New Jersey Federal Trade Commission Affidavit regarding Identity Theft

Description

How to fill out Federal Trade Commission Affidavit Regarding Identity Theft?

Are you currently in a situation where you require documents for either professional or personal reasons almost every day.

There are numerous legitimate document templates available on the internet, but finding reliable ones is not simple.

US Legal Forms offers a vast array of form templates, such as the New Jersey Federal Trade Commission Affidavit concerning Identity Theft, which is designed to comply with federal and state regulations.

Once you find the right form, click Purchase now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Federal Trade Commission Affidavit concerning Identity Theft template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

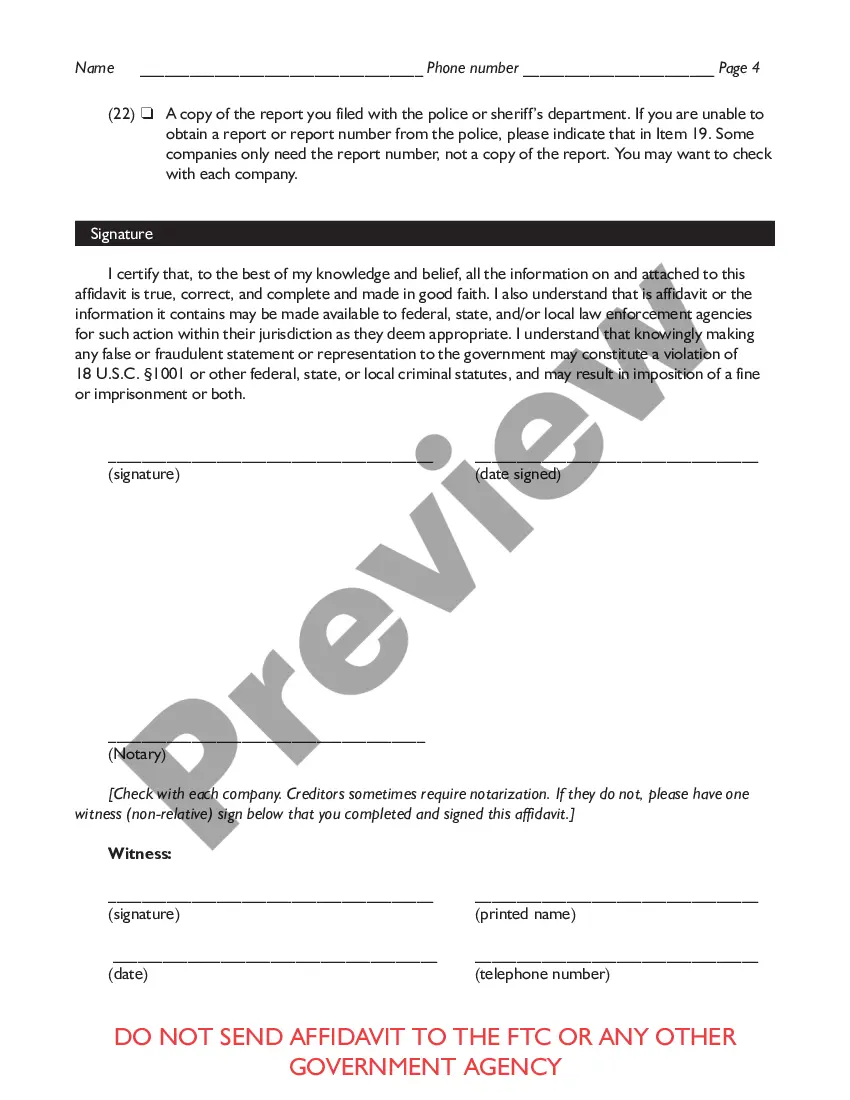

- Utilize the Preview feature to examine the form.

