New Jersey Sample Letter regarding Completion of Corporate Annual Report

Description

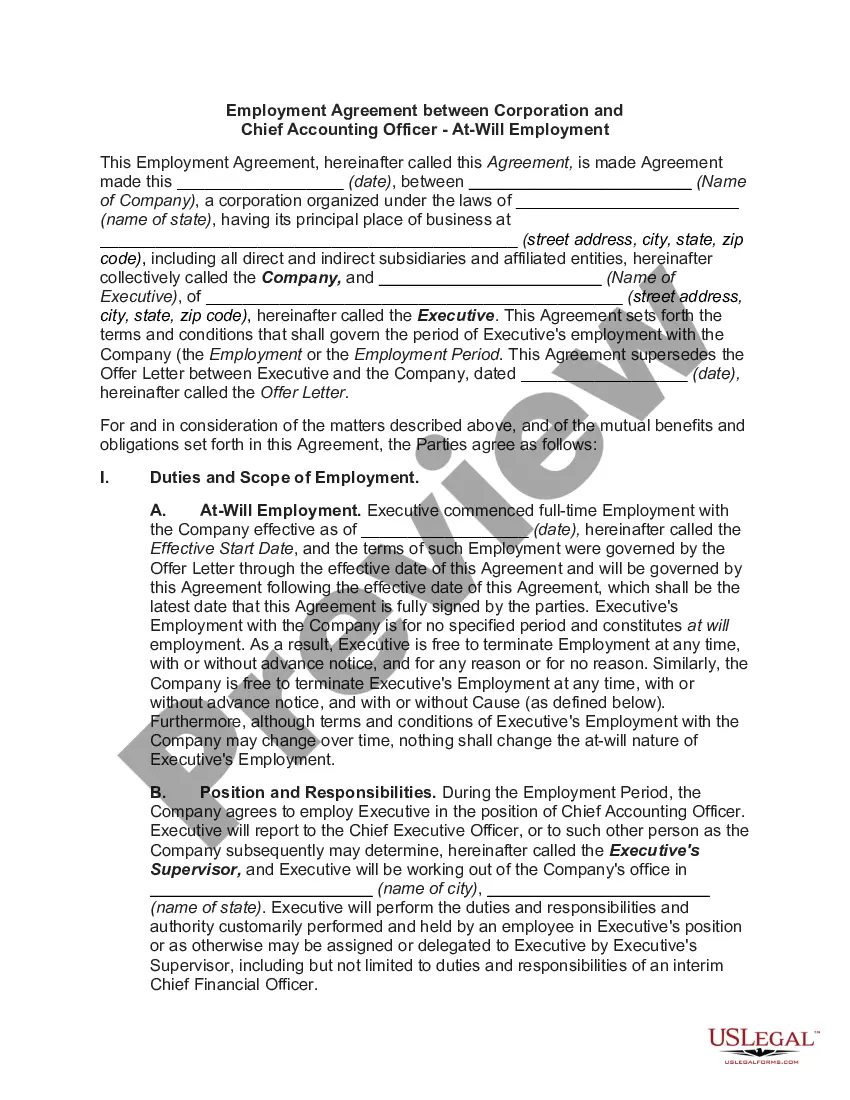

How to fill out Sample Letter Regarding Completion Of Corporate Annual Report?

You can dedicate time online trying to locate the legal template that satisfies the state and federal requirements you need.

US Legal Forms provides a vast array of legal documents that have been reviewed by experts.

You can easily download or print the New Jersey Sample Letter concerning the Completion of Corporate Annual Report from our service.

If available, use the Review button to examine the template as well. If you wish to find another version of your form, utilize the Search field to locate the template that meets your needs and requirements. Once you have identified the template you desire, click Acquire now to proceed. Select the pricing plan you prefer, enter your credentials, and register for your account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to pay for the legal document. Choose the format of your file and download it to your device. Make adjustments to your file if necessary. You can fill out, modify, sign, and print the New Jersey Sample Letter concerning Completion of Corporate Annual Report. Download and print numerous document templates using the US Legal Forms site, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can fill out, modify, print, or sign the New Jersey Sample Letter concerning the Completion of Corporate Annual Report.

- Every legal template you purchase is yours permanently.

- To obtain another copy of any purchased document, visit the My documents tab and click on the corresponding button.

- If you are utilizing the US Legal Forms site for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct template for the area/town of your choice.

- Review the document details to confirm you have chosen the correct form.

Form popularity

FAQ

When you need to update your New Jersey LLC's Certificate of Formation, you'll have to file an amendment with the New Jersey Department of the Treasury's Division of Revenue and Enterprise Services. There are multiple ways to amend your Certificate of Formation by mail or online, but every method requires a $100 fee.

You can file an amendment or change the information when your LLC files its annual report. Corporations in New Jersey also list the names, contact information, and addresses of their officers and directors on the Articles of Incorporation. The record of the state should be updated.

To close your business in New Jersey and avoid potential fines and fees there are several steps you need to take: File the closure of your business. ... File your future annual reports until your business is formally closed. ... Cancel tax registration. ... File final tax returns.

Every business in NJ must file an annual report.

You would file Restated Certificate form to restate or restate and amend the certificate of incorporation. For profit corporations would file form C-100A Restated Certificate of Incorporation. There are two pages required to restate the certificate. Make sure you submit both pages to the Division of Revenue.

Late Fees: New Jersey will administratively dissolve or revoke your business if no report is filed for two consecutive years. There are no penalty fees. Don't remember when you registered your business? You can easily find your anniversary month by searching the New Jersey Business Database.

Every business in NJ must file an annual report. This includes simply ensuring that your registered agent and address are up to date, and submitting a $75 filing fee.

Late Fees: New Jersey will administratively dissolve or revoke your business if no report is filed for two consecutive years. There are no penalty fees. Don't remember when you registered your business? You can easily find your anniversary month by searching the New Jersey Business Database.