New Jersey C-159S Domestic Profit Corporations are a type of business entity incorporated in the state of New Jersey. This type of corporation is dissolved when the board of directors takes action with the approval of the shareholders. This can be done either with a meeting of the shareholders or with written consent from the shareholders. There are two types of New Jersey C-159S Domestic Profit Corporations: close corporations and regular corporations. Close corporations are those in which the majority of the shareholders are also the directors of the corporation, while regular corporations are those in which the shareholders are not also the directors. Both types of New Jersey C-159S Domestic Profit Corporations must have their dissolution approved by the board and shareholders in order to be dissolved.

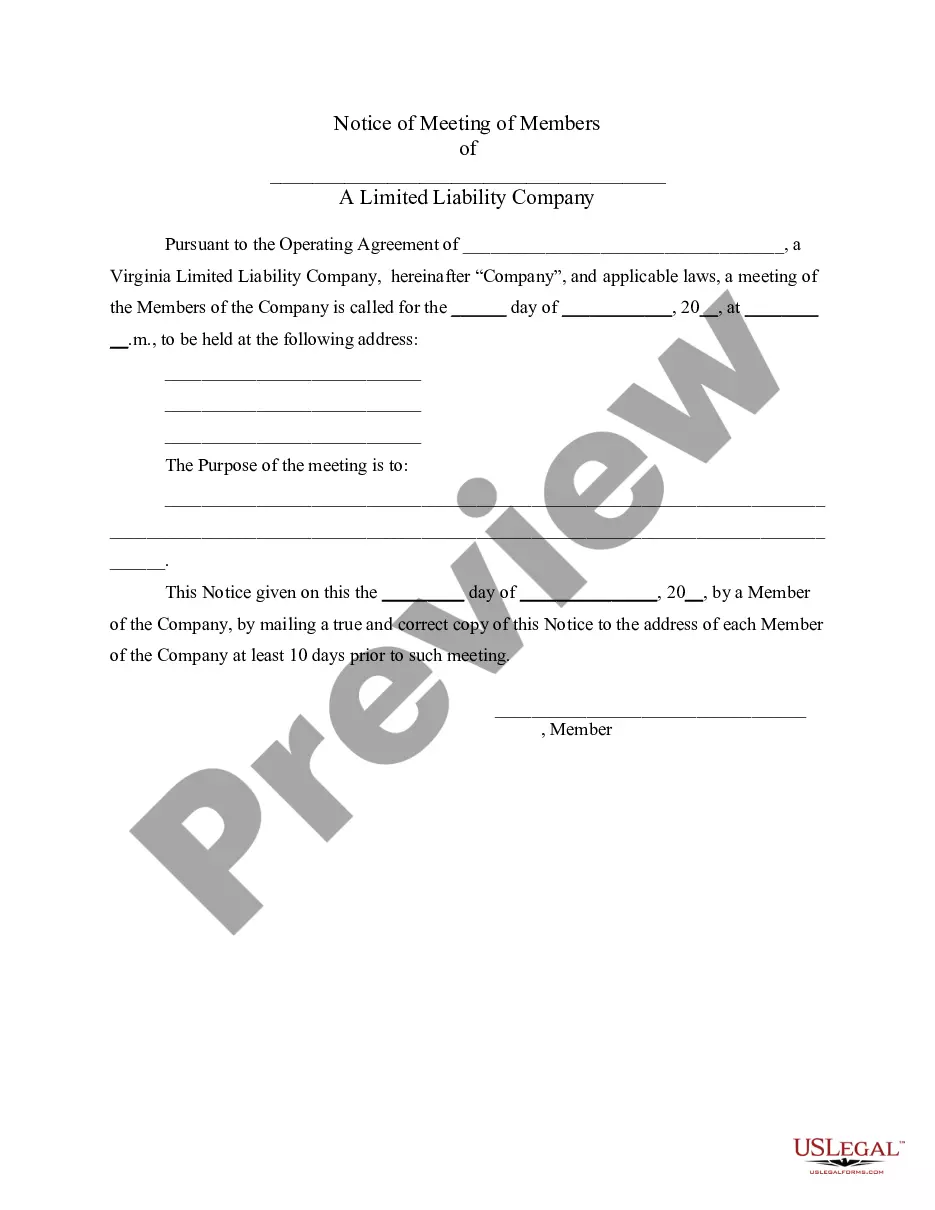

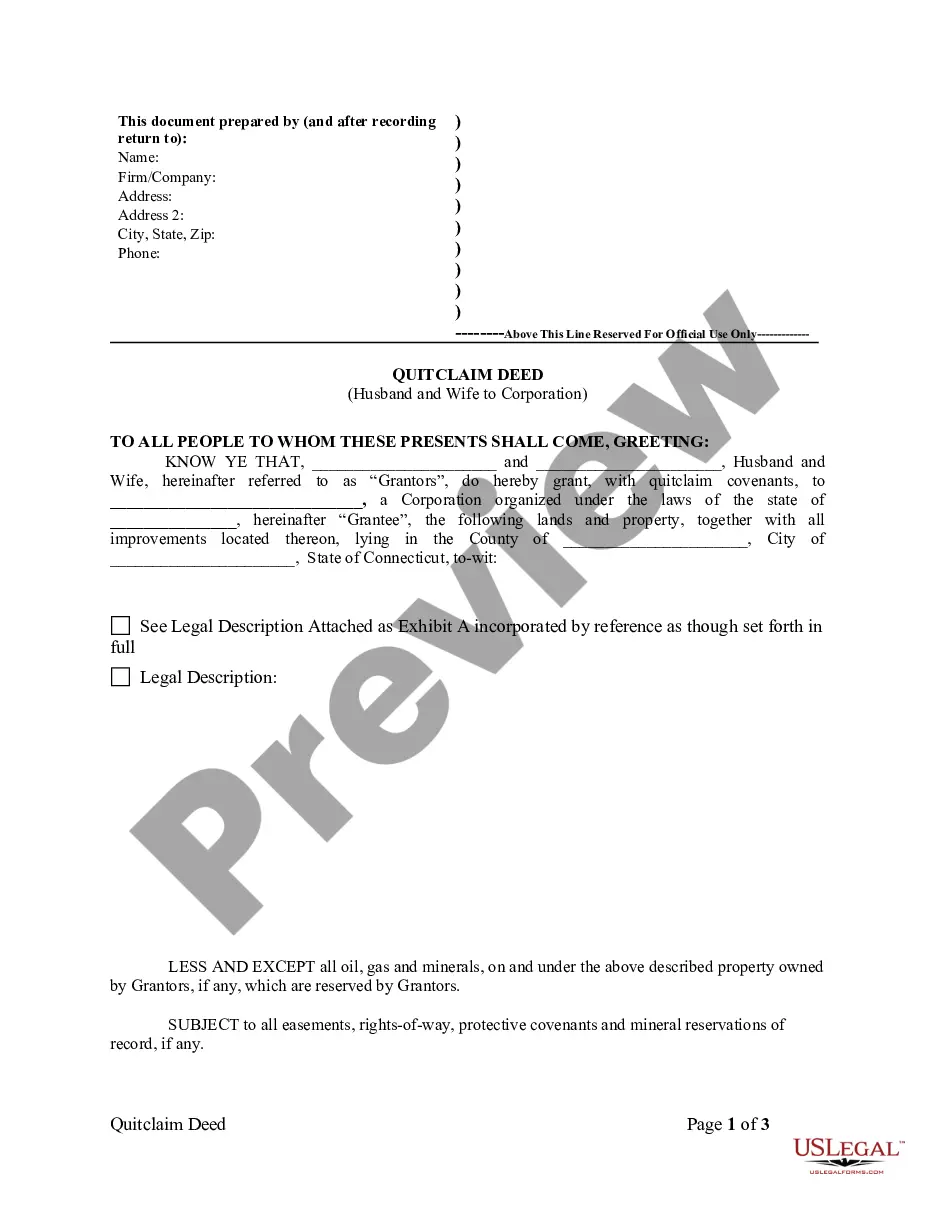

New Jersey C-159S Domestic profit corporations. Dissolution pursuant to action of the board and with a meeting of the shareholders.

Description C 159s

How to fill out New Jersey C-159S Domestic Profit Corporations. Dissolution Pursuant To Action Of The Board And With A Meeting Of The Shareholders.?

US Legal Forms is the most easy and affordable way to locate suitable legal templates. It’s the most extensive online library of business and personal legal paperwork drafted and verified by attorneys. Here, you can find printable and fillable blanks that comply with national and local laws - just like your New Jersey C-159S Domestic profit corporations. Dissolution pursuant to action of the board and with a meeting of the shareholders..

Getting your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted New Jersey C-159S Domestic profit corporations. Dissolution pursuant to action of the board and with a meeting of the shareholders. if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make certain you’ve found the one corresponding to your