New Jersey Terminate S Corporation Status — Resolution For— - Corporate Resolutions: When a corporation in New Jersey no longer wishes to operate as an S Corporation, it can utilize the Terminate S Corporation Status — Resolution FordissolvediSTSts S Corporation status. This document is an official resolution that must be approved by the corporation's board of directors or shareholders, depending on the company's structure. The Terminate S Corporation Status — Resolution Form is designed to document the decision to terminate the S Corporation status, ensuring that it complies with both state and federal laws. This resolution is an essential step for corporations looking to switch their tax status or simply cease operating as an S Corporation. This resolution form typically includes the following key details: 1. Company Information: The form collects basic information about the corporation, such as its legal name, address, and state of incorporation. 2. Date and Location of Meeting: It documents the date and location of the board of directors or shareholders' meeting where the resolution was approved. 3. Approval of Resolution: The form provides space to outline the exact resolution being proposed, including the decision to terminate the S Corporation status. It requires appropriate approval from either the board of directors or shareholders, as per the bylaws of the corporation. 4. Effective Date: The form specifies the date when the termination of S Corporation status will take effect. It is essential to determine the effective date properly to ensure compliance with tax regulations. 5. Filing Actions: The form may also outline any necessary actions to be taken after the resolution is approved, such as filing the appropriate paperwork with the New Jersey Division of Revenue or notifying the Internal Revenue Service (IRS) about the change in tax status. Different Types of New Jersey Terminate S Corporation Status — Resolution Forms: 1. Standard Termination of S Corporation Status Resolution Form: This is the typical form used when a corporation decides to terminate it's S Corporation status voluntarily. It covers the basics of the resolution and effectively records the decision made. 2. Involuntary Termination of S Corporation Status Resolution Form: This form is utilized when a corporation's S Corporation status is involuntarily terminated, usually due to IRS intervention or non-compliance with S Corporation regulations. It may involve additional steps and documentation to rectify the situation, as specified by the IRS or relevant tax authorities. 3. State-Specific Termination of S Corporation Status Resolution Form: New Jersey, like many other states, may have particular requirements or additional information needed for S Corporation termination. A state-specific form ensures compliance with New Jersey state laws and regulations, streamlining the termination process. It's important to consult legal counsel or tax professionals to ensure accurate completion of the Terminate S Corporation Status — Resolution Form based on the specific needs of a corporation operating in New Jersey.

New Jersey Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out Terminate S Corporation Status - Resolution Form - Corporate Resolutions?

If you wish to be thorough, download, or print out official document templates, use US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's straightforward and convenient search feature to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to obtain the New Jersey Terminate S Corporation Status - Resolution Form - Corporate Resolutions in just a few clicks.

Every legal document template you acquire is yours permanently. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, and print the New Jersey Terminate S Corporation Status - Resolution Form - Corporate Resolutions from US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to get the New Jersey Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the correct form for the specific city/state.

