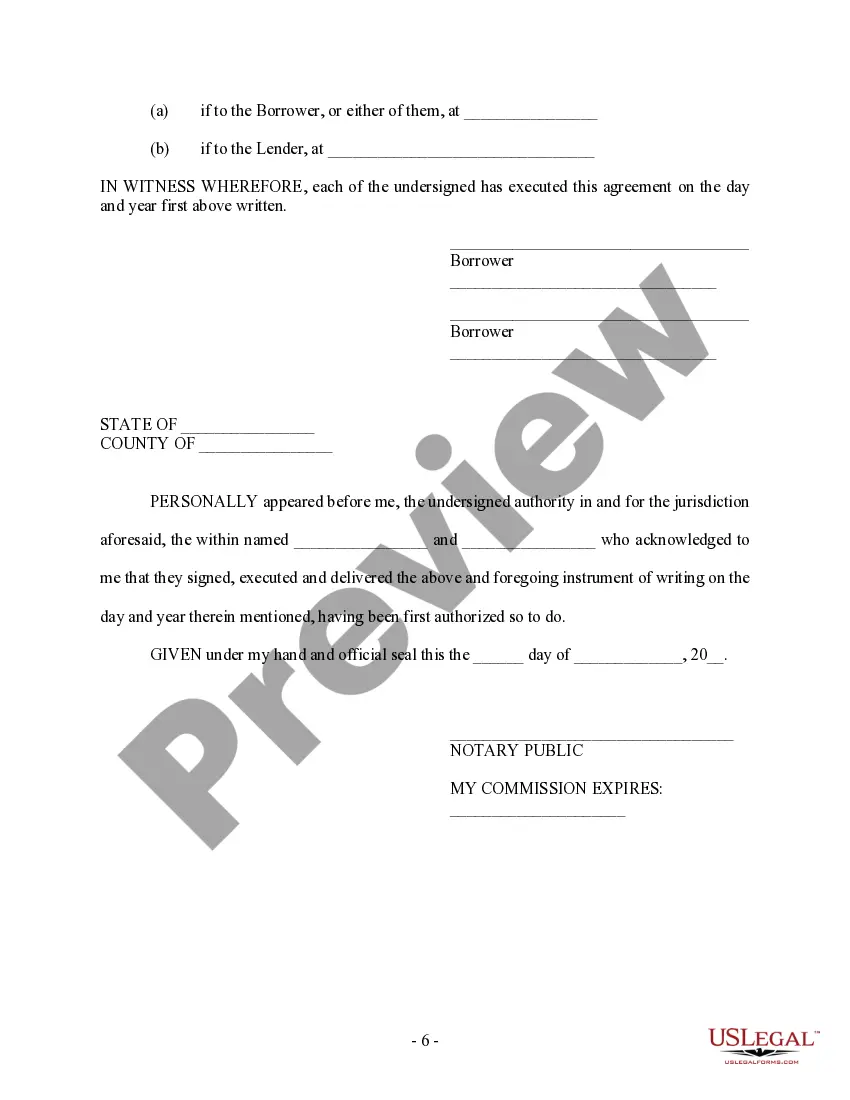

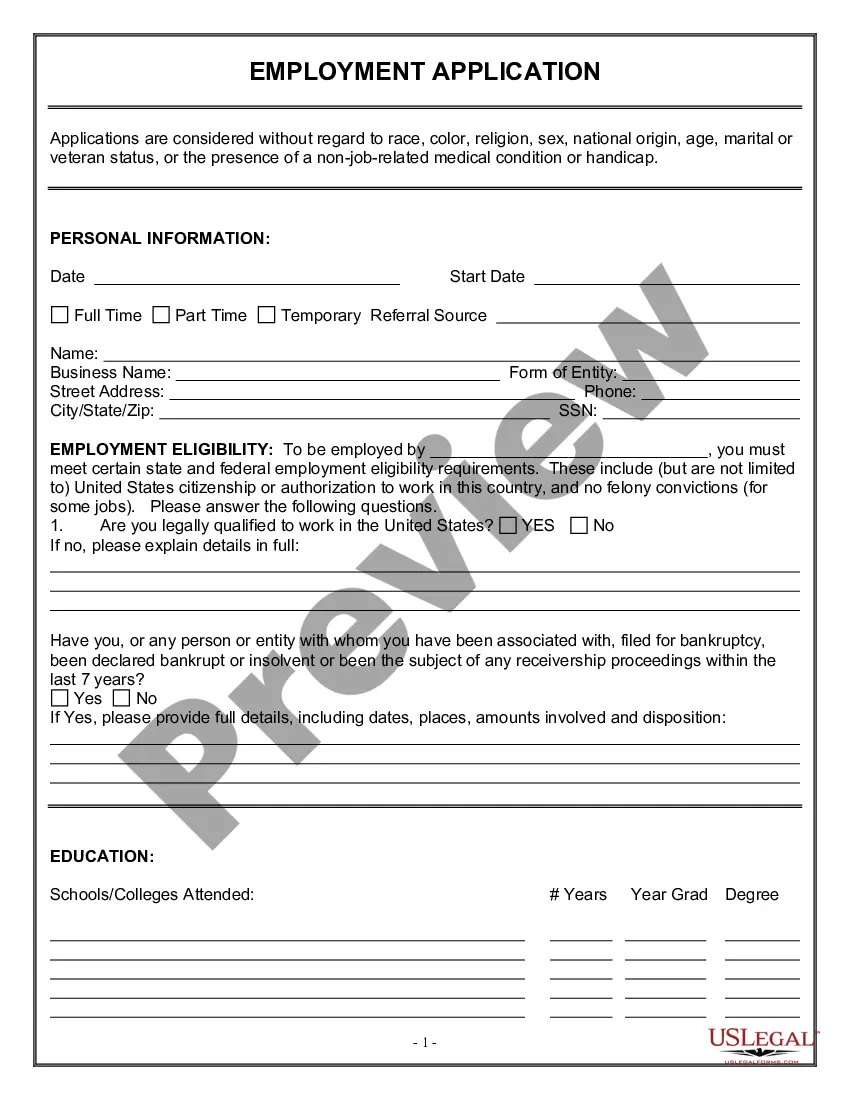

A New Jersey Security Agreement for Promissory Note is a legally binding contract that outlines the terms and conditions between a lender (creditor) and a borrower (debtor). This agreement is designed to ensure that the lender has a security interest in any assets owned by the borrower in case of default or non-payment of the promissory note. The purpose of this agreement is to provide additional security for the lender in the event of default or non-payment by the borrower. It allows the lender to claim and liquidate specific assets owned by the borrower to recover the outstanding principal, interest, and any other fees or charges incurred. A New Jersey Security Agreement for Promissory Note typically includes the following key elements: 1. Identification of the parties involved: This includes the legal names and contact information of both the lender and the borrower. 2. Description of the promissory note: This section details the terms of the promissory note, including the principal amount, interest rate, repayment schedule, and any other relevant conditions. 3. Grant of security interest: The borrower agrees to grant the lender a security interest in certain specified assets, generally listed within the agreement. Examples of assets that can be included are real estate, vehicles, equipment, inventory, accounts receivable, and intellectual property. 4. Collateral description: The agreement should provide a clear and detailed description of the collateral being pledged as security, including its location, condition, and any relevant identifying details. 5. Rights and obligations: This section outlines the rights and obligations of both the lender and the borrower. It may include provisions regarding the borrower's responsibility to maintain the collateral, provide insurance, and refrain from selling or transferring the assets without the lender's consent. 6. Default and remedies: The agreement will define the conditions under which a default occurs, such as non-payment or breach of other terms. It will also outline the remedies available to the lender, including the right to take possession of and sell the collateral to recover any outstanding debt. There may be different types or variations of New Jersey Security Agreements for Promissory Note, depending on the specific needs or circumstances of the parties involved. Some variations could include specific provisions for different types of collateral, such as