New Jersey Obtain Credit Card for an Officer - Corporate Resolutions Forms

Description

How to fill out Obtain Credit Card For An Officer - Corporate Resolutions Forms?

It is feasible to dedicate time online searching for the legal document template that aligns with the federal and state requirements you need.

US Legal Forms provides a vast array of legal forms that can be reviewed by experts.

You can download or print the New Jersey Obtain Credit Card for an Officer - Corporate Resolutions Forms from the service.

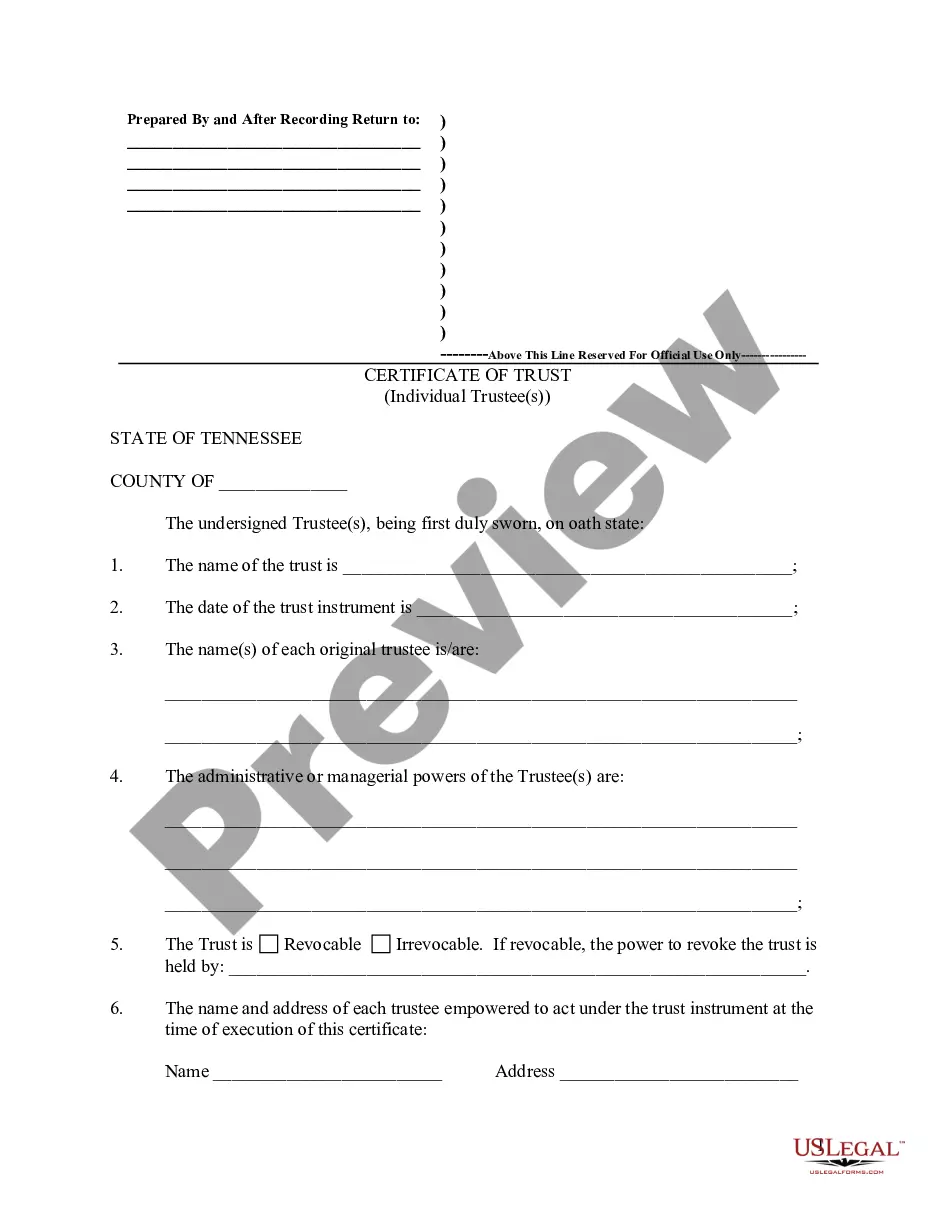

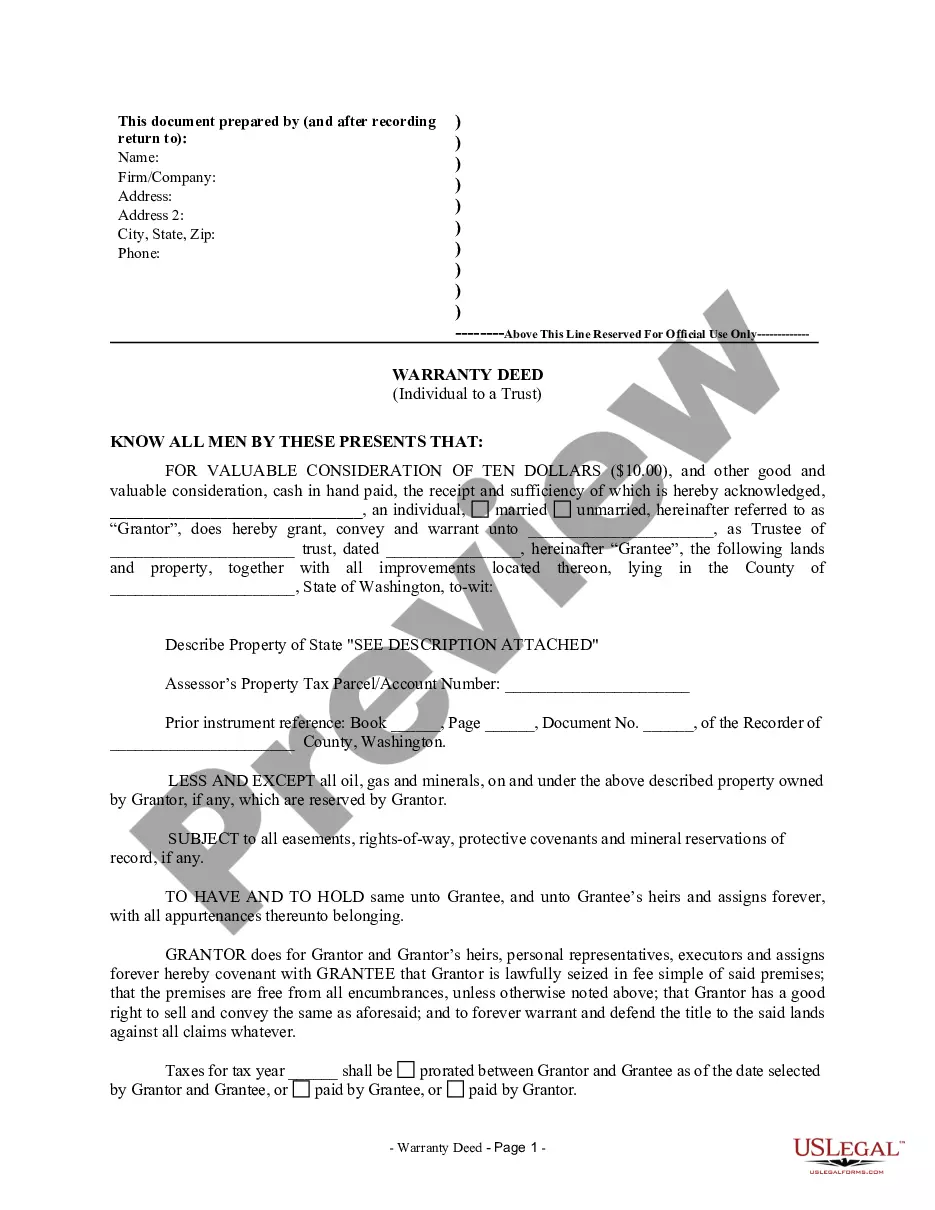

If available, use the Review button to look through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Afterward, you can fill out, modify, print, or sign the New Jersey Obtain Credit Card for an Officer - Corporate Resolutions Forms.

- Every legal document template you acquire is yours to keep indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the easy steps below.

- First, ensure that you have chosen the correct document template for your desired county/city.

- Review the document description to confirm you have selected the appropriate form.

Form popularity

FAQ

Neglecting to file an annual report can result in serious repercussions, including fines and the loss of good standing for your business. This may hinder your ability to secure loans or enter contracts. To prevent these issues, ensure timely filing, and consider USLegalForms for guidance and access to essential corporate resolutions forms to keep your business compliant.

Failing to file an annual report in New Jersey can lead to penalties and possibly the dissolution of your business. The state might impose fines and restrict your ability to conduct business. To avoid these consequences, it's important to stay on top of your filing requirements, and USLegalForms can assist you in maintaining compliance with necessary reports.

Your NJ business corporation number is a unique identifier assigned to your business by the state. You can find this number on your business registration documents or by searching on the New Jersey Division of Revenue website. If you face challenges, USLegalForms can help you locate your business details with ease.

To obtain a copy of your NJ annual report, visit the New Jersey Division of Revenue and Enterprise Services website. There, you can access your business profile and download the report directly. If you prefer assistance, USLegalForms offers resources that can guide you through this process effectively, helping you with necessary forms.

