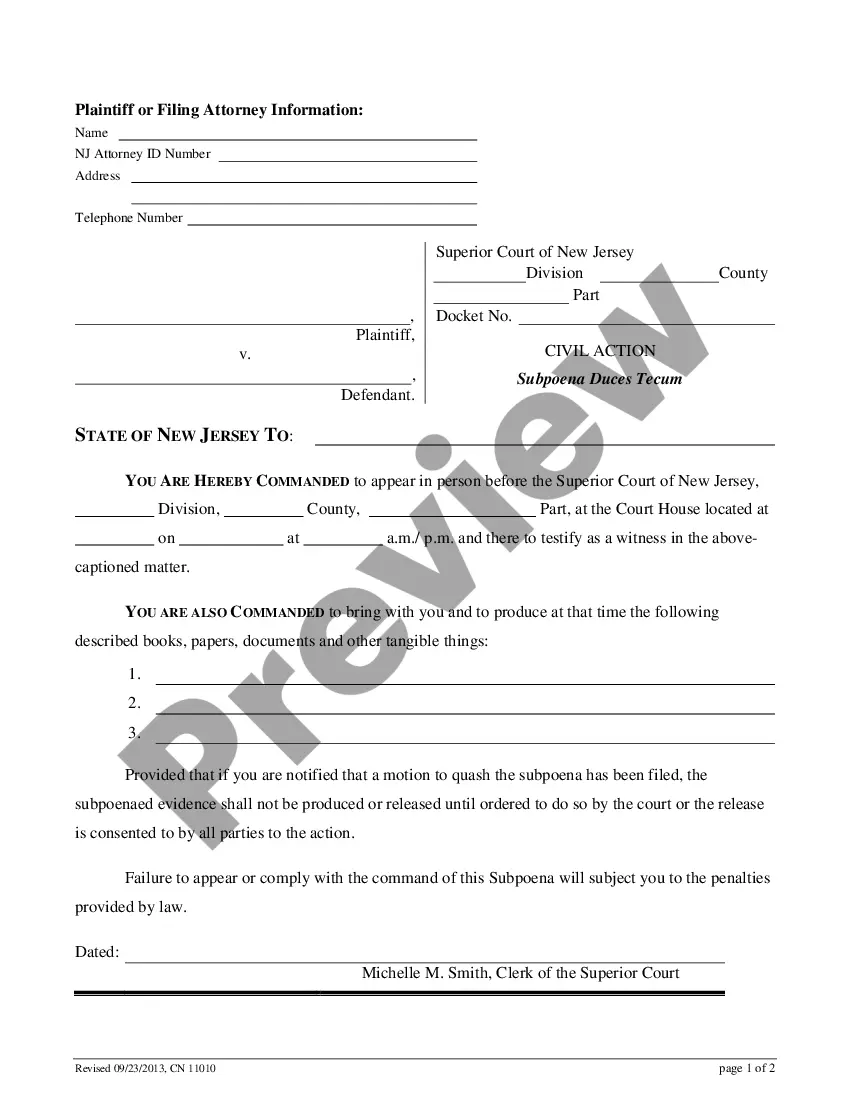

New Jersey Certification Regarding Calculation of Amount Due is a form that is required by the state of New Jersey to ensure accurate calculation of the amount due for taxable income. This form is used to certify that the calculations of the amount due have been accurately made according to the state's rules and regulations. There are two types of this form: Form NJ-1080A for individuals and the Form NJ-1080B for business entities. The individual form requires the taxpayer to enter their Social Security Number, filing status, and income information, while the business form requires the taxpayer to enter their Federal Employer Identification Number, entity type, and income information. Both forms require the taxpayer to certify that the calculation of the amount due is correct and sign the form for the certification to be valid.

New Jersey Certification Regarding Calculation of Amount Due is a form that is required by the state of New Jersey to ensure accurate calculation of the amount due for taxable income. This form is used to certify that the calculations of the amount due have been accurately made according to the state's rules and regulations. There are two types of this form: Form NJ-1080A for individuals and the Form NJ-1080B for business entities. The individual form requires the taxpayer to enter their Social Security Number, filing status, and income information, while the business form requires the taxpayer to enter their Federal Employer Identification Number, entity type, and income information. Both forms require the taxpayer to certify that the calculation of the amount due is correct and sign the form for the certification to be valid.