[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [New Jersey State Tax Commission] [Address] [City, State, ZIP] Subject: [Type of Estate] — Letter Regarding Decedent's Estate Taxation Dear [New Jersey State Tax Commission], I hope this letter finds you well. I am writing to provide the necessary information and documentation regarding the estate of the late [Decedent's Full Legal Name], as required by the New Jersey State Tax laws. [Type of Estate]: If you have different types of New Jersey Sample Letters to the State Tax Commission concerning Decedent's Estate, you could mention them here. For instance, there could be letters concerning various estate types such as: 1. Probate Estate 2. Intestate Estate 3. Small Estate Affidavit 4. Revocable Living Trust Estate 5. Joint Tenancy with Right to Survivorship (TWOS) Estate This letter pertains to the [Type of Estate — Example: Probate Estate]. Enclosed are the requisite documents and information concerning the estate, which I trust will assist you in assessing and determining the appropriate estate tax liabilities. 1. Death Certificate: The attached certified copy of the decedent's death certificate validates their passing and provides necessary vital information. 2. Estate Tax Return (Form Inheritance and Estate Tax Resident Return): Enclosed, please find the completed and signed New Jersey Estate Tax Return form. This contains detailed information about the estate's assets, liabilities, beneficiaries, and other essential details necessary for the estate tax assessment. 3. Letter Testamentary/Letter of Administration: The accompanying document identifies the appointed executor/administrator of the estate, authorized to handle the estate's affairs and correspond with the State Tax Commission. 4. Notice of Appraisal (If applicable): If the estate's assets have been appraised, including real estate, businesses, or other significant properties, you will find a copy of the relevant appraisals enclosed. 5. Schedule of Assets: The attached document showcases an itemized list of assets held by the decedent, their valuation, and other relevant details for comprehensive tax assessment. 6. Beneficiary Designations: The enclosed document outlines the named beneficiaries of the estate, along with their respective entitlements and relationship to the decedent. 7. Other Supporting Documents: [Include any other relevant supporting documents like receipts, bank statements, trust instruments, prior gift tax returns, etc., based on the decedent's estate type and specific requirements.] It is my fervent hope that these documents provide you with a clear understanding of the decedent's estate, facilitating a proper and just assessment of any estate tax obligations. Should you require any additional information or documentation, please do not hesitate to contact me at the above-mentioned contact details. I kindly request that you keep me updated regarding any further steps or requirements necessary from my end concerning the estate's tax matters. I am committed to ensuring full compliance with the New Jersey State Tax laws and regulations. Thank you for your attention to this matter and your prompt assistance in processing the estate's tax affairs. Your cooperation and guidance are greatly appreciated. Sincerely, [Your Name]

