A New Jersey Consulting Agreement — Assist Company Obtain Loan is a legal contract entered into between a consulting firm and a company based in New Jersey. The purpose of this agreement is to outline the terms and conditions under which the consulting firm will provide services to help the company secure a loan. The agreement typically starts with an introductory section that identifies the parties involved, namely the consulting firm and the company seeking the loan. It will also provide the effective date of the agreement and specify the scope of the consulting services to be provided. The key aspect of this agreement is the assistance provided by the consulting firm in securing a loan for the company. The agreement will outline in detail the responsibilities and obligations of the consulting firm, including conducting a thorough financial analysis of the company to determine its eligibility for a loan. The consultants will gather relevant financial documents, analyze the financial health of the company, and recommend necessary improvements or adjustments required to increase the chances of obtaining the loan. The agreement will also specify the consulting firm's role in preparing the loan application materials, including the creation of a comprehensive business plan, financial statements, cash flow projections, and any other necessary documentation. This ensures that the loan application is professional, well-prepared, and meets the requirements of potential lenders. Furthermore, the agreement may address the consulting firm's responsibilities in identifying suitable lenders or financial institutions for the company to approach for the loan. The consultants may provide guidance on the best loan options available, such as traditional bank loans, Small Business Administration (SBA) loans, or alternative financing options. They may also assist in negotiating the loan terms and conditions, including interest rates, repayment schedules, and collateral requirements. Additionally, the agreement may highlight the confidentiality obligations of the consulting firm, ensuring that all sensitive financial information obtained from the company during the consulting engagement remains protected and is not disclosed to unauthorized parties. Different types of New Jersey Consulting Agreements — Assist Company Obtain Loan may exist based on the specific services offered by the consulting firm. These could include: 1. Comprehensive Loan Consulting: This type of agreement encompasses a wide range of services, from the initial financial analysis to loan application preparation and lender selection. 2. specialized Loan Consulting: In some cases, consulting firms may specialize in certain industries or specific types of loans (e.g., real estate loans, equipment financing). The agreement may outline any industry-specific expertise that the consulting firm possesses. 3. Short-term Loan Consulting: In situations where the company requires immediate financing, a short-term loan consulting agreement may be used. This type of agreement focuses on expediting the process of securing short-term financing to meet urgent financial needs. Overall, a New Jersey Consulting Agreement — Assist Company Obtain Loan serves as a legally binding document that establishes the roles, responsibilities, and obligations of the consulting firm in assisting a company based in New Jersey to secure a loan. By leveraging the expertise of professional consultants, companies can increase their chances of obtaining the necessary financing for their business operations, expansion, or other financial needs.

