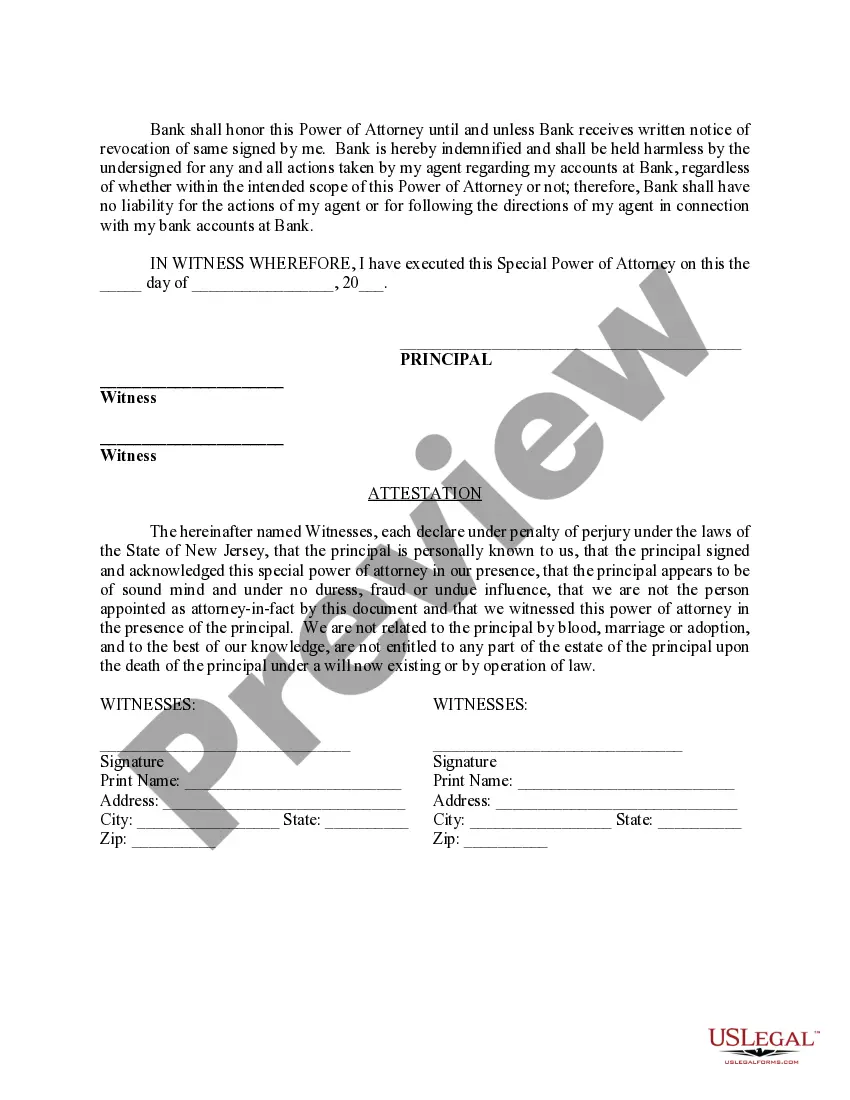

In New Jersey, all power of attorney documents require that both the principal and the attorney-in-fact are competent and be of sound mind at the point at which they are executed. They must be signed in the presence of at least 2 witnesses and in the presence of a licensed Notary of the State of New Jersey.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

The principal must sign the power of attorney document in front of either a notary public or an attorney licensed to practice in New Jersey. The principal should not sign the document until they are in the presence of the notary or attorney. After the principal signs, the notary or attorney signs the document.

You can draft a durable power of attorney by writing out or typing the document, which should include the date, your full name, and speech that clearly identifies the document as a durable power of attorney that applies even in the case of your incapacitation.