The New Jersey Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legal document that outlines the terms and conditions under which a sole proprietorship transfers ownership of their business to a purchaser. This agreement is unique in that the purchase price is contingent upon the completion of an audit, which ensures that the financial records and statements of the business accurately represent its true value. This agreement aims to protect both the seller and the buyer by providing a framework for a fair and transparent transaction. The document covers various aspects such as the purchase price, payment terms, liabilities, representations and warranties, and the process for conducting the audit. The New Jersey Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit can be customized to suit different types of businesses. Some specific variations may include: 1. Agreement for Sale of Retail Business: This type of agreement is specifically designed for the sale of a retail sole proprietorship, such as a clothing store, grocery store, or convenience store. 2. Agreement for Sale of Service Business: Meant for the transfer of ownership of a service-based sole proprietorship, such as a consulting firm, hair salon, or healthcare practice. 3. Agreement for Sale of Manufacturing Business: This agreement is tailored for the sale of manufacturing sole proprietorship, which involve the production and distribution of physical goods. 4. Agreement for Sale of Professional Practice: Suitable for the transfer of ownership of a professional practice, such as a law firm, dental clinic, or accounting practice. Regardless of the specific type, the New Jersey Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is designed to ensure a smooth transaction while safeguarding the interests of all parties involved. It is crucial to seek legal counsel when drafting or reviewing this agreement to ensure compliance with New Jersey laws and regulations.

New Jersey Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

How to fill out New Jersey Agreement For Sale Of Business By Sole Proprietorship With Purchase Price Contingent On Audit?

You might spend time online trying to locate the legal document template that meets the federal and state criteria you need.

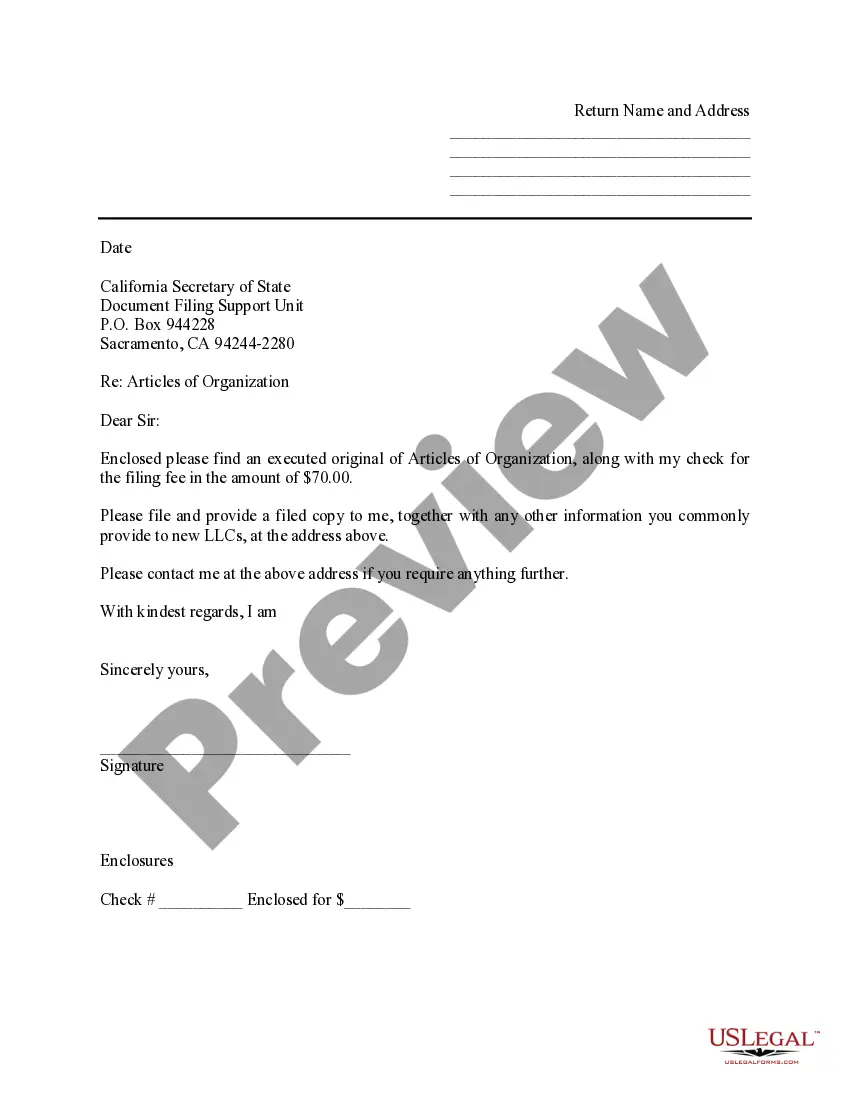

US Legal Forms offers thousands of legal documents that can be reviewed by professionals.

You can effortlessly download or print the New Jersey Agreement for Sale of Business by Sole Proprietorship with a Purchase Price Subject to Audit from their service.

If you are using the US Legal Forms site for the first time, follow the simple instructions below: First, ensure you have chosen the correct document template for the county/city of your choice. Review the form description to confirm you have selected the right form. If available, use the Review button to look through the document format simultaneously.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, modify, print, or sign the New Jersey Agreement for Sale of Business by Sole Proprietorship with a Purchase Price Subject to Audit.

- Every legal document template you receive is yours permanently.

- To get another copy of a purchased form, visit the My documents tab and click the corresponding button.

Form popularity

FAQ

For a contract to be valid, there must be agreement among all the parties. Typically, that means there must have been an offer and an acceptance. The offer need not be in writing (with some exceptions, covered by what is known as the statute of frauds).

How to Fill Out a Residential Purchase AgreementPlace the name(s) of the seller(s) on the contract.Write the date of the offer on the agreement.Add the purchase price to the contract.Include a request for the seller to provide a clear title and deed for the property.More items...

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

Your guide to filling out a sale and purchase agreementRun the contract past your solicitor.Are there any cross outs in the general terms of sale?Check to make sure there have been no extra conditions inserted in the further terms of sale.Read and sign any addendums the contract has.OIA (overseas investment act) form.More items...?

The most important sections include:Offer & closing dates.Legal names of the buyer(s) & seller(s)Property address, frontage, and legal description.Offer price & deposit amount.Irrevocable date for when the offer is good until.Chattels & fixtures included and not included in the sale.Rental items included in the sale.More items...

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

How to Fill Out a Residential Purchase AgreementPlace the name(s) of the seller(s) on the contract.Write the date of the offer on the agreement.Add the purchase price to the contract.Include a request for the seller to provide a clear title and deed for the property.More items...

What Should Be Included in a Sales Agreement?A detailed description of the goods or services for sale.The total payment due, along with the time and manner of payment.The responsible party for delivering the goods, along with the date and time of delivery.More items...

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

Interesting Questions

More info

The mortgage broker for example is a potential victim. If the client was to find out that the broker provided the client with a lump sum payment for a home under the condition that the borrower default, or in other words that it did the borrower a favor in order to keep them on the home, the borrower might become dissatisfied with the product and not be able to repay the mortgage. For instance, he or She might decide to sell the home and cash in the proceeds, instead of paying the mortgage. This might be considered as a form of theft, which results in the borrower declaring bankruptcy. This may cause other problems for the borrower. For more information, you can click on: What Means Real Estate on the next page.