New Jersey Letter to Other Entities Notifying Them of Death

Description

How to fill out Letter To Other Entities Notifying Them Of Death?

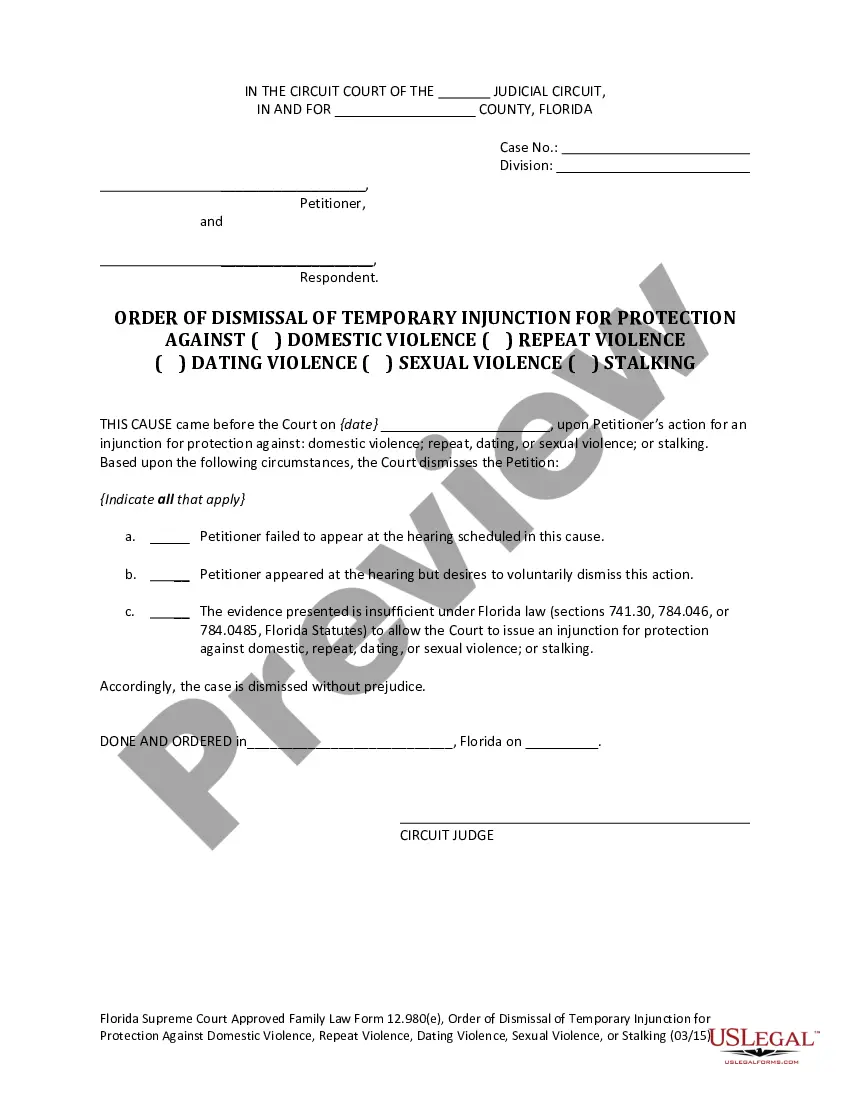

Discovering the right lawful papers format can be a struggle. Needless to say, there are plenty of templates available online, but how do you get the lawful develop you need? Utilize the US Legal Forms web site. The support delivers thousands of templates, including the New Jersey Letter to Other Entities Notifying Them of Death, which can be used for organization and personal requires. All the types are examined by pros and fulfill federal and state needs.

Should you be previously authorized, log in for your account and then click the Down load button to obtain the New Jersey Letter to Other Entities Notifying Them of Death. Make use of account to check from the lawful types you possess bought earlier. Proceed to the My Forms tab of your account and acquire yet another version in the papers you need.

Should you be a fresh consumer of US Legal Forms, listed here are simple guidelines that you should follow:

- Initial, ensure you have chosen the proper develop to your area/state. You can look through the shape making use of the Preview button and look at the shape outline to make certain this is basically the best for you.

- In case the develop fails to fulfill your requirements, use the Seach area to obtain the right develop.

- Once you are certain that the shape is proper, go through the Buy now button to obtain the develop.

- Select the pricing program you would like and enter in the essential details. Create your account and purchase the order using your PayPal account or charge card.

- Choose the document formatting and down load the lawful papers format for your device.

- Complete, modify and printing and indication the obtained New Jersey Letter to Other Entities Notifying Them of Death.

US Legal Forms may be the largest library of lawful types in which you can discover numerous papers templates. Utilize the service to down load expertly-created files that follow status needs.

Form popularity

FAQ

It is with our deepest sorrow that we inform you of the death of our beloved husband and father (insert name). With great sadness, we announce the loss of our beloved father, (insert name). In loving memory of (insert name), we are saddened to announce their passing on (insert date).

It's best to talk slowly and gently using plain, simple language. You may want to warn them that you have bad (or sad) news to try to make it less of a shock. It is usually clearer to say that someone has died than to say things such as 'gone to sleep', 'gone away' or that you have 'lost' the person.

How to Write a Death Announcement Full name of the deceased. State that they have died. Date and location of death. Funeral and/or memorial date, time, and location. Optional information, such as for donations.

On (date/time), we were given some sad news. (Name of student, teacher, etc.) was (murdered, killed in car accident, committed suicide, died suddenly). We do not have all the information at this time, but will inform you as we learn more.

The death announcement wording includes one paragraph announcing the decedent's full name, city and state where they died, and date of death. Often it also includes birth date and place, funeral arrangements or memorial details, and instructions for how to honor the deceased.

Simply put, a death announcement informs people of a recent death and usually includes the following information: Full name (including maiden name) Dates of birth and death. Location of death. Details regarding the funeral and/or memorial service.

Your message should be direct. You don't want to share the news five minutes into the conversation. Instead, start with, ?I have some sad news,? then go from there, using simple, to-the-point language. Don't try to make them feel better about the situation, because you don't know how they're feeling.

Your message should be direct. You don't want to share the news five minutes into the conversation. Instead, start with, ?I have some sad news,? then go from there, using simple, to-the-point language. Don't try to make them feel better about the situation, because you don't know how they're feeling.