- Review the details to ensure that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

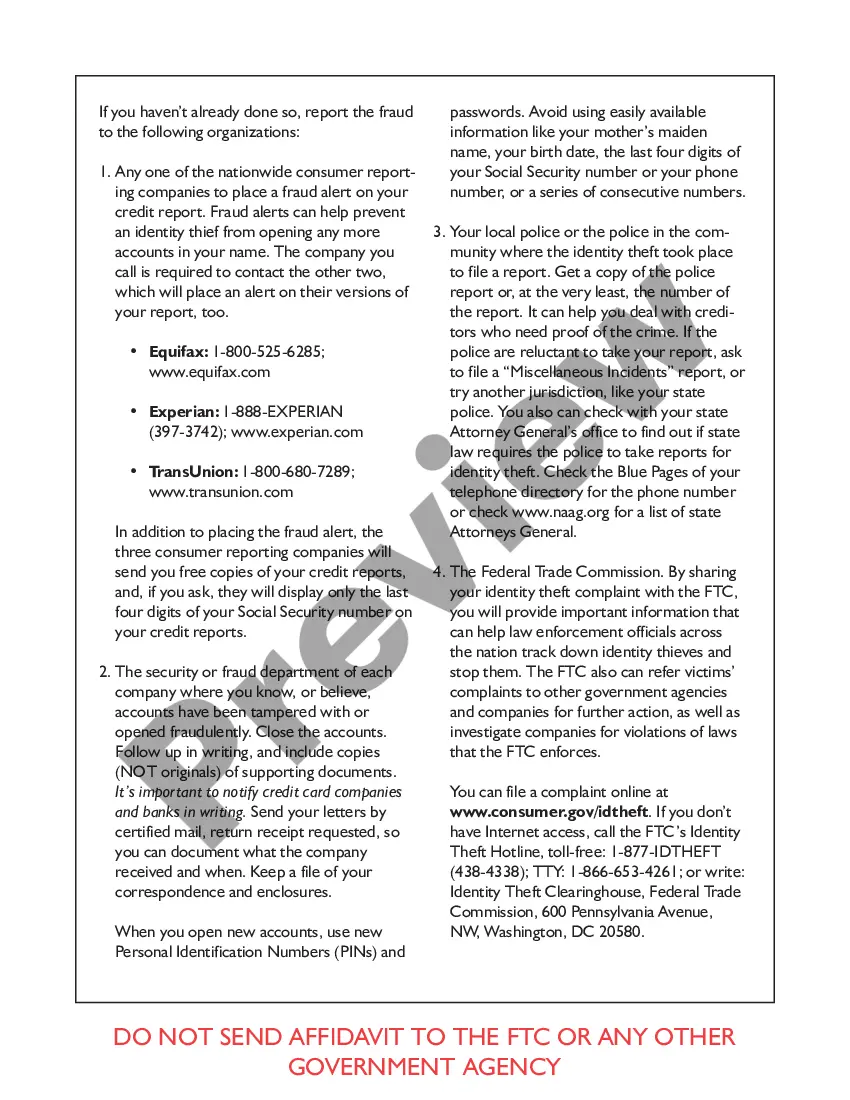

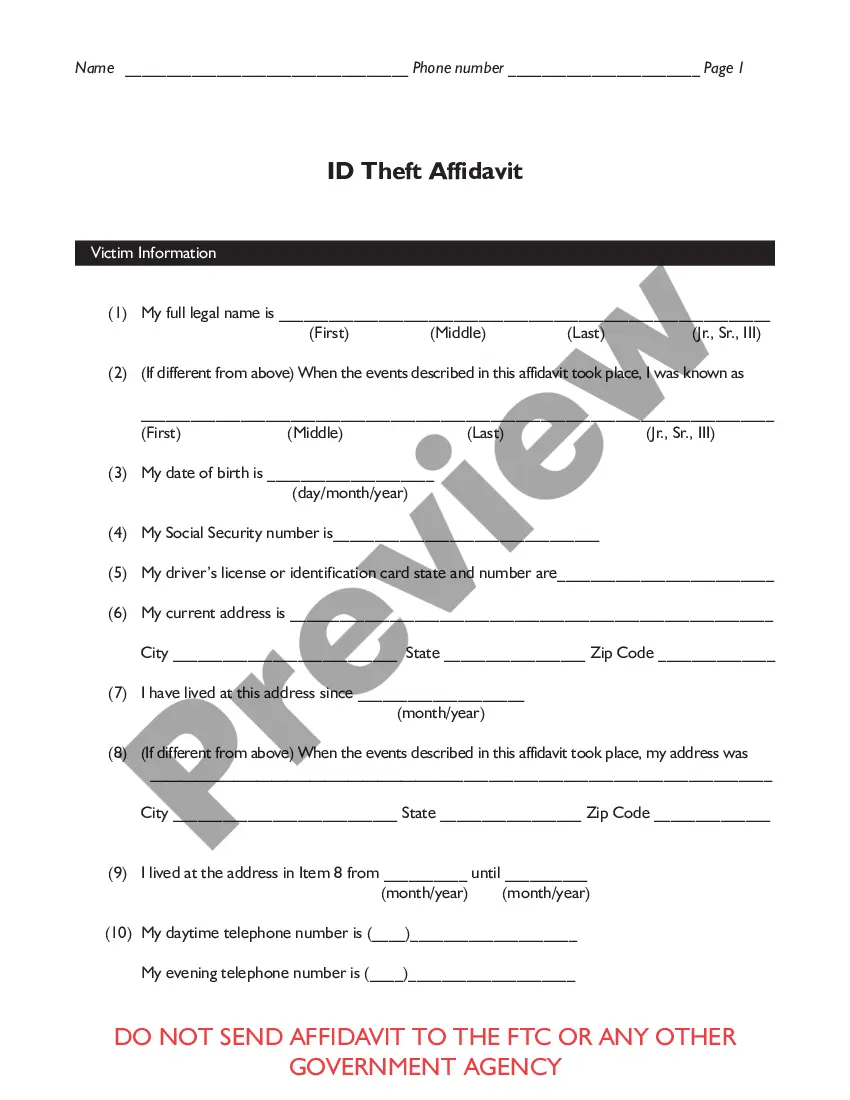

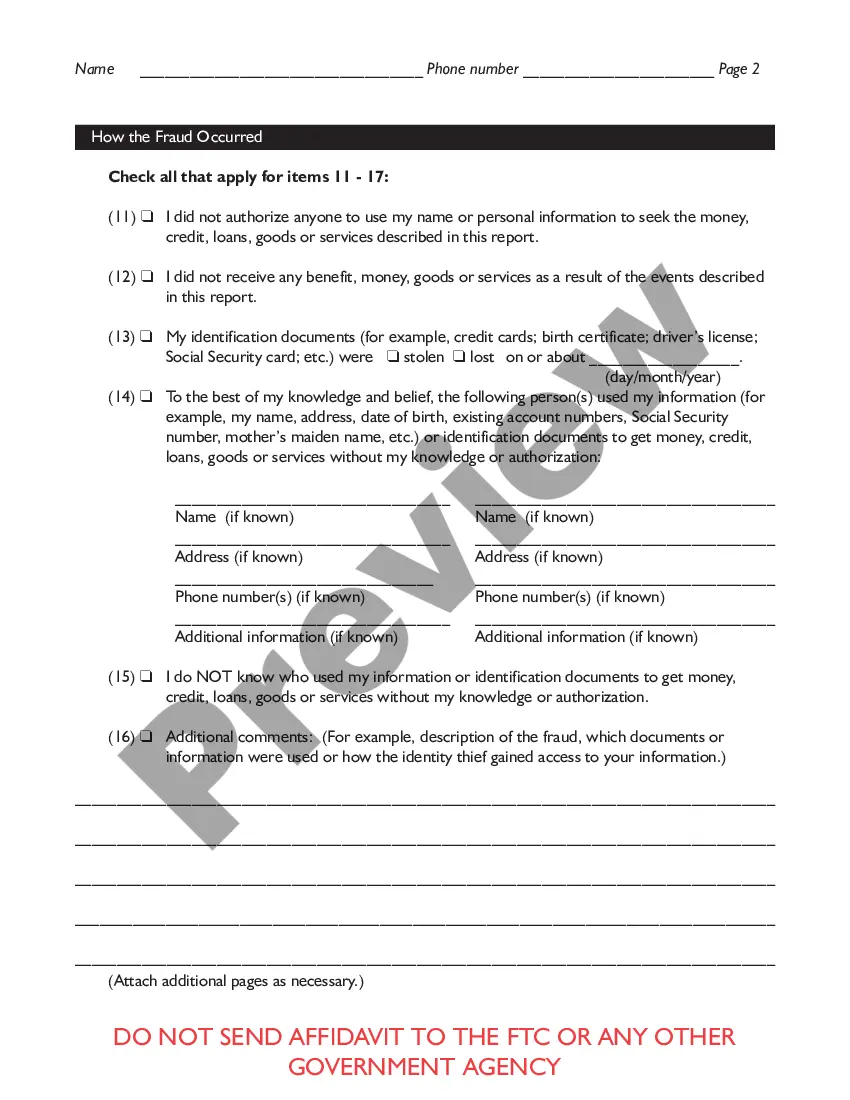

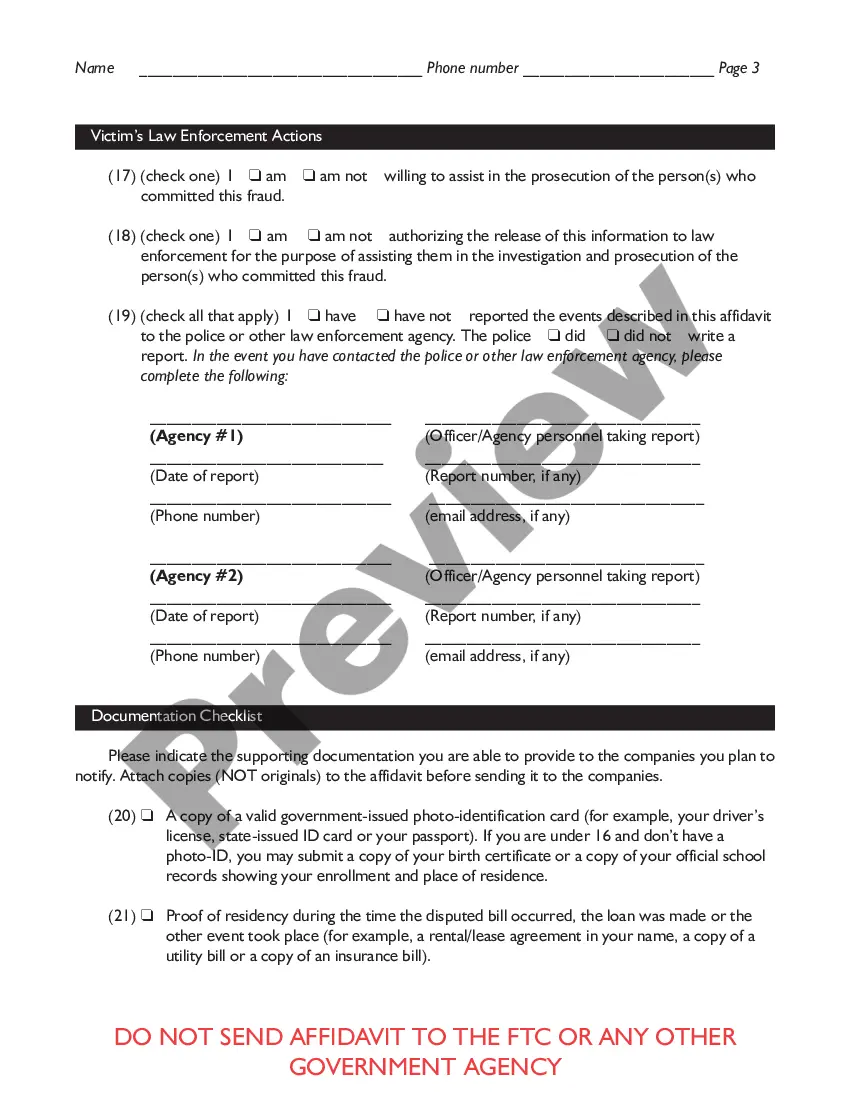

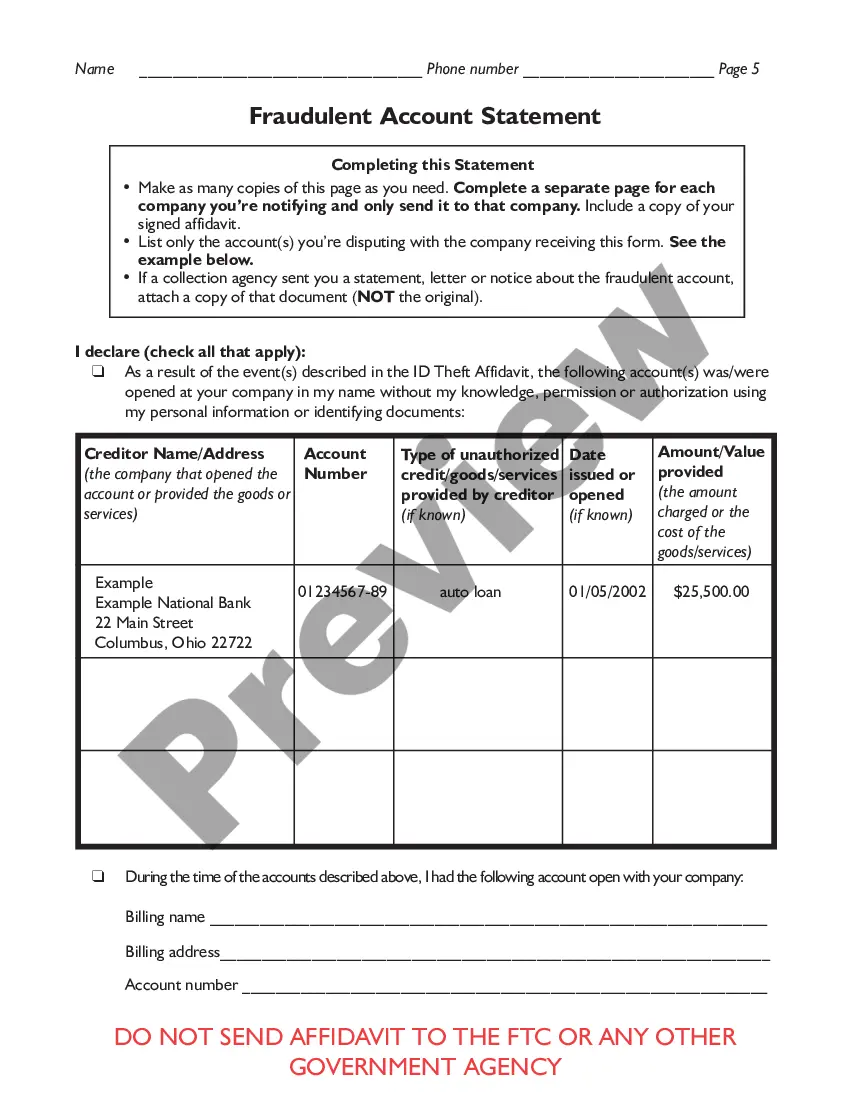

FTC ID Theft Affidavit The FTC provides an ID Theft Affidavit to help victims of identity theft quickly and accurately dispute new unauthorized accounts. It is especially helpful in cases where consumers are unable to file or obtain a police report. Some creditors will accept this affidavit instead of a police report.

The FTC's IdentityTheft.gov can assist attorneys who counsel identity theft victims. The site provides victims with a personal recovery plan, walking through each step to take. It also provides pre-filed letters and forms to send to credit bureaus, businesses, and debt collectors.

Visit ftc.gov/idtheft to use a secure online version that you can print for your records. Before completing this form: 1. Place a fraud alert on your credit reports, and review the reports for signs of fraud.

In most cases, taxpayers do not need to complete this form. Only victims of tax-related identity theft should submit the Form 14039, and only if they haven't received certain letters from the IRS.

If you're not sure of the victim's identity, the FCRA allows you to ask for proof of identity, such as a copy of a government-issued identification. You also may ask for proof of a claim of identity theft, such as an Identity Theft Report issued by the FTC or a police report.

Visit ftc.gov/idtheft to use a secure online version that you can print for your records. Before completing this form: 1. Place a fraud alert on your credit reports, and review the reports for signs of fraud.

In 1998, Congress enacted the Identity Theft and Assumption Deterrence Act (?the Identity Theft Act? or ?the Act?),1 directing the Federal Trade Commission to establish the federal government's central repository for identity theft complaints and to provide victim assistance and consumer education.