This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

New Jersey Application for Certificate of Discharge of IRS Lien

Description

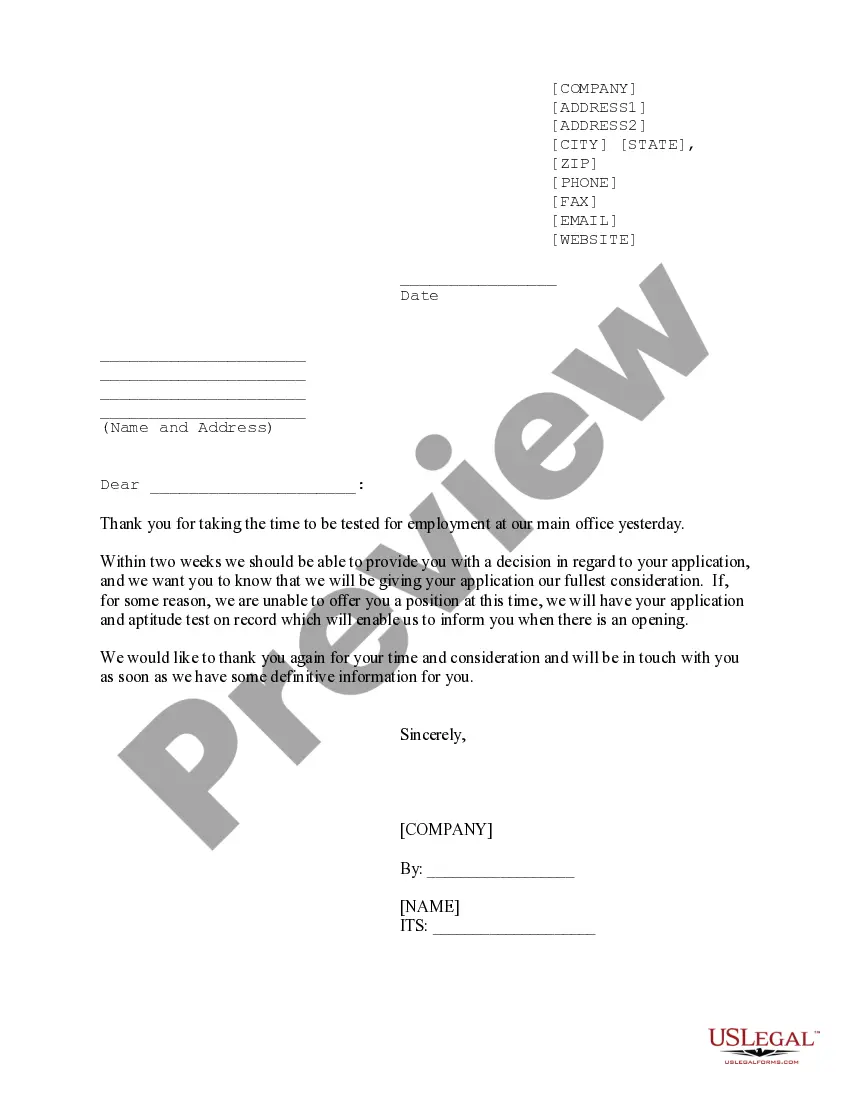

How to fill out Application For Certificate Of Discharge Of IRS Lien?

Are you currently within a place the place you need to have papers for possibly organization or individual purposes just about every day? There are plenty of legitimate document templates accessible on the Internet, but discovering versions you can rely is not effortless. US Legal Forms gives thousands of develop templates, like the New Jersey Application for Certificate of Discharge of IRS Lien, which are published to meet state and federal specifications.

In case you are previously acquainted with US Legal Forms web site and possess your account, just log in. Next, you can acquire the New Jersey Application for Certificate of Discharge of IRS Lien format.

If you do not come with an accounts and would like to start using US Legal Forms, follow these steps:

- Get the develop you will need and ensure it is for your proper town/area.

- Take advantage of the Review button to analyze the form.

- Look at the information to ensure that you have selected the right develop.

- In case the develop is not what you are trying to find, utilize the Look for field to find the develop that suits you and specifications.

- When you obtain the proper develop, just click Purchase now.

- Opt for the rates program you would like, fill in the desired information and facts to generate your money, and purchase the transaction using your PayPal or Visa or Mastercard.

- Decide on a practical paper formatting and acquire your version.

Discover each of the document templates you might have purchased in the My Forms food selection. You can get a extra version of New Jersey Application for Certificate of Discharge of IRS Lien at any time, if required. Just go through the required develop to acquire or print the document format.

Use US Legal Forms, probably the most considerable variety of legitimate kinds, in order to save time as well as stay away from errors. The services gives expertly made legitimate document templates which can be used for a variety of purposes. Generate your account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

When you pay off your full tax balance or when the IRS runs out of time to collect the balance, the IRS will automatically release your tax lien. This removes the lien from your property. If the lien isn't automatically released, you can write to the IRS to request the release certificate.

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

Discharge means the IRS removes the lien from property so that it may transfer to the new owner free of the lien. Use Form 14135. Subordination means the IRS gives another creditor the right to be paid before the tax lien is paid.

Releasing a Lien The IRS will release the lien once you pay the debt ? either in a lump sum or over time. However, if the IRS releases a lien, it may remain on your credit report for many years. A lien withdrawal, discussed below, however, removes the lien from your credit report.

The IRS generally uses Form 668?W(ICS) or 668-W(C)DO to levy an individual's wages, salary (including fees, bonuses, commissions, and similar items) or other income. Form 668-W(ICS) and/or 668-W(C)(DO) also provides notice of levy on a taxpayer's benefit or retirement income.

To request IRS consider discharge, complete Form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien. See Publication 783, Instructions on how to apply for a Certificate of Discharge from Federal Tax Lien, for more information on how to request discharge.

A discharge is when you ask the IRS to remove a federal tax lien from a specific piece of property. To apply, you should file Form 14135 and explain why you want the tax lien discharged.