New Jersey 8. Sample of a Refunding Bond & Release Form is a legal document used to secure the payment of debt obligations. This document is typically used when an individual or entity is refinancing a loan or making payments on a debt. It outlines the conditions of the repayment agreement and serves as a guarantee of payment. The form includes the names of parties involved, the amount of the debt, the terms of repayment, and a release of lien or personal guarantee. A Refunding Bond & Release Form is also known as a Surety Bond or Guaranty Bond. New Jersey 8. Sample of a Refunding Bond & Release Form is typically used for a variety of situations, such as refinancing a mortgage, settling a debt, or transferring a loan from one party to another. The form is also used when a borrower defaults on a loan and the lender needs protection. There are two types of New Jersey 8. Sample of a Refunding Bond & Release Form: a single-party form and a joint-party form. The single-party form is used when one party is the sole obliged of the debt, while the joint-party form is used when two or more parties are jointly liable for repayment of the debt. Each form requires the signatures of all parties involved and must be notarized before it is valid. It is important to read and understand the terms of the form before signing in order to ensure that all parties understand the terms of the repayment agreement.

New Jersey 8. Sample of a Refunding Bond & Release Form

Description Sample Form Contract

How to fill out New Jersey 8. Sample Of A Refunding Bond & Release Form?

How much time and resources do you usually spend on drafting official paperwork? There’s a greater opportunity to get such forms than hiring legal experts or wasting hours searching the web for a proper template. US Legal Forms is the leading online library that provides professionally drafted and verified state-specific legal documents for any purpose, including the New Jersey 8. Sample of a Refunding Bond & Release Form.

To acquire and complete an appropriate New Jersey 8. Sample of a Refunding Bond & Release Form template, adhere to these easy steps:

