A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

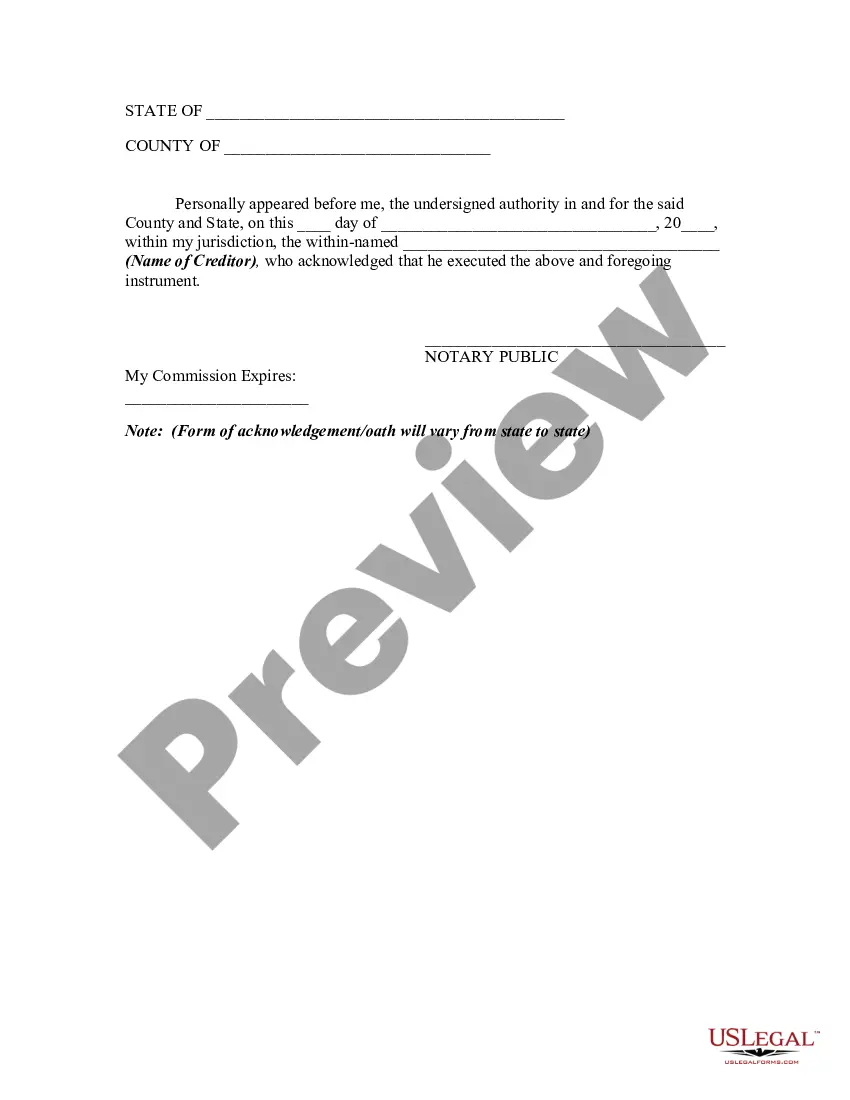

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A New Jersey Release of Claims Against an Estate By Creditor is a legal document that outlines the terms and conditions under which a creditor relinquishes any claims they may have against the assets or property of a deceased person's estate. This release is crucial for creditors who wish to settle and close any outstanding debts owed to them by the decedent. In New Jersey, there are two primary types of Release of Claims Against an Estate By Creditor: 1. Voluntary Release: This type of release occurs when a creditor voluntarily forgives the debt owed to them by the deceased individual. This can happen if the creditor determines that pursuing the debt through the estate would be impractical or unproductive. By signing the voluntary release, the creditor renounces any right to seek repayment from the estate and agrees to waive their claim entirely. 2. Compromise and Settlement Release: When a creditor and the estate's representative reach a mutually agreed-upon compromise or settlement, a Compromise and Settlement Release is executed. In this scenario, the creditor and the estate negotiate terms that are agreeable to both parties, which could include a reduced payment amount or an extended repayment period. Once the compromise agreement is reached, the creditor signs the release, acknowledging the agreed-upon terms, and agrees not to pursue further legal action to recover the remainder of the debt. Keywords: New Jersey, Release of Claims Against an Estate By Creditor, legal document, creditor, deceased, estate, assets, property, outstanding debts, settle, decedent, voluntary release, forgiveness, pursue, impractical, unproductive, repayments, waive, claim, compromise, settlement, representative, negotiate, reduced payment, extended repayment, legal action, recover.A New Jersey Release of Claims Against an Estate By Creditor is a legal document that outlines the terms and conditions under which a creditor relinquishes any claims they may have against the assets or property of a deceased person's estate. This release is crucial for creditors who wish to settle and close any outstanding debts owed to them by the decedent. In New Jersey, there are two primary types of Release of Claims Against an Estate By Creditor: 1. Voluntary Release: This type of release occurs when a creditor voluntarily forgives the debt owed to them by the deceased individual. This can happen if the creditor determines that pursuing the debt through the estate would be impractical or unproductive. By signing the voluntary release, the creditor renounces any right to seek repayment from the estate and agrees to waive their claim entirely. 2. Compromise and Settlement Release: When a creditor and the estate's representative reach a mutually agreed-upon compromise or settlement, a Compromise and Settlement Release is executed. In this scenario, the creditor and the estate negotiate terms that are agreeable to both parties, which could include a reduced payment amount or an extended repayment period. Once the compromise agreement is reached, the creditor signs the release, acknowledging the agreed-upon terms, and agrees not to pursue further legal action to recover the remainder of the debt. Keywords: New Jersey, Release of Claims Against an Estate By Creditor, legal document, creditor, deceased, estate, assets, property, outstanding debts, settle, decedent, voluntary release, forgiveness, pursue, impractical, unproductive, repayments, waive, claim, compromise, settlement, representative, negotiate, reduced payment, extended repayment, legal action, recover.