New Jersey Sample Letter to State Tax Commission concerning Decedent's Estate

Description

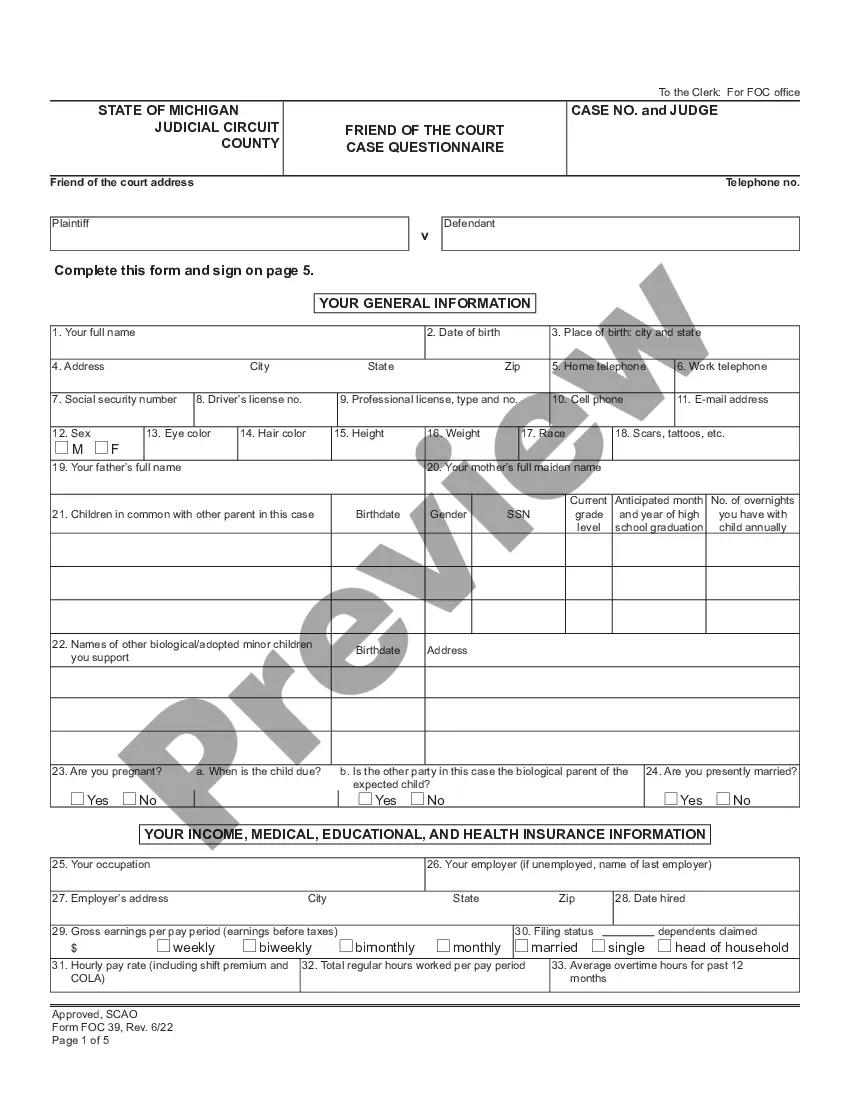

How to fill out Sample Letter To State Tax Commission Concerning Decedent's Estate?

