New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

How to fill out Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

If you need to thorough, obtain, or print authorized document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site’s user-friendly search feature to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and enter your information to register for the account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor in just a couple of clicks.

- If you are an existing US Legal Forms customer, Log In to your account and then click the Download button to access the New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

- You can also view forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview feature to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find alternative versions of the legal form template.

Form popularity

FAQ

Independent contractors typically need to complete a W-9 form to provide their taxpayer information. This form is often requested by clients before payment is made. If you are operating under a New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, filling out this form correctly is vital for tax reporting. Additionally, you should keep thorough records of your contracts and payments to ensure smooth tax filings.

In the United States, independent contractors need to earn at least $600 in a calendar year to receive a 1099 form. This form is essential for reporting income to the IRS. If you are working under a New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, ensure that your earnings meet this threshold. It is crucial for tax purposes, as maintaining proper records will help you manage your finances effectively.

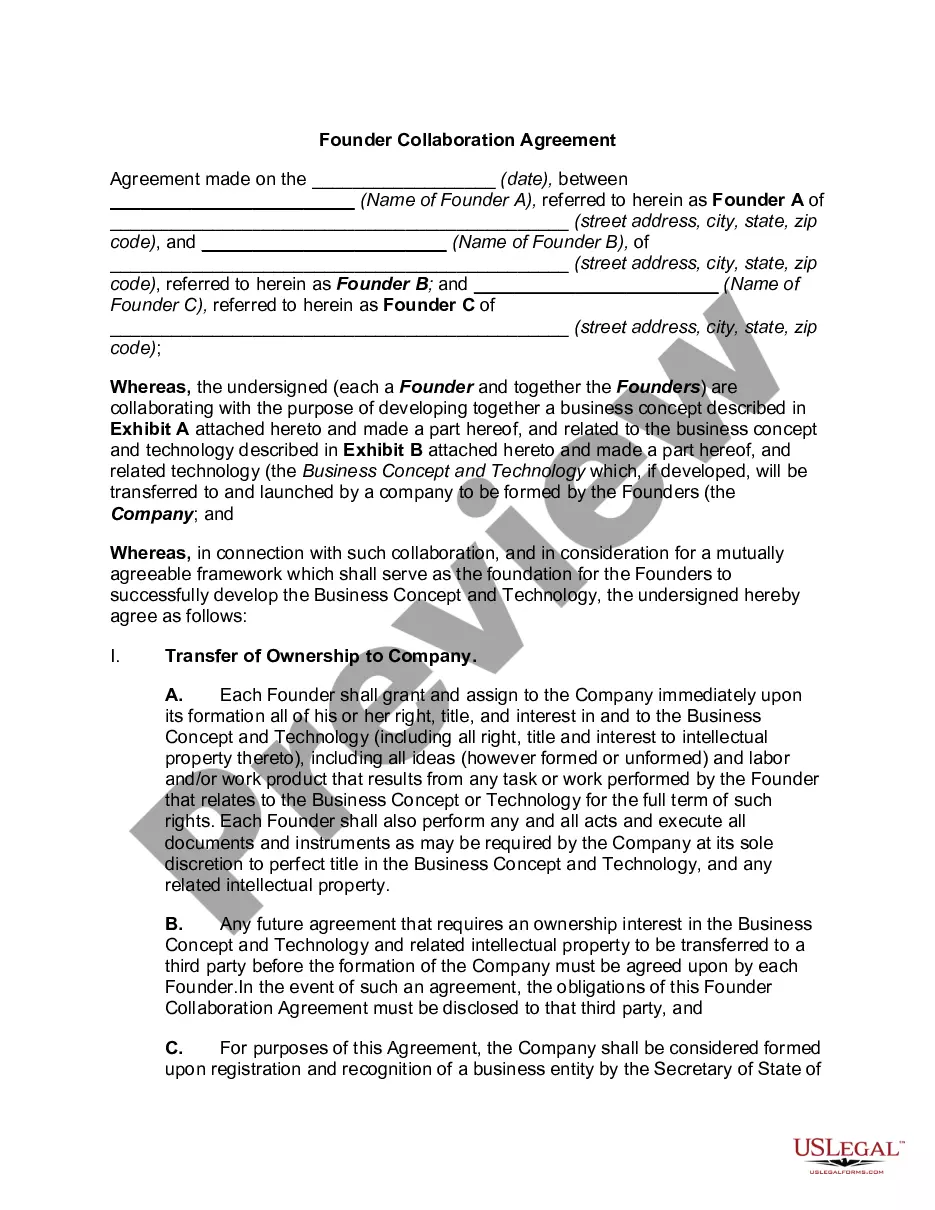

In a New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, the commission structure can vary based on the agreement made between the parties. Typically, independent contractors earn a percentage of the sales they generate, which often ranges from 10% to 50%. This arrangement allows contractors to benefit directly from their efforts and sales success. Our platform, USLegalForms, can help you create a tailored agreement that clearly defines commission rates and expectations.

The percentage for an independent contractor can vary widely based on the industry and specific contract terms. Generally, agreements specify a percentage of sales or profits, accommodating both parties' interests. Understanding your worth and negotiating a fair share in your New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor is essential. This way, both you and the client benefit from the collaboration.

