Title: New Jersey Letter to Other Entities Notifying Them of Identity Theft: Protecting Your Digital Identity Introduction: Identity theft is a serious issue affecting individuals across the globe, and New Jersey is not exempt from this growing concern. To ensure the protection of victims and create awareness surrounding identity theft, New Jersey has developed a Letter to Other Entities Notifying Them of Identity Theft. This letter acts as a crucial communication tool for victims of identity theft to notify relevant entities and take necessary steps to minimize the damages caused by fraudsters. Types of New Jersey Letters to Other Entities Notifying Them of Identity Theft: 1. New Jersey Letter to Banks: In cases where one's banking information is compromised, a specific New Jersey Letter to Banks can be used to immediately inform the financial institution. This letter is complete with relevant details, such as the affected account numbers, dates of suspicious activity, and any unauthorized transactions. By notifying banks promptly, victims reduce the risk of mounting financial losses and work towards recovering their stolen assets. 2. New Jersey Letter to Credit Card Companies: Credit card fraud is a rising issue globally, and New Jersey residents are advised to use a specialized New Jersey Letter to Credit Card Companies in such cases. This letter helps victims inform credit card companies about unauthorized transactions, potentially fraudulent accounts, and any suspicious activities on their credit cards. By taking immediate action, individuals can protect both their credit score and their finances from further damage. 3. New Jersey Letter to Social Security Administration: Identity theft can also involve misappropriation of social security numbers, which poses significant risks to an individual's personal information. By utilizing a New Jersey Letter to Social Security Administration, victims can report the unlawful usage of their social security number, enabling the administration to take appropriate measures to address the issue promptly and prevent further misuse. 4. New Jersey Letter to Government Agencies: Typically utilized when identity theft involves stolen or misused personal identification documents, a New Jersey Letter to Government Agencies allows victims to report the fraudulent activity to relevant government entities. This letter includes detailed information about the incident, such as the stolen document types (driver's license, passport, etc.), dates of theft, and any unauthorized activities linked to the documents. Reporting promptly to government agencies helps victims regain control of their identity and prevent criminals from misusing their personal information for illegal activities. Conclusion: As identity theft continues to pose a grave threat to individuals in New Jersey, it is imperative to take immediate action by utilizing the appropriate New Jersey Letter to Other Entities Notifying Them of Identity Theft. These letters aid in the timely reporting of fraudulent activities to relevant institutions, ensuring that victims take necessary steps to restore their stolen identity and protect themselves from further harm. By proactively addressing identity theft, we can collectively combat this pervasive crime and secure a safer future for all.

