The New Jersey Certificate of Withdrawal (For Use By Foreign Profit Corporations) is a legal document used by foreign profit corporations in order to withdraw from New Jersey. This Certificate of Withdrawal is used to terminate the foreign profit corporation’s status and to inform the New Jersey Secretary of State of the corporation’s intent to withdraw from the state. It must be filed with the Secretary of State, along with a copy of the Articles of Dissolution, any applicable fees, and any other required documents. The two types of New Jersey Certificate of Withdrawal (For Use By Foreign Profit Corporations) are Voluntary Withdrawal and Administrative Withdrawal. A Voluntary Withdrawal is filed by the foreign profit corporation to initiate a voluntary withdrawal from New Jersey and is usually done when a corporation is no longer doing business in the state. An Administrative Withdrawal is filed by the Secretary of State when the foreign profit corporation fails to comply with the requirements of the state.

New Jersey Certificate of Withdrawal (For Use By Foreign Profit Corporations)

Description

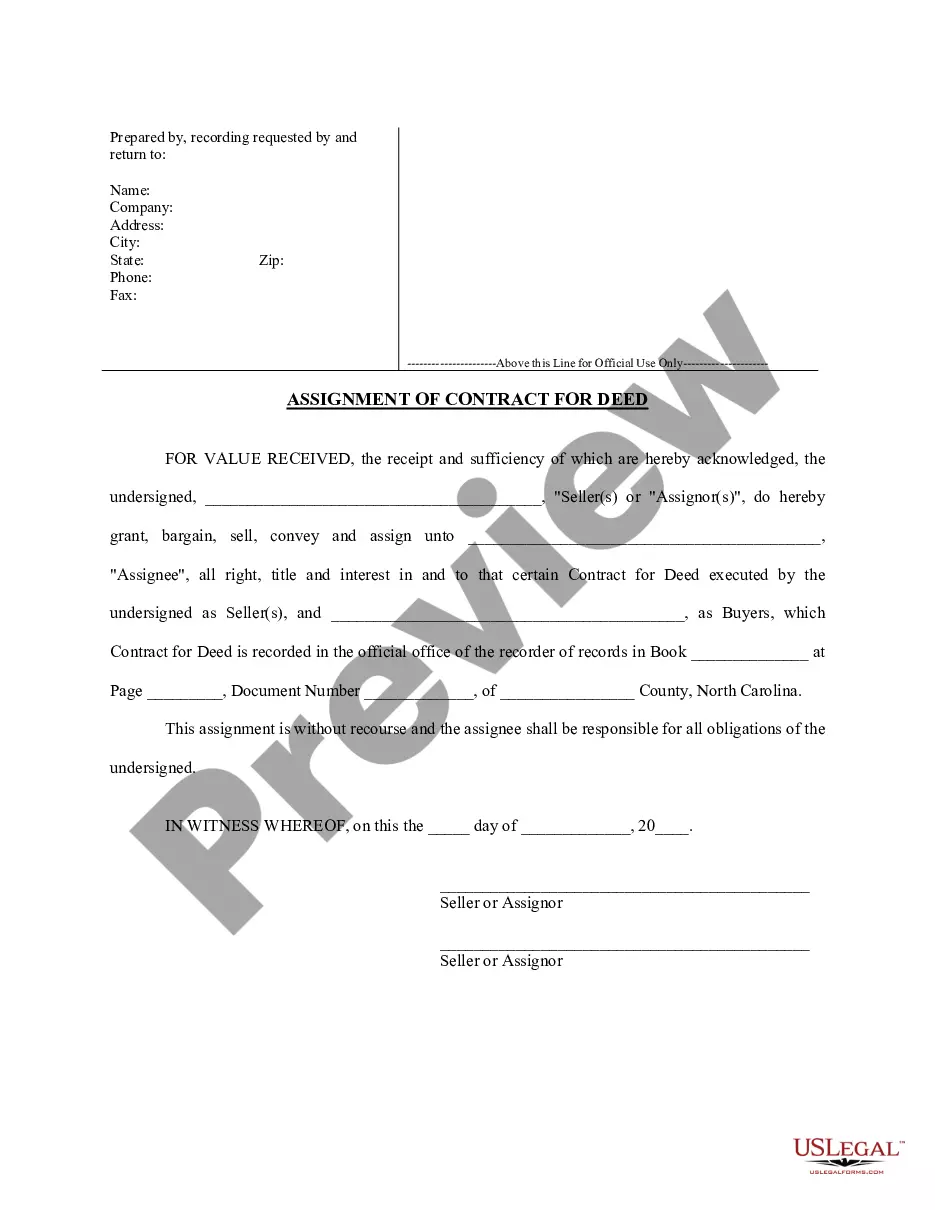

How to fill out New Jersey Certificate Of Withdrawal (For Use By Foreign Profit Corporations)?

Coping with official documentation requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your New Jersey Certificate of Withdrawal (For Use By Foreign Profit Corporations) template from our service, you can be sure it complies with federal and state laws.

Dealing with our service is straightforward and quick. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to find your New Jersey Certificate of Withdrawal (For Use By Foreign Profit Corporations) within minutes:

- Make sure to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the New Jersey Certificate of Withdrawal (For Use By Foreign Profit Corporations) in the format you need. If it’s your first time with our service, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the New Jersey Certificate of Withdrawal (For Use By Foreign Profit Corporations) you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

Failure to dissolve the corporation when the corporation has ceased doing business will result in the legal requirement to continue to file Corporation Business Tax returns with the necessary remittance of the minimum CBT tax.

New Jersey does allow you to submit your partnership dissolution request online. You'll also need to select the correct forms and submit them along with your request. These forms can be found at the NJ Department of the Treasury website.

Corporations ending business in New Jersey can dissolve, cancel, or withdraw online. Go to njportal.com/dor/annualreports and select ?Close a Business.? Businesses that choose to complete a paper application must submit all of the following: Appropriate dissolution/withdrawal/cancellation form.

Corporations ending business in New Jersey can dissolve, cancel, or withdraw online. Go to njportal.com/dor/annualreports and select ?Close a Business.? Businesses that choose to complete a paper application must submit all of the following: Appropriate dissolution/withdrawal/cancellation form.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

What is a Plan Of Dissolution? A plan of dissolution is a written description of how an entity intends to dissolve, or officially and formally close the business. A plan of dissolution will include a description of how any remaining assets and liabilities will be distributed.

Yes. You will need clearance from the Division of Taxation to dissolve a New Jersey corporation.

To cancel a foreign LLC, just submit form L-109, Certificate of Cancellation to the New Jersey Division of Revenue. To withdraw a foreign corporation, file form C-124P, Certificate of Withdrawal with the Division of Revenue.