requirements, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you prefer most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your New Jersey C-159S Domestic profit corporations. Dissolution pursuant to action of the board and with a meeting of the shareholders. and save it on your device with the appropriate button.

Once you save a template, you can reaccess it anytime - just find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more efficiently.

Benefit from US Legal Forms, your reputable assistant in obtaining the corresponding formal paperwork. Give it a try!

Form popularity

FAQ

Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence. What it does is change the purpose of its existence. Instead of conducting whatever business it conducted before, a dissolved LLC exists solely for the purpose of winding up and liquidating.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

Yes. You will need clearance from the Division of Taxation to dissolve a New Jersey corporation.

Corporations ending business in New Jersey can dissolve, cancel, or withdraw online. Go to njportal.com/dor/annualreports and select ?Close a Business.? Businesses that choose to complete a paper application must submit all of the following: Appropriate dissolution/withdrawal/cancellation form.

The Process of Dissolving a NJ LLC Dissolution is a process in which the LLC begins its legal termination. It is the death of the LLC. It takes place when one or more of its members cease their association with the LLC or an event takes place which so affects the company it is forced to legally dissolve.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

A certificate of dissolution NJ may be sought by a company looking to dissolve itself. A certificate of dissolution NJ may be sought by a company looking to dissolve itself. When you dissolve your company in the state of New Jersey, you are ending your existence as a business entity registered in the state.