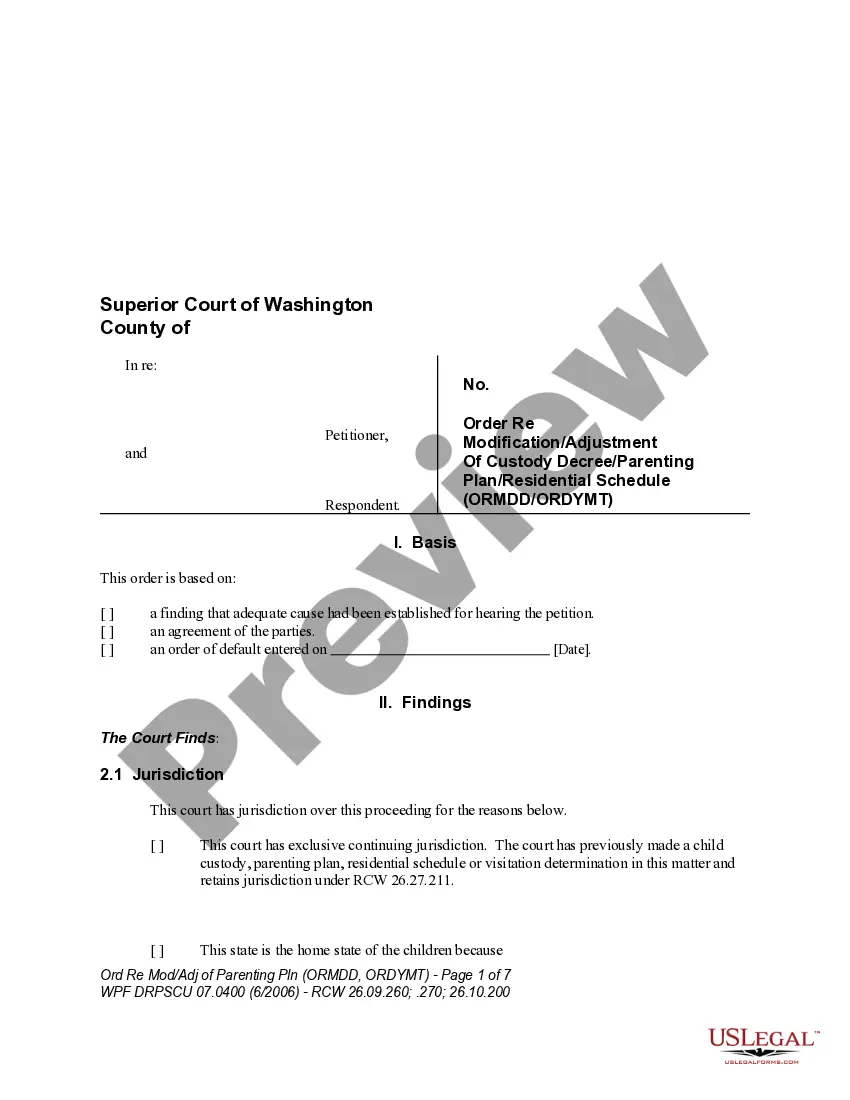

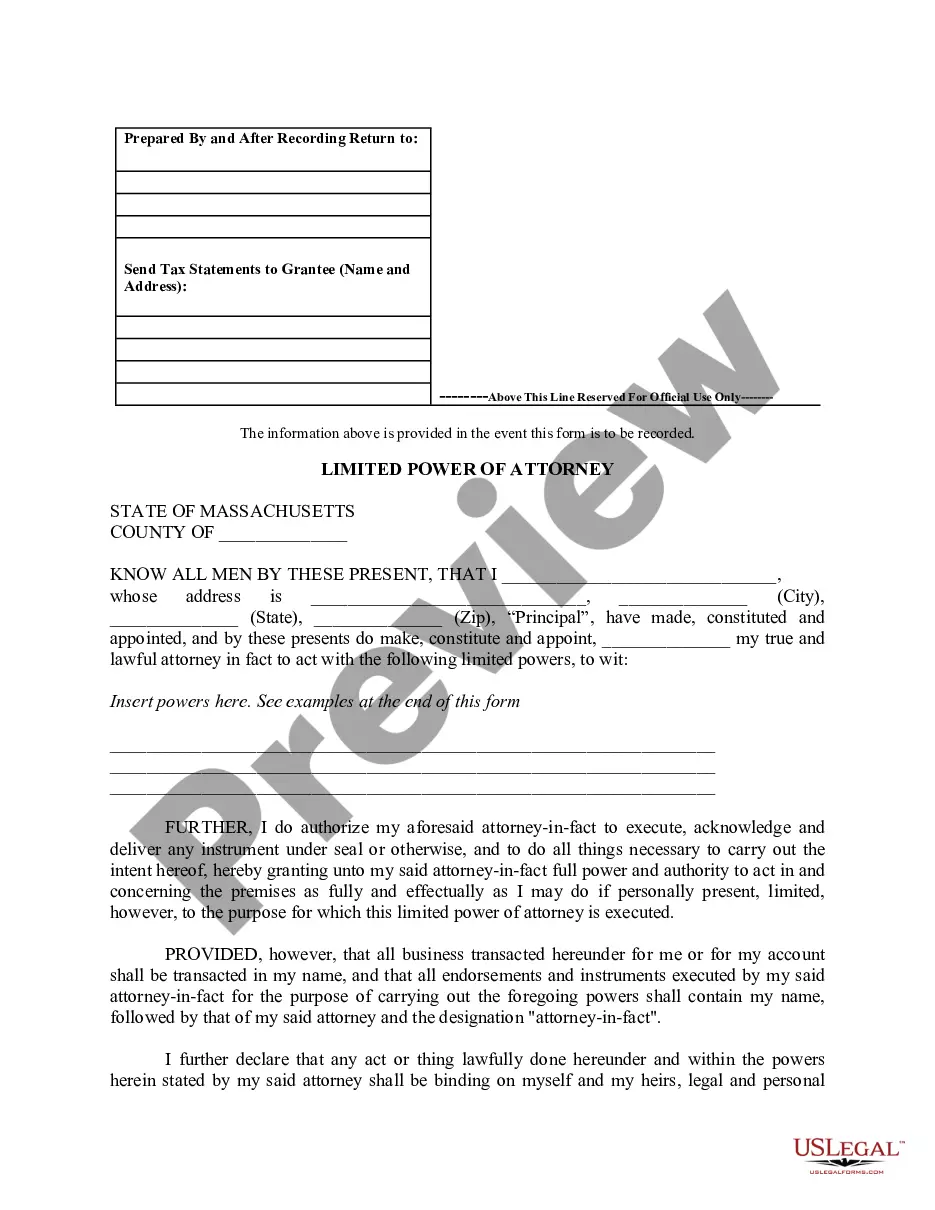

- Look through the form content to ensure it complies with your state regulations. To do so, read the form description or use the Preview option.

- In case your legal template doesn’t satisfy your needs, locate another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the New Jersey 8. Sample of a Refunding Bond & Release Form. If not, proceed to the next steps.

- Click Buy now once you find the right document. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely reliable for that.

- Download your New Jersey 8. Sample of a Refunding Bond & Release Form on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you securely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trusted web services. Sign up for us today!

Sample Release Agreement Form popularity

Refunding Form Other Form Names

FAQ

The bonds which are issued to refund older bonds are called refunding bonds or pre-refunding bonds. The outstanding bonds which are paid off using proceeds from refunding bonds are called refunded bonds.

The decision of bond refunding involves two major questions ? (1) is it economically feasible to call back the outstanding bonds at the current interest and replace them with the new issue; and (2) would the expected value of the firm improve further if the bond refunding is done on a later date.

A forward general obligation bond refunding is when a district sells the bonds with a closing date that is more than 4 weeks from the sale date.

For example, an issuer that refunds a $100 million bond issue with a 10% coupon at maturity and replaces it with a new $100 million issue (refunding bond issue) with a 6% coupon, will have savings of $4 million in interest expense per annum.

Generally unique to municipal securities, a refunding is the process by which an issuer refinances outstanding bonds by issuing new bonds. This may serve either to reduce the issuer's interest costs or to remove a restrictive covenant imposed by the terms of the bonds being refinanced.

The Refunding Bond and Release has a dual purpose: Refunding ? To refund to the Executor or Administrator out of his/her share of the estate his ratable part of any unpaid debts, owed by the testator or intestate, if there are no other assets to pay them.

The decision of bond refunding involves two major questions ? (1) is it economically feasible to call back the outstanding bonds at the current interest and replace them with the new issue; and (2) would the expected value of the firm improve further if the bond refunding is done on a later date.

Bond refunding is the process of reissuing new bonds in place of existing bonds, while bond refinancing is a different concept. Unlike bond refunding, it does not refund the money to the investor. Bond refinancing is the restructuring of bonds instead of the repayment of money to the investors.