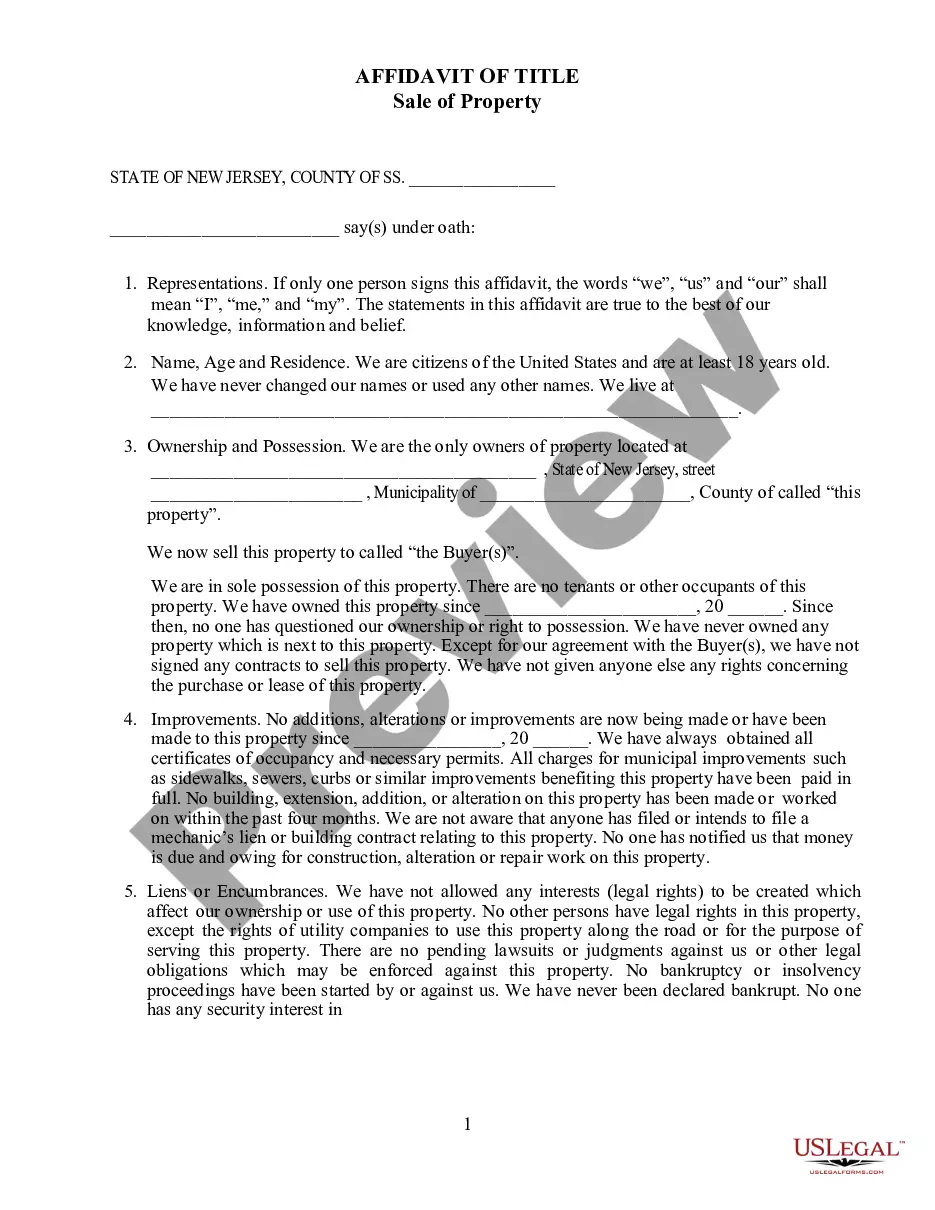

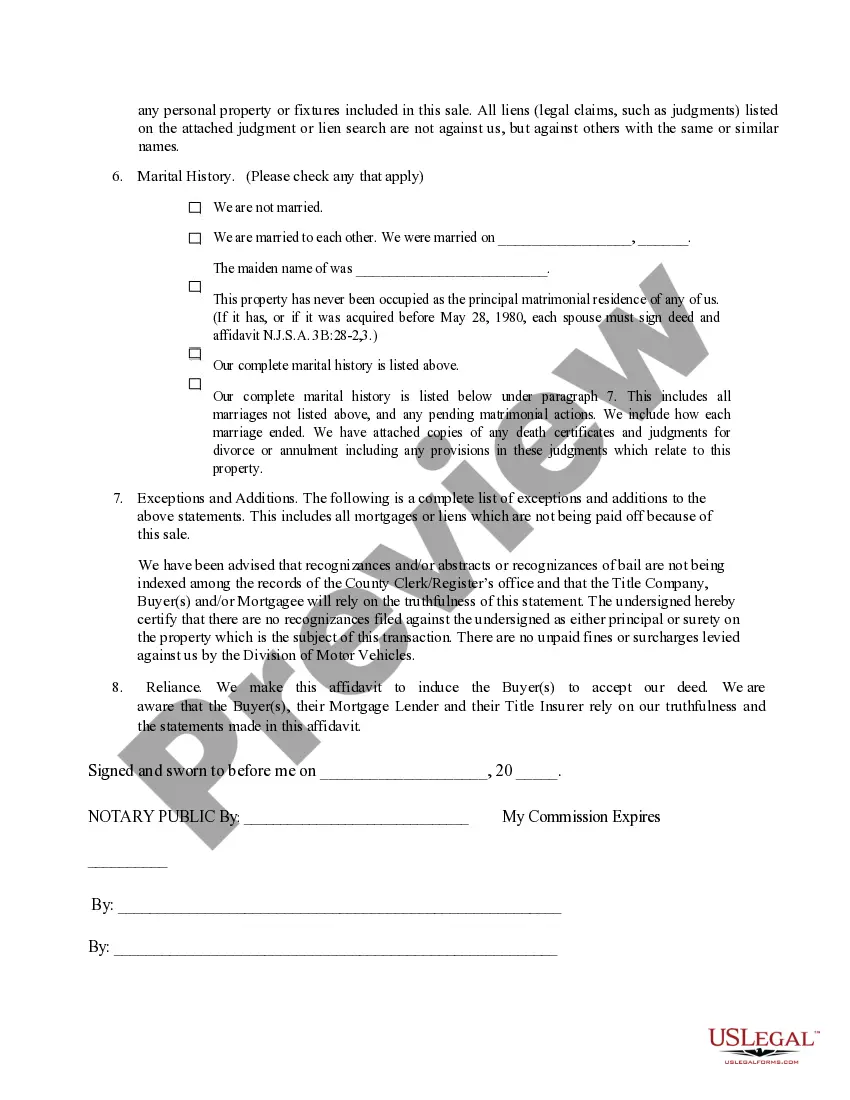

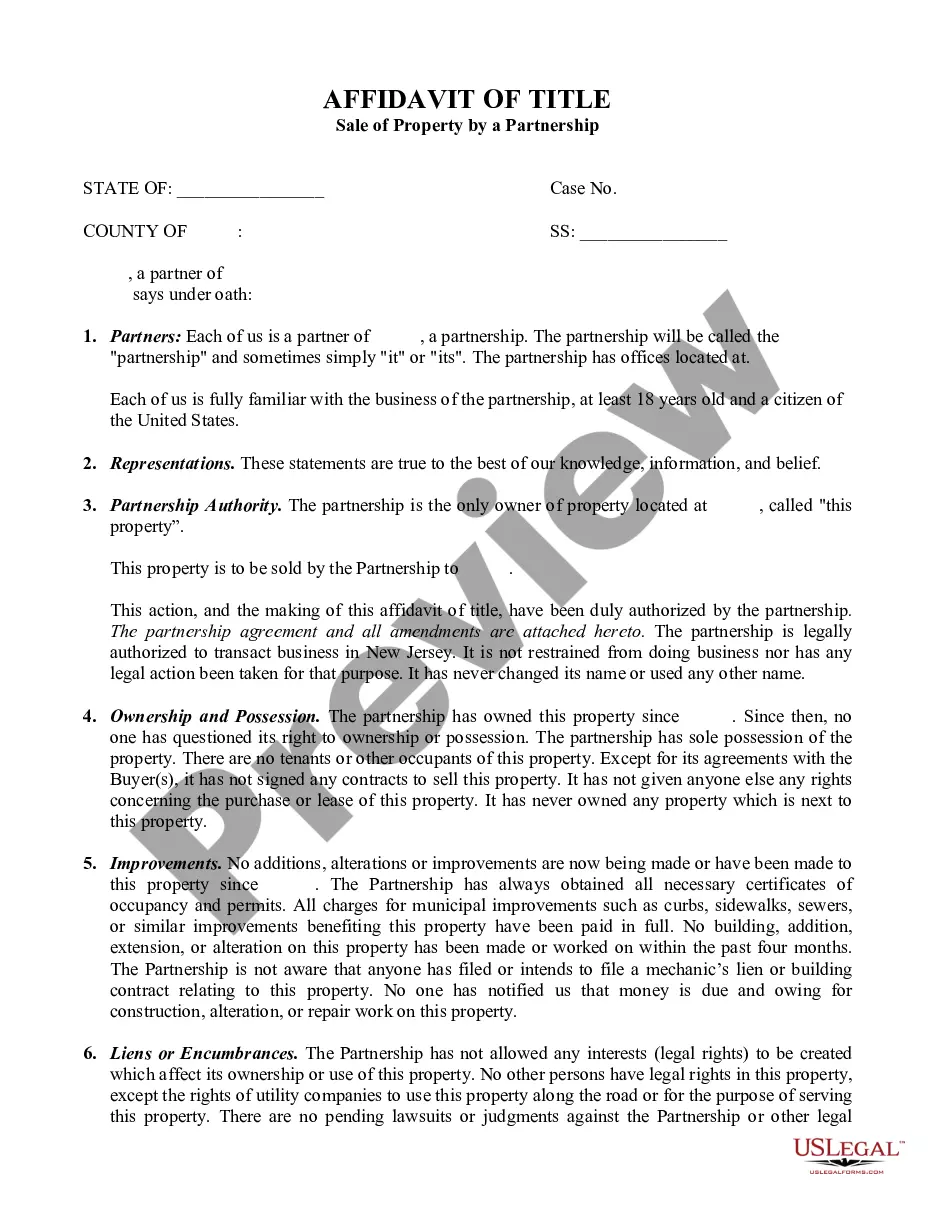

The New Jersey Affidavit of Title — Sale of Property is a document used to establish the legal ownership of real property located in New Jersey. It is typically signed and submitted by the seller, and includes information regarding the property's current legal titleholder, any encumbrances or defects afflicting the title, and any facts that may be relevant to the transfer of the title. The document is used to provide assurance to the buyer that they are obtaining a good and marketable title to the property. There are two types of New Jersey Affidavit of Title — Sale of Property: an Unconditional Affidavit of Title and a Conditional Affidavit of Title. An Unconditional Affidavit of Title is a statement by the seller that they have a valid and marketable title to the property and that it is free of encumbrances or defects. A Conditional Affidavit of Title is a statement by the seller that the title is valid and marketable but that there may be encumbrances or defects.

New Jersey Affidavit of Title - Sale of Property

Description