New Jersey Consulting Agreement - Assist Company Obtain Loan

Description

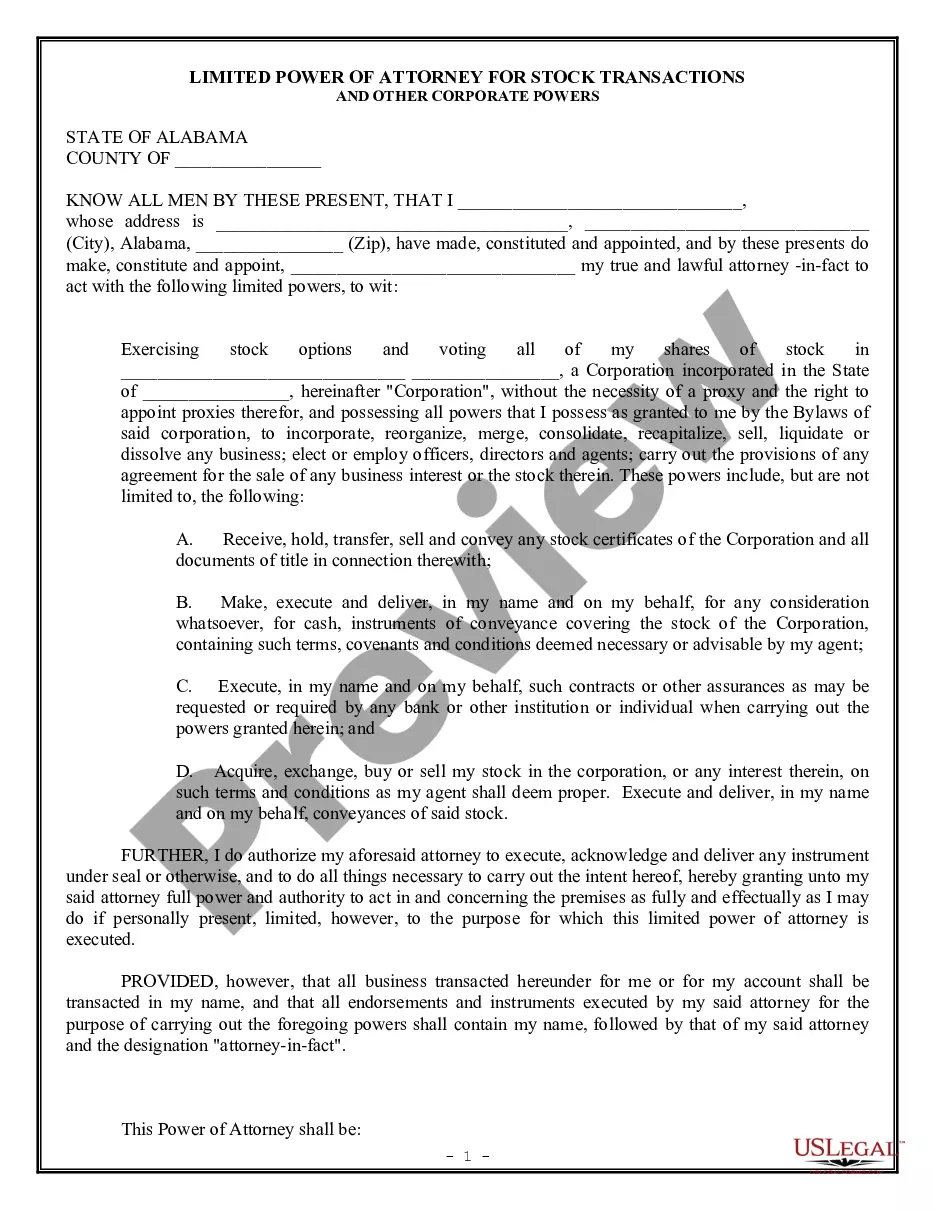

How to fill out New Jersey Consulting Agreement - Assist Company Obtain Loan?

Discovering the right authorized file web template can be a have a problem. Obviously, there are plenty of layouts accessible on the Internet, but how do you get the authorized form you require? Make use of the US Legal Forms web site. The assistance offers a huge number of layouts, like the New Jersey Consulting Agreement - Assist Company Obtain Loan, which can be used for business and private needs. Every one of the types are checked by pros and fulfill federal and state requirements.

In case you are presently listed, log in in your accounts and then click the Down load switch to get the New Jersey Consulting Agreement - Assist Company Obtain Loan. Utilize your accounts to search from the authorized types you have acquired in the past. Proceed to the My Forms tab of your own accounts and have yet another backup from the file you require.

In case you are a new end user of US Legal Forms, here are straightforward directions for you to comply with:

- First, make sure you have chosen the correct form for the town/county. You may examine the shape making use of the Review switch and look at the shape explanation to ensure this is the best for you.

- When the form does not fulfill your expectations, use the Seach area to discover the correct form.

- When you are certain that the shape is suitable, click the Purchase now switch to get the form.

- Select the costs strategy you would like and enter in the required information. Build your accounts and purchase your order using your PayPal accounts or Visa or Mastercard.

- Select the data file structure and acquire the authorized file web template in your gadget.

- Comprehensive, modify and print and indicator the obtained New Jersey Consulting Agreement - Assist Company Obtain Loan.

US Legal Forms is definitely the most significant catalogue of authorized types for which you can find a variety of file layouts. Make use of the service to acquire expertly-manufactured paperwork that comply with state requirements.