New Jersey Letter to Other Entities Notifying Them of Identity Theft

Description

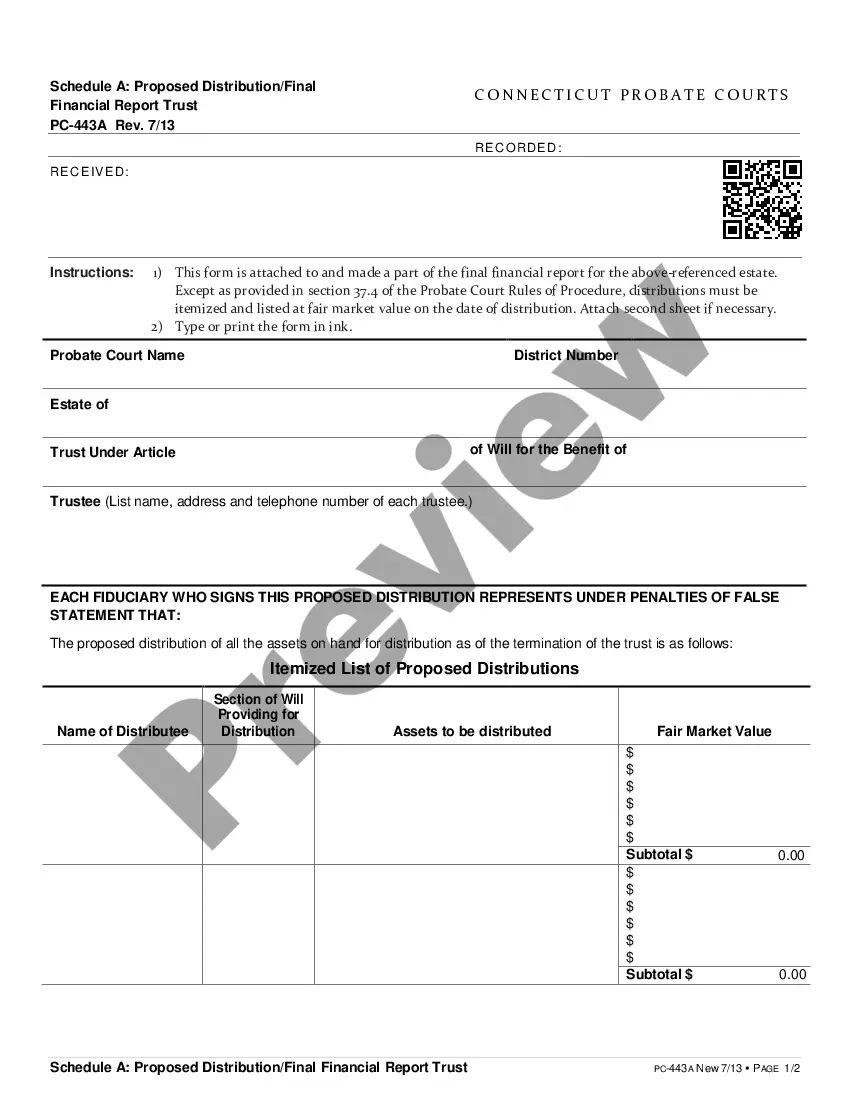

How to fill out New Jersey Letter To Other Entities Notifying Them Of Identity Theft?

Are you presently in a placement the place you require papers for either company or individual uses nearly every day? There are a variety of legitimate file templates available on the Internet, but finding types you can trust isn`t straightforward. US Legal Forms offers a huge number of type templates, much like the New Jersey Letter to Other Entities Notifying Them of Identity Theft, that are created to meet federal and state needs.

When you are previously informed about US Legal Forms website and also have a free account, merely log in. Afterward, you are able to obtain the New Jersey Letter to Other Entities Notifying Them of Identity Theft template.

If you do not provide an accounts and would like to begin using US Legal Forms, adopt these measures:

- Get the type you need and ensure it is for that right area/county.

- Use the Review option to review the shape.

- Look at the description to actually have selected the correct type.

- When the type isn`t what you`re searching for, use the Research area to get the type that suits you and needs.

- Once you find the right type, simply click Get now.

- Choose the pricing strategy you want, fill out the desired information and facts to generate your money, and pay money for your order making use of your PayPal or bank card.

- Select a convenient file format and obtain your backup.

Get every one of the file templates you might have bought in the My Forms food selection. You can obtain a further backup of New Jersey Letter to Other Entities Notifying Them of Identity Theft any time, if necessary. Just click on the essential type to obtain or print the file template.

Use US Legal Forms, one of the most comprehensive collection of legitimate forms, to save some time and avoid mistakes. The service offers professionally made legitimate file templates which you can use for a range of uses. Produce a free account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

Warning signs of identity theft Debt collection calls for accounts you did not open. Information on your credit report for accounts you did not open. Denials of loan applications. Mail stops coming to, or is missing from, your mailbox.

The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts. The fraud department at your credit card issuers, bank, and other places where you have accounts.

Identity theft is a second-degree crime if the amount is $75,000 or more or there are five or more victims. A second-degree conviction can yield five to 10 years in prison and a fine of up to $150,000. Identity theft is a second-degree crime if false information is used to obtain a government document.

You may be a victim of identity theft if: bills do not arrive. statements show transactions you did not make. creditors ask you about an account or card you have not applied for.

Look out for notifications that a tax return has been filed under your name. Additionally, if you receive a W-2, 1099, or any other tax form from a company you've never worked for, it might mean that someone obtained your Social Security number and is using it for employment purposes.

Consumers can report identity theft at IdentityTheft.gov, the federal government's one-stop resource to help people report and recover from identity theft. The site provides step-by-step advice and helpful resources like easy-to-print checklists and sample letters.

Check your bank, investment, and credit card accounts for unfamiliar transactions. Flag anything and follow up with either the vendor or your bank or credit card company. Don't ignore small transactions. Identity thieves may make small purchases to test if a card or account number works before moving on to larger ones.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.