How to fill out New Jersey Affidavit Of Title - Sale Of Property?

Dealing with official documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your New Jersey Affidavit of Title - Sale of Property template from our service, you can be sure it meets federal and state laws.

Working with our service is easy and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your New Jersey Affidavit of Title - Sale of Property within minutes:

- Remember to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another official template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the New Jersey Affidavit of Title - Sale of Property in the format you need. If it’s your first time with our website, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the New Jersey Affidavit of Title - Sale of Property you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

The vehicle owner must appear in person. Schedule an appointment prior to your visit. You must show the Manufacturer's Certificate of Origin (MCO) displaying the sales tax-satisfied stamp. You need to pay sales tax on the actual vehicle price.

New Jersey's gift deed form must clearly outline the following: The grantor's and grantee's full names, The grantor's and grantee's marital statuses, The grantor's and grantee's mailing addresses, Vesting (how the grantor owns the property), and. A legal description of the property or gifted amount of money.

It is calculated, paid, and recorded at the same time that the deed is recorded and is typically between 0.4% to 1% of the transaction's value. For homes that sell for under $150,000 the NJ transfer tax is only 0.4%, but for homes above $1 million, it is around 1%, depending on the exact sale price.

You need to know that: Quitclaim Deeds are used to transfer property rights from one individual to another. To do so, a New Jersey Quitclaim Deed form must be completed. The writing must be in English. You must go to a notary public. Take the form to the county clerk's office.

While the seller pays the RTF, the buyer pays this supplemental fee of 1% of the consideration recited in the deed.

This affidavit must state that there is a reasonable probability that the afforded treatment and care by the defendants, and/or the skill or knowledge exercised by the defendants, fell outside of the acceptable customs, standards and/or practices of the profession.