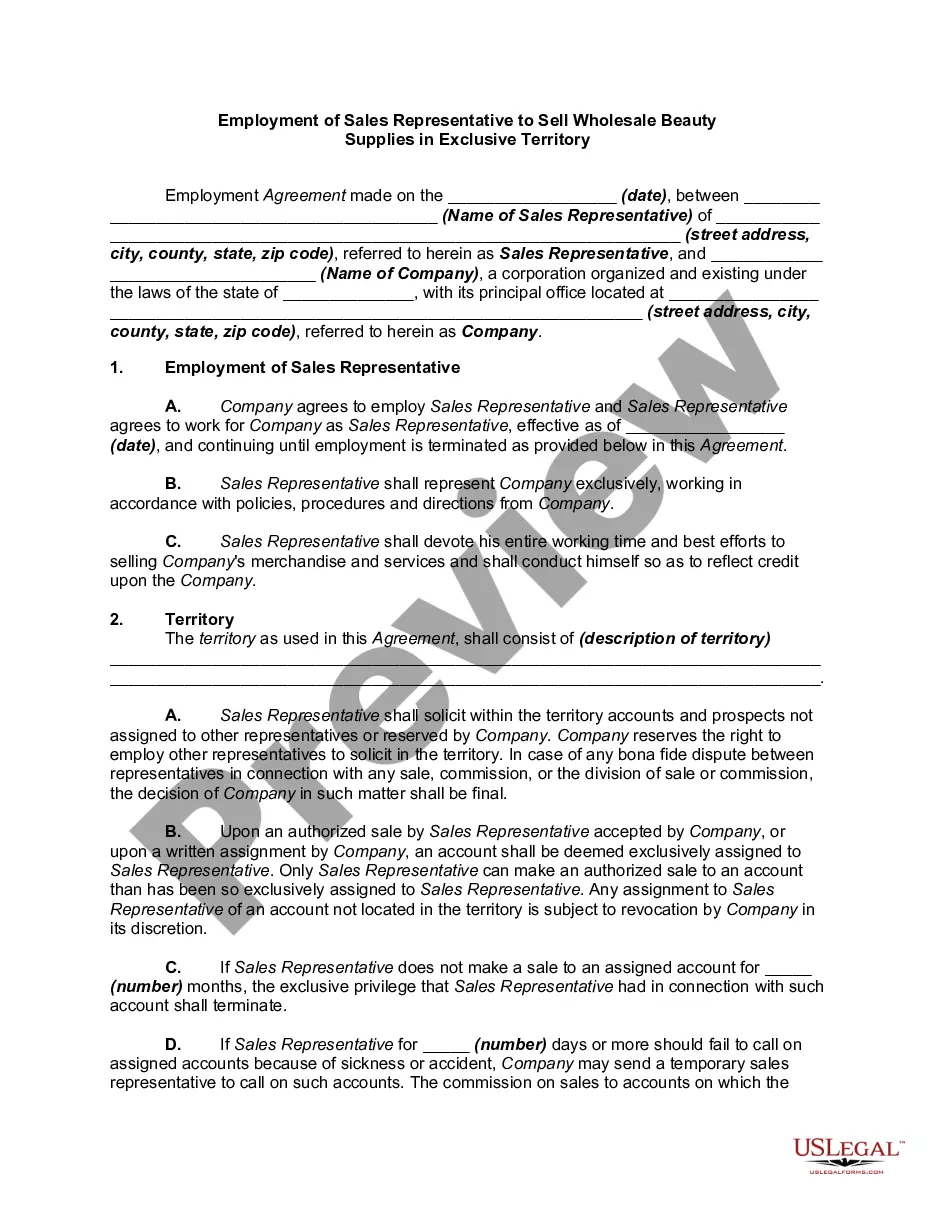

The New Jersey Deferred Compensation Agreement — Long Form is a legally binding document that outlines the terms and conditions for deferred compensation plans in the state of New Jersey. These plans are designed to help public employees save for retirement by deferring a portion of their income until a later date. The agreement contains various sections that cover important aspects of the deferred compensation plan. Keywords that can be associated with this document include: compensation, agreement, deferred, retirement, income, public employees, and New Jersey. The agreement typically includes the following sections: 1. Purpose: This section outlines the purpose of the deferred compensation plan, which is to provide additional retirement savings options for public employees in New Jersey. 2. Eligibility: This section specifies the requirements for employees to be eligible to participate in the plan. It may include criteria such as length of employment or job classification. 3. Deferral Options: This section details the various ways in which employees can defer a portion of their income. It may include options such as percentage-based deferrals or fixed dollar amount deferrals. 4. Investment Options: This section provides information on the investment options available for the deferred compensation plan. It may include a range of investment choices such as mutual funds or bond funds. 5. Vesting: This section clarifies the vesting schedule for the deferred compensation plan. Vesting refers to the timeline over which employees become entitled to their deferred compensation funds. It may be based on years of service or other predetermined factors. 6. Distribution Options: This section explains the different methods by which employees can receive their deferred compensation funds upon retirement or separation of service. Options may include lump sum payouts, periodic payments, or annuity options. 7. Plan Administration: This section outlines the administration of the deferred compensation plan, including the roles and responsibilities of the plan administrator(s) and any administrative fees associated with the plan. It is important to note that there may be different variations of the New Jersey Deferred Compensation Agreement — Long Form, tailored to specific categories of public employees or organizations. For example, there might be separate versions for state employees, county employees, or local government employees. These variations would consider the specific needs and regulations applicable to each category.

New Jersey Deferred Compensation Agreement - Long Form

Description

How to fill out New Jersey Deferred Compensation Agreement - Long Form?

Finding the right legal papers template can be a struggle. Needless to say, there are a lot of themes available on the Internet, but how can you discover the legal kind you will need? Make use of the US Legal Forms internet site. The services offers a large number of themes, including the New Jersey Deferred Compensation Agreement - Long Form, that you can use for organization and personal requirements. All the varieties are checked out by experts and fulfill federal and state requirements.

In case you are presently authorized, log in to the accounts and click on the Obtain switch to find the New Jersey Deferred Compensation Agreement - Long Form. Make use of your accounts to check through the legal varieties you may have purchased earlier. Proceed to the My Forms tab of your accounts and have another backup of your papers you will need.

In case you are a fresh user of US Legal Forms, listed below are straightforward directions that you should follow:

- Initial, make sure you have selected the appropriate kind for your metropolis/area. You may check out the form utilizing the Review switch and read the form explanation to ensure it will be the right one for you.

- If the kind will not fulfill your preferences, utilize the Seach discipline to discover the proper kind.

- When you are positive that the form is proper, click the Purchase now switch to find the kind.

- Pick the prices program you desire and type in the necessary information. Create your accounts and purchase an order using your PayPal accounts or Visa or Mastercard.

- Pick the data file file format and acquire the legal papers template to the product.

- Full, modify and print out and sign the acquired New Jersey Deferred Compensation Agreement - Long Form.

US Legal Forms will be the largest local library of legal varieties where you will find various papers themes. Make use of the service to acquire expertly-manufactured documents that follow express requirements.