Yes, many independent contractors in New Jersey must obtain a business license. This requirement varies based on the type of service provided and local regulations. By securing the proper licenses, independent contractors can operate legally and maintain compliance within their New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor. Additionally, using platforms like uslegalforms can help simplify the licensing process.

Breaking an independent contractor agreement can lead to legal consequences. If either party fails to fulfill the terms of the New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, the other party may pursue damages. This typically includes lost earnings or additional costs incurred. To avoid these issues, it’s crucial to understand the agreement fully.

It's advisable to set aside approximately 25-30% of your income for self-employment tax, especially if you are self-employed under a New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor. This buffer will help you cover your tax liabilities when they come due. Consult with a financial advisor to tailor your savings strategy.

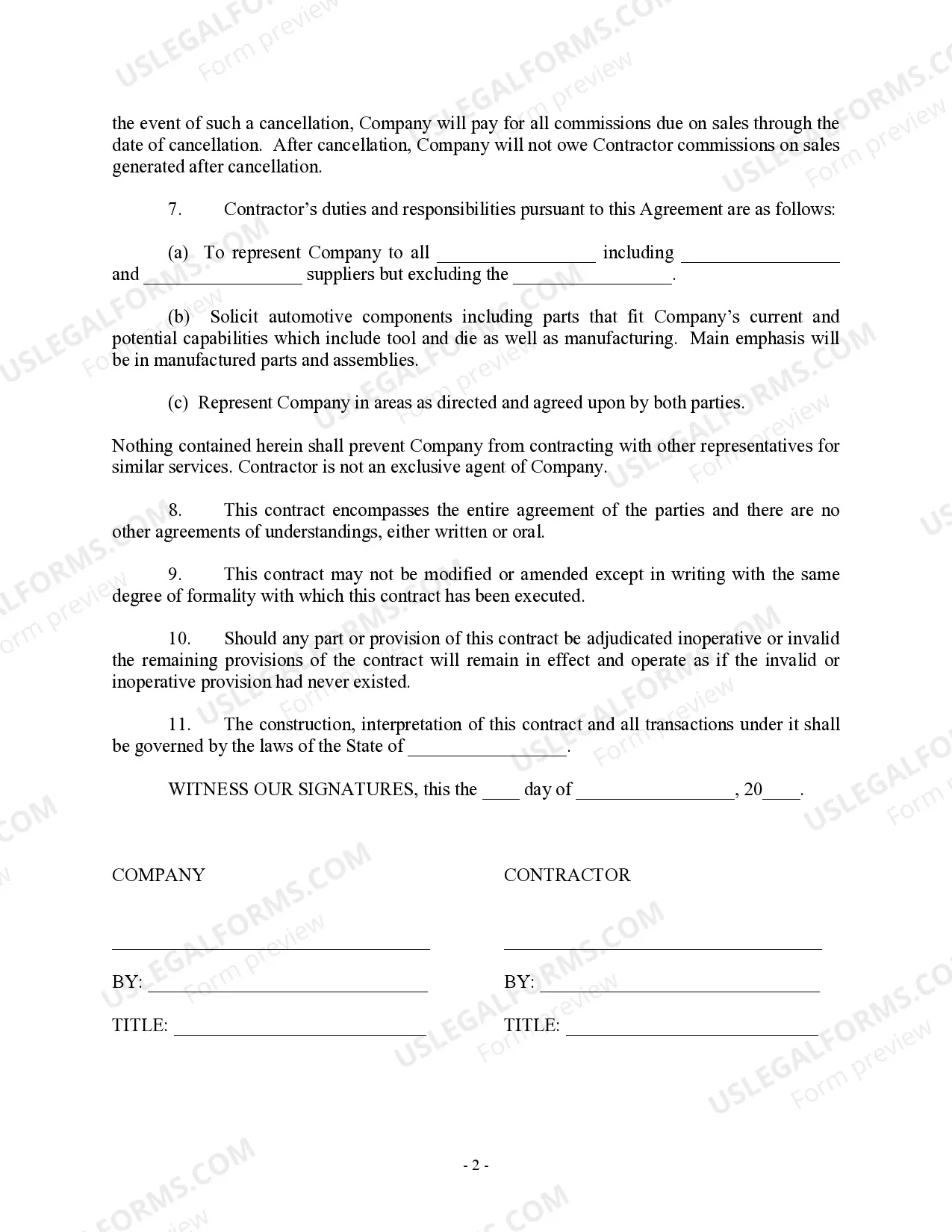

An independent contractor agreement should have a clear structure to cover essential elements. Start with the scope of work, followed by payment details, such as a percentage of sales in a New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor. Don't forget to include termination clauses and confidentiality requirements to protect both parties.

The self-employment tax is 15.3%, not 30%. This tax combines Social Security and Medicare contributions on net earnings, which can include income from a New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor. Properly understanding this tax is pivotal for managing your finances.

While you cannot entirely avoid the 15% self-employment tax, you can minimize it by deducting business expenses from your gross income. Tracking all your expenses as a self-employed independent contractor is crucial, especially when you work under a New Jersey Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor. Consider consulting with a tax professional for more strategies.