real estate mortgages, vehicle liens, or UCC (Uniform Commercial Code) filings for personal property. It is crucial for both parties to carefully review and understand the terms of the agreement before signing, as it outlines their rights and responsibilities. Consulting with legal professionals experienced in New Jersey laws and regulations is recommended to ensure compliance and protection for all parties involved.

New Jersey Security Agreement for Promissory Note

Description

How to fill out New Jersey Security Agreement For Promissory Note?

Are you presently inside a situation in which you require files for sometimes business or personal purposes just about every day? There are a variety of authorized document layouts available on the net, but finding types you can rely isn`t straightforward. US Legal Forms delivers a huge number of kind layouts, just like the New Jersey Security Agreement for Promissory Note, which can be published to fulfill federal and state specifications.

If you are previously informed about US Legal Forms website and also have a free account, basically log in. Next, you may acquire the New Jersey Security Agreement for Promissory Note design.

Should you not offer an accounts and want to begin using US Legal Forms, adopt these measures:

- Get the kind you will need and make sure it is to the appropriate area/region.

- Utilize the Preview option to examine the shape.

- Read the explanation to ensure that you have chosen the appropriate kind.

- When the kind isn`t what you are seeking, make use of the Search discipline to find the kind that meets your requirements and specifications.

- Once you find the appropriate kind, just click Purchase now.

- Opt for the costs strategy you desire, submit the specified details to produce your account, and pay money for the order using your PayPal or Visa or Mastercard.

- Decide on a handy paper file format and acquire your version.

Discover all of the document layouts you possess purchased in the My Forms menu. You may get a additional version of New Jersey Security Agreement for Promissory Note any time, if required. Just select the essential kind to acquire or print out the document design.

Use US Legal Forms, probably the most substantial variety of authorized kinds, to conserve efforts and avoid mistakes. The support delivers professionally produced authorized document layouts which you can use for an array of purposes. Generate a free account on US Legal Forms and initiate producing your way of life a little easier.