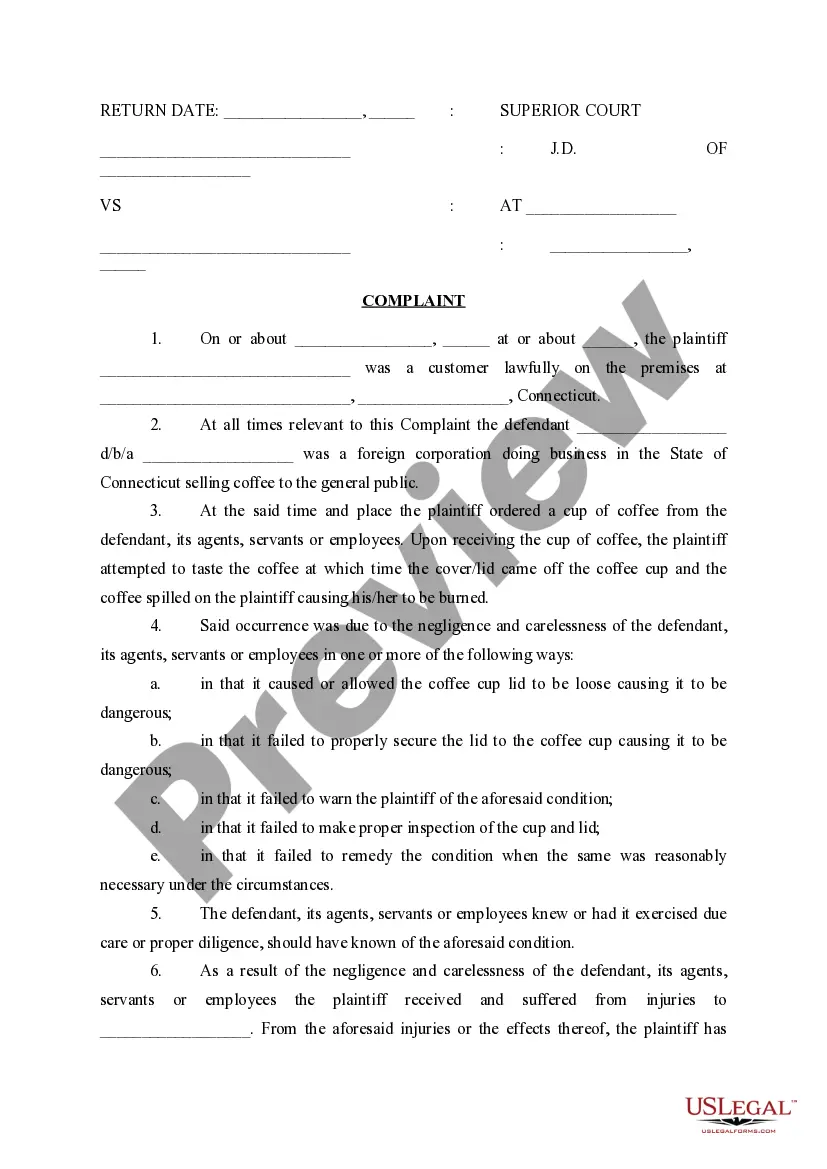

If you have to complete, download, or print legitimate record templates, use US Legal Forms, the greatest variety of legitimate forms, that can be found on-line. Take advantage of the site`s easy and hassle-free search to get the files you want. Various templates for organization and individual reasons are sorted by groups and claims, or key phrases. Use US Legal Forms to get the New Jersey Sample Letter to State Tax Commission concerning Decedent's Estate in a handful of click throughs.

In case you are already a US Legal Forms customer, log in to the profile and click on the Download switch to have the New Jersey Sample Letter to State Tax Commission concerning Decedent's Estate. Also you can accessibility forms you previously acquired in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for that appropriate town/region.

- Step 2. Utilize the Review solution to look through the form`s articles. Never overlook to see the information.

- Step 3. In case you are unhappy with the form, take advantage of the Lookup field near the top of the screen to find other models of the legitimate form web template.

- Step 4. Upon having identified the shape you want, click on the Acquire now switch. Pick the rates prepare you favor and add your credentials to register for an profile.

- Step 5. Procedure the purchase. You can use your credit card or PayPal profile to finish the purchase.

- Step 6. Choose the structure of the legitimate form and download it in your system.

- Step 7. Comprehensive, modify and print or sign the New Jersey Sample Letter to State Tax Commission concerning Decedent's Estate.

Every single legitimate record web template you buy is yours forever. You possess acces to every single form you acquired in your acccount. Click on the My Forms segment and decide on a form to print or download yet again.

Compete and download, and print the New Jersey Sample Letter to State Tax Commission concerning Decedent's Estate with US Legal Forms. There are millions of expert and express-particular forms you can utilize for your personal organization or individual requires.

Form popularity

FAQ

NJ Taxation The due date for filing is the same as for federal purposes. Use the same filing status that was used on the final federal income tax return, unless the decedent was a partner in a civil union. Joint Return. Write the name and address of the decedent and the surviving spouse in the name and address fields.

Inheritance Tax Rates Beneficiary or TransfereeTax Rate for Each Beneficiary or TransfereeClass ANo tax is dueClass CFirst $25,000 Next $1,075,000 Next $300,000 Next $300,000 Over $1,700,000No tax is due 11% 13% 14% 16%Class DFirst $700,000 Over $700,00015% 16%

In New Jersey, creditors have nine months after death to stake a claim against an estate. If the claim is not made within those nine months, the courts may dismiss the claim and leave the creditor empty-handed. This is why notice of death from the executor to the creditors is so important.

The personal representative of an estate is an executor, administrator, or anyone else in charge of the decedent's property. The personal representative is responsible for filing any final individual income tax return(s) and the estate tax return of the decedent when due.

If a person dies with assets but no will or trust, an administrator for his/her estate must be appointed by a court. If a person owns assets or property jointly with another person or in trust, then probate and estate administration is not necessary because ownership automatically goes to the surviving owner.

An estate can be closed in one of four fashions: (1) the mere release of funds by the Executor or Administrator to estate beneficiaries; (2) the release of estate distributions to estate beneficiaries after the execution of a Release and Refunding Bond upon which there is a waiver of any form of accounting; (3) ...

An estate can be closed in one of four fashions: (1) the funds can simply be distributed directly by the Executor or Administrator to estate beneficiaries; (2) the funds can be distributed to heir(s) after each signs a Release and Refunding Bond waiving his or her right to a formal accounting; (3) distribution can be ...

Regular New Jersey Probate: One Year or Less Closing an estate can take just a little over nine months if there's no litigation, no problems determining beneficiaries, and no creditor issues.