New Jersey Direct Deposit Form for Chase

Description

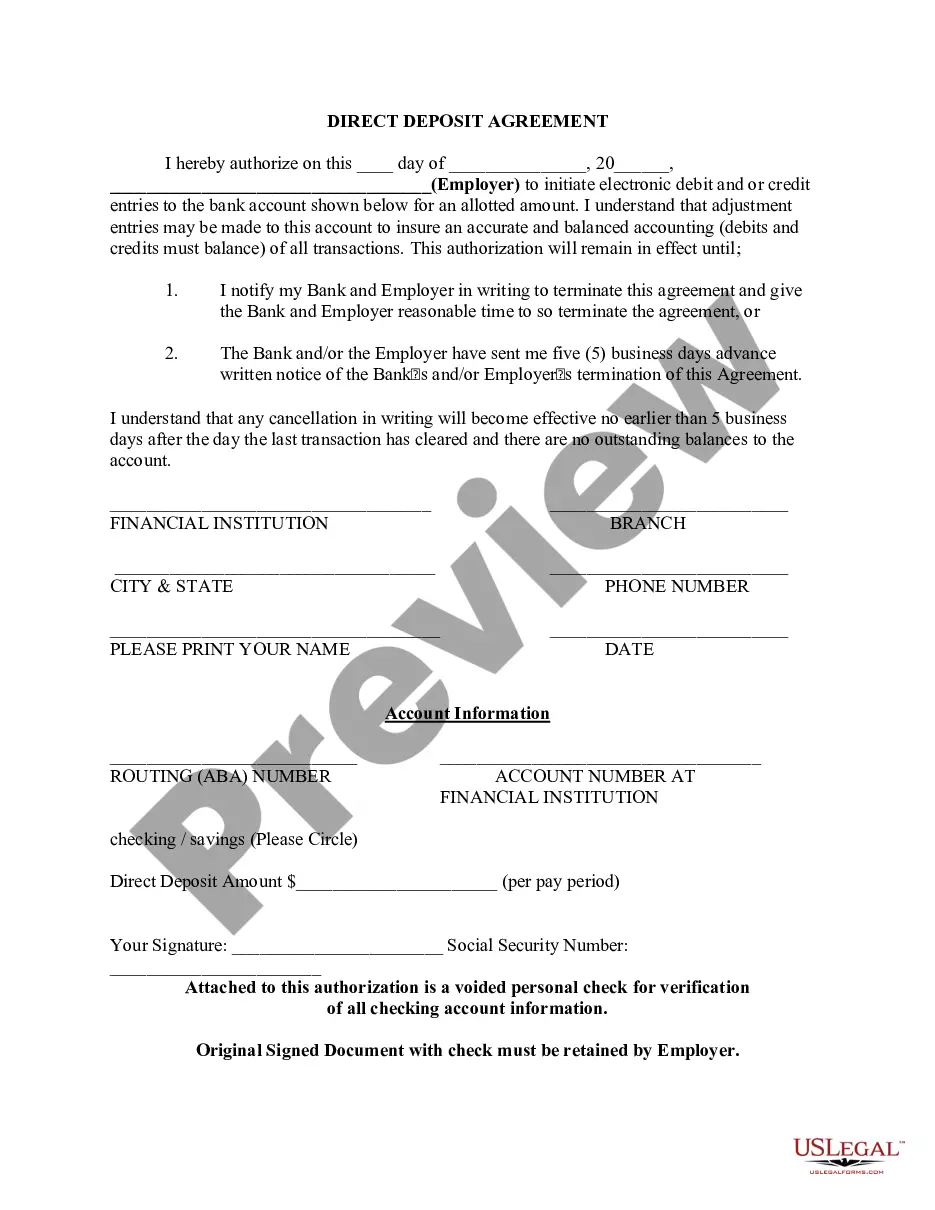

How to fill out Direct Deposit Form For Chase?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form formats that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, categorized by types, states, or keywords. You can find the latest forms such as the New Jersey Direct Deposit Form for Chase within moments.

If you hold a monthly subscription, Log In and download the New Jersey Direct Deposit Form for Chase from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms through the My documents tab in your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Edit. Complete, modify, print, and sign the downloaded New Jersey Direct Deposit Form for Chase. Each template added to your account has no expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the New Jersey Direct Deposit Form for Chase with US Legal Forms, one of the most extensive collections of legal document formats. Utilize thousands of professional and state-specific formats that meet your business or personal requirements.

- Ensure you have chosen the correct form for your city/state.

- Use the Preview button to examine the contents of the form.

- Read the form details to confirm you have selected the correct document.

- If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Getting a bank verification letter from Chase is a straightforward process. You can request it through the Chase website, by visiting a branch, or by calling customer service. The New Jersey Direct Deposit Form for Chase may require this letter if you are setting up direct deposits, so it's useful to have it ready. Always ensure your account details are accurate to expedite your request.

To obtain the New Jersey Direct Deposit Form for Chase, you can visit the official Chase website or your local branch. The form is typically available for download online, making it convenient for you to complete it at home. If you prefer assistance, bank representatives can help you fill it out during your visit. Be sure to have your account information on hand to ensure a smooth process.

You can submit your direct deposit form either online or in person. For online submissions, ensure you follow the instructions provided on Chase’s website. If you are using the New Jersey Direct Deposit Form for Chase, make sure it is filled out correctly to expedite the approval process.

For Chase, you should put 'Chase Bank' as the bank name on any related forms. This is essential for ensuring proper processing of your deposits. This is also applicable when you fill out the New Jersey Direct Deposit Form for Chase.

The bank name for your Chase direct deposit is 'Chase Bank'. This name is crucial for ensuring that your direct deposits are routed correctly to your account. Always ensure this is correctly stated on the New Jersey Direct Deposit Form for Chase to avoid delays.

To obtain a direct deposit authorization form from Chase, you can visit their website or contact customer support. They provide a downloadable version that you can easily fill out online. Utilizing the New Jersey Direct Deposit Form for Chase will simplify this process significantly.

The branch name for your Chase direct deposit depends on the location of your account. You can typically find this information in your bank statements or by contacting Chase customer service. Including the correct branch name on your New Jersey Direct Deposit Form for Chase can facilitate smoother transactions.

When filling out a direct deposit form, you should enter 'Chase Bank' as your bank name. This ensures that your funds are correctly directed to your Chase account. Make sure to double-check your account details on the New Jersey Direct Deposit Form for Chase to avoid any issues.

Yes, you can easily print a Chase deposit slip online. Simply log in to your Chase account, navigate to the deposit section, and select the option to print a deposit slip. This feature enhances your convenience and allows you to manage your deposits effortlessly, especially when filling out your New Jersey Direct Deposit Form for Chase.

On the New Jersey Direct Deposit Form for Chase, you should include your name, address, and social security number. Additionally, you need to provide your Chase account number and the bank's routing number. Including these details accurately allows for prompt and secure deposits to your account, giving you peace of mind regarding your finances.