For S corporations in New Jersey, estimated tax payments are required during the year. These installment payments depend on projected income and should align with state guidelines. Making timely installment payments can help avoid penalties and interest. As you navigate this process, the New Jersey Obtain Credit Card for an Officer - Corporate Resolutions Forms can be a valuable resource.

Residents of New Jersey, as well as non-residents with income sourced from New Jersey, must file a state income tax return. This includes all individuals who earn income over a certain threshold. Filing accurately is important to avoid issues with the tax administration. For enhancing your understanding, look into the New Jersey Obtain Credit Card for an Officer - Corporate Resolutions Forms.

NJ CBT 100S is required for corporations that elect to be treated as S corporations for tax purposes. This form ensures that income and deductions are properly reported. Corporations must meet specific eligibility requirements to file this form. For help ensuring compliance, utilize the New Jersey Obtain Credit Card for an Officer - Corporate Resolutions Forms for guidance.

Form 100S must be filed by S corporations operating in New Jersey. This form is essential for reporting income, deductions, gains, and losses. S corporations need to be mindful of the filing deadlines to remain compliant with state laws. For an efficient process, consider using New Jersey Obtain Credit Card for an Officer - Corporate Resolutions Forms.

To amend your NJ CBT 100, you should first complete a new CBT-100 form with the corrected information. Then, submit this amended form along with any additional documentation required. Be sure to note the amendments clearly to avoid confusion. You can rely on the New Jersey Obtain Credit Card for an Officer - Corporate Resolutions Forms for the necessary amendments.

Any corporation doing business in New Jersey must file a corporate business tax (CBT). This includes both in-state and out-of-state corporations earning income from New Jersey sources. It’s crucial to comply with state regulations to avoid penalties. For assistance, explore the New Jersey Obtain Credit Card for an Officer - Corporate Resolutions Forms for clarity on your filing obligations.