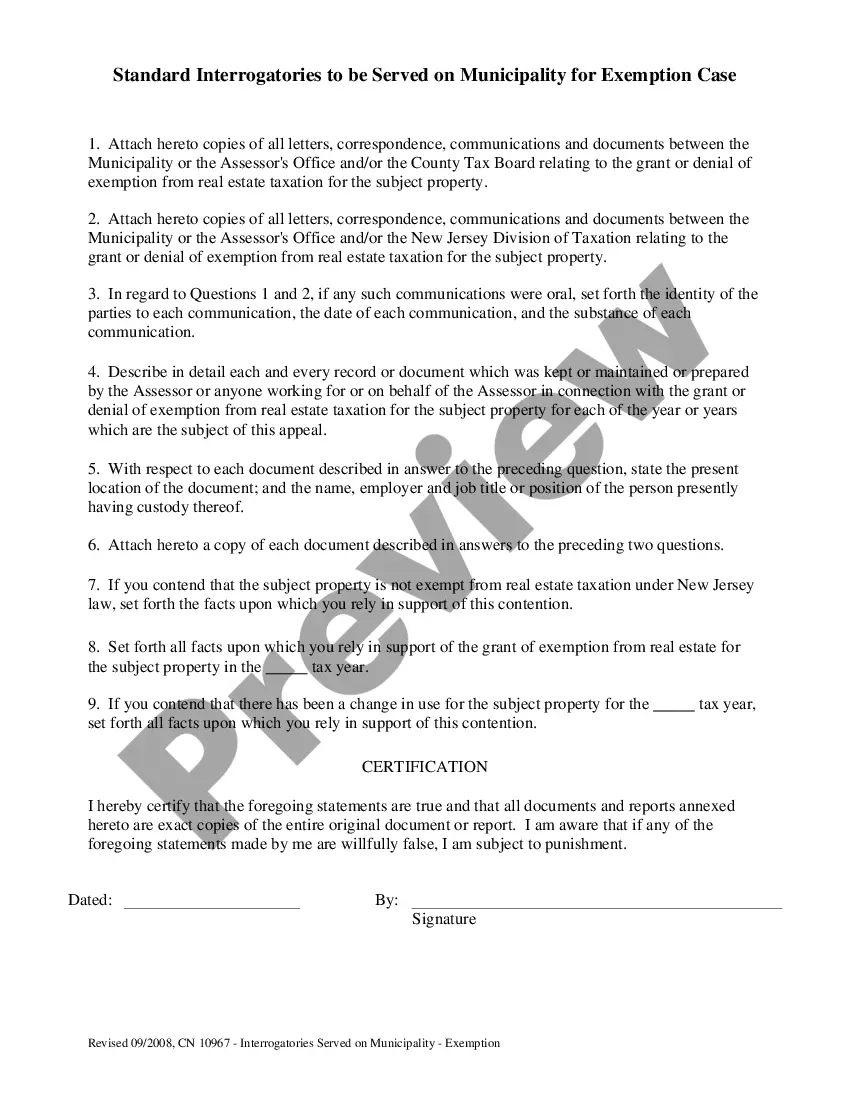

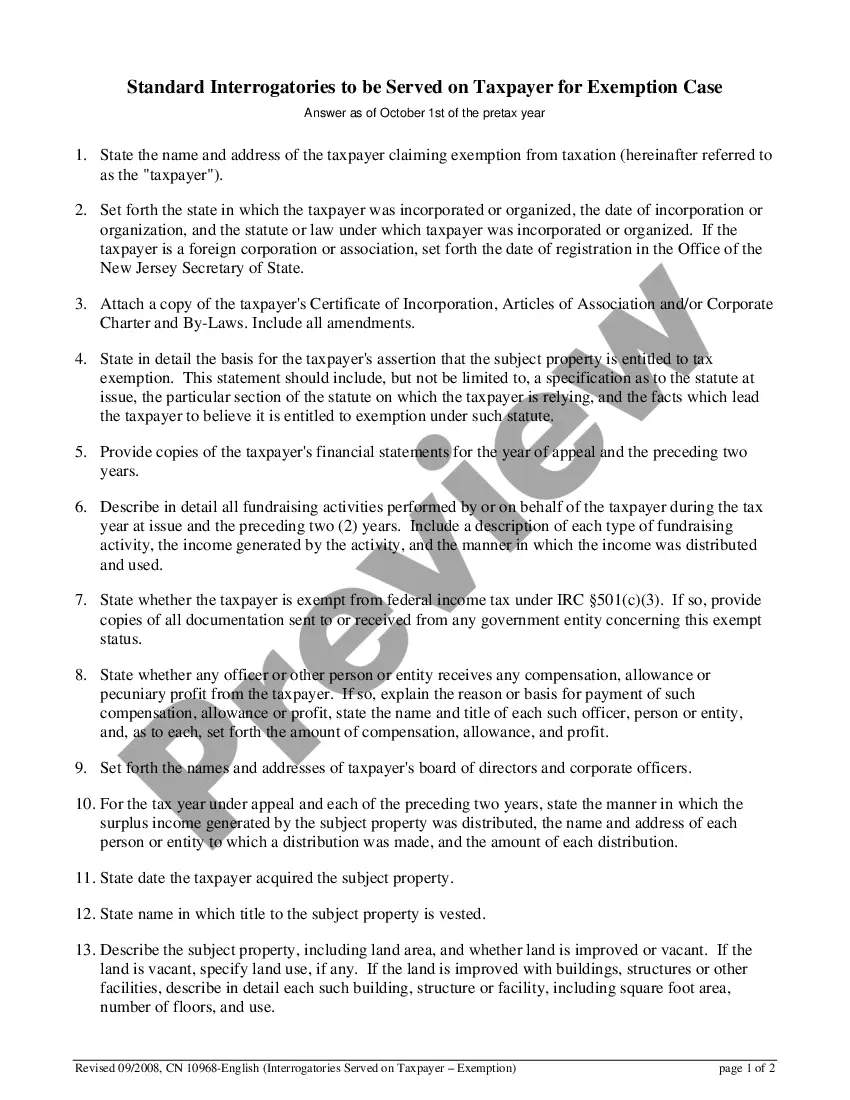

New Jersey Standard Interrogatories to be Served on Taxpayer for Exemption Case are a set of written questions, drafted by the state of New Jersey, that must be answered by the taxpayer in order to determine whether they qualify for an exemption from taxation. The questions are designed to determine the taxpayer's current financial situation and assets, as well as their future plans and intentions. The types of New Jersey Standard Interrogatories to be Served on Taxpayer for Exemption Case include: 1. Qualification Questions: These questions are designed to determine whether the taxpayer meets the state's criteria for exemption from taxation. 2. Financial Questions: These questions are designed to determine the taxpayer's current financial situation, such as their income, assets, debts, and expenses. 3. Intent Questions: These questions are designed to determine the taxpayer's future plans and intentions, such as whether they intend to remain in the state of New Jersey or move elsewhere. 4. Property Questions: These questions are designed to determine the taxpayer's ownership of any property in the state of New Jersey, as well as any property they may have transferred out of the state.

New Jersey Standard Interrogatories to be Served on Taxpayer for Exemption Case

Description

How to fill out New Jersey Standard Interrogatories To Be Served On Taxpayer For Exemption Case?

Coping with legal documentation requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your New Jersey Standard Interrogatories to be Served on Taxpayer for Exemption Case template from our library, you can be sure it complies with federal and state laws.

Working with our service is straightforward and fast. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your New Jersey Standard Interrogatories to be Served on Taxpayer for Exemption Case within minutes:

