The New Jersey Affidavit of Lost Promissory Note is a legal document used to declare the loss or destruction of a promissory note and to request a court's permission to proceed with the underlying loan or debt. This affidavit serves as evidence that the original promissory note was lost and is necessary for the lender or creditor to legally enforce the debt. The affidavit typically includes the name and contact information of the affine, who is the party declaring the loss of the promissory note. It also includes details about the original promissory note, such as the issuance date, the principal amount owed, and the parties involved, such as the lender and the borrower. In addition to the general information about the promissory note, the affine needs to provide a detailed explanation of how the original promissory note was lost or destroyed. This can include circumstances such as fire, theft, natural disaster, or simply misplacing it. It is important to describe the efforts made to locate the missing note, such as contacting the parties involved or conducting extensive searches. The affine is required to affirm that they have no knowledge of any transfers, assignments, pledges, or encumbrances of the promissory note in question. This ensures that the loss or destruction of the note does not result in any fraudulent claims or multiple claims on the same debt. It is worth mentioning that there are no specific variations or types of New Jersey Affidavit of Lost Promissory Note. However, the affidavit may vary depending on the specific court or jurisdiction where it is filed. Certain courts may have specific requirements or additional forms that need to be filed along with the affidavit. To conclude, the New Jersey Affidavit of Lost Promissory Note is an essential legal document used to overcome the loss or destruction of a promissory note. By providing a detailed account of the original note, the circumstances of its loss, and ensuring the absence of any fraudulent claims, the affidavit helps creditors and lenders continue their legal pursuit of repayment.

New Jersey Affidavit of Lost Promissory Note

Description

How to fill out New Jersey Affidavit Of Lost Promissory Note?

Are you in a situation that you need to have paperwork for possibly organization or specific reasons just about every time? There are plenty of legal record themes available online, but discovering types you can rely on isn`t easy. US Legal Forms gives thousands of develop themes, just like the New Jersey Affidavit of Lost Promissory Note, which can be written to meet state and federal needs.

When you are presently informed about US Legal Forms web site and also have an account, basically log in. After that, you may download the New Jersey Affidavit of Lost Promissory Note format.

If you do not offer an profile and want to begin using US Legal Forms, abide by these steps:

- Find the develop you want and make sure it is for your appropriate area/county.

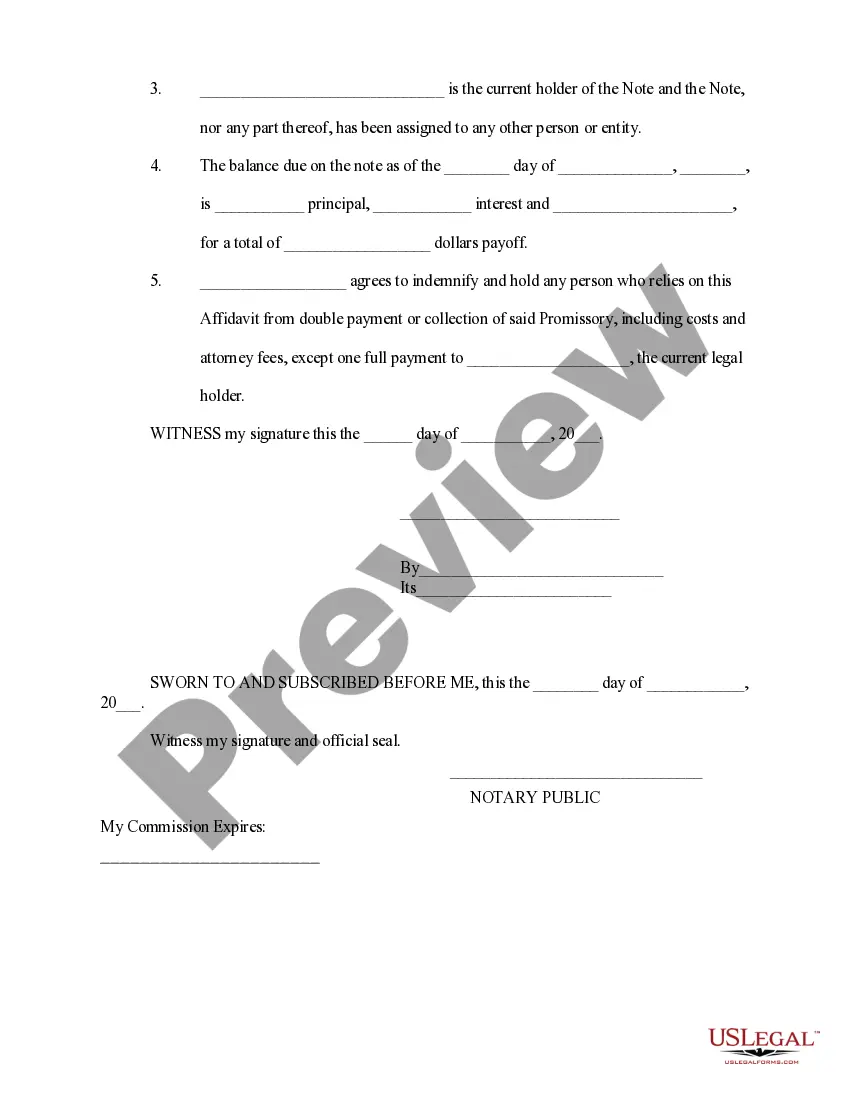

- Utilize the Preview option to analyze the form.

- Read the information to actually have chosen the appropriate develop.

- In case the develop isn`t what you are seeking, utilize the Search discipline to find the develop that meets your needs and needs.

- If you find the appropriate develop, simply click Purchase now.

- Choose the rates strategy you desire, fill in the required information to generate your account, and purchase the order making use of your PayPal or bank card.

- Decide on a handy paper file format and download your duplicate.

Get each of the record themes you possess purchased in the My Forms food selection. You can aquire a more duplicate of New Jersey Affidavit of Lost Promissory Note whenever, if needed. Just go through the needed develop to download or print the record format.

Use US Legal Forms, by far the most considerable variety of legal forms, in order to save time and stay away from faults. The support gives expertly made legal record themes which can be used for a selection of reasons. Produce an account on US Legal Forms and begin generating your life easier.