A New Jersey Promissory Note — Payable on Demand refers to a legal document that outlines the borrower's promise to repay a specific amount of money to the lender. This type of promissory note is known for its flexibility as it allows for the debt to be paid back at any time, upon the lender's request. It is a powerful tool commonly used in various financial and business transactions within the state of New Jersey. Keywords: New Jersey Promissory Note, Payable on Demand, legal document, borrower, lender, repay, flexibility, debt, financial transactions, business transactions. There are several types of New Jersey Promissory Note — Payable on Demand available depending on the specific purpose and details of the agreement. Here's a brief overview of some common types: 1. Personal Promissory Note — Payable on Demand: This type of note is typically used in personal lending scenarios, such as loans between family members or friends. It outlines the terms of the loan, repayment schedule, and the interest rate (if applicable). 2. Business Promissory Note — Payable on Demand: This note is utilized for financial transactions between businesses. It establishes the obligation of one business to repay the borrowed funds to another, either for investment purposes, expansion, cash flow management, or other business-related needs. 3. Demand Promissory Note — Payable on Demand: This note allows the lender to demand repayment from the borrower at any time without prior notice or a specific maturity date. It provides flexibility for the lender to access their funds whenever required. 4. Secured Promissory Note — Payable on Demand: This note includes collateral as security against the borrowed amount, providing assurance to the lender in case of default. Collateral can be an asset like a property, vehicle, or any valuable item agreed upon by both parties. 5. Unsecured Promissory Note — Payable on Demand: This note does not require any collateral from the borrower to secure the loan. As a result, the lender relies solely on the borrower's creditworthiness and their promise to repay the borrowed amount. Irrespective of the type, a New Jersey Promissory Note — Payable on Demand should include essential details, such as the names and contact information of both parties involved, the loan amount, the interest rate (if applicable), repayment terms, default clauses, and any additional terms or conditions agreed upon. Remember, it is always advisable to consult with a legal professional to ensure the note complies with New Jersey state laws and accurately reflects the borrower's and lender's intentions.

New Jersey Promissory Note - Payable on Demand

Description

How to fill out New Jersey Promissory Note - Payable On Demand?

Choosing the right authorized papers template can be a struggle. Needless to say, there are a lot of themes accessible on the Internet, but how do you obtain the authorized form you need? Take advantage of the US Legal Forms internet site. The support delivers 1000s of themes, including the New Jersey Promissory Note - Payable on Demand, that can be used for business and private needs. Each of the types are checked out by professionals and meet up with state and federal specifications.

If you are previously registered, log in for your profile and click the Down load option to get the New Jersey Promissory Note - Payable on Demand. Utilize your profile to search through the authorized types you have acquired in the past. Visit the My Forms tab of your respective profile and acquire an additional version of the papers you need.

If you are a brand new consumer of US Legal Forms, listed below are straightforward directions that you should stick to:

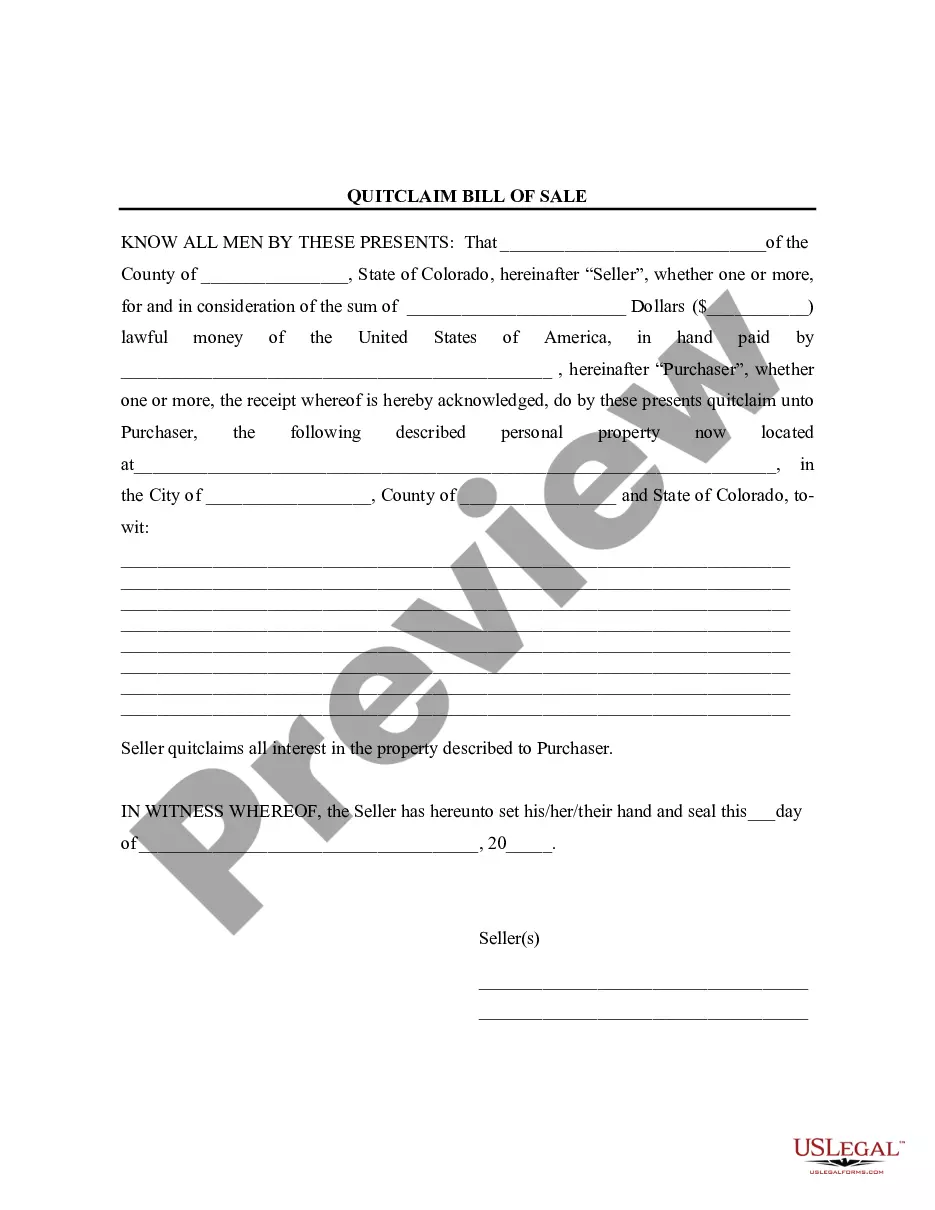

- Initial, make certain you have chosen the proper form for your area/state. You may examine the shape making use of the Preview option and look at the shape outline to make sure it will be the right one for you.

- In the event the form does not meet up with your expectations, use the Seach discipline to get the right form.

- Once you are sure that the shape would work, click on the Acquire now option to get the form.

- Select the rates plan you need and type in the essential information. Create your profile and pay for the order with your PayPal profile or charge card.

- Pick the file structure and acquire the authorized papers template for your system.

- Complete, revise and produce and indicator the acquired New Jersey Promissory Note - Payable on Demand.

US Legal Forms may be the greatest catalogue of authorized types that you can discover a variety of papers themes. Take advantage of the service to acquire skillfully-manufactured paperwork that stick to express specifications.