New Jersey Charitable Remainder Inter Vivos Annuity Trust

Description

How to fill out Charitable Remainder Inter Vivos Annuity Trust?

Have you ever been in a situation where you require documents for either business or personal reasons almost constantly.

There are numerous trustworthy document templates accessible online, but finding forms you can depend on is not simple.

US Legal Forms offers a vast collection of template designs, including the New Jersey Charitable Remainder Inter Vivos Annuity Trust, which is tailored to meet state and federal regulations.

Once you find the right form, click Purchase now.

Select the pricing plan you want, complete the necessary information to create your account, and pay for your order using PayPal or a credit card. Choose a preferred file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the New Jersey Charitable Remainder Inter Vivos Annuity Trust whenever needed; simply click the desired form to download or print the document template. Use US Legal Forms, one of the largest collections of legitimate forms, to save time and prevent errors. The service provides well-crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life simpler.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the New Jersey Charitable Remainder Inter Vivos Annuity Trust template.

- If you do not have an account yet and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

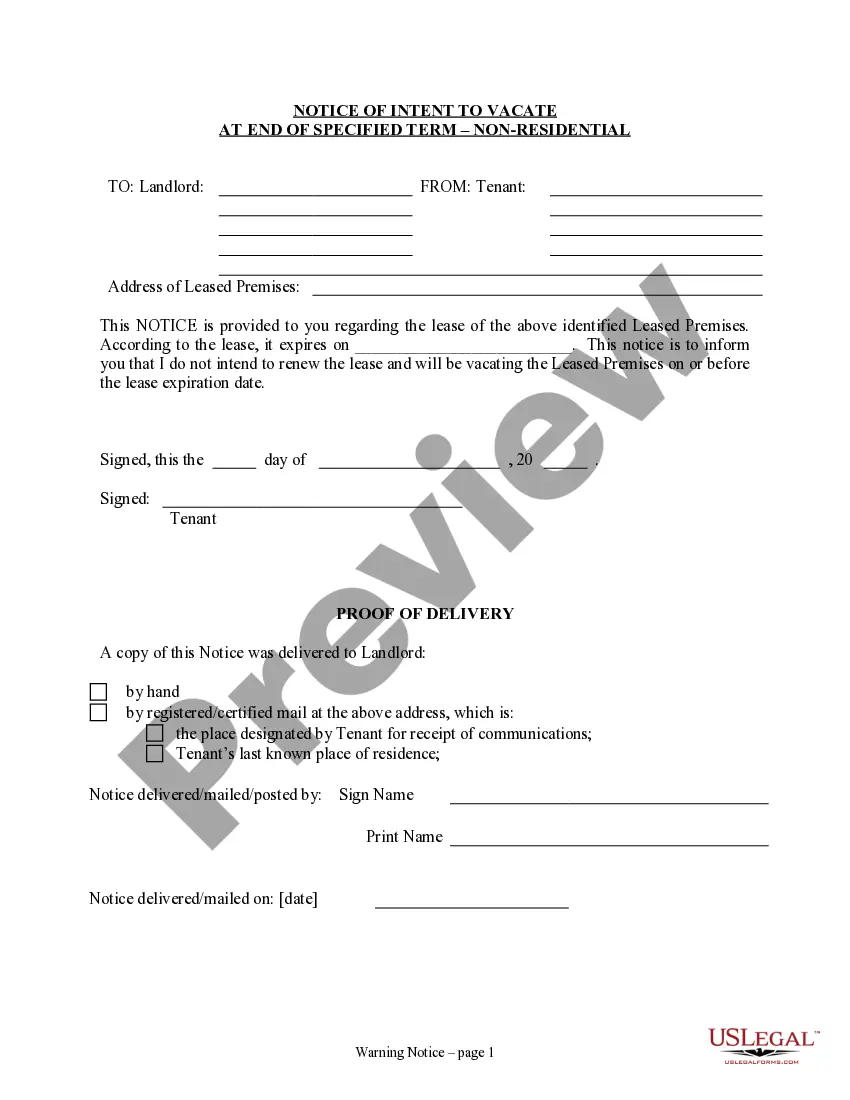

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the correct document.

- If the form is not what you seek, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

A New Jersey Charitable Remainder Inter Vivos Annuity Trust may not be suitable for everyone due to certain downsides. Depending on the structure, you might face higher costs for administration and legal setup. Moreover, once established, alterations can be challenging, limiting your financial flexibility.

While a charitable trust can be beneficial, there are some disadvantages to consider. For example, once you place assets in the trust, you may lose some control over them. Furthermore, setting up a New Jersey Charitable Remainder Inter Vivos Annuity Trust can involve legal complexities and fees that may deter some individuals.

Setting up a charitable trust, like a New Jersey Charitable Remainder Inter Vivos Annuity Trust, offers several advantages. It helps you support causes you care about while providing you with a reliable income stream. Additionally, it can help reduce estate taxes and enhance your financial legacy for future generations.

A charitable remainder trust allows you to transfer assets to a trust while receiving income during your lifetime. After your passing, the remaining assets go to designated charities. This structure offers philanthropic benefits and can yield substantial tax advantages, making it a valuable option for a New Jersey Charitable Remainder Inter Vivos Annuity Trust.

In New Jersey, the taxation of trusts, including a New Jersey Charitable Remainder Inter Vivos Annuity Trust, can be complex. Generally, income generated by the trust is subject to state income tax. It's essential to consult with a tax advisor to fully understand the implications and ensure compliance with state laws.

An inter vivos charitable remainder trust is a legal arrangement created during your lifetime. It allows you to donate assets to a charity while retaining the right to receive income for a specified period. This type of trust is commonly known as a New Jersey Charitable Remainder Inter Vivos Annuity Trust, which provides you with a steady income stream throughout your life.

Non-residents who earn income sourced from New Jersey are required to file a NJ non-resident tax return. This includes income from a New Jersey Charitable Remainder Inter Vivos Annuity Trust if you're not a state resident. Filing accurately helps you stay in good standing with New Jersey tax authorities.

The NJ-1041 form must be filed by estates and trusts that generate income during the tax year, including those associated with a New Jersey Charitable Remainder Inter Vivos Annuity Trust. If the trust has income above a certain amount, filing becomes a requirement. Understanding your obligations is critical for compliance.

In general, annuities can be subject to New Jersey inheritance tax, depending on the beneficiaries. The New Jersey Charitable Remainder Inter Vivos Annuity Trust may provide benefits that can affect tax obligations. Consulting with a tax professional helps clarify your responsibilities.

If you reside in New Jersey and earn income, you typically need to file a New Jersey state income tax return. This includes income generated from a New Jersey Charitable Remainder Inter Vivos Annuity Trust. Timely filing ensures you meet your tax obligations and can optimize your financial planning.