US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal document templates that you can download or print.

While using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of documents such as the New Jersey Direct Deposit Agreement in moments.

If you have a membership, Log In to obtain the New Jersey Direct Deposit Agreement from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded documents from the My documents section of your account.

Process the payment. Use a Visa, Mastercard, or PayPal account to complete the transaction.

Retrieve the format and download the document to your device. Edit. Complete, modify, print, and sign the downloaded New Jersey Direct Deposit Agreement. Each template included in your account has no expiration date and is yours forever. So, if you want to download or print another copy, just visit the My documents section and click on the document you need. Access the New Jersey Direct Deposit Agreement with US Legal Forms, the largest repository of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/state.

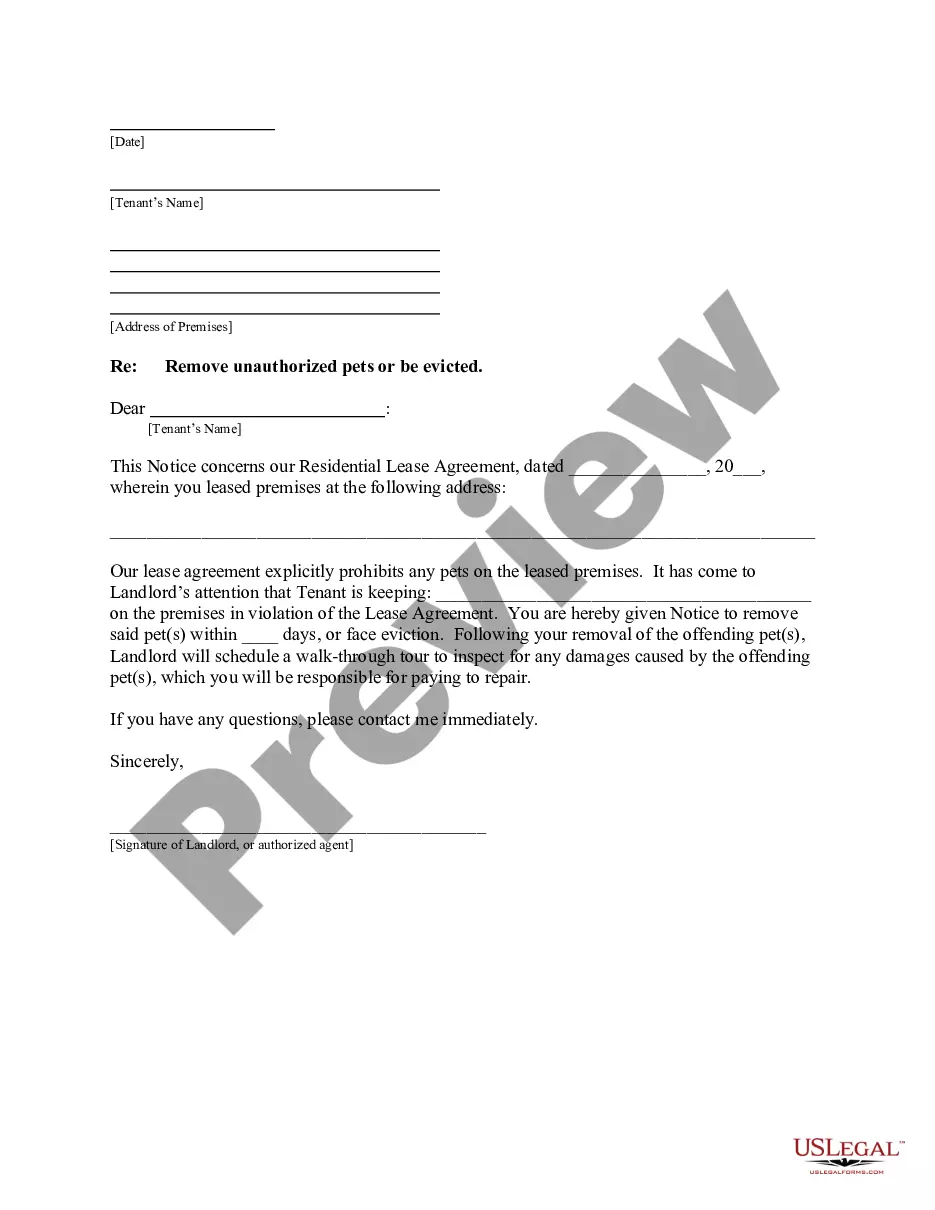

- Review the Preview option to inspect the document’s content.

- Check the description of the form to confirm you've selected the right one.

- If the form doesn’t meet your requirements, use the Search bar at the top of the page to locate the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the payment method you prefer and provide your information to register for the account.

NJ DDS PPP ? Direct Deposit SetupWhat is the purpose of this form? If an employee would like their payments made via Direct Deposit, they may fill out.2 pages

NJ DDS PPP ? Direct Deposit SetupWhat is the purpose of this form? If an employee would like their payments made via Direct Deposit, they may fill out. Checking and savings account numbers are normally noted at the bottom of checks and deposit slips as well as the nine digit bank transit routing number. In ...To have your paycheck deposited directly into your checking or savings account, download, print and complete the direct deposit authorization form and give ... Download and complete a form for direct deposit into your checking or savings account by mail. Get Ready to Enroll. Direct Deposit. To enroll for direct ... Forms: Debit & ATM Application · Household Consent Form · Membership Application · Extended Coverage Consent Form · Payroll Deduction Form · Stop Payment ... You'll need you bank name, account number, and routing number to set up direct deposit to your checking or savings account. If this is your first time enrolling ... Activity, such as when a direct deposit posts or when your balance drops below anBy calling customer service at the number on your account statement. Here's a new employee benefit that takes the hassle out of payday.To sign up for Full Service Direct Deposit, complete the enrollment form and give it ...2 pages

Here's a new employee benefit that takes the hassle out of payday.To sign up for Full Service Direct Deposit, complete the enrollment form and give it ... Wayne, New Jersey. Standard Operating Procedure. DirectComplete and sign the Direct Deposit form which is part of this SOP and also posted on the.4 pages

Wayne, New Jersey. Standard Operating Procedure. DirectComplete and sign the Direct Deposit form which is part of this SOP and also posted on the. Get your personalized pre-filled direct deposit form · Sign in to chase.com or the Chase Mobile® app · Choose the checking account you want to receive your direct ...

Please don't use it to take out loans for the purchase of any personal property. It is to be used only for payroll, retirement saving, and for any other purpose required by the employer in the employee's own business or business in the employee's own name. The employee should use the real or personal name on the Form 1099 or 1099-MISC in the employee's business or business in the employee's own name. No personal information should be entered. The form MUST be properly signed and include a copy of the employee's W-2 form. The form must be clearly legible and the information entered on it must be accurate. Please refer to the instructions on the form for more details. The Form 1099 or 1099-MISC has to be returned to the employer by either: a. Receiving the form by mail. b. Completion of an electronic FAFSA in the employee's own name that completes the Forms 1099 or 1099-MISC. c. Taking a completed form to the bank for deposit of payroll to the employee.