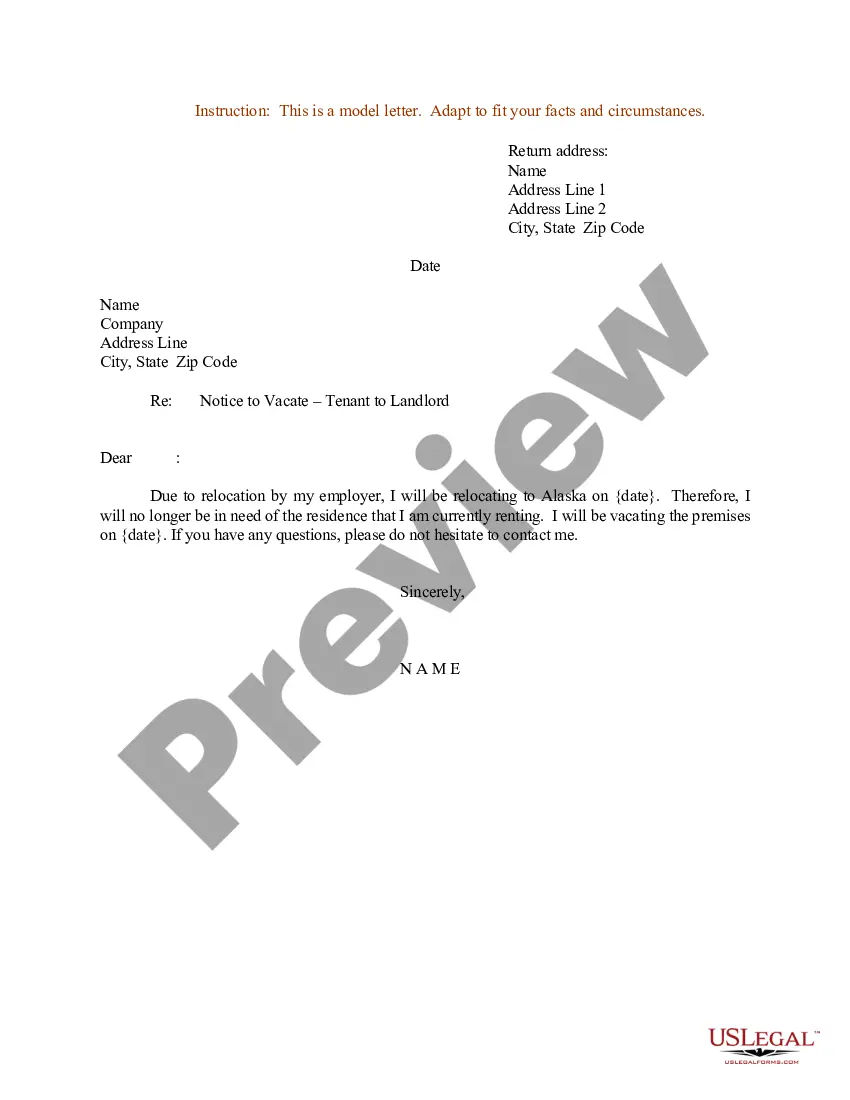

- Step 2. Use the Preview option to review the form’s details. Be sure to check the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find other types of your legal form template.

- Step 4. Once you have found the form you want, click the Acquire now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, revise and print or sign the New Jersey Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

Form popularity

FAQ

An S corporation election may be terminated involuntarily if the entity ceases to qualify as a small business corporation or its passive income exceeds the passive income limitation. An S corporation ceases to qualify as an S corporation if it does not meet the criteria in Sec.

To revoke S corp status, the company must send a letter to the IRS requesting the revocation. The letter must be signed by all shareholders who agreed to it. According to the IRS, the letter should state that the corporation revokes the election made under Section 1362(a).

To revoke a Subchapter S election/small business election that was made on Form 2553, submit a statement of revocation to the service center where you file your annual return. The statement should state: The corporation revokes the election made under Section 1362(a)

Inadvertent Termination of the S Election An entity will cease being a small business corporation if at any time it issues a second class of stock, acquires more than 100 shareholders, or has an ineligible shareholder.

If business owners want to revoke the S Corp election retroactively to the first day of their tax year, they must submit their statement by the 16th day of the third month of the tax year.

An S corporation election may be terminated involuntarily if the entity ceases to qualify as a small business corporation or its passive income exceeds the passive income limitation. An S corporation ceases to qualify as an S corporation if it does not meet the criteria in Sec.

To revoke an election, a letter of revocation must be filed with the NJ Division of Revenue and Enterprise Services, using the online SCORP application, signed by all shareholders holding more than 50% of the outstanding shares of stock on the day of the revocation and filed with a copy of the original election form.

If business owners want to revoke the S Corp election retroactively to the first day of their tax year, they must submit their statement by the 16th day of the third month of the tax year.

In general, you cannot dissolve a business with S Corp status without the approval of shareholders or the board of directors. Approval must come from shareholder and director resolutions, which must be recorded in official corporate records.

To revoke a Subchapter S election/small business election that was made on Form 2553, submit a statement of revocation to the service center where you file your annual return. The statement should state: The corporation revokes the election made under Section 1362(a)

More info

Forming column section headers and footers text contents text value text name To apply in PDF.