- Remember to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the New Jersey Standard Interrogatories to be Served on Taxpayer for Exemption Case in the format you prefer. If it’s your first time with our website, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the New Jersey Standard Interrogatories to be Served on Taxpayer for Exemption Case you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

Any party may serve upon any other party written interrogatories relating to any matters which may be inquired into under R. -2. The interrogatories may include a request, at the propounder's expense, for a copy of any paper.

RULE -2 - Time to Serve Interrogatories Interrogatories may, without leave of court, be served upon the plaintiff or answers demanded pursuant to R. -1(b) after commencement of the action and served upon or demanded from any other party with or after service of the summons and complaint upon that party.

-1(b), the number of interrogatories or of sets of interrogatories to be served is not limited except as required to protect the party from annoyance, expense, embarrassment, or oppression.

Except as otherwise provided in this rule, interrogatories shall be answered in writing under oath by the party upon whom served, if an individual, or, if a public or private corporation, a partnership or association, or governmental agency, by an officer or agent who shall furnish all information available to the

The propounder of a question answered by a statement that it is improper may, within 20 days after being served with the answers, serve a notice of motion to compel an answer to the question, and, if granted, the question shall be answered within such time as the court directs.

(c)Each party may serve on each adverse party no more than 15 interrogatories, including subparts, unless another limit is stipulated by the parties or ordered by the court.

-1(b)(2), the party served with interrogatories shall serve answers thereto upon the party propounding them within 60 days after being served with the interrogatories. For good cause shown the court may enlarge or shorten such time upon motion on notice made within the 60-day period.